Reconstruction Capital II Ltd Disposal of the Top Factoring Group (2616B)

03 April 2017 - 4:00PM

UK Regulatory

TIDMRC2

RNS Number : 2616B

Reconstruction Capital II Ltd

03 April 2017

3 April 2017

Reconstruction Capital II Limited

Disposal of the Top Factoring Group

Reconstruction Capital II Limited (the "Company") announces that

it has conditionally disposed of (a) its 93% interest in Top

Factoring SRL ("Top Factoring"), a Romanian receivables collection

company, and (b) the whole of the non-performing loan book held by

the Company's wholly owned subsidiary Glasro Holdings Limited

("Glasro"), (together the "Top Factoring Group") to Intrum Justitia

AB, a leading European credit management services group listed on

NASDAQ Stockholm for an enterprise value of approximately EUR25

million (the precise amount being dependent on the date of closing)

which, net of debt and minority interest, results in a cash

consideration for the Company of approximately EUR13.85 million

(the "Disposal"). From 31 December 2016, the Top Factoring Group is

valued at EUR11.28 million in the Company's Net Asset Value

computation.

A condition of the Disposal was the acquisition by Glasro of a

74.5% interest in Telecredit IFN SA ("Telecredit"), a Romanian

non-banking financial institution that provides consumer loans (the

"Acquisition"), which is majority-owned by Catalin Neagu, the

founder and CEO of Top Factoring. The cash consideration for the

Acquisition is EUR2.67 million, and Glasro has also committed to

making a EUR0.15 million capital increase in Telecredit, bringing

its total shareholding to 80%. For the year ended December 2016,

Telecredit had unaudited net assets of EUR0.75 million, and

reported total revenues of EUR1.13 million, profit before tax of

EUR0.35 million and net loans of EUR0.53 million.

The net cash receivable by the Company and Glasro following the

Disposal and the Acquisition is approximately EUR11 million, and

funds will be received conditional on regulatory approval of

Intrum's acquisition of Glasro's non-performing loan book, which is

expected to take place by 30 April 2017. The Board has yet to

conclude on the use of the cash proceeds and will advise

shareholders in due course.

As part of the Acquisition, the Company has provided Mr Catalin

Neagu (together with his wife a 100% shareholder of Telecredit)

with a EUR0.15 million interest free loan to allow him to increase

the shareholder equity of Telecredit (the "Loan"). The Loan is to

be repaid to the Company from the cash proceeds received by Mr

Neagu from the sale of Telecredit.

Mr Neagu is a director of Top Factoring and consequently, the

Acquisition and the Loan constitute related party transactions

pursuant to Rule 13 of the AIM Rules for Companies. The directors

of the Company, having consulted with the Company's nominated

adviser, Grant Thornton UK LLP, consider that the terms of the

Acquisition and the Loan are fair and reasonable insofar as the

Company's shareholders are concerned.

For further information, please contact:

Reconstruction Capital II Limited

Ion Florescu/Anca Moraru

Tel: +40 21 3167680

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett/Carolyn Sansom

Tel: +44 (0) 20 7383 5100

Panmure Gordon (UK) Limited (Broker)

Paul Fincham/Jonathan Becher

Tel: +44 (0) 20 7886 2500

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISQFLFXDXFEBBX

(END) Dow Jones Newswires

April 03, 2017 02:00 ET (06:00 GMT)

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jun 2024 to Jul 2024

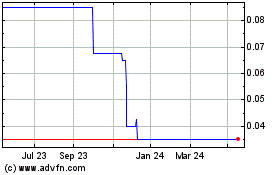

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jul 2023 to Jul 2024