Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

30 August 2023 - 2:20AM

Edgar (US Regulatory)

Bancroft

Fund

Ltd.

Schedule

of

Investments

—

June

30,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

—

90.7%

Airlines

—

2.7%

$

1,465,000

JetBlue

Airways

Corp.,

0.500%,

04/01/26

...............

$

1,210,462

2,360,000

Southwest

Airlines

Co.,

1.250%,

05/01/25

...............

2,714,590

3,925,052

Automotive:

Parts

and

Accessories

—

0.8%

1,000,000

Rivian

Automotive

Inc.,

4.625%,

03/15/29(a)

.............

1,098,688

Business

Services

—

5.2%

3,000,000

2U

Inc.,

2.250%,

05/01/25

...............

1,977,000

2,000,000

BigBear.ai

Holdings

Inc.,

6.000%,

12/15/26(a)

.............

1,406,959

2,500,000

Perficient

Inc.,

0.125%,

11/15/26

...............

2,062,719

2,000,000

Shift4

Payments

Inc.,

Zero

Coupon,

12/15/25

...........

2,182,000

7,628,678

Communications

Equipment

—

5.6%

3,000,000

InterDigital

Inc.,

3.500%,

06/01/27

...............

4,059,258

2,000,000

Kaleyra

Inc.,

6.125%,

06/01/26(a)

.............

1,956,447

Lumentum

Holdings

Inc.

2,000,000

0.500%,

12/15/26

...............

1,774,752

395,000

1.500%,

12/15/29(a)

.............

410,405

8,200,862

Computer

Software

and

Services

—

15.4%

2,000,000

3D

Systems

Corp.,

Zero

Coupon,

11/15/26

...........

1,521,250

1,700,000

Akamai

Technologies

Inc.,

0.375%,

09/01/27

...............

1,650,258

3,000,000

Bandwidth

Inc.,

0.250%,

03/01/26

...............

2,374,239

1,915,000

Edgio

Inc.,

3.500%,

08/01/25

...............

1,621,598

2,605,000

i3

Verticals

LLC,

1.000%,

02/15/25

...............

2,407,997

1,750,000

Match

Group

Financeco

3

Inc.,

2.000%,

01/15/30(a)

.............

1,579,329

2,250,000

PAR

Technology

Corp.,

2.875%,

04/15/26

...............

2,406,657

3,090,000

Progress

Software

Corp.,

1.000%,

04/15/26

...............

3,399,000

1,805,000

PROS

Holdings

Inc.,

2.250%,

09/15/27

...............

1,814,025

Principal

Amount

Market

Value

$

3,156,000

Veritone

Inc.,

1.750%,

11/15/26

...............

$

2,066,976

1,150,000

Workiva

Inc.,

1.125%,

08/15/26

...............

1,621,320

22,462,649

Consumer

Products

—

0.8%

1,150,000

Post

Holdings

Inc.,

2.500%,

08/15/27(a)

.............

1,165,180

Consumer

Services

—

4.9%

Marriott

Vacations

Worldwide

Corp.

700,000

Zero

Coupon,

01/15/26

...........

652,050

1,350,000

3.250%,

12/15/27(a)

.............

1,281,150

NCL

Corp.

Ltd.

660,000

5.375%,

08/01/25

...............

907,500

623,000

1.125%,

02/15/27

...............

577,247

600,000

Royal

Caribbean

Cruises

Ltd.,

6.000%,

08/15/25(a)

.............

1,321,800

2,530,000

Stride

Inc.,

1.125%,

09/01/27

...............

2,431,917

7,171,664

Diversified

Industrial

—

0.9%

450,000

Chart

Industries

Inc.,

1.000%,

11/15/24

...............

1,235,925

Energy

and

Utilities

—

14.5%

1,500,000

Alliant

Energy

Corp.,

3.875%,

03/15/26(a)

.............

1,497,000

2,938,000

Array

Technologies

Inc.,

1.000%,

12/01/28

...............

3,368,417

700,000

Bloom

Energy

Corp.,

3.000%,

06/01/28(a)

.............

798,992

2,000,000

CMS

Energy

Corp.,

3.375%,

05/01/28(a)

.............

