UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

Of the Securities Exchange

Act of 1934

For the month of

August 2024

Commission File Number:

001-38164

CALEDONIA

MINING CORPORATION PLC

(Translation of registrant's name into English)

B006 Millais House

Castle Quay

St Helier

Jersey JE2 3EF

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F

X Form 40-F ______

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

CALEDONIA MINING CORPORATION

PLC

|

| |

(Registrant) |

|

| |

|

|

|

| |

By: |

/s/ Mark Learmonth |

|

| Dated: August 12, 2024 |

Name:

|

Mark Learmonth |

|

| |

Title: |

CEO and Director |

|

Exhibit Index

Exhibit 99.1

Caledonia Mining Corporation Plc

| MANAGEMENT’S

RESPONSIBILITY FOR FINANCIAL INFORMATION |

To the Shareholders of Caledonia Mining Corporation Plc:

Management has prepared the information and representations

in this interim report. The unaudited condensed consolidated interim financial statements of Caledonia Mining Corporation Plc and its

subsidiaries (the “Group”) have been prepared in accordance with IFRS Accounting Standards, as issued by the International

Accounting Standards Board (“IFRS”) and, where appropriate, these statements include some amounts that are based on best estimates

and judgment. Management has determined such amounts on a reasonable basis in order to ensure that the unaudited condensed consolidated

interim financial statements are presented fairly, in all material respects.

The accompanying Management Discussion and Analysis (“MD&A”)

also includes information regarding the impact of current transactions, sources of liquidity, capital resources, operating trends, risks

and uncertainties. Actual results in the future may differ materially from our present assessment of this information because future events

and circumstances may not occur as expected.

The Group maintains adequate systems of internal accounting

and administrative controls, within reasonable cost. Such systems are designed to provide reasonable assurance that relevant and reliable

financial information is produced.

Management is responsible for establishing and maintaining adequate

internal controls over financial reporting (“ICOFR”). Any system of ICOFR, no matter how well designed, has inherent limitations.

Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation

and presentation.

At June 30, 2024 management evaluated the effectiveness of the

Group’s ICOFR and concluded that such ICOFR was effective based on the criteria outlined in the Internal Control Integrated Framework

(2013) issued by the Committee of Sponsoring Organisations of the Treadway Commission.

The Board of Directors, through its Audit Committee, is responsible

for ensuring that management fulfils its responsibilities for financial reporting and internal control. The Audit Committee is composed

of four independent non-executive directors. This Committee meets periodically with management, the external auditor and internal auditor

to review accounting, auditing, internal control and financial reporting matters.

These unaudited condensed consolidated interim financial statements

have not been audited by the Group’s independent auditor.

The unaudited condensed consolidated interim financial statements

for the period ended June 30, 2024 were approved by the Board of Directors and signed on its behalf on August 12, 2024.

| (Signed) J.M. Learmonth | |

(Signed) C.O. Goodburn |

| | |

|

| Chief Executive Officer | |

Chief Financial Officer |

Caledonia Mining Corporation Plc

Consolidated statements of profit or loss and other comprehensive

income

(in thousands of United States Dollars, unless indicated otherwise)

