TIDMPEG

RNS Number : 0688S

Petards Group PLC

15 March 2016

15 March 2016

PETARDS GROUP PLC

FINAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2015

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its audited

results for the year ended 31 December 2015.

Key points:

-- Financial

o Results for 2015

-- Revenues GBP13.1 million (2014: GBP13.5 million)

-- Gross margin up to 35.2% from 30.4% in 2014

-- EBITDA increased 24% to GBP1,260,000 (2014: GBP1,015,000)

-- Operating profit increased 22% to GBP935,000 (2014:

GBP769,000 profit)

-- Profit after tax GBP765,000 (2014: GBP620,000 profit)

o Finance

-- Generated GBP1.2 million of operating cash inflows (2014:

GBP0.8 million)

-- Cash at 31 December 2015 GBP2.5 million (31 Dec 2014: GBP1.4

million) and no bank debt

-- Convertible loan notes of GBP1.5 million maturing in

September 2018 providing long term finance (31 Dec 2014: GBP1.5

million)

-- Basic EPS increased 22% to 2.19p earnings per share (2014:

1.80p)

-- Diluted EPS increased 18% to 1.62p earnings per share (2014:

1.37p per share)

-- Operational

o Closing order book GBP16 million (2014: GBP20 million)

o Order book for eyeTrain maintained with significant orders

received from Siemens Mobility, Bombardier Transportation and

Hitachi Rail Europe

o ProVida revenues up 35% on 2014

o Defence order intake disappointing but signs of improvement in

Q1 2016

o Recurring revenue orders for eyeTrain spares and support were

90% ahead of 2014

o Export revenues increased by 25% and totalled 26% of Group

revenues

-- Outlook

o Current order book contains GBP11 million scheduled for

delivery in 2016

Raschid Abdullah, Chairman of Petards, commented:

"Our strong opening order book together with recently received

orders provides GBP11 million of revenues that are presently

scheduled for delivery in 2016. With new projects still under

discussion, the board is confident that the Group is well

positioned to achieve another good year's performance in 2016."

Contacts

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

WH Ireland Limited, Nomad www.wh-ireland.co.uk

and Joint Broker

Mike Coe, Ed Allsopp Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3764 2341

Chairman's statement

I am pleased to report to our shareholders and stakeholders that

the Company made considerable progress during the course of 2015

building on the foundations for growth that were laid down by the

board in the previous year. You will also note that the board has

decided to alter the layout of the annual report with the

Chairman's Statement now focussing on the key drivers and business

strategy with a separate in-depth operational business review

section.

We achieved a healthy increase in pre-tax profits which totalled

GBP762,000 for 2015 against the previous year's pre-tax profit of

GBP620,000, being a 23% increase year on year. Basic earnings per

share improved to 2.19p against 1.80p recorded for 2014 with fully

diluted earnings per share registering an increase to 1.62p

compared to 1.37p for 2014 representing increases of 21.7% and

18.2% respectively.

Although overall revenues at GBP13.1 million were broadly

similar to the previous year's of GBP13.5 million, gross margins

increased significantly to 35.2% against 30.4% for 2014. This was

largely a reflection of the changed product mix during the course

of the year with revenues being weighted towards our transport and

emergency services products and reduced levels of revenue being

recorded from lower margin defence products.

We entered 2016 with an overall order book of GBP16 million of

which approaching GBP10 million is scheduled to be delivered during

2016. Whilst this is ahead of the same period last year, active

negotiations continue to secure new projects in all of our product

areas. I was delighted that earlier this month we were successful

in winning a new MOD contract with a value in excess of GBP800,000

to be delivered during 2016 further strengthening our order book

position.

The improved performance in profitability for 2015 generated

excellent cash flow in the business during the course of the year

with Group cash balances growing from GBP1.4 million at the close

of 2014 to GBP2.5 million at the end of 2015, a GBP1.1 million

increase. Although the Group negotiated and put in place a small

bank overdraft facility, this was not required or utilised during

the course of the year.

