Filed by: HomeStreet, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: HomeStreet, Inc.

Commission File No.: 001-35424

The following HomeStreet Employee FAQ and HomeStreet, Inc. Talking Points for HomeStreet Bank customers regarding the merger were made in connection with the proposed transaction between HomeStreet, Inc. and FirstSun Capital Bancorp.

HomeStreet, Inc. and FirstSun Capital Bancorp Merger Information

Employee FAQs – Not for Distribution

When and what was announced?

On January 16, 2024, we announced HomeStreet, Inc. will merge with FirstSun Capital Bancorp (FirstSun), the holding company of Sunflower Bank. HomeStreet, Inc. and HomeStreet Bank will merge with and into FirstSun and Sunflower Bank, respectively.

Who is FirstSun Capital Bancorp?

FirstSun Capital Bancorp, (OTCQX: FSUN) headquartered in Denver, Colorado, is the financial holding company for Sunflower Bank, headquartered in Dallas, Texas, and which also operates under the brands First National 1870 and Guardian Mortgage. Sunflower Bank provides a full range of relationship-focused services to meet personal, business and wealth management financial objectives, with a branch network in Texas, Kansas, Colorado, New Mexico, and Arizona and mortgage capabilities in 43 states. FirstSun had total consolidated assets of $7.8 billion as of September 30, 2023. First National 1870 and Guardian Mortgage are divisions of Sunflower Bank.

Why is HomeStreet Bank combining with FirstSun?

Once completed, the merger will create a premier regional bank with $17 billion in total assets and 129 branch locations across some of the most attractive markets in the United States. Each entity brings a presence in large, dynamic markets that are poised for further organic growth. The depth and density of our business in the Pacific Northwest and Southern California markets provides ample opportunity for the combined entity to deploy FirstSun’s proven playbook of Commercial & Industrial focused growth in loans and deposits. The transaction will be transformative and will create a premier regional bank operating in some of the nation’s best markets in the Southwest and West Coast.

The combined company will also have an attractive and comprehensive product suite and market footprint as well as a more diversified loan portfolio and increased lending capabilities across asset classes, geographies, and industry verticals. We believe this merger will also improve our customers’ experience and create new opportunities for our employees enabling us to retain and attract top talent. The post-merger holding company will be traded on Nasdaq under the FSUN ticker symbol.

What will happen between now and when the transaction is complete?

The transaction is expected to close in the middle of 2024, subject to satisfaction of customary closing conditions, including receipt of required shareholder and regulatory approvals.

It is important to remember that until that time, HomeStreet, Inc. and FirstSun Capital Bancorp along with each of our banks will continue to operate as separate, independent companies.

Will my position be affected & how does this impact my day-to-day responsibilities?

This week is just the beginning of the process and there are no immediate impacts on your day-to-day responsibilities. It is important to remember that until the transaction closes, we are operating as separate, independent companies. In the coming weeks and months leaders from both companies will be planning the companies’ operations. HomeStreet Bank is combining with FirstSun with the goal of retaining many HomeStreet employees. In the coming weeks we will be working together with FirstSun’s management to make preliminary decisions regarding the integration of the two companies, leadership, and employee retention. As soon as we can, HomeStreet will provide important information to our employees about continued employment. We appreciate your patience as we carefully work through this process.

In the months ahead, as our companies make integration plans, we recommend our employees continue to focus on superior customer service. HomeStreet is committed to transparency and to keeping our employees and our clients informed as we move through this process.

What will happen to the HomeStreet Bank brand?

HomeStreet Bank will continue to operate under its name in its current markets of operation.

INTERNAL USE ONLY | Not for Public Distribution | January 19, 2024

HomeStreet, Inc. and FirstSun Capital Bancorp Merger Information

Who will lead the combined company?

•Mollie Hale Carter, Executive Chairman of FirstSun, will retain her current role.

•Neal Arnold, CEO, President, COO & Director of First Sun will become our new CEO.

•Mark Mason, our current Board Chairman, CEO and President, will serve as Executive Vice Chairman of the combined bank holding company and the combined bank following the merger. Mr. Mason will be part of the executive leadership team for the combined Company.