| For the | |

| |

Three months ended | | |

Six months ended | |

| | |

| |

June 30, | | |

June 30, | |

| Unaudited | |

Note | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| |

| | |

| | |

| | |

| |

| Revenue | |

| |

| 50,107 | | |

| 37,031 | | |

| 88,635 | | |

| 66,466 | |

| Royalty | |

| |

| (2,475 | ) | |

| (1,963 | ) | |

| (4,409 | ) | |

| (3,443 | ) |

| Production costs | |

6 | |

| (20,460 | ) | |

| (20,726 | ) | |

| (39,420 | ) | |

| (40,576 | ) |

| Depreciation | |

13 | |

| (4,239 | ) | |

| (3,409 | ) | |

| (8,058 | ) | |

| (5,664 | ) |

| Gross profit | |

| |

| 22,933 | | |

| 10,933 | | |

| 36,748 | | |

| 16,783 | |

| Net foreign exchange loss | |

7 | |

| (2,014 | ) | |

| (3,610 | ) | |

| (6,153 | ) | |

| (2,077 | ) |

| Administrative expenses | |

8 | |

| (3,664 | ) | |

| (3,183 | ) | |

| (6,275 | ) | |

| (9,122 | ) |

| Net derivative financial instrument expense | |

| |

| (174 | ) | |

| (54 | ) | |

| (476 | ) | |

| (488 | ) |

| Equity-settled share-based expense | |

9.2 | |

| (305 | ) | |

| (221 | ) | |

| (506 | ) | |

| (331 | ) |

| Cash-settled share-based expense | |

9.1 | |

| (4 | ) | |

| 9 | | |

| (57 | ) | |

| (271 | ) |

| Other expenses | |

10 | |

| (664 | ) | |

| (1,461 | ) | |

| (1,264 | ) | |

| (2,099 | ) |

| Other income | |

| |

| 185 | | |

| 168 | | |

| 349 | | |

| 186 | |

| Operating profit | |

| |

| 16,293 | | |

| 2,581 | | |

| 22,366 | | |

| 2,581 | |

| Finance income | |

11 | |

| 3 | | |

| 4 | | |

| 9 | | |

| 9 | |

| Finance cost | |

11 | |

| (797 | ) | |

| (1,061 | ) | |

| (1,529 | ) | |

| (1,833 | ) |

| Profit before tax | |

| |

| 15,499 | | |

| 1,524 | | |

| 20,846 | | |

| 757 | |

| Tax expense | |

| |

| (5,151 | ) | |

| (1,273 | ) | |

| (7,681 | ) | |

| (4,775 | ) |

| Profit (loss) for the period | |

| |

| 10,348 | | |

| 251 | | |

| 13,165 | | |

| (4,018 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income | |

| |

| | | |

| | | |

| | | |

| | |

| Items that are or may be reclassified to profit or loss | |

| |

| | | |

| | | |

| | | |

| | |

| Exchange differences on translation of foreign operations | |

| |

| 178 | | |

| (330 | ) | |

| 34 | | |

| (699 | ) |

| Total comprehensive income for the period | |

| |

| 10,526 | | |

| (79 | ) | |

| 13,199 | | |

| (4,717 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Profit (loss) attributable to: | |

| |

| | | |

| | | |

| | | |

| | |

| Owners of the Company | |

| |

| 8,429 | | |

| (513 | ) | |

| 10,560 | | |

| (5,542 | ) |

| Non-controlling interests | |

| |

| 1,919 | | |

| 764 | | |

| 2,605 | | |

| 1,524 | |

| Profit (loss) for the period | |

| |

| 10,348 | | |

| 251 | | |

| 13,165 | | |

| (4,018 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Total comprehensive income attributable to: | |

| |

| | | |

| | | |

| | | |

| | |

| Owners of the Company | |

| |

| 8,607 | | |

| (843 | ) | |

| 10,594 | | |

| (6,241 | ) |

| Non-controlling interests | |

| |

| 1,919 | | |

| 764 | | |

| 2,605 | | |

| 1,524 | |

| Total comprehensive income for the period | |

| |

| 10,526 | | |

| (79 | ) | |

| 13,199 | | |

| (4,717 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) per share | |

| |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share ($) | |

| |

| 0.43 | | |

| (0.01 | ) | |

| 0.53 | | |

| (0.31 | ) |

| Diluted earnings (loss) per share ($) | |

| |

| 0.43 | | |

| (0.01 | ) | |

| 0.53 | | |

| (0.31 | ) |

The accompanying notes on pages 6 to 28 are an integral part of these consolidated financial

statements.

On behalf of the Board: “J.M. Learmonth”- Chief Executive Officer and “C.O.

Goodburn”- Chief Financial Officer.

Caledonia Mining Corporation Plc

Consolidated statements of financial position

(in thousands of United States Dollars, unless indicated otherwise)