We continued our 'Fit for Growth' programme that was initiated

at Petards Joyce-Loebl, the Group's principal trading subsidiary,

over two years ago which included designing new products,

recruitment and growing our software engineering skills to support

our customers on future projects. I would like to express on behalf

of the board, its sincere appreciation and thanks to all of our

employees with a warm welcome to those who joined us during the

course of the year, for their excellent contribution and valued

support to the business during the year and going forward into

2016.

In my statement last year I referred to the considerable deficit

that existed on distributable reserves within our balance sheet.

The board took steps to resolve this issue and High Court approval

was granted last December for a capital reduction. I am pleased to

inform shareholders that we now have positive distributable

reserves with a structured balance sheet to support the Group going

forward. This places the board in a better position for the

commencement of dividend payments at some future date. No dividend

is being proposed in respect of 2015 as it is presently considered

appropriate to retain our strong cash position to support

investment in our growth plans and acquisition strategy.

As a result of the past two years positive trading, improved

balance sheet and financial robustness following our initial

turnaround, we are now well positioned to pursue an earnings

enhancing acquisition strategy. We intend to expand the Group into

a larger and more prosperous business. The board has under review a

number of potential businesses to acquire and we will of course be

keeping shareholders fully advised of our progress.

Our strong opening order book together with recently received

orders provides GBP11 million of revenues that are presently

scheduled for delivery in 2016. With new projects still under

discussion, the board is confident that the Group is well

positioned to achieve another good year's performance in 2016.

Raschid Abdullah

Chairman

Business review

The Group continues to have one segment in terms of products and

services, being the development, supply and maintenance of

technologies used in advanced security, surveillance and ruggedized

electronic applications, the main markets for which are:

-- Rail Transport - software driven video and other sensing

systems for on-train applications (eyeTrain brand)

-- Defence - electronic countermeasure protection systems,

mobile radios and related engineering services

-- Emergency Services - in-car speed enforcement and ANPR systems (ProVida brand)

During 2015 good progress was made from both an operational and

financial perspective and the Group made significant improvements

in the majority of its key performance measures.

Operating review

The Group closed the year with a strong order book that provides

good visibility of earnings with 60% of the GBP16 million order

book scheduled for delivery in 2016. While the overall order book

is lower than that at the close of 2014, its composition remains

very encouraging with the 2015 closing order book for eyeTrain

products being maintained at the same level as that at 31 December

2014.

During the course of the year the Group secured a number of

significant orders for eyeTrain systems from train builders that

included Siemens Mobility Germany, Bombardier Transportation and

Hitachi Rail Europe. In addition, the trend of increasing recurring

revenues from spares and support reported at the half year

continued. Orders for spares and support were 90% ahead of those

received in 2014, supporting management's view that this will

increasingly become a significant contributor to revenues as the

eyeTrain installed base increases and the trains to which eyeTrain

systems are fitted enter operational service.

Looking to the future we are working on a number of exciting

opportunities for eyeTrain with both UK and overseas based train

builders and we anticipate that some of these will come to fruition

during the course of 2016.

The slower than anticipated order intake for our defence related

products and services reported at the half year continued into the

second half of 2015 which coupled with the delivery of substantial

milestones for projects in the 2015 opening order book, led to the

reduction in the Group's overall closing order book.

The GBP4.5 million software modification project for the MOD

secured in 2014 progressed to schedule and was over 80% complete by

the end of 2015. The project was a significant contributor to 2015

Group revenues and should be completed during the course of 2016.

While there remains a small amount of equipment to supply on the

RAF's Secure Management Radio Equipment (SMRE) contract, that

project has entered its support phase for which Petards holds a 10

year contract.

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:01 ET (07:01 GMT)

Defence products remain an important element of Petards'

business and the Group continues to provide equipment and support

services to the MOD in the niche areas of its expertise which it

has operated in for many years. The nature of larger projects for

Petards' defence products, particularly those relating to

electronic countermeasures, means that the order book for these

products tends to follow a more variable trend than that for

eyeTrain and ProVida. Nevertheless, the Group remains well placed

to win defence business and has made some alterations to the way it

addresses this market. It is therefore encouraging that 2016 has

started well, an example of which was the recently announced GBP0.8

million order from the MOD for communication systems and related

support.