•Rob Cafera will continue as Chief Financial Officer of FirstSun Capital Bancorp and Sunflower Bank.

•Additional appointments will be announced in the coming months.

How will this affect our clients? If my clients ask me a question about the merger, how should I respond?

We ask that all our employees work to deliver a consistent message to customers, so they read and hear a unified message. As we update talking points and as integration planning evolves, communications we release to employees and customers will be posted on our internal SharePoint site for your reference. Please do not share or distribute our employee Q&As or FAQs as these are for internal employee use only.

I have never been involved in a merger or acquisition and am not sure what to expect. What should I do?

Many employees have never been involved in merger and acquisition (M&A) activities.

Your Human Resources (HR) department and your supervisor or management team will each have information to share at various times. You should continue to perform your job at the direction of your manager and if you have questions, simply ask. You may have a chance to develop new working relationships and to learn new skills to help grow your own skillsets along the way. Until additional information and guidance is provided, every employee should continue in a ‘business-as-usual' manner.

One of the biggest challenges during a time like this is the flow of information. A Merger Resources Center page has been created on MyHomeStreet so you may easily reference merger-related communications that have already been shared.

You should feel free to ask your supervisor questions to get the answers you need. During M&A transactions like this, it is possible senior leaders may not have the answers to some questions. Since this transaction is a partnership between HomeStreet and FirstSun, decisions that are unusual may need to be made in a thoughtful way, and in alignment with leadership at both companies.

The experiences you will have will be individual to you, yet you are not alone. We are all in this together and will all work together to support each other. It is important during this time that you support your fellow employees.

What if I have additional questions that are not covered in the Q&A?

If you have personal questions about your situation, you may send an email to the HR Mailbox HR@Homestreet.com. If you would like guidance on how to find important information or if you feel you need additional resources about things you may be experiencing, such practical stress management techniques, etc., please reach out to your supervisor or HR.

As a reminder, HomeStreet Bank offers all employees access to our free Employee Assistance Program (EAP). This service, staffed by experienced clinicians, gives you access to issues that matter to you like confidential counseling, work-life needs, legal information and consultation, and financial resources and tools.

What should I say if I am contacted by the media or receive inquiries from individuals outside the company?

Please follow our current policy and procedure and direct any media inquiries to our Corporate Marketing Director, Misty Ford, at misty.ford@homestreet.com. Any questions from investors should be directed to our Chief Financial Officer, John Michel, at john.michel@homestreet.com.

Page 2 of 2

INTERNAL USE ONLY | Not for Public Distribution | January 19, 2024

HomeStreet, Inc. and FirstSun Capital Bancorp Merger Information

Talking Points for HomeStreet Bank Customers

(INTERNAL USE ONLY – DO NOT DISTRIBUTE)

For full public details, refer clients to the http://www.homestreet.com on the HomeStreet.com website.

Who are FirstSun Capital Bancorp and Sunflower Bank?

FirstSun Capital Bancorp, (OTCQX: FSUN) headquartered in Denver, Colorado, is the financial holding company for Sunflower Bank, headquartered in Dallas, Texas, which operates under the brands First National 1870 and Guardian Mortgage. Sunflower Bank provides a full range of relationship-focused services to meet personal, business and wealth management financial objectives, with a branch network in Texas, Kansas, Colorado, New Mexico, and Arizona and mortgage capabilities in 43 states. FirstSun had total consolidated assets of $7.8 billion as of September 30, 2023. First National 1870 and Guardian Mortgage are divisions of Sunflower Bank.

Why did the parties choose to merge?

•The combination will create a premier bank operating in some of the nation’s best markets in the Southwest and West Coast.

•Together we believe the combined company will deliver stronger and more sustainable growth with greater earnings power and opportunities for shareholder value creation to our combined shareholders.

•This combination of two complementary banks is poised to deliver top tier profitability metrics, a diversified balance sheet and a reduction of the overall risk profile, bringing significant benefits to all our respective stakeholders.

•The combined entity will have attractive positions in both its product suite and market footprint, as well as a more diversified loan portfolio and increased lending capabilities across asset classes, geographies, and industry verticals.