1,977,000

2,000,000

Duke

Energy

Corp.,

4.125%,

04/15/26(a)

.............

1,958,000

850,000

Nabors

Industries

Inc.,

1.750%,

06/15/29(a)

.............

640,475

1,750,000

NextEra

Energy

Partners

LP,

2.500%,

06/15/26(a)

.............

1,575,866

2,000,000

Northern

Oil

and

Gas

Inc.,

3.625%,

04/15/29(a)

.............

2,240,443

1,250,000

Ormat

Technologies

Inc.,

2.500%,

07/15/27(a)

.............

1,355,625

900,000

PPL

Capital

Funding

Inc.,

2.875%,

03/15/28(a)

.............

864,000

1,500,000

Stem

Inc.,

4.250%,

04/01/30(a)

.............

1,508,250

1,900,000

Sunnova

Energy

International

Inc.,

2.625%,

02/15/28(a)

.............

1,560,169

Bancroft

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

June

30,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Energy

and

Utilities

(Continued)

$

1,800,000

The

Southern

Co.,

3.875%,

12/15/25(a)

.............

$

1,804,500

21,148,737

Entertainment

—

4.5%

DISH

Network

Corp.

2,500,000

Zero

Coupon,

12/15/25

...........

1,334,500

2,000,000

3.375%,

08/15/26

...............

1,025,000

1,810,000

fuboTV

Inc.,

3.250%,

02/15/26

...............

1,046,327

1,815,000

Liberty

Media

Corp.-Liberty

Formula

One,

2.250%,

08/15/27(a)

.............

1,958,385

1,050,000

Live

Nation

Entertainment

Inc.,

3.125%,

01/15/29(a)

.............

1,159,725

6,523,937

Financial

Services

—

5.1%

1,500,000

Bread

Financial

Holdings

Inc.,

4.250%,

06/15/28(a)

.............

1,541,582

900,000

Envestnet

Inc.,

2.625%,

12/01/27(a)

.............

948,600

2,000,000

HCI

Group

Inc.,

4.750%,

06/01/42

...............

1,977,000

1,800,000

LendingTree

Inc.,

0.500%,

07/15/25

...............

1,404,000

2,000,000

SoFi

Technologies

Inc.,

Zero

Coupon,

10/15/26(a)

.........

1,554,000

7,425,182

Food

and

Beverage

—

1.5%

500,000

Freshpet

Inc.,

3.000%,

04/01/28(a)

.............

591,625

1,500,000

The

Chefs'

Warehouse

Inc.,

2.375%,

12/15/28(a)

.............

1,581,099

2,172,724

Health

Care

—

11.6%

2,165,000

Coherus

Biosciences

Inc.,

1.500%,

04/15/26

...............

1,347,713

2,125,000

CONMED

Corp.,

2.250%,

06/15/27

...............

2,382,125

Cutera

Inc.

1,000,000

2.250%,

03/15/26

...............

843,660

1,750,000

2.250%,

06/01/28

...............

1,096,094

1,040,000

4.000%,

06/01/29(a)

.............

657,280

Exact

Sciences

Corp.

1,000,000

0.375%,

03/01/28

...............

1,028,176

1,000,000

2.000%,

03/01/30(a)

.............

1,385,500

2,200,000

Halozyme

Therapeutics

Inc.,

1.000%,

08/15/28(a)

.............

2,013,000

1,500,000

Insulet

Corp.,

0.375%,

09/01/26

...............

2,067,750

Principal

Amount

Market

Value

$

235,000

Integer

Holdings

Corp.,

2.125%,

02/15/28(a)

.............

$

278,005

940,000

Invacare

Corp.,

Escrow,

Zero

Coupon,

05/08/28

...........

0

2,270,000

PetIQ

Inc.,

4.000%,

06/01/26

...............

2,102,531

1,500,000

TransMedics

Group

Inc.,

1.500%,

06/01/28(a)

.............

1,714,547

16,916,381

Materials

—

0.1%

312,000

Danimer

Scientific

Inc.,

3.250%,

12/15/26(a)

.............

130,666

Real

Estate

Investment

Trusts

—

3.7%

1,500,000

Arbor

Realty

Trust

Inc.,

7.500%,

08/01/25(a)

.............

