RNS Number : 9955C

Somero Enterprises Inc.

09 September 2008

Tuesday, 9 September 2008

Somero Enterprises, Inc �

("Somero" or "the Company" or "the Group")

Interim Results for the six months ended 30 June 2008

Somero Enterprises, Inc. �, is pleased to report its interim results for the six months to 30 June 2008. Somero is a North American

manufacturer of patented laser guided equipment used for the spreading and levelling of high volumes of concrete for floors in the

commercial construction industry. Expanding into new geographic markets, Somero's innovative, proprietary products help contractors

worldwide achieve a high level of precision in flat floor construction which reduces construction time and improves cost savings.

Financial Highlights

* Revenue and profits in line with management's expectations following 15 May update on trading

* Group revenue of US$31.0m (H1 2007: US$34.4m)

* Improved revenue balance between US and international sales with international sales now accounting for 51.6% of group revenue, up

from 40.8% in H1 2007

* Adjusted EBITDA(1)(3) of US$4.9m (H1 2007: US$9.3m)

* Pre-tax income of US$3.1m (H1 2007: US$5.4m)

* Adjusted net income before amortisation(2)(3) of US$3.1m (H1 2007: US$6.0m)

* EPS diluted - adjusted to reflect net income before amortisation and cost of early extinguishment of debt of US$0.09 (H1 2007:

US$0.17)

* Cash flow remains strong, with net debt reduced as planned by a further US$2.1m to US$9.0m

* Proposed interim dividend maintained at US$0.03 per share

Business Highlights

* Increased focus on opportunities for growth in international markets

* International sales increased 14.3% during the period

* Investment in China and Middle East producing positive interest and response

* Latin and South America sales up significantly from H1 2007

* Balance of cost management and investment for growth

* Continued focus on creating further cost savings across the Group

* Strategic investment in new products with new Small Line targeted for release in Q4 2008

* Continued commitment to increasing penetration of the Middle and Far East markets

* Positive actions keep progress on track

* Cost saving programme implemented in May

* Somero Sales College now operational and improving small line sales

Commenting, Jack Cooney, President and Chief Executive Officer of Somero, said:

"We are pleased to report revenue today that is consistent with the targets set in our Trading Update on 15 May 2008. We continue to

pursue the increasing internationalisation of our business, delivering good growth in international sales during the first half. Revenue

from outside North America now accounts for more than 50% of group revenue bringing further balance to our business.

"We have delivered good cash generation during the period and retained our strong balance sheet, delivering further net debt reductions

as planned. We remain committed to combining cost control with sensible international expansion and tailored product development and we

remain confident of continued net debt reduction for the full year."

For further information please contact:

Financial Dynamics +44 (0)20 7831 3113

Harriet Keen / Matt Dixon / Erwan Gouraud

Hawkpoint Partners +44 (0)20 7665 4500

Christopher Kemball / Chris Robinson

Collins Stewart +44 (0)20 7523 8000

Nick Ellis

Notes

1 References to adjusted EBITDA are to Somero's net income plus interest income, interest expense, taxes, depreciation,

amortisation, foreign exchange, stock based compensation and other expense.

2 References to adjusted net income before amortisation and cost of early extinguishment of debt are to Somero's net income plus

amortisation expense of intangibles plus loss on early extinguishment of debt.

3 Adjusted EBITDA and adjusted net income before amortisation and cost of early extinguishment of debt are not measurements of the

Company's financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other

performance measures derived in accordance with GAAP or as an alternative to GAAP cash flow from operating activities as a measure of

profitability or liquidity. Adjusted EBITDA and adjusted net income before amortisation and cost of early extinguishment of debt are

presented herein because management believes they are useful analytical tools for measuring the profitability and cash generation of the

business. Adjusted EBITDA is also used to determine pricing and covenant compliance under the Company's credit facility and as a measurement

for calculation of management incentive compensation. The Company understands that although adjusted EBITDA is frequently used by securities

analysts, lenders and others in their evaluation of companies, its calculation of adjusted EBITDA may not be comparable to other similarly titled measures reported by other companies. See page 7 for a

reconciliation of adjusted EBITDA and adjusted net income before amortisation and cost of early extinguishment of debt to net income.

About Somero

Somero� designs, manufactures and sells equipment that automates the process of spreading and leveling large volumes of concrete for

commercial flooring and other horizontal surfaces, such as paved parking lots. Somero's innovative, proprietary products, including the

large SXP� Laser Screed�, CopperHead� and new Mini Screed*, employ laser-guided technology to achieve a high level of precision.

Somero's products have been sold primarily to concrete contractors for use in non-residential construction projects in over 50 countries

across every time zone around the globe. Laser Screed equipment has been specified for use in constructing warehouses, assembly plants,

retail centres and in other commercial construction projects requiring extremely flat concrete slab floors by a variety of companies, such

as Costco, Home Depot, B&Q, DaimlerChrysler, various Coca-Cola bottling companies, the United States Postal Service, Lowe's and Toys 'R'

Us.

Somero's executive offices and training facility are located in Florida, USA. Its main operations, including manufacturing, are in

Michigan, USA. There is also a sales and service office in Chesterfield, England. Somero has 145 employees, and markets and sells its

products through a direct sales force, external sales representatives and independent dealers in North America, Latin America, Europe, the

Middle East, South Africa, Asia and Australia. Somero is listed on the Alternative Investment Market of the London Stock Exchange and its

trading symbol is SOM.L.

Chairman's and Chief Executive Officer's Statement

During the first half of 2008, the Company made further progress towards our goal of decreasing our dependence on North American markets

and broadening our revenue base. International sales now account for more than 50% of group revenue, up from 40.8% in the comparative period

last year.