•We believe the combined company will also create new opportunities for our employees and enable us to attract and retain top talent.

•Both organizations share a deep commitment to supporting and giving back to the communities we serve.

How does the merger strengthen customer service following the merger?

•With $17 billion in expected pro-forma assets at merger close, we will have the increased strength and capital to grow as our clients grow.

•The FirstSun team brings additional talent to enhance our specialty business line capabilities across this expanded footprint.

•The combination will create increased lending capabilities across asset classes, geographies, and industry verticals.

What will change for me?

•You will continue to be served by your local bankers.

•You may continue to use all your current accounts and products. We will inform you of changes, if any, that may impact you.

•Steps will eventually be taken to integrate our banking systems. We will inform you of changes, if any, that may impact you.

INTERNAL USE ONLY | Not for Public Distribution | January 19, 2024

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements can be identified through use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, and include statements related to the expected timing, completion, financial benefits, and other effects of the proposed mergers (the "Merger"). Forward‑looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to, (1) expected cost savings, synergies and other financial benefits from the Merger not being realized within the expected time frames and costs or difficulties relating to integration matters being greater than expected, (2) the ability of HomeStreet, Inc. (“HomeStreet”) to obtain the necessary approval by its shareholders, (3) the ability of FirstSun Capital Bancorp (“FirstSun”) and HomeStreet to obtain required governmental approvals of the Merger, (4) the ability of FirstSun to consummate their investment agreements to obtain the necessary capital to support the transaction, and (5) the failure of the closing conditions in the definitive Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 16, 2024, by and between HomeStreet and FirstSun to be satisfied, or any unexpected delay in closing the Merger. Further information regarding additional factors that could affect the forward-looking statements can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” (in the case of FirstSun), “Forward-Looking Statements” (in the case of HomeStreet), and “Risk Factors” in FirstSun’s and HomeStreet’s Annual Reports on Form 10-K for the year ended December 31, 2022, and other documents subsequently filed by FirstSun and HomeStreet with the U.S. Securities and Exchange Commission (“SEC”).

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Merger between FirstSun, a Delaware corporation, and HomeStreet, a Washington corporation, FirstSun will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Homestreet and a Prospectus of FirstSun, as well as other relevant documents concerning the proposed transaction. Investors and security holders, prior to making any investment or voting decision, are urged to read the registration statement and proxy statement/prospectus when it becomes available (and any other documents filed with the SEC in connection with the Merger or incorporated by reference into the proxy statement/prospectus) because such documents will contain important information regarding the Merger.

Investors and security holders may obtain free copies of these documents and other documents filed with the SEC on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by (i) FirstSun on its website at https://ir.firstsuncb.com/investor-relations/default.aspx, and (ii) HomeStreet on its website at https://ir.homestreet.com/sec-filings/all-filings/default.aspx.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

HomeStreet, Inc. and FirstSun Capital Bancorp Merger Information

PARTICIPANTS IN THE SOLICITATION

FirstSun, HomeStreet and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from shareholders of HomeStreet in connection with the proposed Merger. Information regarding the directors and executive officers of FirstSun and HomeStreet and other persons who may be deemed participants in the solicitation of the shareholders of HomeStreet in connection with the proposed Merger will be included in the proxy statement/prospectus for HomeStreet’s special meeting of shareholders, which will be filed by FirstSun with the SEC. Information about the directors and officers of FirstSun and their ownership of FirstSun’s common stock can be found in FirstSun’s annual report on Form 10-K, as filed with the SEC on March 16, 2023, and other documents subsequently filed by FirstSun with the SEC. Information about the directors and officers of HomeStreet and their ownership of HomeStreet’s common stock can be found in HomeStreet’s definitive proxy statement in connection with its 2023 annual meeting of shareholders, as filed with the SEC on April 11, 2023, and other documents subsequently filed by HomeStreet with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed Merger filed with the SEC when they become available.

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

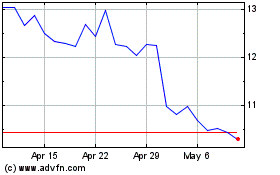

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024