1,501,500

350,000

Braemar

Hotels

&

Resorts

Inc.,

4.500%,

06/01/26

...............

322,669

1,500,000

Pebblebrook

Hotel

Trust,

1.750%,

12/15/26

...............

1,273,687

1,000,000

Redwood

Trust

Inc.,

7.750%,

06/15/27

...............

846,250

1,710,000

Summit

Hotel

Properties

Inc.,

1.500%,

02/15/26

...............

1,461,086

5,405,192

Security

Software

—

3.7%

1,495,000

Cardlytics

Inc.,

1.000%,

09/15/25

...............

842,881

3,090,000

Verint

Systems

Inc.,

0.250%,

04/15/26

...............

2,738,513

1,475,000

Zscaler

Inc.,

0.125%,

07/01/25

...............

1,726,487

5,307,881

Semiconductors

—

7.3%

2,500,000

Impinj

Inc.,

1.125%,

05/15/27

...............

2,715,636

1,500,000

indie

Semiconductor

Inc.,

4.500%,

11/15/27(a)

.............

1,998,000

1,050,000

ON

Semiconductor

Corp.,

0.500%,

03/01/29(a)

.............

1,191,057

2,500,000

Semtech

Corp.,

1.625%,

11/01/27(a)

.............

2,338,750

3,125,000

Wolfspeed

Inc.,

1.875%,

12/01/29(a)

.............

2,425,000

10,668,443

Telecommunications

—

2.4%

2,020,000

8x8

Inc.,

0.500%,

02/01/24

...............

1,928,978

Infinera

Corp.

1,250,000

2.500%,

03/01/27

...............

1,161,894

Bancroft

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

June

30,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Telecommunications

(Continued)

$

325,000

3.750%,

08/01/28(a)

.............

$

325,487

3,416,359

TOTAL

CONVERTIBLE

CORPORATE

BONDS

....................

132,004,200

Shares

CONVERTIBLE

PREFERRED

STOCKS

—

0.5%

Business

Services

—

0.0%

809,253

Amerivon

Holdings

LLC,

4.000%(b)

....................

0

272,728

Amerivon

Holdings

LLC,

common

equity

units

(b)

..........................

3

3

Health

Care

—

0.5%

28,911

Invacare

Holdings

Corp.,

Ser.

A,

9.000%

......................

722,780

TOTAL

CONVERTIBLE

PREFERRED

STOCKS

...................

722,783

MANDATORY

CONVERTIBLE

SECURITIES(c)

—

4.4%

Diversified

Industrial

—

1.7%

38,000

Chart

Industries

Inc.,

Ser.

B,

6.750%,

12/15/25

...............

2,475,320

Energy

and

Utilities

—

1.8%

NextEra

Energy

Inc.

24,860

6.219%,

09/01/23

...............

1,218,886

30,000

6.926%,

09/01/25

...............

1,358,700

2,577,586

Financial

Services

—

0.9%

32,000

New

York

Community

Capital

Trust

V,

6.000%,

11/01/51

...............

1,294,400

TOTAL

MANDATORY

CONVERTIBLE

SECURITIES

................

6,347,306

COMMON

STOCKS

—

0.0%

Health

Care

—

0.0%

12,938

Invacare

Holdings

Corp.†

............

0

Principal

Amount

Market

Value

U.S.

GOVERNMENT

OBLIGATIONS

—

4.4%

$

6,480,000

U.S.

Treasury

Bills,

5.148%

to

5.313%††,

08/31/23

to

09/14/23

......................

$

6,414,061

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$150,629,965)

.............

$

145,488,350

(a)

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

(b)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

(c)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

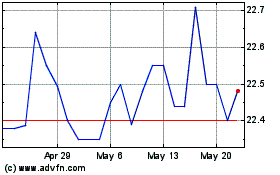

Bancroft (AMEX:BCV-A)

Historical Stock Chart

From Jan 2025 to Feb 2025

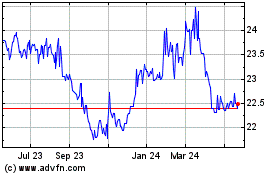

Bancroft (AMEX:BCV-A)

Historical Stock Chart

From Feb 2024 to Feb 2025