HYLD: The Best Choice Among High Yield Bond ETFs? - ETF News And Commentary

25 December 2013 - 4:07AM

Zacks

The year 2013 can easily

be earmarked as a year of the beginning of the ‘great rotation’ –

from bonds to stocks – aided by improving economic conditions

especially on the domestic front made it clear that rock-bottom

interest rate environment prevailing in the U.S. would not last

long. If this was not enough, heightened concerns related to the

scaling back of the monetary easing policies by the Fed have made

overall bond investing lose its luster.

A reduction in stimulus raises the interest rates thereby

increasing yields and hurting the bonds prices. Amid such a

backdrop, investors looking to maximize current income landed up in

high-yield bonds in 2013 as these products are less vulnerable to

interest rate risks thanks to their low duration (in general) and

are less co-related to other sectors of the fixed income space.

Also, high-yield bonds perform better in an uptrending economy

(read: Forget BOND, Focus on These Junk Bond ETFs Instead).

Despite this fundamental, not all high-yields products fared better

in 2013. One product PeritusHigh Yield ETF (HYLD)

stood out in the space. Below we are detailing the products:

HYLD in Focus

This fund is actively managed providing exposure to the junk

segment of the U.S. bond market. With total assets of $457.1

million, HYLD is one of the popular ETFs in the active high yield

bond space.

The fund aims to provide capital appreciation in addition to high

yields. It invests in a variety of non-investment grade corporate

debt securities by primarily employing a bottom-up approach of

securities selection. It offers the best value and least credit

risk to investors in the high yield space by investing in

corporates with a lower effective duration of roughly 3.00 years

thus effectively reducing interest rate risks.

Investors have to pay a higher fee for this decent exposure as HYLD

charges 1.25% in expenses which is way above the average expenses

charged by the high-yield space (55 bps a year). Its actively

managed nature can be held responsible for increased expenses.

The product holds 81 securities in the basket and the allocation is

pretty spread out with no single holding accounting for more than

2.36% of the total. Further, the ETF pays out a high annual

yield of about 7.70% per annum. The fund returned 3.83% in the YTD

frame (as of December 18) – highest among the top 10 high-yield

bond ETFs this year.

Final Word

Lower duration and an impressively high yield compared to the likes

of iShares iBoxx $ High Yield Corporate Bond ETF

(HYG), SPDR Barclays Capital High Yield

Bond ETF (JNK) and Senior Loan

Portfolio (BKLN) made HYLD a winner in

the space.

Recently, the Fed announced a $10 billion monthly curtail in the QE

program from January which is a danger signal in bond investing.

However, this does not mean the complete wrap-up of the QE program,

but a modest trimming. The flow of cheap money into the economy

will continue at least for some time. (read: Buy These ETFs to

Profit from The Great Duration Rotation).

Also, the Fed has vowed to keep the interest rate low for longer

irrespective of the taper. This should keep high-yield bond

investing alive in 2014. An improving economy and relatively

low-rates will trigger corporate earnings thus benefiting their

bonds too. This should also minimize the default risks of the junk

bond funds.

Though HYLD currently carries a Zacks Rank #5 (Strong Sell), we

expect HYLD to pull through the taper-inflicted environment

decently in early 2014. This may be an interesting choice for

investors looking for a high yield and diversification in their

portfolio. Genuine trouble might be felt in the space in the latter

part of the year when the economy will likely be devoid of the

Fed’s stimulus.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report

>>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

PERITUS-HIGH YL (HYLD): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

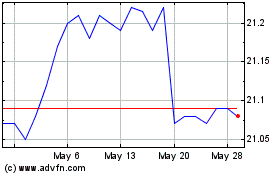

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

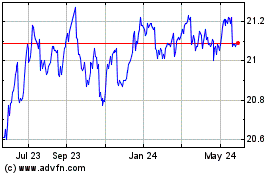

Invesco Senior Loan ETF (AMEX:BKLN)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Invesco Senior Loan ETF (American Stock Exchange): 0 recent articles

More Powershares Exchange-Traded Fund Trust Etf News Articles