Whilst the revenues reported today are lower than the same period last year, we are pleased to confirm that they are in line with the

revised full year targets set in our Trading Update of 15 May. We are also pleased to have maintained our strong cash flow during the

period, allowing us to comfortably meet our net debt reduction target for the first half, reducing net debt by a further US$2.1m to

$US9.0m.

Operational Performance

As expected, revenues in our North American market declined by US$5.4m as a result of the difficult environment for Large Line sales we

identified in our May Trading Update. As expected, contractors have been slower in the first half of this year to expand their fleets of

Somero machines. However, it is encouraging to report that demand for replacement machines - i.e. the direct replacement of older or

end-of-life models with new Somero models - has remained good, proving the value of Somero's technology to the concrete contractor

community. US Small Line equipment has continued to sell at good levels; a direct result of the improved effectiveness of our Sales College

training.

We are pleased to report that the overall decrease reported in North America was partially offset in the first half by an increase in

sales of US$2.0m in our non-US markets, with international sales overall growing by 14.3% during the period.

Europe, Middle East and Africa ("EMEA") was our strongest performing segment in the first half, with sales increases and continuing

strong market demand reported across each of our Large Line, Small Line and other categories. Growth in EMEA during the first half has been

particularly broad-based, with sales reported of 20 machines into 12 different countries.

Sales in our Rest of World ("RoW") segment, which constitutes the smaller part of our International business, are below those reported

in H1 2007: although on very low volumes, due to slowness particularly in Australia and Korea. However, sales in Latin and South America are

significantly ahead of the comparative period last year and we expect this growth to continue, helping to drive an improvement in RoW sales

through the second half of the year.

Emerging Markets

Emerging markets such as Latin and South America, China and the Middle East remain a key area of focus for Somero. A central component

of our business strategy continues to be our entry into and growth within emerging international markets where construction demand remains

strong and demand for ever higher building quality standards is rising. We will continue to position ourselves to take advantage of these

trends by adding additional investments in these markets.

The rollout of our emerging markets strategy is centred on three core aims:

* to identify international logistics companies, development companies and building operators with a view to ensuring Western floor

flatness specifications are carried through to new markets;

* to target local contractors who are tendering for projects for these major international players and local contractors with a

Western joint venture partner; and

* to develop a package whereby we can provide in-depth floor construction training, beyond the operator training that we currently

provide, and selling this training as part of the overall package of equipment and services to install a concrete floor.

We continue to pursue these three aims and it is encouraging that international refurbished sales - a key indicator of progress in these

emerging markets - are strong.

Product Development

As well as focusing on emerging market opportunities, we remain committed to developing innovative, proprietary high-margin products

that meet the ever changing needs of our customers. During the period we have continued to invest in product development and expect to

launch a new commercial Mini-Screed product in Q4 2008 as well as further product launches for Q4 2008. Additional products are also in the

prototyping stage. We remain confident that the launch of these products will continue to provide growth opportunities for Somero over the

medium and longer term.

Interim Dividend

In line with its view on the continued long term growth prospects for the business, the Board has decided to maintain an interim

dividend at a level of US$0.03 per share for the six months ended 30 June 2008. It will review the final dividend in light of the outcome

for the full year and its view of the prospects for the business at that time.

The Board proposes that the interim dividend be paid on 6 October 2008 to shareholders on the register as at 19 September 2008.

Current Trading and Outlook

We are pleased with the performance delivered during the first half against the backdrop of the difficult environment we identified

earlier in the year for our US Large Line sales.

As we enter the second half of the year, we believe trading is continuing in line with the revised revenue and earnings targets set

following our Trading Update in May. We see the international non-residential construction market remaining strong, and also see strong

demand remaining in the North American and European replacement market. We remain committed to combining cost control with sensible

international expansion and tailored product development and we remain confident of continued net debt reduction for the full year.

Stuart Doughty

Chairman

Jack Cooney

President and Chief Executive Officer

Business and Financial Review

Summary of Financial Results (1) (2) (3) (4)

For the six months ended 30 June

2008 2007

US$ 000 US$ 000

Revenue 31,016 34,374

Cost of sales 13,460 14,604

Gross profit 17,556 19,770

Operating expenses

Selling expenses 6,760 5,619

Engineering expenses 981 847

General and administrative expenses 6,459 5,612

Total operating expenses 14,200 12,078

Operating income 3,356 7,692

Other income (expense)

Interest expense (457) (944)

Interest income 22 36

Foreign exchange gain 225 50

Other (22) (1,481)

Income before income taxes 3,124 5,353

Provision for income taxes (1,164) (2,042)

Net income 1,960 3,311

EPS diluted(4) US $0.06 US $0.10

EPS diluted - adjusted net income before US $0.09 US $0.17

amortisation and cost of early

extinguishment(4)

Other data

Adjusted EBITDA(1)(3) 4,918 9,284

Adjusted net income before amortisation and 3,126 5,984

cost of early extinguishment of debt(2)(3)

Depreciation expense 184 191

Amortisation of intangibles 1,166 1,192

Loss on early extinguishment of debt 0 1,481

Capital expenditures 347 216

1 References to adjusted EBITDA are to Somero's net income plus interest income, interest expense, taxes,

depreciation, amortisation, foreign exchange and other expense.

2 References to adjusted net income before amortisation and cost of early extinguishment of debt are to Somero's net Income plus

amortisation expense of intangibles plus loss on early extinguishment of debt.

