false000140370800014037082024-09-272024-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 27, 2024 |

EVOKE PHARMA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36075 |

20-8447886 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

420 Stevens Avenue, Suite 230 |

|

Solana Beach, California |

|

92075 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 858 345-1494 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

EVOK |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 27, 2024, Evoke Pharma, Inc. (the “Company”) entered into an amendment (the “Exercise Price Warrant Amendment”) with certain affiliates of Nantahala Capital Management, LLC (“Nantahala”), who are holders (each, a “Nantahala Holder”) of its outstanding Series A Warrants to purchase shares of common stock (the “Series A Warrants”), Series B Warrants to purchase shares of common stock (the “Series B Warrants”), and Series C Warrants to purchase shares of common stock (the “Series C Warrants,” and together with the Series A Warrants and Series B Warrants, the “Warrants”) (each as previously amended).

Pursuant to the Exercise Price Warrant Amendment, the Nantahala Holders agreed to pay $3.99 per share to reduce the exercise price with respect to 250,627 Series A Warrants and 250,627 Series C Warrants from $8.16 to $0.01. The remaining Series A Warrants and Series C Warrants held by the Nantahala Holders are not subject to the Exercise Price Warrant Amendment and the exercise price for such warrants remained unchanged at $8.16 per share. The Warrant Amendment does not change the number of shares of common stock underlying the Warrants (the “Warrant Shares”).

In addition, the Company entered into an amendment (the “Series C Vesting Warrant Amendment”) with certain holders (each, a “Series C Holder”) of its Series C Warrants. Pursuant to the Series C Vesting Warrant Amendment, to the extent a Series C Holder exercises (a Series C Holder so exercising, an “Exercising Holder”) its Series B Warrants before 5:00 p.m. Pacific Time on September 30, 2024 (the “Amendment Exercise Deadline”), the Series C Holder’s corresponding Series C Warrants shall be exercisable for a number of Warrant Shares equal to the lesser of (i) three times the number of Warrant Shares exercised by the Exercising Holder pursuant to its Series B Warrants and (ii) the total number of remaining Warrant Shares exercisable under the Series C Warrants (such Warrant Shares that become exercisable, “Vested Warrant Shares,” and any remaining unvested and unexercisable Warrant Shares, “Unvested Warrant Shares”). For any Exercising Holder, following the Amendment Exercise Deadline, if such Exercising Holder exercises any remaining Series B Warrants, the remaining Series C Warrants, if any, shall become vested and exercisable on a one-for-one basis as to the same number of Series B Warrants exercised following the Amendment Exercise Deadline. The exercise price for the Series B Warrants remains unchanged at $8.16 per share.

The Company expects to raise an aggregate of approximately $2.4 million in gross proceeds pursuant to the cash payment from the Exercise Price Warrant Amendment and the exercise of Series B Warrants pursuant to the Series C Vesting Warrant Amendment described above.

The Company will allow all other holders of Series A Warrants or Series C Warrants to enter into amendments on the same terms as the Exercise Price Warrant Amendment or the Series C Warrant Amendment provided such amendment is executed and the holder pays the consideration no later than the Amendment Exercise Deadline on September 30, 2024.

In connection with the Exercise Price Warrant Amendment, the Company entered into a letter agreement, dated September 27, 2024 (the “Letter Agreement”), with Nantahala, pursuant to which, subject to certain limitations, the Company will provide Nantahala the right to appoint (or cause to be nominated) (i) one member of the Company’s Board of Directors (the “Board”) and one member of each Board committee so long as Nantahala, together with its affiliates, beneficially owns at least 5.0% of the Company’s outstanding shares of common stock and (ii) two members of the Board so long as Nantahala, together with its affiliates, beneficially owns at least 15.0% of the Company’s outstanding shares of common stock, subject to certain exceptions, with such director(s) to be mutually agreeable to Nantahala and the Company.

The foregoing descriptions of the Exercise Price Warrant Amendment, Series C Vesting Warrant Amendment and Letter Agreement are not complete and are qualified in their entirety by reference to the full text of the form of such agreements, copies of which are filed as Exhibit 4.1, Exhibit 4.2 and Exhibit 10.1, respectively, to this report and are incorporated by reference herein.

