RNS Number:4814A

Plexus Holdings Plc

28 March 2006

FOR IMMEDIATE RELEASE 28 March 2006

Plexus Holdings plc

Interim Results for the six months ended 31st December 2005

Plexus Holdings plc (Plexus or "the Company") the oil wellhead services company

and owner of the proprietary POS-GRIP(TM) method of wellhead engineering

announces its maiden interim results for the six months to 31 December 2005.

Highlights

. successful flotation on AIM in December 2005 and the raising of circa #9.7

million net of expenses and before repayment of loans and debt

. transfer to larger 25,000 sq. ft. facility in Aberdeen

. completion of "Extended Field Life Testing" of 18 3/4 inch POS-GRIP HG(TM)

(metal to metal)seals to 15,000 psi

Continuing Progress

. securing of Plexus' first high pressure/high temperature (HP/HT) rental

contract for BP Egypt with a value in excess of #750,000

. formation of a presence in Egypt to capitalise on the initial success of the

BP Egypt rental contract win

. BP Shah Deniz on schedule to deliver the first 5 wellhead sets (out of a total

of 9) before the financial year end

. continuing development of proprietary intellectual property to broaden scope

and applications of the POS-GRIP method of engineering

Plexus' CEO, Ben van Bilderbeek, commented:

"Following the successful flotation of Plexus and its admission to AIM the

Company has rapidly increased its investment in new facilities; personnel; and

associated infrastructure to accelerate growth in both rental of exploration

wellheads and sale of production wellheads. I am confident that the level of

interest in our proprietary technology, particularly in the HP/HT arena will

continue to strengthen as we are increasingly invited to present and demonstrate

the benefits of our technology to major operators around the world".

For further details please contact:

Plexus Holdings plc Tel: +44 (0)20 7589 8555

Bernard van Bilderbeek, Chief Executive

Graham Stevens, Finance Director

Buchanan Communications Tel: +44 (0)20 7466 5000

Tim Thompson / James Strong

Notes to Editors

The Plexus Group is an established oil and gas engineering, and service business

based in Aberdeen, with an office in London and a presence in Houston, Texas

through Plexus Deepwater Technologies. Plexus has developed and patented a

method of engineering for oil and gas field wellheads and connectors, named POS-

GRIP, which involves deforming one tubular member against another to effect

gripping and sealing. Plexus was admitted to trading on AIM in December 2005

when it raised approximately #10m of new funds for the Company.

POS-GRIP wellhead systems have been used in more than 60 oil and gas wells to

date by international customers and end users including, ConocoPhillips, BHP

Billiton, Talisman Energy, Tullow Oil, Global Santa Fe, Gaz de France and

Wintershall. In February 2004, BP contracted to purchase POS-GRIP gas platform

production wellhead systems for the US$4.1 billion Shah Deniz development, one

of the major gas fields in the Caspian Sea. Between 2005 and the end of 2008,

the Directors estimate that this relationship has and will generate revenues in

excess of #6.5 million for the Group.

The Directors believe that the raising of the Company's corporate profile

following its recent Admission to AIM in December will accelerate the roll out

of POS-GRIP technology as a superior alternative to current wellhead technology,

and which has particular advantages in HP/HT oil and gas environments for which

there is increasing demand throughout the world. The Company's long-term goal is

to develop POS-GRIP technology as the future industry standard for wellhead

design. This objective includes the distribution of POS-GRIP technology through

licensees to maximise market penetration. The Directors believe that the Plexus

Group can over time become a member of the 'first tier' of global wellhead

systems suppliers.

Chairman's Statement

Introduction

The first half of the year was dominated by the AIM flotation process, following

which Plexus has made significant progress in capitalising on its new public

company status enabling the company to accelerate the establishment of an

operational infrastructure that will allow it to support and service future

sales growth. This is particularly important as the focus of Plexus' targeted

customer base is moving away from renting exploration wellheads to the smaller

North Sea independent 'turn key' operators, and moving to the rental and sale of

wellheads to the major oil company operators around the world.

It is particularly exciting to note that as anticipated at the time of float

there is growing evidence of increased exploration and production activity

(particularly of gas fields) in evermore technically challenging unconventional

fields, which are often HP/HT environments where equipment requirements are

increasingly stringent. We are confident that this trend, and in particular the

growing need for HP/HT applications supports Plexus' strategy of becoming over

time a new wellhead standard: this will generate significant sales growth over

the years ahead as the company's HG metal to metal seal production wellheads

gain increased industry recognition.