| Unaudited | |

| |

June 30, | | |

December 31, | |

| As at | |

Note | |

2024 | | |

2023 | |

| | |

| |

| | |

| |

| Assets | |

| |

| | | |

| | |

| Exploration and evaluation assets | |

12 | |

| 94,536 | | |

| 94,272 | |

| Property, plant and equipment | |

13 | |

| 181,027 | | |

| 179,649 | |

| Deferred tax asset | |

| |

| 180 | | |

| 153 | |

| Total non-current assets | |

| |

| 275,743 | | |

| 274,074 | |

| | |

| |

| | | |

| | |

| Income tax receivable | |

| |

| 274 | | |

| 1,120 | |

| Inventories | |

14 | |

| 20,401 | | |

| 20,304 | |

| Derivative financial assets | |

| |

| 20 | | |

| 88 | |

| Trade and other receivables | |

15 | |

| 7,882 | | |

| 9,952 | |

| Prepayments | |

16 | |

| 5,287 | | |

| 2,538 | |

| Cash and cash equivalents | |

17 | |

| 15,412 | | |

| 6,708 | |

| Assets held for sale | |

18 | |

| 13,484 | | |

| 13,519 | |

| Total current assets | |

| |

| 62,760 | | |

| 54,229 | |

| Total assets | |

| |

| 338,503 | | |

| 328,303 | |

| | |

| |

| | | |

| | |

| Equity and liabilities | |

| |

| | | |

| | |

| Share capital | |

19 | |

| 165,188 | | |

| 165,068 | |

| Reserves | |

| |

| 138,445 | | |

| 137,819 | |

| Retained loss | |

| |

| (57,985 | ) | |

| (63,172 | ) |

| Equity attributable to shareholders | |

| |

| 245,648 | | |

| 239,715 | |

| Non-controlling interests | |

| |

| 26,326 | | |

| 24,477 | |

| Total equity | |

| |

| 271,974 | | |

| 264,192 | |

| | |

| |

| | | |

| | |

| Liabilities | |

| |

| | | |

| | |

| Deferred tax liabilities | |

| |

| 5,381 | | |

| 6,131 | |

| Provisions | |

20 | |

| 9,416 | | |

| 10,985 | |

| Loans and borrowings | |

| |

| 2,033 | | |

| – | |

| Loan notes - long term portion | |

21 | |

| 8,238 | | |

| 6,447 | |

| Cash-settled share-based payment - long term portion | |

9.1 | |

| 190 | | |

| 374 | |

| Lease liabilities - long term portion | |

| |

| 22 | | |

| 41 | |

| Total non-current liabilities | |

| |

| 25,280 | | |

| 23,978 | |

| | |

| |

| | | |

| | |

| Cash-settled share-based payment - short term portion | |

9.1 | |

| 454 | | |

| 920 | |

| Income tax payable | |

| |

| 4,152 | | |

| 10 | |

| Lease liabilities - short term portion | |

| |

| 114 | | |

| 167 | |

| Loan notes - short term portion | |

21 | |

| 855 | | |

| 665 | |

| Trade and other payables | |

22 | |

| 18,803 | | |

| 20,503 | |

| Overdraft and term loans | |

17 | |

| 16,778 | | |

| 17,740 | |

| Liabilities associated with assets held for sale | |

18 | |

| 93 | | |

| 128 | |

| Total current liabilities | |

| |

| 41,249 | | |

| 40,133 | |

| Total liabilities | |

| |

| 66,529 | | |

| 64,111 | |

| Total equity and liabilities | |

| |

| 338,503 | | |

| 328,303 | |

The accompanying notes on pages 6 to 28 are an integral part of these consolidated

financial statements.

Caledonia Mining Corporation Plc

Consolidated statements of changes in equity

(in thousands of United States Dollars, unless indicated otherwise)

| Unaudited | |

Note | |

Share

capital | | |

Foreign

currency

translation

reserve | | |

Contributed

surplus | | |

Equity-

settled

share-based

payment

reserve | | |

Retained

loss | | |

Total | | |

Non-

controlling

interests

(NCI) | | |

Total

equity | |

| Balance December 31, 2022 | |

| |

| 83,471 | | |

| (9,787 | ) | |

| 132,591 | | |

| 14,997 | | |

| (50,222 | ) | |

| 171,050 | | |

| 22,409 | | |

| 193,459 | |

| Transactions with

owners: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividends declared | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,066 | ) | |

| (6,066 | ) | |

| (1,512 | ) | |

| (7,578 | ) |

| Share-based payments: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Shares issued on settlement of

incentive plan awards | |

9.1 | |

| 351 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 351 | | |

| - | | |

| 351 | |

| - Equity-settled share-based expense | |

9.2 | |

| - | | |

| - | | |

| - | | |

| 331 | | |

| - | | |

| 331 | | |

| - | | |

| 331 | |

| Shares issued: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Equity raise (net of transaction cost) | |

19 | |

| 15,658 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 15,658 | | |

| - | | |

| 15,658 | |

| - Bilboes acquisition | |

| |

| 65,677 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 65,677 | | |

| - | | |

| 65,677 | |

| Total comprehensive

income: | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| | | |

| | |

| (Loss) profit for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,542 | ) | |

| (5,542 | ) | |

| 1,524 | | |

| (4,018 | ) |

| Other comprehensive income

for the period | |

| |

| - | | |

| (699 | ) | |

| - | | |

| - | | |

| - | | |

| (699 | ) | |

| - | | |

| (699 | ) |

| Balance at June 30, 2023 | |

| |

| 165,157 | | |

| (10,486 | ) | |

| 132,591 | | |

| 15,328 | | |

| (61,830 | ) | |

| 240,760 | | |

| 22,421 | | |

| 263,181 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance December 31, 2023 | |

| |

| 165,068 | | |

| (10,409 | ) | |

| 132,591 | | |

| 15,637 | | |

| (63,172 | ) | |

| 239,715 | | |

| 24,477 | | |

| 264,192 | |

| Transactions with

owners: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividends declared* | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,373 | ) | |

| (5,373 | ) | |

| (756 | ) | |

| (6,129 | ) |

| Share-based payments: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Shares issued on settlement of incentive plan awards | |

9.1 | |

| 83 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 83 | | |

| - | | |

| 83 | |

| - Equity-settled share-based expense | |

9.2 | |

| - | | |

| - | | |

| - | | |

| 592 | | |

| - | | |

| 592 | | |

| - | | |

| 592 | |

| Shares issued: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Options exercised | |

19 | |

| 37 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 37 | | |

| - | | |

| 37 | |

| Total comprehensive

income: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,560 | | |

| 10,560 | | |

| 2,605 | | |

| 13,165 | |

| Other comprehensive income

for the period | |

| |

| - | | |

| 34 | | |

| - | | |

| - | | |

| - | | |

| 34 | | |

| - | | |

| 34 | |

| Balance at June 30, 2024 | |

| |

| 165,188 | | |

| (10,375 | ) | |

| 132,591 | | |

| 16,229 | | |

| (57,985 | ) | |

| 245,648 | | |

| 26,326 | | |

| 271,974 | |

| | |

Note | |

| 19 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| * |

Dividends of $2.7 million declared on January 2, 2024 were paid on January

26, 2024. Dividends of $2.7 million declared on March 27, 2024 were paid on April 26, 2024. Dividends to NCI declared and accrued

for during the period amounted to $756. $259 of the NCI dividends declared during 2023 was paid during the period. |

The accompanying notes on pages 6 to 28 are an integral part of these consolidated

financial statements.

