TIDMZEG

RNS Number : 6460Z

Zegona Communications PLC

24 May 2021

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR TO ANY US PERSON, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA

(OTHER THAN SPAIN) OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

ZEGONA COMMUNICATIONS PLC ( " Zegona " )

LEI: 213800ASI1VZL2ED4S65

24 MaY 2021

ZEGONA ANNOUNCES RETURN OF GBP335 MILLION OF CAPITAL TO ITS

SHAREHOLDERS, EQUIVALENT TO GBP1.53 PER SHARE, AND MANAGEMENT

INCREASES ITS INVESTMENT IN ZEGONA

Zegona Communications plc ("Zegona") today announces its

intention to return GBP335 million to its shareholders in cash via

a capital return following receipt of the proceeds from the

acquisition of Euskaltel, S.A. ("Euskaltel") by MásMóvil Ibercom,

S.A.U. ("MasMovil").

MasMovil's Offer will deliver substantial cash proceeds to

Zegona

-- On 28 March 2021, MasMovil launched a tender offer to acquire

100% of Euskaltel at EUR11.17 per share in cash (the "Offer"),

valuing Euskaltel's equity at EUR2.0 billion, which represents an

enterprise value of EUR3.5 billion

-- The Offer equates to a Zegona Underlying Asset Value of

GBP1.70 per share(1) and represents a return on Zegona's Net

Invested Capital of 87%(2)

-- Assuming the Offer closes as expected, Zegona will receive

c.EUR428 million in cash for its 21.44% stake(3) . These proceeds

will convert into c.GBP370 million under the contingent FX forward

transaction that Zegona entered into on 8 April 2021

-- Together with Zegona's other net cash(4) , the outstanding

tax contingent consideration(5) and anticipated ongoing operating

costs, Zegona's total asset value is expected to be c.GBP372

million at the closing of MasMovil's Offer

Zegona has committed to returning GBP335 million to its

shareholders

-- Zegona has undertaken to seek the necessary approvals to

return GBP335 million in cash to its shareholders following the

closing of MasMovil's Offer. This represents a value of GBP1.53 per

Zegona share(6)

-- Zegona is committed to returning as much of the proceeds from

the sale of Euskaltel as soon as reasonably possible, while leaving

the business in a position to source its next investment

opportunity. Following the capital return and payment of Zegona

management's long term incentive programme ("LTIP"), Zegona expects

to have a net cash balance of c.GBP11 million, equivalent to

GBP0.05 per Zegona share. Together with the capital return of

GBP1.53 per share, the total value for shareholders is expected to

be GBP1.58 per Zegona share(7)

-- The capital return will be implemented using the mechanism

which the directors believe offers the best combination of

timeliness, cost effectiveness and tax efficiency. Zegona is

committed to completing the capital return as soon as is reasonably

practicable(8)

-- Zegona will hold a shareholder vote within 2 years of the

closing of the Euskaltel sale on returning remaining funds to

shareholders if it has not made its next investment within that

timeframe(9)

Zegona management has agreed to increase its investment in

Zegona by GBP4 million

-- Zegona management's LTIP will be triggered by the sale of

Zegona's holding in Euskaltel and the return of the net proceeds of

that sale to shareholders(10)

-- The Zegona senior team (the "Managers") has committed to

re-invest a portion of the LTIP, equating to GBP4 million in

aggregate, back into Zegona and has entered into binding

subscription agreements(11) for new shares. The subscription price

will be the adjusted net asset value per share(12) of Zegona

immediately prior to completion of the subscription, which is

currently expected to be c.GBP0.05

-- Zegona's two executive directors will waive any bonus payment

for 2021 and will not receive any bonus for the period when Zegona

does not own a material underlying asset

-- Following the re-investments, Zegona expects to have a net

cash balance of c.GBP15 million(13) , with management owning in

aggregate c.28% of the business(14)

Marwyn supports proposals

-- Marwyn Investment Management LLP ("Marwyn")(15) supports the

Company's plans and timing for the distribution of proceeds to

shareholders. These plans also have the support of other

significant shareholders with whom Zegona has consulted

-- Marwyn has confirmed that its concerns have been addressed

and, as a result, has withdrawn its request for a General Meeting,

which was announced on 4 May 2021

-- Marwyn strongly supports management's intention to re-invest

in the ongoing Zegona business and has agreed to vote in favour of

all resolutions at the forthcoming AGM

Once Zegona exits Spain, it will continue to execute its

Buy-Fix-Sell strategy across the European TMT sector. We will focus

on businesses that require active change to realise full value,

creating long-term returns through fundamental business

improvements.