AIM listing and share issue

On the 9th December the company issued 18.6 million new ordinary shares by way

of an institutional placing at #0.59 per share and the shares were admitted to

trading on AIM. The placing raised #9.7 million net of expenses from which #2.7

million was allocated to satisfy debt.

The strengthened balance sheet increases Plexus ability to tender for more

significant contracts, and funds have been invested to support our ambitious

growth plans in rental inventory; expanding the territorial reach of the sales

force; recruiting additional high calibre engineering and sales staff; and

developing and expanding the company's intellectual property portfolio for both

upstream and downstream applications.

Interim Results

Turnover for the 6 month period was #1.55m up 35% from #1.15m the previous year.

The rental business continued to represent the majority of Plexus' business

activities during the current period. In the second half and into the next

financial year the manufacture and delivery of the Shah Deniz production

wellhead contract for BP will then become a significant contributor. Gross

margins have improved due to the increased utilisation of the rental assets with

minimal additional costs. Administration expenses have increased significantly,

partly as a result of costs connected to the AIM listing, but principally due to

Plexus investing in personnel and associated infrastructure to enable the

business to expand both in terms of product and service offering in our

traditional North Sea market, as well as in new markets, such as Egypt.

The loss before tax of #0.16m was slightly higher than the previous year due to

increased overhead, and tax has been recognised at nil effective rate which with

the losses brought forward is the estimated tax charge for the full year. Loss

per share was 0.4p (2004 - 0.39p).

The balance sheet has changed significantly following the new share issue and

the use of the funds. The Shah Deniz contract has also given rise to significant

payments received in advance to assist the financing of the production and

manufacture of the POS-GRIP wellheads, and this is shown as long term contract

payments on account.

Operating Review

Plexus operations up until flotation had been focused on inventing, patenting

and proving POS-GRIP technology in the upstream oil and gas wellhead market,

with operations being centred around the rental of its wellhead equipment to

third party 'turn key' well management companies operating on behalf of mainly

"independent" exploration and production companies in the North Sea. Over time

we anticipate that this will reduce as a percentage of total revenues as sales

of production wellhead equipment and rentals elsewhere grow much more rapidly.

In addition, we anticipate that in time licence income arrangements will develop

into an important contributor.

In the short term it has become evident as previously announced that there has

been a significant tightening of exploration and appraisal well rig availability

in the North Sea. This development has led to delays in the commencement of

certain rental projects as wells are deferred. Although this impacts Plexus'

wellhead rental income in the current financial year, we believe we will benefit

once more rigs become available for exploration drilling. This assumes that the

recently announced increase in the supplementary corporation tax rate on North

Sea profits will not curtail current investment plans in the region.

Despite the impact of rig shortages the opportunities and interest in the more

specialised HP/HT areas with the larger oil companies is continuing to grow with

recent rental contract tender wins generating work for BP Egypt and

ConocoPhillips. This provides a sound base for our future growth.

Of particular note is the level of interest in Plexus' proprietary HG metal to

metal seal production wellheads and discussions are now ongoing with a number of

operators about significant longer term contract opportunities. This follows the

successful completion of qualification testing to 15,000 psi of the 18 3/4 inch

HG metal to metal seal carried out to Plexus "Extended Field Life Testing"

standards, which are more stringent than current industry standards. We now plan

to extend the qualified performance envelope of HG seal technology above 20,000

psi, and to higher temperatures: this has already been achieved in prototype

testing. The importance and relevance of such progress is supported by the

recent HSE (Health and Safety Executive) Report No. 409 which noted that there

are seal and integrity problems with current wellhead technology when applied in

HP/HT conditions: this underlines the exciting opportunities available for our

technology.

The supply of our equipment for the BP Shah Deniz project, which uses the

qualified HG seals, continues to make good progress and the testing and

manufacturing programme is on track to deliver the first five wellhead systems

(out of a total of 9) before the financial year end. This project is a

tremendous showcase for our technology and we expect the commercial benefits of

this to be forthcoming in the future.

The infrastructure of the company in terms of physical resources associated with

our new facilities in Aberdeen and the increased number of personnel (doubled

over the last 12 months) is now such that we have capacity for sales growth. We

are also able to increase our rental inventory and service capabilities as a

result of our move into the new Aberdeen facilities.