3 Adjusted EBITDA and adjusted net income before amortisation and cost of early extinguishment of debt are not measurements of the

Company's financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other

performance measures derived in accordance with GAAP or as an alternative to GAAP cash flow from operating activities as a measure of

profitability or liquidity. Adjusted EBITDA and adjusted net Income before amortisation and cost of early extinguishment of debt are

presented herein because management believes they are useful analytical tools for measuring the profitability and cash generation of the

business. Adjusted EBITDA is also used to determine pricing and covenant compliance under the Company's credit facility and as a measurement

for calculation of management incentive compensation. The Company understands that although adjusted EBITDA is frequently used by securities

analysts, lenders and others in their evaluation of companies, its calculation of adjusted EBITDA may not be comparable to other similarly titled measures reported by other companies. See page 7 for a

reconciliation of adjusted EBITDA and adjusted net income before amortisation and cost of early extinguishment of debt to net income.

4 Diluted earnings per share represents income available to shareholders divided by the weighted average shares outstanding plus

additional common shares that would have been outstanding if dilutive potential common shares had been issued. Dilutive common shares

outstanding at June 30, 2008 were approximately 0 and 168,000 at June 30, 2007. Diluted earnings per share on 'net income before

amortisation and cost of early extinguishment of debt' is not a GAAP measurement and has been presented because management believes it is a

useful analytical tool.

Net income to EBITDA reconciliation and net income before amortisation and cost of early extinguishment of debt reconciliation

For the six months ended 30 June

2008 2007

US$ 000 US$ 000

Adjusted EBITDA reconciliation

Net income 1,960 3,311

Tax provision 1,164 2,042

Interest expense 457 944

Interest income (22) (36)

Foreign exchange gain (225) (50)

Other expense 22 1,481

Depreciation 184 191

Amortisation 1,166 1,192

Stock-based compensation 212 209

Adjusted EBITDA 4,918 9,284

Adjusted net income before amortisation

reconciliation

Net income 1,960 3,311

Amortisation 1,166 1,192

Cost of early extinguishment of debt 0 1,481

Adjusted net income before amortisation and 3,126 5,984

loss on early extinguishment of debt

Notes

References to 'adjusted net income before amortisation and cost of early extinguishment of debt' in this document are to Somero's net

income plus amortisation of intangibles plus costs associated with early extinguishment of debt. Although net income before amortisation and

cost of early extinguishment of debt is not a measure of operating income, operating performance or liquidity under US GAAP, this financial

measure is included because management believes it will be useful to investors when comparing Somero's results of operations by eliminating

the effects of amortisation of intangibles that have occurred as a result of the write-up of assets in connection with the Somero

Acquisition [defined?]. Net income before amortisation and cost of early extinguishment of debt should not, however, be considered in

isolation or as a substitute for operating income as determined by US GAAP, or as an indicator of operating performance, or of cash flows

from operating activities as determined in accordance with US GAAP. Since net income before amortisation and cost of early extinguishment of debt is not a measure determined in accordance with US GAAP

and is thus susceptible to varying calculations, net income before amortisation and cost of early extinguishment of debt, as presented, may

not be comparable to other similarly titled measures of other companies. A reconciliation of net income to EBITDA and net income before

amortisation and cost of early extinguishment of debt is presented above.

Revenues

Somero's consolidated revenues for the six months ended 30 June 2008 were US$31.0m, which represented a 9.8% decrease from US$34.4m in

consolidated revenues for the six months ended 30 June 2007. Somero's revenues consist primarily of sales of new Large Line products (the

SXP Large Laser Screed), sales of new Small Line products (the CopperHead and PowerRake) and other revenues, which consist of, among other

things, revenue from sales of spare parts, refurbished machines, topping spreaders and accessories. The overall decrease in revenues for

the six months ended 30 June 2008 as compared to the six months ended 30 June 2007 was driven, as expected, by reduced Large Line sales.

The table below shows the breakdown between Large Line sales, Small Line sales and other revenues during the six months ended 30 June 2008

and the six months ended 30 June 2007:

six months ended June 30, 2008 six months ended June 30, 2007

(unaudited) (unaudited)

In US$ 000 Percentage of net In US$ 000 Percentage of net sales

sales

Large Line sales 13,197 42.5% 17,109 49.8%

Small Line sales 9,542 30.8% 9,532 27.7%

Other revenues 8,277 26.7% 7,733 22.5%

Total 31,016 100% 34,374 100%

Revenue by Product Line

Large Line sales decreased from US$17.1m for the six months ended 30 June 2007 to US$13.2m for the six months ended 30 June 2008. This

decrease in revenue was driven by a 28.3% decrease in unit volume (from 60 units to 43 units) but partially offset by increases in average

selling prices. The lower unit volume was driven primarily by lower North American sales.

Small Line sales were flat from US$9.5m for the six months ended 30 June 2007 to US$9.5m for the six months ended 30 June 2008. Sales

of CopperHeads and PowerRakes unit sales decreased from 214 units sold during the six months ended 30 June 2007 compared with 198 units sold

during the six months ended 30 June 2008 but were offset by increases in average selling prices.

Other revenues, including sales of spare parts, refurbished machines, topping spreaders and accessories, increased from US$7.7m during

the six months ended 30 June 2007 to US$8.3m during the six months ended 30 June 2008. This revenue growth resulted primarily from the

increased sales of refurbished machines.

Revenue by Geography

Sales to customers located outside North America comprise the majority of Somero's revenue, constituting 51.6% and 40.8% of total

revenue for the six months ended 30 June 2008 and 2007 respectively.