We see a very healthy environment for investments across the

broader European TMT industry. The market is large and fragmented,

with well over 100 operators, of which over half fit our target

investment size of an enterprise value range of GBP2-5 billion. We

have seen increased deal activity and greater availability of

assets driven by significant consolidation and convergence. We

believe this will continue over the coming years, creating fertile

ground to both buy and sell assets and once again create

shareholder value through fundamental business improvement.

Eamonn O'Hare, Zegona's Chairman and CEO commented:

"When we originally invested in Spain in 2015, we identified the

opportunity for substantial value creation, with further upside

potential from industry consolidation. The offer by MasMovil to

acquire Euskaltel underscored the success of our strategy,

delivering significant value for Zegona shareholders. Zegona has a

well-established policy of raising capital when we need it and

returning capital quickly and efficiently when we monetise our

investments. Today's announcement represents the return of the

value from Euskaltel to shareholders and reflects Zegona

management's confidence in the opportunity to deliver an attractive

new investment in the European TMT sector."

Enquiries

Tavistock (Public Relations adviser - UK)

Tel: +44 (0)20 7920 3150

Jos Simson - jos.simson@tavistock.co.uk

About Zegona

Zegona was established in 2015 with the objective of investing

in businesses in the European Telecommunications, Media and

Technology sector and improving their performance to deliver

attractive shareholder returns. Zegona is led by former Virgin

Media executives Eamonn O'Hare and Robert Samuelson.

Zegona's first transaction was the EUR640 million acquisition of

Telecable in August 2015, the leading quad-play telecommunications

operator in Asturias, Spain. In 2017, Zegona sold Telecable for a

total consideration of up to EUR701 million(16) to the northern

Spanish telecoms group Euskaltel. As part of the transaction,

Zegona returned GBP140 million of capital to its shareholders and

became a 15% shareholder in Euskaltel.

In 2019, Zegona became the largest shareholder in Euskaltel and,

through the introduction of José Miguel García as CEO, implemented

a plan to drive significant change in the business. The plan

involved efficiency gains of at least EUR40 million per annum,

returning Euskaltel's core business to growth and expanding

nationally through launching the Virgin telco brand.

In March 2021, MasMovil launched a tender offer to acquire

Euskaltel at EUR11.17 per share, valuing Euskaltel's equity at

EUR2.0 billion, which equates to an enterprise value of EUR3.5

billion. The offer was supported by Zegona and Euskaltel's other

major shareholders and represents a return on Zegona's Net Invested

Capital of 87%. The acquisition underscores the success of our

strategy, delivering significant value creation for Zegona

shareholders.

About Euskaltel

Euskaltel is the leading converged telecommunications provider

in northern Spain and has recently expanded to offer services

nationally. It provides high speed broadband, data-rich mobile,

advanced TV and fixed communications services to residential and

business customers under the Euskaltel, R Cable, Telecable and

Virgin telco brands. Euskaltel is a public company traded on the

stock markets of Bilbao, Madrid, Barcelona and Valencia.

Notes:

