Petards Group PLC Half Yearly Report -2-

30 September 2013 - 4:02PM

UK Regulatory

The Company currently has no bank borrowings. However the Board

recognises that to sustain and grow the business additional working

capital finance is required and it is presently reviewing its

options for raising additional equity and debt.

While orders have been slow in the first half of 2013 all of the

signs are that order intake will improve in the second half

although it is largely 2014 that will see the benefit of this

trend.

Raschid Abdullah

30 September 2013

Condensed Consolidated Income Statement

for the six months ended 30 June 2013

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

Note 2013 2012 2012

GBP000 GBP000 GBP000

Revenue 3,572 4,667 9,013

Cost of sales (2,147) (2,741) (5,125)

Gross profit 1,425 1,926 3,888

Administrative expenses (1,724) (1,875) (3,561)

Operating (loss)/profit (299) 51 327

Financial income 15 - -

Financial expenses (54) (29) (121)

(Loss)/profit before tax (338) 22 206

Income tax 2 - - (6)

(Loss)/profit for the period

attributable to equity

shareholders of the company (338) 22 200

Basic and diluted earnings

per share 3 (3.11)p 0.35p 2.92p

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2013

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP000 GBP000 GBP000

(Loss)/profit for period (338) 22 200

Other comprehensive income

Currency translation on foreign

currency net investments (13) - 16

Total comprehensive income for

the period (351) 22 216

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2013

Currency

Share Share Retained translation Total

capital premium earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2012

(audited) 6,367 23,223 (29,016) (214) 360

Profit for the period - - 22 - 22

Other comprehensive income - - - - -

Total comprehensive income

for the period - - 22 - 22

Equity-settled share based

payments - - 1 - 1

Balance at 30 June 2012

(unaudited) 6,367 23,223 (28,993) (214) 383

Balance at 1 January 2012

(audited) 6,367 23,223 (29,016) (214) 360

Profit for the year - - 200 - 200

Other comprehensive income - - - 16 16

Total comprehensive income

for the year - - 200 16 216

Equity-settled share based

payments - - (33) - (33)

Share issue: open offer

and placing 45 1,080 - - 1,125

Expenses of share issue - (151) - - (151)

Balance at 31 December

2012 (audited) 6,412 24,152 (28,849) (198) 1,517

Balance at 1 January 2013

(audited) 6,412 24,152 (28,849) (198) 1,517

Loss for the period - - (338) - (338)

Other comprehensive income - - - (13) (13)

Total comprehensive income

for the period - - (338) (13) (351)

Equity-settled share based - - - - -

payments

Balance at 30 June 2013

(unaudited) 6,412 24,152 (29,187) (211) 1,166

Condensed Consolidated Balance Sheet

at 30 June 2013

Unaudited Unaudited Audited

30 June 30 June 31 December

2013 2012 2012

ASSETS GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 182 192 172

Goodwill 401 401 401

Development costs 488 575 530

Deferred tax assets 587 669 587

1,658 1,837 1,690

Current assets

Inventories 1,924 823 1,211

Trade and other receivables 1,311 1,662 1,528

Cash and cash equivalents -

escrow deposits - 77 77

Cash and cash equivalents 256 23 5

3,491 2,585 2,821

Total assets 5,149 4,422 4,511

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 6,412 6,367 6,412

Share premium 24,152 23,223 24,152

Currency translation reserve (211) (214) (198)

Retained earnings deficit (29,187) (28,993) (28,849)

Total equity 1,166 383 1,517

Non-current liabilities

Deferred tax liabilities 122 132 122

122 132 122

Current liabilities

Interest-bearing loans and

borrowings 1,334 814 94

Trade and other payables 2,527 3,093 2,778

3,861 3,907 2,872

Total liabilities 3,983 4,039 2,994

Total equity and liabilities 5,149 4,422 4,511

Condensed Consolidated Statement of Cash Flows

for the six month period ended 30 June 2013

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss)/profit for the period (338) 22 200

Adjustments for:

Depreciation 24 33 57

Amortisation of intangible assets 45 158 223

Financial income (15) - -

Financial expense 54 29 121

Equity settled share-based payment expenses - 1 (33)

Income tax charge - - 6

Exchange differences (13) - 16

Operating cash flows before movement in

working capital (243) 243 590

Change in trade and other receivables 217 1,425 1,559

Change in inventories (713) 414 26

Change in trade and other payables (251) (1,299) (1,581)

Cash (absorbed by)/generated from operations (990) 783 594

Interest paid (39) (29) (123)

Income tax received - 162 196

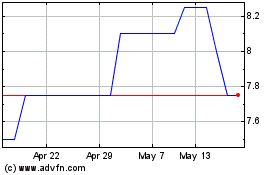

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

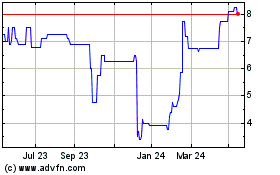

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024