Safe Harbor Statement

The Company cautions you that statements included in this Current Report on Form 8-K that are not a description of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negatives of these terms or other similar expressions. These statements are based on the Company’s current beliefs and expectations. Such forward-looking statements include, among other things, references to the completion of the offering and the expected net proceeds therefrom. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the risk and uncertainties associated with market conditions, as well as risks and uncertainties in the Company’s business, including those risks described in the Company’s periodic reports it files with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EVOKE PHARMA, INC. |

|

|

|

|

Date: |

September 27, 2024 |

By: |

/s/ Matthew J. D'Onofrio |

|

|

|

Name: Matthew J. D'Onofrio

Title: Chief Executive Officer |

EVOKE PHARMA, INC.

AMENDMENT TO

SERIES A COMMON STOCK PURCHASE WARRANT,

SERIES B COMMON STOCK PURCHASE WARRANTS,

AND

SERIES C COMMON STOCK PURCHASE WARRANT

This Amendment (this “Amendment”) is made as of ___________, 2024 by and between Evoke Pharma, Inc., a Delaware corporation (the “Company”), and _____________ (the “Holder”), and constitutes an amendment to that certain Series A Common Stock Purchase Warrant (Warrant No.: A-[ ]), issued by the Company on February 13, 2024 (the “Series A Warrant”) (as amended on March 25, 2024), an amendment to that certain Series B Common Stock Purchase Warrant (Warrant No.: B-[ ]), issued by the Company on February 13, 2024 (the “Series B Warrant”) (as amended on March 25, 2024), and an amendment to that certain Series C Common Stock Purchase Warrant (Warrant No.: C-[ ]), issued by the Company on February 13, 2024 (the “Series C Warrant”) (as amended on March 25, 2024). Capitalized terms used but not otherwise defined in this Amendment shall have the meanings given to such terms in the Series A Warrant, Series B Warrant or the Series C Warrant, as applicable.

Whereas, pursuant to Section 5(l) of each of the Series A Warrant, Series B Warrant and Series C Warrant, each such warrant may be modified or amended with the written consent of the Company and the Holder;

Whereas, pursuant to Section 3(g) of each of the Series A Warrant and Series C Warrant, subject to the rules and regulations of the Trading Market, the Company may reduce the current Exercise Price to any amount and for any period of time deemed appropriate by the board of directors of the Company; provided in no event may the Exercise Price be adjusted below the par value of the Common Stock then in effect;

Whereas, the Company intends to offer other holders of outstanding Series A Warrants, Series B Warrants and Series C Warrants the opportunity to amend such warrants on substantially the same terms, subject to compliance with the rules and regulations of the Trading Market; and

Whereas, the Company and the Holder desire to amend the Series A Warrant with respect to the number of Series A Warrants and to amend the Series C Warrants with respect to the number of Series C Warrants in each case as set forth in Exhibit A (respectively, as adjusted, the “Series A Adjusted Warrant Shares” and the “Series C Adjusted Warrant Shares”).

Now, Therefore, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree to amend the Series A Warrant, Series B Warrant and Series C Warrant as set forth herein.

1. Amendments to Series A Warrant.

(a) The Company and the Holder hereby agree to amend and restate Section 2(b) of the Series A Warrants with respect to the Series A Adjusted Warrant Shares as follows:

“b) Exercise Price. The exercise price per share of Common Stock under this Warrant shall be $0.01, subject to adjustment hereunder (the “Exercise Price”).”

(b) Notwithstanding anything else to the contrary in the Series A Warrant, upon exercise of the Series A Warrant a Holder may only receive a share of Common Stock.

2. Amendment to Series B Warrant. Notwithstanding anything else to the contrary in the Series B Warrant, upon exercise of the Series B Warrant a Holder may only receive a share of Common Stock.

3. Amendments to Series C Warrant.

(a) The Company and the Holder hereby agree to amend and restate Section 2(b) of the Series C Warrants with respect to the Series C Adjusted Warrant Shares as follows:

“b) Exercise Price. The exercise price per share of Common Stock under this Warrant shall be $0.01, subject to adjustment hereunder (the “Exercise Price”).”