Caledonia Mining Corporation Plc

Consolidated statements of cash flows

(in thousands of United States Dollars, unless indicated otherwise)

| Unaudited | |

| |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

Note | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| |

| | |

| | |

| | |

| |

| Cash inflow from operations | |

23 | |

| 20,988 | | |

| 2 | | |

| 27,523 | | |

| 666 | |

| Interest received | |

| |

| 3 | | |

| 4 | | |

| 9 | | |

| 9 | |

| Finance costs paid | |

25 | |

| (710 | ) | |

| (1,231 | ) | |

| (1,283 | ) | |

| (1,431 | ) |

| Tax paid | |

25 | |

| (1,195 | ) | |

| (1,001 | ) | |

| (2,276 | ) | |

| (2,346 | ) |

| Net cash inflow (outflow) from operating activities | |

| |

| 19,086 | | |

| (2,226 | ) | |

| 23,973 | | |

| (3,102 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Cash flows used in investing activities | |

| |

| | | |

| | | |

| | | |

| | |

| Acquisition of property, plant and equipment | |

25 | |

| (6,897 | ) | |

| (6,009 | ) | |

| (10,638 | ) | |

| (10,602 | ) |

| Acquisition of exploration and evaluation assets | |

12 | |

| (733 | ) | |

| (139 | ) | |

| (1,163 | ) | |

| (283 | ) |

| Acquisition of put options | |

| |

| (168 | ) | |

| (811 | ) | |

| (408 | ) | |

| (811 | ) |

| Net cash used in investing activities | |

| |

| (7,798 | ) | |

| (6,959 | ) | |

| (12,209 | ) | |

| (11,696 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| |

| | | |

| | | |

| | | |

| | |

| Dividends paid | |

25 | |

| (2,912 | ) | |

| (2,893 | ) | |

| (5,632 | ) | |

| (5,317 | ) |

| Payment of lease liabilities | |

| |

| (38 | ) | |

| (35 | ) | |

| (75 | ) | |

| (72 | ) |

| Shares issued – equity raise (net of transaction cost) | |

19 | |

| – | | |

| 4,834 | | |

| – | | |

| 15,658 | |

| Proceeds from loans and borrowings | |

| |

| 2,032 | | |

| – | | |

| 2,032 | | |

| – | |

| Loan notes - Motapa payment | |

| |

| – | | |

| (1,288 | ) | |

| – | | |

| (6,687 | ) |

| Loan notes - solar bond issue receipts (net of transaction cost) | |

21.1 | |

| 1,939 | | |

| 2,500 | | |

| 1,939 | | |

| 7,000 | |

| Net cash from (used in) financing activities | |

| |

| 1,021 | | |

| 3,118 | | |

| (1,736 | ) | |

| 10,582 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| |

| 12,309 | | |

| (6,067 | ) | |

| 10,028 | | |

| (4,216 | ) |

| Effect of exchange rate fluctuations on cash and cash equivalents | |

| |

| 485 | | |

| (30 | ) | |

| (362 | ) | |

| (187 | ) |

| Net cash and cash equivalents at the beginning of the period | |

| |

| (14,160 | ) | |

| 3,190 | | |

| (11,032 | ) | |

| 1,496 | |

| Net cash and cash equivalents at the end of the period | |

| |

| (1,366 | ) | |

| (2,907 | ) | |

| (1,366 | ) | |

| (2,907 | ) |

The accompanying notes on pages 6 to 28 are an integral part of these consolidated

financial statements.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

Caledonia Mining Corporation Plc (“Caledonia” or

the “Company”) is a company domiciled in Jersey, Channel Islands. The Company’s registered office address is B006 Millais

House, Castle Quay, St Helier, Jersey, Channel Islands.

These unaudited condensed consolidated interim financial statements

as at and for the six months ended June 30, 2024 are of the Company and its subsidiaries (the “Group”). The Group’s

primary involvement is in the operation of a gold mine and the exploration and development of mineral properties for precious metals in

Zimbabwe.

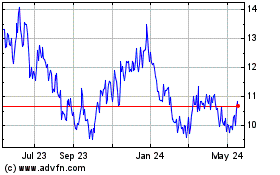

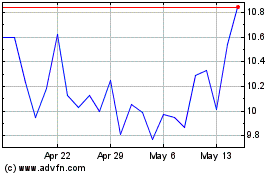

Caledonia’s shares are listed on the NYSE American LLC

stock exchange (symbol – “CMCL”). Depository interests in Caledonia’s shares are admitted to trading on AIM of

the London Stock Exchange plc (symbol – “CMCL”). Caledonia listed on the Victoria Falls Stock Exchange (“VFEX”)

(symbol – “CMCL”) on December 2, 2021. Caledonia voluntarily delisted from the Toronto Stock Exchange (the

“TSX”) on June 19, 2020. After the delisting the Company remains a Canadian reporting issuer and has to comply with Canadian

securities laws until it demonstrates that Canadian shareholders represent less than 2% of issued share capital.

| (a) | Statement of compliance |

These unaudited condensed consolidated interim financial statements

have been prepared in accordance with IAS 34 Interim Financial Reporting and do not include all the information required for full annual

financial statements. Accordingly, certain information and disclosures normally included in the annual financial statements prepared in

accordance with IFRS Accounting Standards, as issued by the International Accounting Standards Board (“IFRS”) have been omitted

or condensed. Selected explanatory notes are included to explain events and transactions that are significant to an understanding of the

changes in the financial position and performance of the Group since the last annual consolidated financial statements as at and for the

year ended December 31, 2023.

