Angel Oak Capital Advisors’ UltraShort Income ETF Surpasses $100M in Assets in One Year, Sets Stage for ETF Platform Growth in 2024

25 October 2023 - 5:44AM

Business Wire

The structured credit-focused investment shop

finds success in delivering distinct income solutions under the

exchange-traded fund wrapper, sub-advisory services

Angel Oak Capital Advisors LLC, an investment management firm

that specializes in value-driven structured credit, is proud to

announce that the Angel Oak UltraShort Income ETF (NYSE: UYLD) has

grown to more than $100 million in assets under management in less

than one year since its inception on Oct. 24, 2022. This important

milestone reflects Angel Oak’s success since launching its

exchange-traded fund platform one-year ago, which has grown to

approximately $300 million in assets under advisement across its

two funds and through its sub-advisory services.

Launched in October 2022, UYLD was the company’s initial entry

into the ETF market. Now accessible on more than 20 platforms,

including LPL Financial, Stifel Nicolaus, Rockefeller Capital

Management and Schwab, the Fund offers investors a distinct yield

profile through its investments, primarily in non-agency

residential mortgage-backed securities and consumer-based

asset-backed securities, while maintaining a duration below one

year. Angel Oak’s distinct approach aims to provide advisors with a

higher-yielding, short-duration ETF compared to conventional money

market strategies or other short-duration funds. The Fund has

outperformed cash-like investments and many of its peers since its

inception.1

“We’re pleased that our team’s approach and strategy have

delivered for our investors at the one-year mark,” said Ward Bortz,

ETF portfolio manager and head of distribution for public

strategies at Angel Oak. “We remain in a complex fixed-income

environment, but our approach to managing duration risk coupled

with the ability to find higher income without reducing credit

quality has resonated with investors across Angel Oak’s broad

platform, including our ETF solutions.”

In 2024, Angel Oak intends to grow its ETF platform

substantially, bringing new ETFs to market and opportunistically

serving as a sub-advisor to support asset managers bringing new and

innovative strategies to market. Alongside UYLD, Angel Oak also

offers the Angel Oak Income ETF (NYSE: CARY). These ETFs complement

Angel Oak’s group of public and private strategies, which include

hedge funds, closed-end funds, interval funds and mutual funds that

are predominantly focused on opportunities in non-agency RMBS and

structured credit more generally.

“Angel Oak has thrived by delivering a broad platform of

distinct investment strategies to both institutional investors and

advisors,” remarked Sreeni Prabhu, group chief investment officer

and managing partner at Angel Oak. “We believe that the

infrastructure we have built over the past ten years combined with

our investment prowess can help build a leading ETF platform

dedicated to delivering differentiated, structured credit-driven

solutions for advisors.”

To learn more about UYLD, click here.

1Since UYLD’s inception date of Oct. 24, 2022, UYLD has returned

6.00%, the Bloomberg U.S. Treasury Bills Index has returned 4.42%

and the Morningstar Ultrashort Bond Category has returned 5.04% as

of Sept. 30.

About Angel Oak Capital Advisors

Angel Oak is an investment management firm focused on providing

compelling fixed-income investment solutions to its clients. Backed

by a value-driven approach, Angel Oak seeks to deliver attractive,

risk-adjusted returns through a combination of stable current

income and price appreciation. Its experienced investment team

seeks the best opportunities in fixed income, with a specialization

in mortgage-backed securities and other areas of structured

credit.

Net Total Returns as of 9/30/23

3 Mo.

YTD

Since Inception2

UYLD (NAV)

1.81%

4.80%

5.95%

UYLD (Market Price)

1.86%

4.78%

6.00%

Morningstar Ultrashort Bond Category

1.41%

3.97%

5.04%

Bloomberg U.S. Treasury Bills Index

1.34%

3.65%

4.42%

Bloomberg Short Term Government/Corporate

Index

1.33%

3.55%

4.37%

2 The inception date of the Angel Oak UltraShort Income ETF was

10/24/22.

Current performance may be lower or higher than performance data

quoted. Performance quoted is past performance and is no guarantee

of future results. The investment return and principal value of an

investment in the Fund will fluctuate so that an investor’s shares,

when redeemed, may be worth more or less than their original cost.

Current performance to the most recent month end can be obtained by

calling 855-751-4324.

Investors should carefully consider the investment

objectives, risks, charges and expenses of the Fund. This and other

important information about the Fund is contained in the Prospectus

which can be obtained by calling Shareholder Services at

855-751-4324 or from www.angeloakcapital.com. The Prospectus should

be read carefully before investing.

Investing involves risk; principal loss is possible. Investments

in debt securities typically decrease when interest rates rise.

This risk is usually greater for longer-term debt securities.

Investments in lower-rated and nonrated securities present a

greater risk of loss to principal and interest than higher-rated

securities do. Investments in asset-backed and mortgage-backed

securities include additional risks that investors should be aware

of, including credit risk, prepayment risk, possible illiquidity,

and default, as well as increased susceptibility to adverse

economic developments. Derivatives involve risks different from—and

in certain cases, greater than—the risks presented by more

traditional investments. Derivatives may involve certain costs and

risks such as illiquidity, interest rate, market, credit,

management, and the risk that a position could not be closed when

most advantageous. Investing in derivatives could lead to losses

that are greater than the amount invested. The Fund may use

leverage, which may exaggerate the effect of any increase or

decrease in the value of securities in the Fund’s portfolio or

higher and duplicative expenses when it invests in mutual funds,

ETFs, and other investment companies. For more information on these

risks and other risks of the Fund, please see the Prospectus.

ETFs may trade at a premium or discount to NAV. Shares of any

ETF are bought and sold at market prices (not NAV) and are not

individually redeemed from the Fund. Brokerage commissions will

reduce returns. The Fund is an actively managed ETF, which is a

fund that trades like other publicly-traded securities. The Fund is

not an index fund and does not seek to replicate the performance of

a specified index.

The Angel Oak Funds are distributed by Quasar Distributors,

LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231024187713/en/

Media: Trevor Davis, Gregory FCA for Angel Oak 443-248-0359

trevor@gregoryfca.com Company: Randy Chrisman, Chief Marketing and

Corporate Investor Relations Officer, Angel Oak 404-953-4969

randy.chrisman@angeloakcapital.com

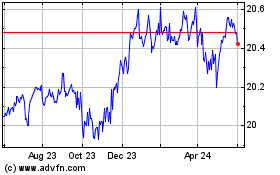

Angel Oak Income ETF (AMEX:CARY)

Historical Stock Chart

From Dec 2024 to Jan 2025

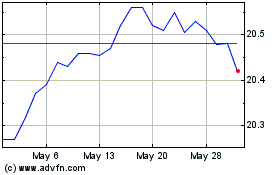

Angel Oak Income ETF (AMEX:CARY)

Historical Stock Chart

From Jan 2024 to Jan 2025