TIDMRECI

RNS Number : 6427W

Real Estate Credit Investments Ltd

27 April 2021

27 April 2021

Real Estate Credit Investments Limited

Company Update Presentation

Real Estate Credit Investments Limited ("RECI" or "the Company")

is pleased to advise investors of the release of its latest Company

Update Presentation.

Given the ongoing uncertainty evolving from the COVID-19

pandemic, RECI's Investment Manager has prepared the Company Update

Presentation to provide investors with:

-- an update of the position of the Company as at 31 March 2021;

-- a detailed review of the portfolio investments held by the Company;

and

-- detail of the Company's strategy with regards to dividends,

leverage, liquidity and opportunities in the UK and European

real estate credit markets.

The Company is pleased to announce that the Company Update

Presentation is now available on the Company's website at:

https://www.recreditinvest.com/investors/results-reports-and-presentations/#currentPage=1

An extract from the Summary section of the Company Update

Presentation is set out for investors in the Appendix to this

announcement.

For further information, please contact:

Broker: Richard Crawley / Richard Bootle (Liberum Capital) +44

(0)20 3100 2222

Investment Manager: Richard Lang (Cheyne) +44 (0)20 7968 7328

Appendix: Company Update Presentation Extract

Summary: The Investment Opportunity

-- Attractive returns from low LTV credit exposure to UK and

European commercial real estate assets

o Weighted Average LTV of 64.9% as at 31 March 2021

o Predominantly large, well capitalised, and experienced

institutional borrowers

-- Quarterly dividends delivered consistently since October 2013

o The Company has consistently sought to pay a stable quarterly

dividend

o This has led to a stable annualised dividend of around 7% of

NAV

o Maintaining dividend policy for March 2021 year end as

announced in May 2020

-- Highly granular book

o 61 positions

o Top position: 14.1% of NAV (by commitment) as at 31 March

2021

-- Transparent and conservative leverage

-- Access to established real estate investment team at Cheyne, which manages over $4bn AUM

-- Access to pipeline of enhanced return investment opportunities identified by Cheyne

-- Robust mitigation against a rising rates environment

o A high yielding portfolio, combined with a short weighted

average life of 1.9 years, ensures minimal exposure to yield

widening and the ability to redeploy quickly at higher rates

Summary: Responding to COVID

-- Market

o Due to banks still not lending, Cheyne has become a "go to"

lender

-- Portfolio

o No defaults due to robust positions. Move to more senior

positions

o Mark to Market recovery of 4.1p to NAV since initial COVID-19

impact in March 2020

-- Cash

o Cash reserves maintained at between 5% to 10% of NAV

-- Dividend

o Dividends maintained at 3.0p per quarter, 8.8% yield, based on

share price, as at 31 March 2021

-- Discount

o Average discount during 2021 calendar year to date of 6.4%,

from >40% at peak

-- Opportunities

o Increased returns at more defensive LTVs

Summary: Structural Strength - Positioned to Capitalise on

Opportunities

-- Having successfully navigated through the challenges posed by

the COVID-19 pandemic, RECI is well positioned to address future

market uncertainty, with a strong portfolio profile and modest

leverage comprising:

o Senior loans and bonds equal to 82% of NAV

o Weighted average LTV of 64.9%

o The portfolio is concentrated on credits to large, well

capitalised and experienced institutional borrowers

o Leverage of 1.23x gross (1.16x net of cash held) as at 31

March 2021

o Cash on balance sheet of GBP22.8m

-- The Company has good visibility on its liquidity and income

profile for the next financial year ending March 2022, and

beyond

-- The Company is positioned to take advantage of a new pipeline

of opportunities from a position of strength

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGZDNVRGMZM

(END) Dow Jones Newswires

April 27, 2021 02:00 ET (06:00 GMT)

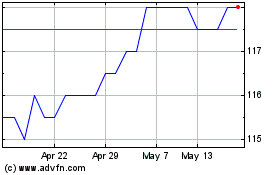

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From Apr 2024 to May 2024

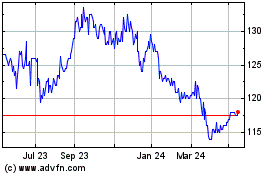

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From May 2023 to May 2024