These unaudited condensed consolidated interim financial statements

have been prepared on the historical cost basis except for:

| · | cash-settled share-based payment arrangements measured at fair value on grant and

re-measurement dates; |

| · | equity-settled share-based payment arrangements measured at fair value on the grant

date; and |

| · | derivative financial assets measured at fair value. |

These unaudited condensed consolidated interim financial statements

are presented in United States Dollar (“$” or “US Dollars” or “USD”), which is also the functional

currency of the Company. All financial information presented in US Dollars has been rounded to the nearest thousand, unless indicated

otherwise.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 3 | Use of accounting assumptions, estimates and judgements |

In preparing these unaudited condensed consolidated interim

financial statements, management has made accounting assumptions, estimates and judgements that affect the application of the Group’s

accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Changes in estimates are recognised prospectively. Key accounting

assumptions, estimates and judgements applied in the preparation of the unaudited condensed consolidated interim annual financial statements

are consistent with those applied in the preparation of the audited annual consolidated financial statements for the year ended December

31, 2023.

| 4 | Material accounting policies |

The same accounting policies and methods of computation have

been applied consistently to all periods presented in these unaudited condensed consolidated interim financial statements as compared

to the Group’s annual consolidated financial statements for the year ended December 31, 2023. In addition, the accounting policies

have been applied consistently throughout the Group.

| 5 | Blanket Zimbabwe Indigenisation Transaction |

On February 20, 2012 the Group announced it had signed a Memorandum

of Understanding (“MoU”) with the Minister of Youth, Development, Indigenisation and Empowerment of the Zimbabwean Government

pursuant to which the Group agreed that indigenous Zimbabweans would acquire an effective 51% ownership interest in the Zimbabwean company

owning the Blanket Mine (also referred to herein as “Blanket” or “Blanket Mine” as the context requires) for a

paid transactional value of $30.09 million. Pursuant to the above, members of the Group entered into agreements with each indigenous shareholder

to transfer 51% of the Group’s ownership interest in Blanket Mine whereby it:

| • | sold a 16% interest to the National Indigenisation and Economic Empowerment Fund

(“NIEEF”) for $11.74 million; |

| • | sold a 15% interest to Fremiro Investments (Private) Limited (“Fremiro”),

which is owned by indigenous Zimbabweans, for $11.01 million; |

| • | sold a 10% interest to Blanket Employee Trust Services (Private) Limited (“BETS”)

for the benefit of present and future managers and employees for $7.34 million. The shares in BETS are held by the Blanket Mine Employee

Trust (“Employee Trust”) with Blanket Mine’s employees holding participation units in the Employee Trust; and |

| • | donated a 10% ownership interest to the Gwanda Community Share Ownership Trust (“Community

Trust”). In addition, Blanket Mine paid a non-refundable donation of $1 million to the Community Trust. |

The Group facilitated the vendor funding of these transactions which is repaid by way of dividends

from Blanket Mine. 80% of dividends declared by Blanket Mine are used to repay such loans and the remaining 20% unconditionally accrues

to the respective indigenous shareholders. Following a modification to the interest rate on June 23, 2017, outstanding balances on these

facilitation loans attract interest at a rate of the lower of a fixed 7.25% per annum payable quarterly or 80% of the Blanket Mine dividend

in the quarter. The timing of the loan repayments depends on the future financial performance of Blanket Mine and the extent of future

dividends declared by Blanket Mine. The Group related facilitation loans were transferred as dividends in specie intra-group and now the

loans and most of the interest thereon is payable to the Company.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 5 | Blanket Zimbabwe Indigenisation Transaction (continued) |

Accounting treatment

The directors of Caledonia Holdings Zimbabwe (Private) Limited

(“CHZ”), a wholly-owned subsidiary of the Company, performed an assessment using the requirements of IFRS 10: Consolidated

Financial Statements (IFRS 10). It was concluded that CHZ should consolidate Blanket Mine after the indigenisation. The subscription agreements

with the indigenous shareholders have been accounted for accordingly as a transaction with non-controlling interests and as a share-based

payment transaction.