(b) Notwithstanding anything else to the contrary in the Series C Warrant, upon exercise of the Series C Warrant a Holder may only receive a share of Common Stock.

4. Closing; Payment. In consideration of entering into the Amendment, the Holder shall wire an amount equal to $[ ] to the Company at the wire instructions set forth on Exhibit B no later than September 30, 2024.

5. Miscellaneous Provisions.

5.1 No Other Amendment. Except for the matters set forth in this Amendment, all other terms of the Series A Warrant, Series B Warrant and Series C Warrant shall remain unchanged and in full force and effect.

5.2 Counterparts. This Amendment may be executed in any number of counterparts, and by facsimile or portable document format (pdf) transmission, and each of such counterparts shall for all purposes be deemed to be an original and all such counterparts shall together constitute but one and the same instrument.

[Signatures follow on next page]

IN WITNESS WHEREOF, each of the parties has caused this Amendment to be duly executed as of the date first above written.

|

|

|

|

|

|

|

|

EVOKE PHARMA, INC. |

|

|

By: |

|

|

|

|

|

Name: |

|

|

Title: |

|

|

|

|

|

|

|

|

[HOLDER] |

|

|

|

|

|

By: |

|

|

|

|

|

Name: |

|

|

Title: |

|

|

[Signature Page to Warrant Agreement Amendment]

Exhibit A

The following sets forth the number of Warrant Shares underlying the Series A Warrants and Series C Warrants held by the Holder following execution of this Amendment.

Series A Warrants

|

|

|

|

|

|

Holder |

Warrant Shares |

Exercise Price1 |

Series A Adjusted Warrant Shares |

Exercise Price1 |

Total |

[ ] |

[ ] |

$8.16 |

[ ] |

$0.01 |

[ ] |

Series C Warrants

|

|

|

|

|

|

Holder |

Warrant Shares |

Exercise Price1 |

Series C Adjusted Warrant Shares |

Exercise Price1 |

Total |

[ ] |

[ ] |

$8.16 |

[ ] |

$0.01 |

[ ] |

1. Subject to adjustment pursuant to Section 3 of the Series A Warrant and Series C Warrant, as applicable.

EVOKE PHARMA, INC.

AMENDMENT TO

SERIES C COMMON STOCK PURCHASE WARRANT

This Amendment (this “Amendment”) is made as of ________, 2024 by and between Evoke Pharma, Inc., a Delaware corporation (the “Company”), and _______________ (the “Holder”), and constitutes an amendment to that certain Series C Common Stock Purchase Warrant (Warrant No.: C-[ ]), issued by the Company on February 13, 2024 (the “Series C Warrant”). Capitalized terms used but not otherwise defined in this Amendment shall have the meanings given to such terms in the Series C Warrant, as applicable.

Whereas, pursuant to Section 5(l) of the Series C Warrant, such warrant may be modified or amended with the written consent of the Company and the Holder; and

Whereas, the Company and the Holder desire to amend the Series C Warrant as set forth in this Amendment.

Now, Therefore, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree to amend the Series C Warrant as set forth herein.

1. Amendments to Series C Warrant.

(a) Notwithstanding the definition of “Vesting Schedule” in the Series C Warrant and anything else to the contrary:

(i) to the extent a Holder exercises (a Holder so exercising, an “Exercising Holder”) its Series B Warrant before 5:00 p.m. Pacific time September 30, 2024 (the “Amendment Exercise Deadline”), the Series C Warrant shall be exercisable for a number of Warrant Shares equal to the lesser of (i) three times the number of Warrant Shares exercised by the Exercising Holder pursuant to its Series B Warrant and (ii) the total number of remaining Warrant Shares exercisable under the Series C Warrant (such Warrant Shares that become exercisable, “Vested Warrant Shares,” and any remaining unvested and unexercisable Warrant Shares, “Unvested Warrant Shares”); and

(ii) for any Exercising Holder, following the Amendment Exercise Deadline, if such Exercising Holder exercises any remaining Series B Warrants, the remaining Series C Warrants, if any, shall become vested and exercisable on a one-for-one basis as to the same number of Series B Warrants exercised following the Amendment Exercise Deadline.