1. Zegona's Underlying Asset Value per share as set out in

Zegona's announcement dated 29 March 2021

2. Return on Zegona's Net Invested Capital as set out in

Zegona's announcement dated 29 March 2021. As at 26 March 2021,

Zegona's Net Invested Capital was GBP198.5 million, equivalent to

GBP0.91 per Zegona share. Zegona's Net Invested Capital represents

the net amount of all shareholder subscriptions less all returns to

shareholders, including dividends, capital returns and share

buy-backs since Zegona's initial quotation on the AIM Market in

March 2015

3. c.EUR428 million proceeds based on tender offer price of

EUR11.17 per share for the 38.3 million Euskaltel shares held by

Zegona

4. On the sale of its stake in Euskaltel, Zegona will need to

repay its current GBP10 million loan facility with Barclays as this

is secured on 32.2 million of its Euskaltel shares

5. As part of its acquisition of Telecable in 2017, Euskaltel

agreed to pay Zegona a contingent consideration equal to 35% of the

value of the Telecable's tax assets once these were confirmed as

being available for use by Euskaltel. Zegona expects Euskaltel to

pay this contingent consideration no later than 15 days after the

settlement of the Offer at the value of EUR8.654 million, which is

the liability to Zegona recorded in Euskaltel's financial

statements for the year ended 31 December 2020

6. The capital return is dependent on the closing of MasMovil's

Offer, which is subject to regulatory clearances and to acceptance

of the Offer by a number of shares representing at least 75% plus

one share of the total outstanding share capital of Euskaltel, and,

amongst other requirements, on the approval of Zegona shareholders

of the actions required for the capital return. The Spanish tender

offer process is expected to take around 6 months from announcement

to settlement. However, this timeline can be impacted by any delays

in regulatory reviews and approvals and if there are competing

offers

7. The total value for shareholders is calculated based on a

capital return of GBP335 million plus Zegona's expected net cash

balance of c.GBP11 million post the return of capital and payment

of the LTIP. This value is a calculation and not a forecast value

for Zegona shareholders. See the heading "Calculation of total

value" below

8. The capital return will be conditional upon the closing of

MasMovil's Offer and subject to all applicable laws and

regulations, including the receipt of the required shareholder and

court approvals and such other third-party approvals as reasonably

required, which the Company has undertaken to use all reasonable

endeavours promptly to procure

9. If holders of a majority of Zegona's shares (excluding shares

held by Zegona management) vote in favour, Zegona will promptly

cease all operations and return its remaining funds to

shareholders. Shareholders will be offered further votes on ceasing

Zegona's operations and returning remaining funds at each

subsequent AGM if Zegona has still not made its next investment by

that time

10. Net proceeds of the sale are after satisfying Zegona

creditors. The value of the LTIP owed to the management team is

expected to be c.GBP25.7 million, as per the calculation set out in

the Zegona Limited articles of association in the event of a

"Takeover", which includes the scenario where all or substantially

all of the business or assets of Zegona Limited have been sold and

the net proceeds of the sale, after satisfying Zegona's creditors,

are returned to shareholders. The value of the LTIP will be

confirmed by the Company's auditors or an independent global

accounting firm

11. The Managers have entered into binding subscription

agreements, pursuant to which Eamonn O'Hare has conditionally

subscribed GBP2,366,800, Robert Samuelson has conditionally

subscribed GBP1,183,400, Howard Kalika has conditionally subscribed

GBP224,900 and Menno Kremer has conditionally subscribed

GBP224,900, in each case for new ordinary shares in Zegona (each a

"Re-investment"). The subscription agreements are subject to the

closing of the Offer, the LTIP being paid, shareholder approval for

the new Zegona ordinary shares to be issued at a general meeting to

be convened for immediately prior to the AGM on 30 June 2021 and to

admission of them to trading on the London Stock Exchange. No

prospectus is expected to be required to be issued. To the extent

that the aggregate number of shares to be subscribed under the

subscription agreements exceeds 28.1% of the issued share capital

of the Company at the time, the subscriptions shall be scaled back

pro rata. As key members of Zegona's management team (and in the

case of Eamonn O'Hare and Robert Samuelson, directors of Zegona),

each of the Managers is a related party, and each Re-investment is

a material related party transaction, in each case for the purposes

of and as defined under DTR 7.3

12. The adjusted net asset value will be calculated post the

capital return of GBP335 million to shareholders, with no

provisions being made for any potential value being received from

the non-current tax receivable described below, no provisions for

the termination costs of any contracts or other future potential

liabilities, and on the basis that the terms set out in this

announcement have been adhered to. The independent directors,

comprising Ashley Martin, Kjersti Wiklund, Richard Williams and

Suzi Williams, consider the terms of the Re-investments to be fair

and reasonable and have approved each Re-investment. The adjusted

net asset value per share will be confirmed by the Company's

auditors or an independent global accounting firm. The non-current

tax receivable of GBP4.1 million is dependent on a successful

appeal by Zegona in respect of the tax paid by Zegona to HMRC on 4

March 2021 relating to the UK's Controlled Foreign Company

legislation and the European Commission's decision in 2019 that the

associated Group Financing Exemption was an aid scheme and amounted

to illegal state aid (as disclosed in Zegona's accounts for the

year ended 31 December 2020)