Demand for our ProVida products strengthened in the second half

of 2015 and revenues were up over 35% on the prior year.

Historically ProVida has had a strong overseas customer following

as well as within the UK, although the proportion of overseas

revenues for these products had been reducing in recent years. It

was pleasing that the growth in 2015 was driven by exports,

although it is too early to say whether this will be maintained as

2015 revenues benefitted from a large spares order from an existing

export customer.

Petards has operated within the speed enforcement and ANPR

markets for over 15 years and while it is presently the smallest

element of its business, management continues to consider this to

be an interesting market with scope for the Group to grow its

presence both in the UK and internationally.

Financial review

Operating performance

While revenues for the year ended 31 December 2015 were similar

to those in 2014, the profitability and operating cash flows were

significantly higher. Revenues for the year were GBP13.1 million

(2014: GBP13.5 million) and the improvement in gross margins seen

at the half-year stage over those achieved in 2014 was sustained.

Export revenues grew by over 25% and accounted for over a quarter

of Group revenues.

Margins increased to 35.2% (2014: 30.4%) driving earnings before

interest, tax, depreciation and amortisation (EBITDA) to

GBP1,260,000, an increase over 2014 of over 24% (2014:

GBP1,015,000). Operating profits increased by over 21% to

GBP935,000 (2014: GBP769,000).

The increase in margins arose from the revenue mix comprising a

larger proportion of higher margin eyeTrain and ProVida revenues

and due to the prior year containing GBP4.5 million of lower margin

equipment deliveries on the SMRE project.

Administrative expenses grew by 10% to GBP3.7 million (2014:

GBP3.3 million) primarily due to increases in the amortisation of

development costs capitalised in 2014 and payroll costs following

the strengthening of the team at Petards Joyce-Loebl.

Net financial expenses totalled GBP173,000 (2014: GBP149,000),

the increase being due to net foreign exchange losses of GBP25,000

and after a GBP3,000 tax credit (2014: GBPnil), profit after tax

totalled GBP765,000 (2014: GBP620,000).

Research and development

While product development costs incurred during the year were

much lower than in 2014, this was in line with our expectations

following two years of heavy investment. The Group remains

committed to developing its products and services to maintain and

grow its market position and service its customers. Capitalised

development expenditure for the year was GBP66,000 (2014:

GBP661,000), while development expenditure expensed in the year

increased to GBP217,000 (2014: GBP80,000).

Cash and cash flow

The Group's financial position continued to strengthen and at 31

December 2015 it held cash balances of GBP2.5 million, no bank debt

and had convertible loan notes maturing in September 2018 of GBP1.5

million (2014: GBP1.4 million cash, no bank debt and loan notes of

GBP1.5 million).

Cash flows from operating activities were up 54% to GBP1,174,000

(2014: GBP761,000) reflecting both the strong operating performance

in the year and a reduction in working capital.

Balance sheet

On 16 December 2015, following the approval of the High Court,

the Company completed the reduction of share capital (Capital

Reduction) approved by shareholders on 11 November 2015. The

Capital Reduction eliminated the deficit in the Company's retained

earnings that previously existed and consequently puts it in a

position to pay dividends to shareholders as and when the Board

deems it appropriate.

Taxation

Due to the availability of brought forward tax losses and

research and development tax credits, the Group did not incur a

corporation tax charge in respect of 2015 (2014: GBPnil). In 2014

the Group surrendered tax losses to receive cash payments of

GBP208,000 in respect of research and development tax credits. In

2015 it repaid GBP169,000 of those research and development tax

credits and instead utilised the related tax losses against taxable

profits making a net tax saving of over GBP140,000.

