Buy These ETFs to Profit from The Great Duration Rotation - ETF News And Commentary

26 April 2013 - 9:41PM

Zacks

The so-called “Great Rotation”--from bonds to stocks--appears to

be taking longer than earlier expected. While there were increased

inflows into equity funds earlier this year, the trend slowed down

later on account of renewed worries about global growth and

troubles in the Euro-zone.

Though ETF investors showed a clear preference for equity funds,

most mutual fund investors continued to put money in bond funds as

well. Additionally, most of the money going into stocks came from

the cash lying on the sidelines. (Read: 3 Excellent ETFs for

Income Investors)

However, it was clear that investors were getting increasingly

worried about the interest rate risk in their bond portfolios. ETF

flows during the first quarter show that more interest rate

sensitive ETFs like iShares iBoxx $ Investment Grade Corporate Bond

Fund (LQD) and iShares iBoxx $ High Yield Corporate Bond Fund (HYG)

lost money, and funds with less interest rate sensitivity/shorter

duration gathered assets.

Recent FOMC minutes meetings revealed that there is growing

debate within the committee about continuation of asset purchases

at current levels. Once the Fed slows down its purchases, interest

rates will start to rise. In fact, the ten-year note did break the

psychological barrier of 2% earlier this year but the yields

declined later. Within the fixed income space, junk bonds

appear to be at highest risk.

Investors looking for higher yields but concerned about the

potential rise in interest rates should look at Senior Loan ETFs.

(Read: 3 REIT ETFs you should not ignore)

Senior loans are secured by company’s assets and are thus lower

in risk structure, even though these loans are mostly issued by

companies with below investment grade credit. These are floating

rate loans so they usually pay a spread over some benchmark rate

like LIBOR. Thus, in the event of rise in interest rates,

coupons on senior loans increase while the value of the investment

remains stable. On the other hand, bonds lose value if the interest

rates go up.

So, investors in senior loans or in senior loans ETFs get the

benefit of high yields with protection against any interest rate

rise. Further, they carry lower credit risk compared with most

other assets with similar level of yield. Additionally senior

loans have low correlations with other asset classes. (Read: 3 High

Yield ETFs for your IRA)

PowerShares Senior Loan Portfolio

(BKLN)

BKLN is based on the S&P/LSTA U.S. Leveraged Loan 100 Index

which is designed to track the largest institutional leveraged

loans based on market weightings, spreads, and interest

payments.

The ETF currently holds about 131 securities in total. With most

of these holdings maturing between one and ten years, the fund has

years to maturity at 5.18. In terms of credit rating, about 42% of

the holdings are “BB” while 44% are ranked "B" by S&P.

The product is slightly expensive with an expense ratio of 76

basis points a year, but it pays out an attractive dividend yield

of 4.74% at present.

The ETF was launched in March 2011 and has managed to attract

about $3.7 billion in assets, of which $2.1 billion came this

year—making it the second highest asset gatherer among fixed income

ETFs year-to-date.

The volume is generally high at around 870,000 shares per day,

giving the fund an extremely low bid ask spread.

Pyxis/iBoxx Senior Loan

ETF (SNLN)

The product follows the Markit iBoxx Liquid Leveraged Loan Index

and is the lowest cost choice in the space, charging 55 basis

points in annual expenses. The ETF was launched in November last

year and currently has $60.5 million in AUM. It’s holdings have a

weighted average maturity of 4.83 years.

SPDR Blackstone / GSO Senior Loan ETF

(SRLN)

SRLN is the actively managed product in the space. It seeks to

outperform both the Markit iBoxx USD Liquid Leveraged Loan

Index and the S&P/LSTA U.S. Leveraged Loan 100

Index. The ETF was launched earlier this month and has so far

collected $152.6 million in assets.

The product currently holds 92 securities and charges 90 basis

points in expenses.

Want the latest recommendations from Zacks Investment Research?

Today, you can download7

Best Stocks for the Next 30 Days.Click

to get this free report >>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

ISHARES GS CPBD (LQD): ETF Research Reports

HILND/IBX-SR LN (SNLN): ETF Research Reports

SPDR-BS GSO SL (SRLN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

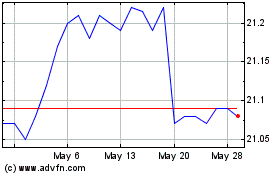

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

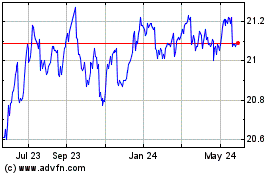

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2023 to Dec 2024