The subscription agreements, concluded on February 20, 2012,

were accounted for as follows:

| • | Non-controlling interests (“NCI”) were recognised on the portion of

shareholding upon which dividends declared by Blanket Mine will accrue unconditionally to equity holders as follows: |

| (a) | 20% of the 16% shareholding of NIEEF; |

| (b) | 20% of the 15% shareholding of Fremiro; and |

| (c) | 100% of the 10% shareholding of the Community Trust. |

| • | This effectively means that NCI was initially recognised at 16.2% of the net assets

of Blanket Mine, until the completion of the transaction with Fremiro, whereby the NCI reduced to 13.2% (see below). |

| • | The remaining 80% of the shareholding of NIEEF and Fremiro was recognised as NCI

to the extent that their attributable share of the net asset value of Blanket Mine exceeds the balance on the facilitation loans, including

interest. |

| • | The transaction with BETS is accounted for in accordance with IAS 19 Employee

Benefits (profit sharing arrangement) as the ownership of the shares does not ultimately pass to the employees. The employees are

entitled to participate in 20% of the dividends accruing to the 10% shareholding in Blanket Mine if they are employed at the date of such

distribution. To the extent that 80% of the attributable dividends exceeds the balance on the BETS facilitation loan, they will accrue

to the employees at the date of such declaration. |

| • | BETS is an entity effectively controlled and consolidated by Blanket Mine. Accordingly,

the shares held by BETS are effectively treated as treasury shares in Blanket Mine and no NCI is recognised. |

Fremiro purchase agreement

On November 5, 2018 the Company and Fremiro entered into a sale

agreement for Caledonia to purchase Fremiro’s 15% shareholding in Blanket Mine. On January 20, 2020 all substantive conditions to

the transaction were satisfied. The Company issued 727,266 shares to Fremiro for the cancellation of their facilitation loan and purchase

of Fremiro’s 15% shareholding in Blanket Mine. The transaction was accounted for as a repurchase of a previously vested equity instrument.

As a result, the Fremiro share of the NCI of $3,600 was derecognised, shares were issued at fair value, the share-based payment reserve

was reduced by $2,247 and the Company’s shareholding in Blanket Mine increased to 64% on the effective date.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 5 | Blanket Zimbabwe Indigenisation Transaction (continued) |

Accounting treatment (continued)

Blanket Mine’s indigenisation shareholding percentages and facilitation loan

balances

| | |

| | |

Effective

interest & NCI | | |

NCI subject to

facilitation | | |

Balance of facilitation

loan # | |

| USD | |

Shareholding | | |

recognised | | |

loan | | |

June 30, 2024 | | |

December 31, 2023 | |

| NIEEF | |

| 16 | % | |

| 3.2 | % | |

| 12.8 | % | |

| 8,096 | | |

| 8,489 | |

| Community Trust | |

| 10 | % | |

| 10.0 | % | |

| 0.0 | % | |

| – | | |

| – | |

| BETS ~ | |

| 10 | % | |

| - | * | |

| - | * | |

| 4,594 | | |

| 4,908 | |

| | |

| 36 | % | |

| 13.2 | % | |

| 12.8 | % | |

| 12,690 | | |

| 13,397 | |

* The shares held by BETS are effectively

treated as treasury shares (see above).

~ Accounted for under

IAS19 Employee Benefits.

# Facilitation loans are accounted

for as equity instruments and are accordingly not recognised as loans receivable.

The balance on the facilitation loans is reconciled as follows:

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Balance at January 1 | |

| 13,397 | | |

| 15,026 | |

| Interest incurred | |

| 237 | | |

| 259 | |

| Dividends used to repay loan | |

| (944 | ) | |

| (1,888 | ) |

| Balance at June 30 | |

| 12,690 | | |

| 13,397 | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Blanket Mine | |

| 37,839 | | |

| 33,046 | |

| Salaries and wages | |

| 14,953 | | |

| 12,459 | |

| Consumable materials | |

| 12,381 | | |

| 11,544 | |

| Electricity costs | |

| 7,014 | | |

| 5,812 | |

| Safety | |

| 548 | | |

| 554 | |

| Share-based expense (note 9) | |

| 145 | | |

| 386 | |

| On mine administration | |

| 1,971 | | |

| 1,472 | |

| Security | |

| 570 | | |

| 523 | |

| Solar operations and maintenance services | |

| 173 | | |

| 198 | |

| Pre-feasibility exploration costs | |

| 84 | | |

| 98 | |

| | |

| | | |

| | |

| Bilboes | |

| 1,581 | | |

| 7,530 | |

| Salaries and wages | |

| 569 | | |

| 1,774 | |

| Consumable materials | |

| 374 | | |

| 4,742 | |

| Electricity costs | |

| 185 | | |

| 425 | |

| Share-based expense (note 9) | |

| 7 | | |

| – | |

| On mine administration | |

| 446 | | |

| 589 | |

| | |

| | | |

| | |

| | |

| 39,420 | | |

| 40,576 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 7 | Net foreign exchange (loss) gain |

The RTGS$ devalued from RTGS$ 6,104: USD1 on December 31, 2023

to RTGS$ 22,055: USD1 on March 31, 2024 and RTGS$ 30.674:USD1 on April 5, 2024. The significant and accelerating rate of devaluation in

the RTGS$ led the Reserve Bank of Zimbabwe (“RBZ”) to introduce a new currency which is referred to as the “ZiG”

on April 5, 2024.