By way of example, if the Holder exercises one-third (33.33%) of its Series B Warrant by the Amendment Exercise Deadline, all Warrant Shares subject to the corresponding Series C Warrants shall be Vested Warrant Shares and may be exercised by the Holder, whereas if the Holder exercises one-fifth (20%) of its Series B Warrants by the Amendment Exercise Deadline, only three-fifths (60%) of the Warrant Shares subject to the Series C Warrants shall be Vested Warrant Shares and therefore become exercisable until such time that the Holder exercises additional Series B Common Stock Purchase Warrants. For the avoidance of doubt, if the Holder is not an Exercising Holder, the definition of Vesting Schedule shall remain unmodified from that originally contained in such Holder’s Series C Warrant.

2. Miscellaneous Provisions.

2.1 No Other Amendment. Except for the matters set forth in this Amendment, all other terms of the Series C Warrant shall remain unchanged and in full force and effect.

2.2 Counterparts. This Amendment may be executed in any number of counterparts, and by facsimile or portable document format (pdf) transmission, and each of such counterparts shall for all purposes be deemed to be an original and all such counterparts shall together constitute but one and the same instrument.

[Signatures follow on next page]

IN WITNESS WHEREOF, each of the parties has caused this Amendment to be duly executed as of the date first above written.

|

|

|

|

|

|

|

|

EVOKE PHARMA, INC. |

|

|

By: |

|

|

|

|

|

Name: |

|

|

Title: |

|

|

|

|

|

|

|

|

[HOLDER] |

|

|

|

|

|

By: |

|

|

|

|

|

Name: |

|

|

Title: |

|

|

[Signature Page to Warrant Agreement Amendment]

September 27, 2024

Evoke Pharma, Inc.

420 Stevens Avenue, Suite 230

Solana Beach, CA 92075

Re: Warrant Amendments, dated September 27, 2024, to those certain Series A Common Stock Purchase Warrants and Series C Common Stock Purchase Warrants

Ladies and Gentlemen:

Reference is made to those certain Warrant Amendments, dated September 27, 2024 (the “Warrant Amendments”), by and between Evoke Pharma, Inc. (the “Company”) and each of Nantahala Capital Partners Limited Partnership, NCP RFM LP and Blackwell Partners LLC, affiliates of Nanthala Capital Management, LLC (“Nantahala Capital Management”). Capitalized terms used but not otherwise defined herein shall have the meanings given to such terms in the Warrant Amendments.

The Company agrees that (i) for as long as Nantahala Capital Management, or its affiliates (“Nantahala”) beneficially own securities representing at least 5% of the ordinary voting power of all common stock of the Company, par value $0.0001 per share, then outstanding (“Common Stock”), Nantahala shall have the right, subject to compliance with applicable Nasdaq rules, to designate one (1) member of the board of directors of the Company and (ii) for as long as Nantahala beneficially own securities representing at least 15% of the ordinary voting power of all Common Stock, Nantahala shall have the right, subject to compliance with applicable Nasdaq rules, to designate two (2) members of the board of directors of the Company (each designee, a “Nantahala Board Representative”).

For as long as Nantahala holds the right to designate aNantahala Board Representative pursuant to this letter agreement, the Company shall cause such Nantahala Board Representative to be elected or appointed to the board of directors, including by taking all action as may be necessary to secure the favorable votes of the board of directors or the stockholders of the Company, as applicable, in respect of the election or appointment of such Nantahala Board Representative at the time of any future director elections or appointments (including to fill any vacancy), whether at any annual or special meeting of the board of directors or stockholders or pursuant to any written consent of the board of directors or stockholders of the Company or, to the extent necessary, by expanding the size of the board of directors or seeking the resignation of a member of the board of directors as of the date hereof, and appointing the Nantahala Board Representative to the board of directors (and, to the extent necessary, calling a special meeting of the Company’s stockholders for the purpose of amending the Company’s certificate of incorporation, bylaws and other governing documents, as required to allow such expansion). As soon as practicable following the designation of a Nantahala Board Representative by Nantahala, the Company shall cause such person to be elected or appointed to the board of directors as a Nantahala Board Representative.