Osman Abdullah

Group Chief Executive

Consolidated Income Statement

for year ended 31 December 2015

Note 2015 2014

GBP000 GBP000

Revenue 2 13,072 13,462

Cost of sales (8,473) (9,370)

Gross profit 4,599 4,092

Administrative expenses (3,664) (3,323)

Operating profit 935 769

------------------------------------ ---- ------- -------

Analysed as:

Earnings before interest,

tax, depreciation and amortisation

('EBITDA') 1,260 1,015

Depreciation and amortisation (325) (246)

935 769

Financial income 3 3 3

Financial expenses 3 (176) (152)

Profit before tax 762 620

Income tax 4 3 -

Profit for the year attributable

to equity shareholders of

the parent 765 620

Earnings per share (pence)

Basic 8 2.19 1.80

Diluted 8 1.62 1.37

Consolidated Statement of Comprehensive Income

for year ended 31 December 2015

2015 2014

GBP000 GBP000

Profit for the year 765 620

Other comprehensive

income

Items that may be reclassified

to profit:

Currency translation on foreign - -

currency net investments

Total comprehensive

income for the year 765 620

Statement of Changes in Equity

for year ended 31 December 2015

Share Share Merger Special Retained Currency Total

capital premium reserve Equity reserve earnings translation equity

reserve differences

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January

2014 6,645 25,153 1,075 206 - (31,132) (211) 1,736

Profit for

the year - - - - - 620 - 620

Total comprehensive

income - - - - - 620 - 620

Conversion

of

convertible

loan notes 4 23 - (2) - 2 - 27

Exercise

of share

options 2 16 - - - - - 18

At 31 December

2014 6,651 25,192 1,075 204 - (30,510) (211) 2,401

At 1 January

2015 6,651 25,192 1,075 204 - (30,510) (211) 2,401

Profit for

the year - - - - - 765 - 765

Total comprehensive

income - - - - - 765 - 765

Equity-settled

share based

payments - - - - - 6 - 6

Conversion

of

convertible

loan notes 1 14 - (1) - - - 14

Capital reduction

(note 6) (6,303) (25,192) (1,075) - 8 32,562 - -

At 31 December

2015 349 14 - 203 8 2,823 (211) 3,186

Consolidated Balance Sheet

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:01 ET (07:01 GMT)

at 31 December 2015

Note 2015 2014

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 247 187

Goodwill 401 401

Development costs 902 1,103

Deferred tax assets 429 516

1,979 2,207

Current assets

Inventories 2,168 1,439

Trade and other receivables 1,861 2,982

Cash and cash equivalents

- escrow deposits - 54

Cash and cash equivalents 2,478 1,434

6,507 5,909

Total assets 8,486 8,116

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Share capital 7 349 6,651

Share premium 14 25,192

Equity reserve 203 204

Merger reserve - 1,075

Special reserve 8 -

Currency translation reserve (211) (211)

Retained earnings 2,823 (30,510)

Total equity 3,186 2,401

Non-current liabilities

Interest-bearing loans and

borrowings 5 1,543 1,524

Deferred tax liabilities - 100

1,543 1,624

Current liabilities

Other trade and other payables 3,757 4,091

3,757 4,091

Total liabilities 5,300 5,715

Total equity and liabilities 8,486 8,116

Consolidated Statement of Cash Flows

for year ended 31 December 2015

Note 2015 2014

GBP000 GBP000

Cash flows from operating

activities

Profit for the year 765 620

Adjustments for:

Depreciation 58 48

Amortisation of intangible

assets 267 198

Financial income 3 (3) (3)

Financial expense 3 176 152

Equity settled share-based

payment expenses 6 -

Income tax credit (3) -

Operating cash flows before

movement in working capital 1,266 1,015

Change in trade and other

receivables 1,138 (2,035)

Change in inventories (729) 340

Change in trade and other

payables (195) 1,340

Cash generated from operations 1,480 660

Interest received 3 3

Interest paid (146) (110)