13. Post the repayment of Zegona's GBP10 million loan facility,

the proposed return of GBP335 million of capital to shareholders

and payment of the LTIP, and assuming the tax contingent

consideration is received, Zegona expects to have approximately

GBP11 million of net cash on its balance sheet. Including the

Re-investments, the net cash balance is expected to be c.GBP15

million

14. Assuming a net asset value of c.GBP11 million, management

will have a c.28% ownership stake in Zegona post the Re-investments

(including management's existing 1.4% ownership). Managers are

committed to hold the shares in Zegona issued to them under the

Re-investment for a minimum period of 6 months from the date of

payment for the shares

15. Funds managed by Marwyn currently hold a 19.2% stake in

Zegona. Marwyn has undertaken to vote all shares it holds in favour

of all resolutions at the Zegona AGM which is due to be held on 30

June 2021

16. Total value of up to EUR701 million comprised of an

Enterprise Value of EUR686 million and a contingent deferred

payment of up to EUR15 million related to tax assets acquired

IMPORTANT NOTICES

Zegona is listed on the standard listing segment of the Official

List of the Financial Conduct Authority and the Main Market for

listed securities of the London Stock Exchange. This announcement

has been prepared in accordance with English law, the Listing Rules

and the Disclosure Guidance and Transparency Rules and information

disclosed may not be the same as that which would have been

prepared in accordance with the laws of jurisdictions outside

England. The distribution of this announcement in jurisdictions

outside the United Kingdom may be restricted by law and therefore

persons into whose possession this announcement comes should inform

themselves about and observe such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "expects", "believes",

"estimates", "envisages", "plans", "anticipates", "targets",

"aims", "continues", "expects", "intends", "hopes", "may", "will",

"would", "could" or "should" or, in each case, their negative or

other variations or comparable terminology. These forward-looking

statements include matters that are not facts. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. A number of factors

could cause actual results and developments to differ materially

from those expressed or implied by the forward-looking statements.

Forward-looking statements contained in this announcement based on

past trends or activities should not be taken as a representation

that such trends or activities will continue in the future. Subject

to any requirement under the Listing Rules, Prospectus Rules, the

Disclosure Guidance and Transparency Rules or other applicable

legislation or regulation, Zegona does not undertake any obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Investors

should not place undue reliance on forward-looking statements,

which speak only as of the date of this announcement.

Underlying Asset Value per share

The Underlying Asset Value per share of Zegona is a calculation,

not a forecast value for Zegona's shareholders. There can be no

assurance that such a value will be achieved and investors should

place no reliance on such value when making an investment decision.

Nothing in this announcement is intended, or is to be construed, as

a forecast of the expected value to Zegona's shareholders.

Calculation of total value

The total value referred to in this announcement is a

calculation, not a forecast value for Zegona's shareholders. There

can be no assurance that such a value will be achieved and

investors should place no reliance on such value when making an

investment decision. Nothing in this announcement is intended, or

is to be construed, as a forecast of the expected value to Zegona's

shareholders.

Eamonn O'Hare

Executive Chairman

Zegona Communications plc

8 Sackville St, Mayfair

London W1S 3DG

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVRESISFIL

(END) Dow Jones Newswires

May 24, 2021 12:36 ET (16:36 GMT)

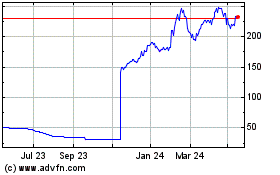

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Jan 2025 to Feb 2025

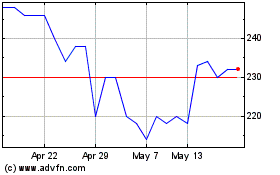

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Feb 2024 to Feb 2025