According to the 2024 Monetary Policy Statement issued by the

Governor of the Reserve Bank of Zimbabwe (“RBZ”) on April 5, 2024, the ZiG is a structured currency which is anchored by a

composite basket of foreign currency and precious metals (mainly gold) held as reserves for this purpose by the RBZ. The ZiG replaced

the RTGS$ with immediate effect and was introduced at an official rate of ZiG13.56:US$1 on April 5, 2024. On the same date, all RTGS$

balances were translated from RTGS$ to ZiG using an exchange rate of ZiG1: RTGS$ 2,499. The ZiG co-circulates with other foreign currencies

in the economy. The retention threshold on gold receipts remained unchanged: gold producers will continue to receive 75% of their revenues

in US dollars and the balance in local currency i.e. the ZiG.

The ZiG has been much more stable on the formal market to the

US Dollar since its introduction, compared to the RTGS$. The ZiG closed at an official ZiG13.70:US$1 on June 30, 2024. All conversions

were performed at the official rate.

The table below illustrates the effect the weakening of the ZiG,

RTGS$ and other foreign currencies had on the consolidated statement of profit or loss.

| | |

2024 | | |

2023 | |

| | |

ZiG | | |

RTGS$ | | |

Other | | |

Total | | |

ZiG | | |

RTGS$ | | |

Other | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Unrealised foreign exchange (losses) gains | |

| (27 | ) | |

| 728 | | |

| (62 | ) | |

| 639 | | |

| – | | |

| 3,221 | | |

| 762 | | |

| 3,983 | |

| Taxation foreign exchange gains (including VAT) | |

| 145 | | |

| 1,021 | | |

| – | | |

| 1,166 | | |

| – | | |

| 3,379 | | |

| – | | |

| 3,379 | |

| Other unrealised foreign exchange (losses) gains | |

| (172 | ) | |

| (293 | ) | |

| (62 | ) | |

| (527 | ) | |

| – | | |

| (158 | ) | |

| 762 | | |

| 604 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Realised foreign exchange (losses) gains | |

| (73 | ) | |

| (6,706 | ) | |

| (13 | ) | |

| (6,792 | ) | |

| – | | |

| (6,091 | ) | |

| 31 | | |

| (6,060 | ) |

| Bullion sales receivable foreign exchange gains (losses) | |

| 51 | | |

| (1,824 | ) | |

| – | | |

| (1,773 | ) | |

| – | | |

| (2,360 | ) | |

| – | | |

| (2,360 | ) |

| Cash and cash equivalents foreign exchange losses | |

| (81 | ) | |

| (1,731 | ) | |

| (13 | ) | |

| (1,825 | ) | |

| – | | |

| (874 | ) | |

| (23 | ) | |

| (897 | ) |

| Taxation foreign exchange losses (including VAT) | |

| (23 | ) | |

| (1,984 | ) | |

| – | | |

| (2,007 | ) | |

| – | | |

| (1,242 | ) | |

| – | | |

| (1,242 | ) |

| Trade and other payables foreign exchange (losses) gains | |

| (20 | ) | |

| (1,167 | ) | |

| – | | |

| (1,187 | ) | |

| – | | |

| (1,615 | ) | |

| 54 | | |

| (1,561 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net foreign exchange (losses) gains | |

| (100 | ) | |

| (5,978 | ) | |

| (75 | ) | |

| (6,153 | ) | |

| – | | |

| (2,870 | ) | |

| 793 | | |

| (2,077 | ) |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 7 | Net foreign exchange (loss) gain (continued) |

Sensitivity analysis

A strengthening or weakening of the ZiG to the US Dollar exchange

rate will affect the cash flows, profit or loss and financial position (in USD) as indicated below, assuming all other variables remain

constant for the period to June 30, 2024 or on the date as applicable.

| | |

ZiG

weakening

by 10% | | |

ZiG

strengthening by

10% | |

| | |

| | |

| |

| Consolidated statement of financial position: | |

| |

| Cash and cash equivalents | |

| 2,874 | | |

| 3,513 | |

| Bullion sales receivable | |

| 1,421 | | |

| 1,736 | |

| VAT receivables | |

| 1,436 | | |

| 1,755 | |

| Trade and other receivables | |

| 1,822 | | |

| 2,227 | |

| Trade and other payables | |

| (87 | ) | |

| (106 | ) |

| Income tax payable | |

| (1,083 | ) | |

| (1,324 | ) |

| | |

| | | |

| | |

| Consolidated statement of profit or loss and other comprehensive income: | |

| | | |

| | |

| Foreign exchange (losses) gains | |

| (638 | ) | |

| 975 | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Investor relations | |

| 237 | | |

| 322 | |

| Audit fee | |

| 134 | | |

| 139 | |

| Advisory services fees | |

| 782 | | |

| 3,823 | |

| Listing fees | |

| 321 | | |

| 592 | |

| Directors fees – Company | |

| 346 | | |

| 301 | |

| Directors fees – Blanket | |

| 34 | | |

| 30 | |

| Employee costs | |

| 3,350 | | |

| 2,815 | |

| Other office administration cost | |

| 100 | | |

| 247 | |

| Information technology and communication cost– Group related | |

| 128 | | |

| 84 | |

| Director and management liability insurance | |

| 461 | | |

| 414 | |

| Travel costs | |

| 382 | | |

| 355 | |

| | |

| 6,275 | | |

| 9,122 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 9.1 | Cash-settled share-based payments |

| (a) | Restricted Share Units and Performance Units |

Certain management and employees within the Group are granted

Restricted Share Units (“RSUs”) and Performance Units (”PUs”) pursuant to provisions of the 2015 Omnibus Equity

Incentive Compensation Plan (“OEICP”). All RSUs and PUs were granted and approved at the discretion of the Compensation Committee

of the Board of Directors.

