AIM ImmunoTech Announces Pricing of $1.26 Million Registered Direct Offering

30 September 2024 - 11:00PM

AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM” or

the “Company”) today announced that it has entered into a

securities purchase agreement with a single institutional investor

to purchase 4,653,036 shares of common stock in a registered direct

offering at a purchase price of $0.27 per share. In a concurrent

private placement, the Company also agreed to issue unregistered

Class C warrants to purchase up to an aggregate of 4,653,036 shares

of common stock and, unregistered Class D warrants to purchase up

to an aggregate of 4,653,036 shares of common stock. The Class C

and Class D warrants will each have an exercise price of $0.28,

will be exercisable six months from the date of issuance and, in

the case of the Class C warrants, will expire on the eighteen-month

anniversary from the initial exercise date, and in the case of the

Class D warrants, will expire on the five-year anniversary from the

initial exercise date.

The gross proceeds to the Company from the

registered direct offering and concurrent private placement are

estimated to be approximately $1.26 million before deducting the

placement agent’s fees and other estimated offering expenses

payable by the Company.

Maxim Group LLC is acting as the sole placement

agent in connection with the offering.

The shares of common stock are being offered

pursuant to a shelf registration statement on Form S-3 (File No.

333-262280), which was declared effective by the U.S. Securities

and Exchange Commission (the “SEC”) on February 4, 2022. The

offering of the shares of common stock is being made only by means

of a prospectus, including a prospectus supplement, forming a part

of the effective registration statement. A prospectus supplement

relating to the shares of common stock will be filed by the Company

with the SEC. When available, copies of the prospectus supplement

relating to the registered direct offering, together with the

accompanying prospectus, can be obtained at the SEC’s website at

www.sec.gov or from Maxim Group LLC, 300 Park Avenue, New York, NY

10022, at (212) 895-3745.

The warrants to be issued in the concurrent

private placement and the shares issuable upon exercise of such

warrants were offered in a private placement under Section 4(a)(2)

of the Securities Act of 1933, as amended (the "Act"), and

Regulation D promulgated thereunder and have not been registered

under the Act or applicable state securities laws. Accordingly, the

warrants and the shares of common stock underlying the warrants may

not be offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About AIM ImmunoTech Inc.

AIM ImmunoTech Inc. is an immuno-pharma company

focused on the research and development of therapeutics to treat

multiple types of cancers, immune disorders and viral diseases,

including COVID-19. The Company’s lead product is a first-in-class

investigational drug called Ampligen® (rintatolimod), a dsRNA and

highly selective TLR3 agonist immuno-modulator with broad spectrum

activity in clinical trials for globally important cancers, viral

diseases and disorders of the immune system.

For more information, please visit aimimmuno.com

and connect with the Company on X, LinkedIn, and Facebook.

Cautionary Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 (the “PSLRA”). Words such as “may,” “will,”

“expect,” “plan,” “anticipate,” “continue,” “believe,” “potential,”

“upcoming” and other variations thereon and similar expressions (as

well as other words or expressions referencing future events or

circumstances) are intended to identify forward-looking statements.

Many of these forward-looking statements involve a number of risks

and uncertainties. The Company urges investors to consider

specifically the various risk factors identified in its most recent

Form 10-K, and any risk factors or cautionary statements included

in any subsequent Form 10-Q or Form 8-K, filed with the U.S.

Securities and Exchange Commission. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. Among other things, for

those statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the PSLRA. The

Company does not undertake to update any of these forward-looking

statements to reflect events or circumstances that occur after the

date hereof.

Investor Contact:

JTC Team, LLC

Jenene Thomas

(833) 475-8247

AIM@jtcir.com

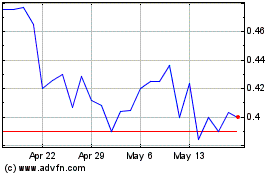

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Nov 2024 to Dec 2024

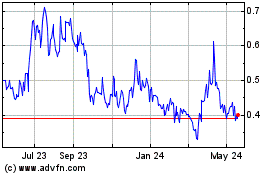

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Dec 2023 to Dec 2024