As expected, North American (the United States and Canada) sales experienced a slowdown from US$20.4m during the six months ended 30

June 2007 to US$15.0m in 2008, principally due to the US economic slowdown. The Company has continued its focus on expanding sales outside

North America, with revenues increasing to US$16.0m during the six months ended 30 June 2008, an increase of 14.3% over revenues of US$14.0m

during the six months ended 30 June 2007. Sales in Europe, South Africa and the Middle East generated US$13.1m during the six months ended

30 June 2008, compared with US$10.3m during the during the six months ended 30 June 2007. Sales of the Large Laser Screed and the Small Line

product outside North America increased by 5.1% and 13.8% respectively between these two periods.

Sales in Asia, Australia and Central and South America represented US$2.9m during the six months ended 30 June 2008, as compared to

US$3.7m during the six months ended 30 June 2007. This decrease was driven by a decrease in sales of Small Line to 18 units during the six

months ended 30 June 2008, compared with 28 during the corresponding period of 2007.

Gross Profit

Somero's gross profit for the six months ended 30 June 2008 was US$17.6m, an 11.0% decrease over US$19.8m for the six months ended 30

June 2007. As a percentage of revenue, gross profit remained relatively stable at 56.6% for the six months ended 30 June 2008, from 57.5%

for the six months ended 30 June 2007. The slight change in gross profit as a percentage of revenue has been due to decreased sales volumes

(and therefore manufacturing volume), and discounting in North America, offset by a change in product mix and geographic mix.

Operating Expenses

Operating expenses were US$14.2m for the six months ended 30 June 2008, a 17.0% increase over US$12.1m for the six months ended 30 June

2007. The increase in operating expenses, which consists of selling, engineering and general and administrative expenses, resulted primarily

from an increase in total selling expenses due to increased mix of sales representatives in Europe; the cost of opening offices in China,

Germany, Spain and the Middle East; increased product development costs; increased legal costs and CREST admission costs. Operating

expenses were 45.8% and 35.1% of revenues for the six months ended 30 June 2008 and for the six months ended 30 June 2007, respectively.

Debt Restructuring

The Company has previously disclosed the March 2007 refinancing with Citizens Bank New Hampshire, a wholly owned subsidiary of Royal

Bank of Scotland at a lower LIBOR rate than prior financing. The RBS financing consisted of a US$10.0m term loan and a US$14.0m available

revolver line. At June 2008 the Company bank debt was US$11.2m, reduced by US$3.7m from a debt of US$14.9m as at 31 December 2007 (see note

5 to the financial statements).

Earnings per Share

Basic earnings per share represents income available to common stockholders divided by the weighted average number of shares outstanding

during the period. Diluted earnings per share reflect additional common shares that would have been outstanding if dilutive potential common

shares had been issued, as well as any adjustment to income that would result from the assumed issuance.

Potential common shares that may be issued by the Company relate to outstanding stock options. Earnings per common share have been

computed based on the following:

June 30, June 30,

2008 2007

US$ 000 US$ 000

Income available to shareholders 1,960 3,311

Basic weighted average shares outstanding 34,282 34,282

Net dilutive effect of stock options 0 168

Diluted weighted average shares outstanding 34,282 34,450

June 30, June 30,

2008 2007

Basic earnings per share $ 0.06 $ 0.10

Diluted earnings per share $ 0.06 $ 0.10

Net Income before amortisation of intangibles and cost of

early extinguishment of debt earnings per share $0.09 $ 0.17

(See note attached to the 'net income to EBITDA reconciliation and net income before amortisation and cost of early extinguishment of

debt reconciliation' table for discussion of the non-GAAP measures used).

The Board has decided to maintain an interim dividend at a level of US$0.03 per share for the six months ended 30 June 2008. The Board

proposes that the interim dividend be paid on 6 October 2008 to shareholders on the register as at 19 September 2008.

SOMERO ENTERPRISES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

AS OF 30 JUNE 2008 AND 31 DECEMBER 2007 (in thousands, except share amounts)

30 31 December

June

2008 2007

US$ 000 US$ 000

Assets

Current assets:

Cash and cash equivalents 2,237 3,842

Accounts receivable - net 4,500 4,279

Inventory - net 6,854 6,948

Prepaid expenses and other assets 715 860

Income tax receivable 0 0

Deferred tax asset 665 594

Assets held for sale 0 618

Total current assets 14,971 17,141

Property, plant and equipment - net 4,256 4,103

Intangible assets - net 18,038 19,236

Goodwill 16,400 16,400

Deferred financing costs 73 94

Other assets 283 135

Total assets 54,021 57,109

Liabilities and stockholder's equity

Current liabilities

Notes payable - current portion 1,429 1,429

Accounts payable 4,227 4,051

Accrued expenses 2,001 2,453

Income taxes payable 145 374

Obligations under capital lease 0 0

Other liabilities 238 152

Total current liabilities 8,040 8,459

Notes payable, net of current portion 9,786 13,500

Capital lease 0 0

Deferred income taxes 519 467

Other liabilities, net of current portion 300 455

Total liabilities 18,645 22,881

Commitments and contingencies - -

Stockholder's equity

Preferred stock, US$0.001 par value, 50m shares - -

authorised, no shares issued and outstanding

Common stock, US$0.001 par value, 80m shares 4 4

authorised, 34,281,968 shares issued and outstanding at

31 December 2007 and 30 June 2008

Additional paid In capital 22,556 22,344

Retained earnings 13,059 12,128

Other comprehensive income(loss) (243) (248)

Total stockholder's equity 35,376 34,228

Total liabilities and equity 54,021 57,109

See notes to condensed consolidated financial statements.