For as long as Nantahala holds the right to designate a member of the board of directors pursuant to this letter agreement, the Company shall not, without the prior written approval of the Nantahala Board Representative:

(i) increase the size of the board of directors in excess of six (6) members plus that number of directors that Nantahala has the right to designate pursuant to this letter agreement; or

(ii) decrease the size of the board of directors if such decrease would require the resignation from the board of directors of a Nantahala Board Representative then serving as a member of the board of directors.

The Company will reimburse the Nantahala Board Representatives then serving as members of the board of directors for their reasonable and documented out-of-pocket expenses incurred in connection with travel to or from and attendance at each meeting of the board of directors. The Nantahala Board Representatives then serving as members of the board of directors will be entitled to compensation by the Company in accordance with the Company’s standard compensation policies as in effect from time to time.

For as long as Nantahala holds the right to designate a member of the board of directors pursuant to this letter agreement, in the event that a vacancy is created at any time by the death, disability, retirement, resignation or removal of a Nantahala Board Representative, Nantahala may designate another individual to be elected to fill the vacancy created thereby, and the Company hereby agrees to take, at any time and from time to time, all actions necessary to accomplish the same.

If the Company reasonably determines that a Nantahala Board Representative is subject to any of the “bad actor” disqualifications (“Disqualification Events”) described in Rule 506(d)(1)(i) through (viii) under the Securities Act of 1933, as amended, as evidenced by the written advice of legal counsel of national or international standing, then the Nantahala Board Representative shall not be eligible for appointment to the board of directors. When designating a Nantahala Board Representative, Nantahala will confirm that, to its knowledge, such designee is not subject to a Disqualification Event.

The Nantahala Board Representatives shall be entitled to indemnification by the Company to the maximum extent permitted by applicable law and the Company’s governing documents. the Company shall enter into an indemnification agreement with any Nantahala Board Representative on terms of the Company’s form of indemnification agreement previously provided to Nantahala.

For as long as Nantahala holds the right to designate a member of the board of directors pursuant to this letter agreement, Nantahala shall have the right, subject to compliance with applicable Nasdaq rules, to designate one (1) member of each committee of the board of directors that now exists or may be established pursuant to the Company’s governing documents or by the board of directors from time to time.

If the foregoing correctly sets forth the understanding between the Company and Nantahala, please so indicate in the space provided below for that purpose, whereupon this letter shall constitute a binding agreement between the Company and Nantahala. This letter agreement may be executed by any one or more of the parties hereto in any number of counterparts, each of which shall be deemed to be an original, but all such respective counterparts shall together constitute one and the same instrument. This letter agreement may be delivered by any party by facsimile, email or other electronic transmission.

[Signature Page Follows]

Very truly yours,

EVOKE PHARMA, INC.

By: /s/ Matthew J. D’Onofrio

Name: Matthew J. D’Onofrio

Title: Chief Executive Officer

Acknowledged and agreed:

NANTAHALA CAPITAL MANAGEMENT, LLC

By: /s/ Daniel Mack

Name: Daniel Mack

Title: Manager

[Signature Page to Letter Agreement]

v3.24.3

Document And Entity Information

|

Sep. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 27, 2024

|

| Entity Registrant Name |

EVOKE PHARMA, INC.

|

| Entity Central Index Key |

0001403708

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36075

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

20-8447886

|

| Entity Address, Address Line One |

420 Stevens Avenue, Suite 230

|

| Entity Address, City or Town |

Solana Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92075

|

| City Area Code |

858

|

| Local Phone Number |

345-1494

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

EVOK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

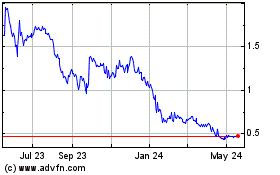

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Sep 2024 to Oct 2024

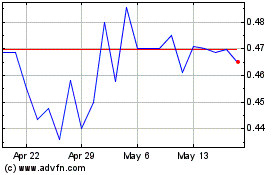

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Oct 2023 to Oct 2024