Tax (paid)/received (163) 208

Net cash from operating activities 1,174 761

Cash flows from investing

activities

Acquisition of property,

plant and equipment (118) (70)

Capitalised development expenditure (66) (661)

Cash deposits held in escrow 54 (54)

Net cash outflow from investing

activities (130) (785)

Cash flows from financing

activities

Proceeds from exercise of

share options - 18

Net cash inflow from financing

activities - 18

Net increase/(decrease) in

cash and cash equivalents

in the year 1,044 (6)

Cash and cash equivalents

at 1 January 1,434 1,440

Cash and cash equivalents

at 31 December 2,478 1,434

1 Basis of preparation and status of financial information

The financial information set out in this statement has been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards as

adopted by the EU ("adopted IFRSs"), IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS. It

does not include all the information required for full annual

accounts.

The financial information does not constitute the Company's

statutory accounts for the years ended 31 December 2015 or 31

December 2014 but is derived from those accounts. Statutory

accounts for 2014 have been delivered to the registrar of

companies, and those for 2015 will be delivered in due course. The

auditor has reported on those accounts; his reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying his report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

2 Segmental information

The analysis by geographic segment below is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to make

strategic decisions, to monitor performance and to allocate

resources.

The Board of Directors regularly reviews the Group's performance

and balance sheet position for its entire operations as a whole.

The Board receives financial information, assesses performance and

makes resource allocation decisions for its UK based business as a

whole and therefore the directors consider the Group to have only

one segment in terms of products and services, being the

development, supply and maintenance of technologies used in

advanced security, surveillance and ruggedised electronic

applications.

As the Board receives revenue, EBITDA and operating profit on

the same basis as set out in the Consolidated Income Statement no

further reconciliation is considered to be necessary.

Revenue by geographical destination can be analysed as

follows:

2015 2014

GBP000 GBP000

United Kingdom 9,684 10,773

Continental Europe 2,552 1,724

Rest of World 836 965

____ ____

13,072 13,462

____ ____

Included in the above amounts are revenues of GBP8,192,000

(2014: GBP9,793,000) in respect of construction contracts. The

balance comprises revenue from sales of goods and services.

3 Financial income and expense

2015 2014

GBP000 GBP000

Recognised in profit or loss

Interest on bank deposits 3 3

Financial income 3 3

GBP000 GBP000

Interest expense on financial liabilities

at amortised cost 151 150

Net foreign exchange loss 25 2

Financial expenses 176 152

4 Taxation

Recognised in the income statement

2015 2014

GBP000 GBP000 GBP000 GBP000

Current tax expense/(credit)

Adjustments in respect

of prior years 10 (109)

Total current tax 10 (109)

Deferred tax (credit)/expense

Origination and reversal

of temporary differences (1) (15)

Recognition of previously

unrecognised tax losses (43) (72)

Utilisation of recognised

tax losses 170 169

Tax rate change 40 -

Adjustment in respect

of prior years (179) 27

Total deferred tax (13) 109

Total tax (credit)/charge

in income statement (3) -

Reconciliation of effective tax rate

2015 2014

GBP000 GBP000

Profit before tax 762 620

Tax using the UK corporation tax

rate of 20.25% (2014: 21.5%) 154 133

Non-deductible expenses 46 36

Non-taxable income (25) -

Utilisation of tax losses 15 (87)

Effect of tax losses generated in

year not provided for in deferred

tax (21) -

Change in unrecognised temporary

differences (43) 7

Adjustments in respect of prior

years (169) (82)

Effect of rate change 40 (7)

Total tax credit (3) -

5 Interest-bearing loans and borrowings

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:01 ET (07:01 GMT)

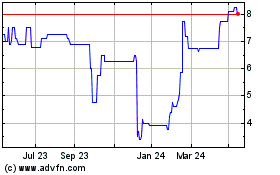

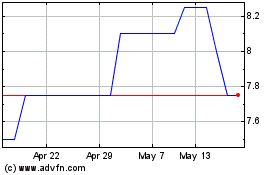

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024