Guggenheim Launches 2 More High Yield BulletShares ETFs - ETF News And Commentary

30 September 2013 - 1:15AM

Zacks

A number of ETF issuers have launched new products lately, bringing

the total number of funds just over the 1,500 mark. While a few of

these funds have been targeting brand new niches, there has also

been a rising trend of ‘getting back to basics’ for issuers, as

many have looked to round out lineups and plug up any weak

spots.

High Yield ETFs in Focus

At this time, Guggenheim, one of the industry veterans, has

launched 2 high yield corporate bond ETFs. This came at a time when

investors were seeking high yields from the bond markets. While

Guggenheim already has an array of ETFs which track specific

maturities, these ETFs are more target based (Read Guggenheim Files

for ASEAN ETF).

The recent launches include

Guggenheim BulletShares 2019

High Yield Corporate Bond ETF (BSJJ) and

Guggenheim BulletShares 2020 High Yield Corporate Bond ETF

(BSJK).

Both these ETFs are designed to track the performance of the high

yield corner of the fixed income world while putting focus on

securities which have a fixed maturity date.

BSJJ seeks to track the performance of high yield corporate debt

notes which have an effective maturity in 2019. The fund took its

start with an AUM of $2.5 million.

BSJK tracks the performance of high yield corporate debt notes

maturing in 2020. Like BSJJ it also has an AUM of $2.5 million.

Both the products charge 42bps in fees and expenses.

Why These Might Be in Focus

In the latest FOMC meeting, Ben Bernanke put QE3 tapering on hold

until pronounced growth is seen in the economy. Instead, it lowered

the GDP growth outlook to 2%–2.3% from 2.3%–2.6% for this year,

citing concerns of tight fiscal policy and higher mortgage rates.

(Read: Time to Buy Treasury Bond ETFs?)

Further, the Fed reiterated that interest rates would stay near

zero and would not be increased until the unemployment rate falls

below 6.5% and inflation exceeds their target.

This surprising move cheered the market and breathed life into the

depressed bond world. Investors have started to shift their focus

towards the debt ceiling, especially high yield bonds, as they are

poised to be upcoming opportunities for investors with a high yield

appetite. (Read: A Better Yield ETF? UBS Launches High Income

ETN).

Why do these ETFs look appealing?

Both the products have a unique feature of held-to-maturity which

might interest investors who seek principal protection along with

high interest rate hike.

In fact, both these ETFs are low in terms of costs as their fees

are much lower than most of the other contenders in the space. The

average expense ratio in the high yield bond category stands at

56bps. (Find all High Yield/Junk Bonds ETFs).

Tough Contenders in the Space

While there are already about 30 ETFs in the High Yield ETF space,

the product may face a tough match-up from these deep rooted funds

in the category:

iShares iBoxx High Yield Corporate Bond

Fund (HYG), State Street

SPDR Barclays Capital High Yield Bond ETF

(JNK

) and PowerShares

Senior Loan Portfolio (BKLN

).

Given this, it may be difficult for these new BulletShares funds to

accumulate assets in light of this competition. However, many other

BulletShares funds have seen solid inflows, so there is definitely

some hope for these new products as well.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

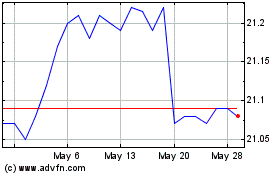

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

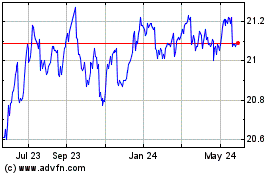

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2023 to Dec 2024