Outlook

The global market for the exploration and production of oil and gas continues to

expand in response to growing global demand and higher prices. Oil and gas

companies are having to explore in more extreme operating environments to

replace/add reserves. This means that oil and gas companies are increasingly

interested in technological solutions as established technologies and methods

reach their limits especially in HP/HT wells. We believe that Plexus'

proprietary POS-GRIP technology and its alternative method of wellhead design is

uniquely positioned to capitalise on these market developments. We have

established a solid platform from which we believe excellent growth can be

achieved. The increasing level of interest in our equipment confirms that our

strategy of convincing the oil and gas industry of the technical, performance,

cost, and safety benefits of wellheads utilising POS-GRIP remain firmly on

track.

I would also add that I have been very impressed by the inventiveness,

enthusiasm and hard work put in by Ben and his team. I am therefore confident

that Plexus will show excellent growth, as we continue to work towards becoming

a new 'standard' for the industry.

Robert Adair

Chairman

28th March 2006

Unaudited Consolidated Profit and Loss Account for the half year ended 31

December 2005

Six Six Year

months months

ended ended ended

31/12/05 31/12/04 30/06/05

#000 #000 #000

Turnover 1,552 1,147 2,637

=======================

Gross profit 961 421 1,327

Administration expenses (988) (406) (903)

Operating (loss)/profit before amortisation (27) 15 424

Amortisation (68) (27) (55)

Operating (loss)/profit (95) (12) 369

Net interest payable (62) (67) (137)

-----------------------

(Loss)/profit on ordinary activities before

taxation (157) (79) 232

Taxation (note 5) - - (81)

-----------------------

(Loss)/profit on ordinary activities after

taxation (157) (79) 151

=======================

(Loss)/earnings per ordinary share (note 6) (0.40)p (0.39)p 0.76p

Fully diluted (loss)/earnings per ordinary

share (note 6) (0.40)p (0.13)p 0.25p

Summary Unaudited Group Balance Sheet at 31 December 2005

31/12/05 31/12/04 30/06/05

#000 #000 #000

Fixed assets

Tangible assets 1,569 1,204 1,631

Intangible assets 6,448 1,002 1,095

---------------------------

8,017 2,206 2,726

Working capital

Stocks 2,948 1,011 1,285

Debtors 842 759 2,009

Creditors (1,565) (297) (1,387)

Long term contract payments on account (2,739) (226) (595)

---------------------------

(514) 1,247 1,312

===========================

Net cash/(debt) 7,313 (3,478) (3,753)

Taxation 85 180 100

---------------------------

14,901 155 385

============================

Capital and reserves (note 7)

Ordinary share capital 802 200 200

Preference share capital - 400 400

Share premium account 15,611 1,140 1,140

Profit and loss reserve (1,512) (1,585) (1,355)

----------------------------

14,901 155 385

============================

Summary Unaudited Consolidated Cash Flow Statement for the half year ended 31

December 2005

Six Six Year

months months

ended ended ended

31/12/05 31/12/04 30/06/05

#000 #000 #000

Net cash inflow/(outflow) from operating

activities (note 8) 1,969 (397) 104

Net interest paid (62) (67) (137)

----------------------------

Returns on investment and servicing of

finance 1,907 (464) (33)

Taxation 15 - -

Purchase of intangible fixed assets (5,421) - (121)

Purchase of tangible fixed assets (108) - (585)

----------------------------

Capital expenditure (5,529) - (706)

Net cash outflow before financing (3,607) (464) (739)

Financing

Proceeds of share issues net of issue

expenses 14,673 - -

Repayment of loans (2,250) (454) (587)

----------------------------

Increase/ (decrease) in cash 8,816 (918) (1,326)

---------------------------

Reconciliation of net cash/(debt)

Opening net debt (3,753) (3,014) (3,014)

Net cash inflow/ (outflow) 11,066 (464) (739)

----------------------------

Closing net cash/ (debt) 7,313 (3,478) (3,753)

============================

Reconciliation of Movements in Consolidated Shareholders' Funds for the half

year ended 31 December 2005

Six Six Year

months months

ended ended ended

31/12/05 31/12/04 30/06/05

#000 #000 #000

(Loss)/profit for the period (157) (79) 151

Dividends - - -

----------------------------

Result for period (157) (79) 151

Share Capital

Ordinary shares issued 602 - -

Preference shares converted (400) - -

----------------------------

202 - -

Share Premium

On issue of ordinary shares 15,740 - -

Less: Expenses of share issues (1,269) - -

-----------------------------

14,471 - -

Net increase /(decrease) in

shareholders' 14,516 (79) 151

funds

Opening shareholders' funds 385 234 234

-----------------------------

Closing shareholders' funds 14,901 155 385

=============================

Notes to the Interim Report December 2005

1. This unaudited interim report has been prepared on the basis of the

accounting policies set out in the annual report for the year ended 30 June

2005.

