Indonesia Scrutinizes U.K. Bank's Clients -- WSJ

11 October 2017 - 6:02PM

Dow Jones News

At issue is whether tax is owed on transfers at Standard

Chartered accounts

By Margot Patrick

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 11, 2017).

Indonesia is investigating whether dozens of citizens with trust

accounts at Standard Chartered PLC owe tax after transferring $1.4

billion from Guernsey to Singapore in 2015.

The transfers, made just before an automatic tax information

sharing program took effect in Guernsey, involved 81 Indonesians,

Indonesia's top tax official said late Monday. He said no names

from the military, police or other law enforcement were on the

client list, contradicting earlier reports that Indonesian military

officials were among the account holders.

The client transfers and subsequent probes by regulators in

Guernsey and Singapore were reported by Bloomberg last week. On

Monday, Singapore's Monetary Authority confirmed it is conducting

an investigation and will take "firm action" against any financial

institution or individual found breaking its anti-money-laundering

or counter terrorist financing rules. Guernsey's Financial Services

Commission didn't immediately return a call Tuesday.

Ken Dwidjugiasteadi, director general of tax at Indonesia's

finance ministry, said 62 of the 81 people had participated in a

recent tax amnesty program in Indonesia. He said ministry tax

officials have been studying the matter for two months and expect

to finish by the end of October.

Standard Chartered self-reported the transfers after questions

were raised internally over their timing, and on due diligence

conducted on the clients, a person familiar with the matter said.

It acquired at least some of the clients in 2008 when it bought

American Express Bank Ltd. and its trust business. Last year,

Standard Chartered said it was moving the Guernsey trust business

to Singapore because of changing client needs.

Guernsey joined other countries automatically exchanging tax

information on individuals and companies a year earlier than

Singapore. It committed to make its first exchange in 2017, while

Singapore isn't due to exchange information until 2018 under the

common reporting standard endorsed by the OECD.

The standard is part of a global effort to crack down on tax

evasion.

--I Made Sentana in Jakarta and P.R. Venkat in Singapore

contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

October 11, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

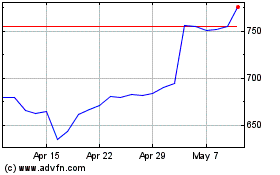

Standard Chartered (LSE:STAN)

Historical Stock Chart

From May 2024 to Jun 2024

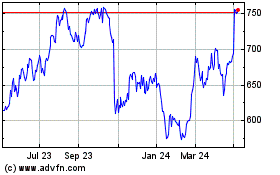

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Jun 2023 to Jun 2024