SOMERO ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

AS OF 30 JUNE 2008 AND 31 DECEMBER 2007

For the six months ended 30 June

2008 2007

US$ 000 US$ 000

Revenue 31,016 34,374

Cost of sales 13,460 14,604

Gross profit 17,556 19,770

Operating expenses

Selling expenses 6,760 5,619

Engineering expenses 981 847

General and administrative expenses 6,459 5,612

Total operating expenses 14,200 12,078

Operating income 3,356 7,692

Other income (expense) 0

Interest expense (457) (944)

Interest income 22 36

Foreign exchange gain 225 50

Other (22) 1,481

Income before income taxes 3,124 5,353

Provision for income taxes (1,164) (2,042)

Net income 1,960 3,311

Earnings per common share

Basic US$0.06 US$0.10

Diluted US$0.06 US$0.10

See notes to condensed consolidated financial statements.

SOMERO ENTERPRISES, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Stockholders' Equity

FOR THE SIX MONTHS ENDED 30 JUNE 2008

Common Stock - Series A Common Stock Series - C Additional Other

Compre- Total Compre-

Common Stock Series - B

paid In Retained

hensive stockholders hensive

Shares Amount Shares Amount Shares Amount capital earnings income

(loss) equity income

US$000 US$000 US$000 US$000 US$000

US$000 US$000 US$000

Balance - December 31, 2007 - - - - 34,281,968 4 22,344 12,128

(248) 34,228 6,677

Cumulative translation

(1) (1) (1)

adjustment

Change in fair value of

6 6 6

derivative instruments

Net income 1,960

1,960 1,960

Share based compensation 212

212

Dividends paid (1,029)

(1,029)

Balance - June 30, 2008 - - - - 34,281,968 4 22,556 13,059

(243) 35,376 1,965

SOMERO ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the 6 months ended 30 June 2008 and the 6 months ended 30 June 2007

Six months ended Six months ended

30 June 2008 30 June 2007

(unaudited) (unaudited)

US$ 000 US$ 000

Cash flows from operating activities:

Net income 1,960 3,311

Deferred taxes (19) 61

Depreciation and amortisation 1,350 2,629

Amortisation of deferred financing 21 114

costs

Loss on sale of assets 22 0

Realised gain (loss) on currency 0 50

exchange

Share based compensation 212 209

Working capital changes:

Accounts receivable (221) (737)

Inventories 94 (1,613)

Prepaid expenses and other assets 145 231

Income taxes receivable 0 212

Other assets (148) (29)

Accounts payable and other liabilities (338) 828

Income taxes payable (229) 909

Net cash provided by operating 2,849 6,175

activities

Cash flows from investing activities:

Proceeds from sale of property and 637 0

equipment

Property and equipment disposal 0

Property and equipment purchases (347) (216)

Net cash used in investing activities 290 (216)

Cash flows from financing activities:

Borrowings from additional financing 0 22,254

Payment for financing costs 0 (125)

Repayment of notes payable (3,714) (27,409)

Payment of capital lease 0 (658)

Repayment of working capital advance 0 0

from parent

Payment of dividends (1,029) (113)

Proceeds from initial public offering 0 0

of common stock, net of costs

Net cash used in financing activities (4,743) (6,051)

Effect of exchange rates on cash and cash (1) (27)

equivalents

Net increase (decrease) in cash and cash (1,605) (119)

equivalents

Cash and cash equivalents:

Beginning of period 3,842 1,895

End of period 2,237 1,776

SOMERO ENTERPRISES, INC. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) FOR THE 6 MONTHS ENDED 30 JUNE 2008 AND 30 JUNE 2007

1 Organisation and Description of Business

Nature of Business - Somero Enterprises, Inc. (the "Company" or "Somero") designs, manufactures, refurbishes, sells and distributes

concrete levelling, contouring and placing equipment, related parts and accessories, and training services worldwide. The operations are

conducted from an executive office in Fort Myers, FL, corporate office in Houghton, Michigan, a single assembly facility located in

Houghton, Michigan, a European distribution office in the United Kingdom, sales offices in Canada and Germany.

2 Summary of Significant Accounting Policies

Basis of Presentation - The interim financial data as of 30 June 2008 and 31 December 2007 and the six months ended 30 June 2008 and 30

June 2007 is unaudited. The condensed consolidated financial statements, in the opinion of Somero management, includes all normal recurring

adjustments necessary for a fair presentation of the statement of results for the interim periods. The statements have been prepared in

accordance with accounting principles generally accepted in the United States of America ("US GAAP") but do not include all of the

information and note disclosures required by US GAAP. The condensed consolidated financial statements should be read in conjunction with the

audited consolidated financial statements and notes thereto included in Somero's Annual Report and filing with the AIM exchange for the year

ended 31 December 2007. The results for the six month period ended 30 June 2008 are not necessarily indicative of the results to be expected

for the year ending 31 December 2008 or for any other interim period.

Principles of Consolidation - The consolidated financial statements include the accounts of Somero Enterprises, Inc. and its

subsidiaries. All significant intercompany transactions and accounts have been eliminated in consolidation.

Cash and Cash Equivalents - Cash includes cash on hand, cash in banks, and temporary investments with a maturity of three months or less

when purchased.