2. This interim report was approved by the board of directors on 27th March

2006.

3. The directors do not recommend payment of an interim dividend.

4. There were no other gains or losses to be recognised in the

financial period other than those reflected in the profit and loss account.

5. Taxation on the operating loss after interest has been provided

at a rate of 0% for the six months ended 31 December 2005 (2004: 0%) which is

the estimated rate of tax for the full year, after accounting for brought

forward tax losses.

6. Basic and pre exceptional earnings per share are based on the

weighted average of ordinary shares in issue during the half-year of 39,261,962

(2004: 20,000,000). In order to aid understanding and comparison, the number of

shares used for the calculation of shares in issue has been rebased at the

comparative dates following the conversion in November 2005 of each #1 ordinary

share into 100 1p ordinary shares. The calculation of fully diluted earnings per

share is based on the weighted average number of ordinary shares in issue plus

the dilutive effect of outstanding share options being 300,824 (2004: nil) and

convertible preference shares being nil (2004: 40,000,000). The number of shares

included in the calculation of fully diluted earnings per share was 39,562,786

(2004: 60,000,000).

7. Share Issues / Capital Reorganisation and Initial Use of Funds from IPO

On 18 October 2005, the preference share capital of 400,000 #1 shares was

converted to ordinary shares of #1 each; on the same date the authorised share

capital was increased to #615,385 to accommodate the issue of 15,385 ordinary #1

shares at #48.75 each.

On 25 November 2005 each ordinary share of #1 was converted to 100 ordinary

shares of 1p each and the authorised share capital was increased to 110,000,000

ordinary shares.

On 8 December 2005 one ordinary share at a premium of #4,191,976.99 was issued

to Plexus International Limited to satisfy loans arising in connection with the

consideration payable by the Company pursuant to agreements relating to the

restructuring of IP ownership.

On 9 December 2005 an Initial Public Offering on the London AIM resulted in

18,644,068 new ordinary shares being placed at an issue price of 59p per share,

raising gross proceeds of #11.0m. Net proceeds after expenses were #9.7m from

which #2.7m was allocated to satisfy debt.

Initial Use of Funds from IPO: #000

Gross proceeds of IPO 11,000

Less: Expenses of share issue 1,269

------

9,731

Repayment of bank overdraft 1,408

Repayment of loans from participating companies 1,320

Net proceeds of issue after settlement of debt 7,003

=======

8. Net cash inflow/ (outflow) from operating activities

Six months Six Year

months

ended ended ended

31/12/05 31/12/04 30/06/05

#000 #000 #000

Operating (loss)/ profit (95) (12) 369

Amortisation 68 27 55

Depreciation 170 124 282

Decrease/ (increase) in working capital 1,826 (536) (602)

-----------------------------

1,969 (397) 104

===========================

9. The comparative figures for the financial year ended 30 June 2005 are not the

Company's statutory accounts for that financial year. Those accounts have been

reported on by the Company's auditors and delivered to the Registrar of

Companies. The report of the auditors was unqualified and did not contain a

statement under section 237(2) or (3) of the Companies Act 1985. The comparative

figures reflected in this report reflect consolidated numbers and previously

consolidated accounts were not prepared. Consolidated accounts have been

prepared to aid understanding and comparison for the current reporting period.

10. Copies of this report will be sent to all Shareholders and will be available

to the public for at least one month, free of charge, from the registered office

of the Company, Plexus House, 1 Cromwell Place, London, SW7 2JE.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFITVTIDFIR

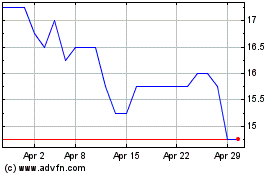

Plexus (LSE:POS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Plexus (LSE:POS)

Historical Stock Chart

From Jul 2023 to Jul 2024