Accounts Receivable and Allowances for Doubtful Accounts - Financial instruments which potentially subject the Company to concentrations

of credit risk consist primarily of accounts receivable. The Company's accounts receivable are derived from revenue earned from a diverse

group of customers primarily located in the United States. The Company performs credit evaluations of its commercial customers and maintains

an allowance for doubtful accounts receivable based upon the expected ability to collect accounts receivable. Reserves, if necessary, are

established for amounts determined to be uncollectible based on specific identification and historical experience. As of 30 June 2008 and 31

December 2007, the allowance for doubtful accounts was approximately US$219,000 and US$191,000, respectively.

Inventories - Inventories are stated at the lower of cost, using the first in, first out ("FIFO") method, or market. Provision for

potentially obsolete or slow-moving inventory is made based on management's analysis of inventory levels and future sales forecasts.

Deferred Financing Costs - Deferred financing costs incurred in relation to long-term debt, are reflected net of accumulated

amortisation and are amortised over the expected repayment term of the debt instrument, which is four years from the debt inception date.

These financing costs are being amortised using the effective interest method. Amortisation of deferred financing costs are included as a

component of interest expense.

Intangible Assets and Goodwill - Intangible assets consist principally of customer relationships and patents, and are carried at their

fair value, less accumulated amortisation. Intangible assets are amortised using the straight-line method over a period of three to 12

years, which is their estimated period of economic benefit. Goodwill is not amortised but is subject to impairment tests on an annual basis

or earlier if a change in circumstances should arise, and the Company has chosen 31 December as its periodic assessment date.

The Company evaluates the carrying value of long-lived assets, excluding goodwill, whenever events and circumstances indicate the

carrying amount of an asset may not be recoverable. For the periods ended 30 June 2008 and 31 December 2007, no such events or circumstances

were identified. The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flows from such

asset (or asset group) are separately identifiable and less than the asset's (or asset group's) carrying value. In that event, a loss is

recognised to the extent that the carrying value exceeds the fair value of the long-lived asset. Fair value is determined primarily using

the anticipated cash flows discounted at a rate commensurate with the risk involved.

Revenue Recognition - The Company recognises revenue on sales of equipment, parts and accessories when persuasive evidence of an

arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable, and collectability is

reasonably assured. For product sales where shipping terms are F.O.B. shipping point, revenue is recognised upon shipment. For arrangements

which include F.O.B. destination shipping terms, revenue is recognised upon delivery to the customer. Standard products do not have customer

acceptance criteria. Revenues for training are deferred until the training is completed unless the training is deemed inconsequential or

perfunctory.

Warranty Reserve - The Company provides warranties on all equipment sales ranging from three months to one year, depending on the

product. Warranty reserves are estimated net of the warranty passed through to the Company from vendors, based on specific identification of

issues and historical experience.

Property, Plant and Equipment - Property, plant and equipment is stated at estimated market value based on an independent appraisal at

the acquisition date or at cost for subsequent acquisitions, net of accumulated depreciation and amortisation. Land is not depreciated.

Depreciation is computed on buildings using the straight-line method over the estimated useful lives of the assets, which is 31.5 to 40

years for buildings (depending on the nature of the building), 15 years for improvements, and two to five years for machinery and

equipment.

Income Taxes - The Company accounts for income taxes in accordance with Statement of Financial Accounting Standards ("SFAS") No. 109,

"Accounting for Income Taxes". Deferred tax assets and liabilities are recognised for the future tax consequences attributable to temporary

differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating

loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognised in income in the period that includes the enactment date. Deferred tax assets are reduced

by a valuation allowance, if necessary, to the extent that it appears more likely than not, that such assets will be unrecoverable.

Use of Estimates - The preparation of financial statements in conformity with US GAAP requires management to make estimates and

assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those

estimates.

Recent Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations. SFAS No. 141 (R) requires an acquirer to recognise the assets

acquired, the liabilities assumed, and any non-controlling interest in the acquiree at the acquisition date, measured at their fair values

as of that date. It requires acquisition-related costs and restructuring costs that the acquirer expects but is not obligated to incur to be

recognised separately from the acquisition. SFAS No. 141(R) modifies the criteria for the recognition of contingencies as of the acquisition

date. It also provides guidance on subsequent accounting for acquired contingencies. SFAS No. 141 (R) is effective for business acquisitions

for which the acquisition date is on or after 1 January 2009. The Company may not apply it before that date. In March 2008, the FASB issued

SFAS No. 161, disclosures about derivative instruments and hedging activities - an amendment of FASB statement No. 133. SFAS No. 161

requires enhanced disclosures about an entities derivative and hedging activities. Under this statement, entities are required to disclose how and why an entity uses derivative

instruments, how derivative instruments and related hedged items are accounted for under SFAS No. 133, accounting for derivative instruments

and hedging activities, and its related interpretations, and how derivative instruments and related hedged items affect an entity's

financial position, financial performance and cash flows. SFAS No. 161 is effective for financial statements issued for fiscal years and

interim periods beginning after 15 November 2008. The Company is evaluating the impact, if any, the adoption of SFAS No. 161 will have on

its financial statement disclosures.

Stock Based Compensation - The Company accounts for its stock option issuances under Statement of

Financial Accounting Standard No 123R "Share-Based Payment". (SFAS 123R) which was issued by the FASB in December 2004. SFAS No. 123R

required recognition of the cost of employee service received in exchange for an award of equity instruments in the financial statements

over the period the employee is required to perform the services in exchange for the award (presumptively the vesting period). SFAS No. 123R

also requires measurement of the cost of employee services in exchange for an award based on the grant-date fair value of the award.

Compensation expense was US$212,000 and US$209,000 for the six month periods ending 30 June 2008 and 30 June 2007, respectively.

Transactions in and Translation of Foreign Currency - The functional currency for the Company's subsidiaries outside the United States

is the applicable local currency. Balance sheet amounts are translated at 30 June exchange rates and statement of operations accounts are

translated at average rates. The resulting gains or losses are charged directly to accumulated other comprehensive income. The Company is

also exposed to market risks related to fluctuations in foreign exchange rates because some sales transactions, and some assets and

liabilities of its foreign subsidiaries, are denominated in foreign currencies other than the designated functional currency. Gains and

losses from transactions are included in the Company's net income as foreign exchange gain (loss).

Comprehensive Income - Comprehensive income, which is the combination of reported net income and other comprehensive income, was

composed of the Company's net income, change in the fair value of interest rate swap, and foreign exchange gains (losses) for the six months

ended 30 June 2008 and 30 June 2007. Total comprehensive income for the periods was approximately US$1,965,000 and US$3,369,000,

respectively.

Earnings Per Share - Basic earnings per share represents income available to common stockholders divided by the weighted average number

of shares outstanding during the period. Diluted earnings per share reflect additional common shares that would have been outstanding if

dilutive potential common shares had been issued, as well as any adjustment to income that would result from the assumed issuance. Dilutive

shares were nil and 168,000 in 2008 and 2007 respectively. Potential common shares that may be issued by the Company relate to outstanding

stock options have been excluded from the calculation because they are anti-dilutive. Earnings per common share have been computed based on

the following (in thousands):

2008 2007

Net income available to shareholders $1,960 $3,311

Basic weighted average shares outstanding 34,282 34,282

Net dilutive effect of stock options 0 168

Diluted weighted average shares outstanding 34,282 34,450

Recently Adopted Accounting Standards - The Company adopted Statement of Financial Accounting Standards ("SFAS") No.157, Fair Value

Measurements, as of 1 January 2008. SFAS No.157 defines fair value, establishes a framework for measuring fair value in generally accepted

accounting principles and expands disclosures about fair value measurements. This statement requires, among other things, the Company's

valuation techniques used to measure fair value to maximise the use of observable inputs and minimize the use of unobservable inputs. This

change resulted in no impact to 1 January 2008 retained earnings.

In conjunction with the adoption of SFAS No.157, the Company adopted SFAS No.159, The Fair Value Option for Financial Assets and

Financial Liabilities, as of 1 January 2008. SFAS No. 159 provides an option for most financial assets and liabilities to be reported at

fair value on an instrument-by-instrument basis with changes in fair value reported in earnings. After initial adoption, the election is

made at the acquisition of a financial asset, financial liability, or a firm commitment and it may not be revoked. The Company has not

elected to report certain financial instruments and other items at fair value as permitted by the SFAS No.159 transition provisions. The

adoption of this statement had no impact to 1 January 2008 retained earnings.

3 Inventories

Inventories consisted of the following at 30 June 2008 and 31 December 2007 (in thousands):

2008 2007

Raw materials $ 2,873 $ 3,358

Finished goods and work in process 4,077 3,725

6,950 7,083

Less: reserve for excess and obsolete inventory (96) (135)

Total $ 6,854 $ 6,948

4 Property, Plant, and Equipment

Property, plant, and equipment consists of the following at 30 June 2008 and 31 December 2007

(in thousands):

2008 2007

Land $ 207 $ 207

Buildings and improvements 3,774 3,574

Machinery and equipment 1,097 975

Property and Equipment held under capital leases 0 0

(See Note 8)

Equipment sold under recourse contracts 178 178

5,256 4,932

Less: accumulated depreciation and amortisation (1,000) (831)

$ 4,256 $ 4,103

Depreciation expense for the six months ended 30 June 2008 and the six months ended 30 June 2007, was approximately US$184,000 and

US$193,000, respectively.

5 Debt Obligations

Summary - The Company executed a credit facility with a financial institution in March 2007 (see section entitled "Credit Facility"

below). The proceeds of the new term loan and the revolving line of credit were used to pay off in full the 31 December 2006 balances. The

Company incurred a loss on the early extinguishment of debt of approximately US$1,481,000 which included deferred financing cost of

approximately US$1,245,000. Company's debt obligations consisted of the following at 30 June 2008 and 31 December 2007:

2008 2007

Bank debt:

Term loans

Five-year secured term loan 8,215 8,929

Five-year secured reducing revolving line of credit 3,000 6,000

Less debt obligations due within one year (1,429) (1,429)

Obligations due after one year 9,786 13,500

Credit Facility - The Company has a credit facility with a financial institution dated 16 March 2007comprising the following at 30 June

2008:

* US$14,000,000 five year secured reducing revolving line of credit

* US$10,000,000 five year secured reducing term loan

The Company has fixed the interest rate for the term loan and the revolving facility through a series of interest rate swaps. The

revolver loan's interest rate swap's notional amount is US$3,000,000, pays a fixed 5.20%, and had a 30 June 2008 fair market value of

approximately (US$94,000) which will amortise down by approximately US$65,000 in the next 12 months. The term loan's interest rate swap's

initial notional amount is US$10,000,000, pays a fixed 5.15%, and had a 30 June 2008 fair market value of approximately (US$277,000) which

will amortise down by approximately US$162,000 in the next 12 months. The interest rate swaps are designated as cash flow hedges. The

revolver and the term loan interest rates are libor (fixed by the interest rate swaps) plus an amount determined by the ratio of "funded

debt/last 12 months EBITDA", as defined in the loan agreement. The effective interest rate at 30 June 2008 for the revolving line of credit

was 6.10% and for the term loan 6.05%. The new credit facilities are secured by substantially all of the Company's assets and contain a number of restrictive covenants that among other things limit the

ability of the Company to incur debt, issue capital stock, change ownership and dispose of certain assets. The revolving line of credit

available reduces over the five year term and as of 30 June 2008 the borrowed balance is below the credit line available.

Effective 1 January 2008, the Company adopted SFAS No. 157. This standard establishes a consistent framework for measuring fair value

and expands disclosure requirements about fair value measurements. SFAS No. 157, among other things, requires the Company to maximise the

use of observable inputs when measuring fair value. The Company recorded no change to 1 January 2008, retained earnings as a result of

adopting SFAS No. 157.

The Company holds certain other financial instruments which are carried at fair value. The Company determines fair value based upon

quoted prices when available or through the use of alternative approaches, such as model pricing, when market quotes are not readily

accessible or available. In determining the fair value of the Company's obligations, various factors are considered including; closing

exchange or over-the-counter market price quotations; time value and volatility of factors underlying options and derivatives; price

activity for equivalent instruments; and the Company's own-credit standing.

These valuation techniques may be based upon observable and unobservable inputs. Observable inputs reflect market data obtained from

independent sources, while unobservable inputs reflect the Company's market assumptions. These two types of inputs create the following fair

value hierarchy.

* Level 1 - Quoted prices for identical instruments in active markets.

* Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in market

that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

* Level 3 - Instruments whose significant value drivers are unobservable.

Future Payments - The future payments by year under the Company's debt obligations are as follows at:

30 June 2008

US$ 000,

2008 $ 714

2009 1,429

2010 1,429

2011 1,429

Thereafter 6,213

Total payments $ 11,214

Interest - Interest expense on the credit facility for the six months ended 30 June 2008 and the six months ended 30 June 2007, was

approximately US$454,000 and US$902,000, respectively, related to the debt obligation. Interest expense paid by the Company's UK subsidiary

was approximately US$2,000 and US$70,000 for the period 30 June 2008 and the six months ended 30 June 2007.

6 Operating Leases

The Company leases property, vehicles and office equipment under leases accounted for as operating leases. Future minimum payments by

year under non-cancelable operating leases with initial terms in excess of one year were as follows (in thousands):

30 June 2008

US$000

2008 224

2009 362

2010 302

2011 193

After 2011 244

1,325

Total rent expense under operating leases for the period ending 30 June 2008 and 30 June 2007 was approximately US$318,000 and

US$123,000.

7 Commitments and Contingencies

The Company has entered into employment agreements with certain members of senior management. The terms of these agreements range from

six months to one year and include non-compete and non-disclosure provisions as well as providing for defined severance payments in the

event of termination or change in control. In 2007 the Company entered into a five year or minimum purchase obligation of US$625,000 with a

supplier. There is a related contingent liability of US$49,000 to cancel the contract which declines over five years on a pro rated basis.

The Company has entered into a short-term lease with the new owners of the Corporate Office in Jaffrey, New Hampshire between February 2008

and September 2008. The Company has also entered into a five year lease for its executive offices in Fort Myers, FL beginning in July 2008.

The Company is subject to various unresolved legal actions which arise in the normal course of its business. Although it is not possible to

predict with certainty the outcome of these unresolved legal actions or the range of possible losses, the Company believes these unresolved legal actions will not have a material effect on

its financial statements.

8 Income Taxes

FASB issued Interpretation No. 48 "Accounting for Uncertainty in Income Taxes" an interpretation of FASB Statement No. 109, which the

Company adopted as of 1 January 2007. The interpretation addresses the determination of whether tax benefits claimed or expected to be

claimed on a tax return should be recorded in the financial statements. Under FIN 48, the Company may recognise the tax benefit from an

uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities,

based on the technical merits of the position. The tax benefits recognised in the financial statements should be measured based on the

largest benefit that has a greater than 50% likelihood of being realised upon ultimate settlement. FIN 48 also provides guidance on

derecognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures.

The Company's effective tax rate for the six months ended 30 June 2008 was 37.3% compared to the federal statutory rate of 34.0%. The

effective tax rate is greater than the statutory rate mainly due to the effect of subpart F income and state taxes.

As of 30 June 2008, the Company had a gross unrecognised tax benefit of US$81,000. Of this total, US$45,000 represents the amount of

unrecognised tax benefits (net of the federal benefit on state issues) that, if recognised, would favorably affect the effective income tax

rate in a future period.

Accrued interest and penalties related to unrecognised tax benefits are not included in tax expense.

Somero is subject to US federal income tax as well as income tax of multiple state jurisdictions. The Company began business in 2005 and

therefore the statute of limitations for all federal, foreign and state income tax matters for tax years from 2005 forward is still open.

Somero has no federal, foreign or state income tax returns currently under examination.

The Company's gross unrecognised tax benefit was reduced during the current period by US$48,000 as a result of a settlement with a

state.

Included in the balance at 30 June 2008 are US$78,000 of tax accruals which will decrease within the next six months. The Company will

be filing amended returns for the years ended 31 December 2005 and 31 December 2006 to eliminate the tax exposure related to these years.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSLESASASEFU

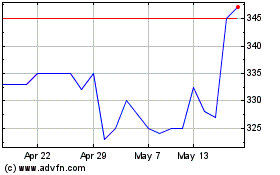

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

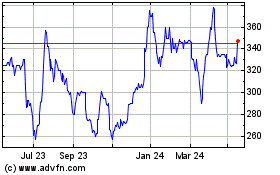

Somero Enterprise (LSE:SOM)

Historical Stock Chart

From Jul 2023 to Jul 2024