RSUs vest three years after grant date given that the service

conditions of the relevant employees have been fulfilled. The value of the vested RSUs is the number of RSUs vested multiplied by the

fair market value of the Company’s shares, as specified by the OEICP, on the date of settlement.

PUs have a performance condition, determined on their grant date,

based on gold production, average normalised controllable cost per ounce of gold, resource development at Blanket Mine, financing and

construction of Bilboes sulphide project and a performance period of one to three years. The number of PUs that vest will be the relevant

portion of the PUs granted multiplied by the performance multiplier, which will reflect the actual performance in terms of the performance

conditions compared to expectations on the date of the award.

RSU holders are entitled to receive dividends over the vesting

period. Such dividends will be reinvested in additional RSUs at the then applicable share price. PUs have rights to dividends only after

they have vested.

RSUs and PUs allow for settlement of the vesting date value in

cash or, subject to conditions, shares issuable at fair market value or a combination of both at the discretion of the unitholder.

The fair value of the RSUs at the reporting date was based on

the Black Scholes option valuation model less the fair value of the expected dividends during the vesting period multiplied by the performance

multiplier expectation. The fair value of the PUs at the reporting date was based on the Black Scholes option valuation model. At the

reporting date it was assumed that there is an 80%-100% probability that the performance conditions will be met and therefore an 80%-100%

(2023: 93%-100%) average performance multiplier was used in calculating the estimated liability.

The liability as at June 30, 2024 amounted to $644 (December

31, 2023: $1,294). Included in the liability as at June 30, 2024 is an amount of $67 (2023: $386) that was expensed and classified as

production costs; refer to note 6.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 9 | Share-based payments (continued) |

| 9.1 | Cash-settled share-based payments (continued) |

| (a) | Restricted Share Units and Performance Units (continued) |

The cash-settled share-based expense for PUs for the period amounted

to $57 (2023: $271). During the period PUs to the value of $83 were settled in share capital (net of employee tax) (2023: $351) with the

employee tax portion recognised in profit or loss.

The following assumptions were used in estimating the fair value

of the cash-settled share-based payment liability on:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

PUs | | |

PUs | |

| Risk free rate | |

| 4.36 | % | |

| 3.88 | % |

| Fair value (USD) | |

| 9.72 | | |

| 12.20 | |

| Share price (USD) | |

| 9.72 | | |

| 12.20 | |

| Performance multiplier percentage | |

| 80-100% | | |

| 93-100% | |

| Volatility | |

| 0.83 | | |

| 0.90 | |

| | |

| | | |

| | |

| Share units granted: | |

PUs | | |

PUs | |

| Grant - January 11, 2021 | |

| 35,341 | | |

| 56,244 | |

| Grant - May 14, 2021 | |

| 482 | | |

| 964 | |

| Grant - June 1, 2021 | |

| 375 | | |

| 1,310 | |

| Grant - June 14, 2021 | |

| 199 | | |

| 398 | |

| Grant - September 6, 2021 | |

| 229 | | |

| 458 | |

| Grant - September 20, 2021 | |

| 230 | | |

| 460 | |

| Grant - October 1, 2021 | |

| 508 | | |

| 1,016 | |

| Grant - October 11, 2021 | |

| 225 | | |

| 450 | |

| Grant - November 12, 2021 | |

| 923 | | |

| 1,846 | |

| Grant - December 1, 2021 | |

| 225 | | |

| 900 | |

| Grant - January 11, 2022 | |

| 41,386 | | |

| 75,198 | |

| Grant - January 12, 2022 | |

| 556 | | |

| 825 | |

| Grant - May 13, 2022 | |

| 1,894 | | |

| 2,040 | |

| Grant - June 1, 2022 | |

| – | | |

| 1,297 | |

| Grant - July 1, 2022 | |

| 1,899 | | |

| 2,375 | |

| Grant - October 1, 2022 | |

| 1,800 | | |

| 2,024 | |

| Grant - April 7, 2023 | |

| 73,464 | | |

| 79,521 | |

| Grant - May 15, 2023 | |

| – | | |

| 581 | |

| Grant - June 1, 2023 | |

| 617 | | |

| 617 | |

| Grant - June 7, 2023 | |

| 572 | | |

| 572 | |

| Grant - August 10, 2023 | |

| 5,514 | | |

| 5,514 | |

| Grant - September 1, 2023 | |

| 1,617 | | |

| 1,617 | |

| Grant - October 3, 2023 | |

| 14,258 | | |

| 14,258 | |

| Grant - April 8, 2024 | |

| 169,141 | | |

| – | |

| Grant - June 10, 2024 | |

| 1,406 | | |

| – | |

| Grant - June 17, 2024 | |

| 1,155 | | |

| – | |

| Settlements/ terminations | |

| (95,571 | ) | |

| (68,171 | ) |

| Total awards outstanding | |

| 258,445 | | |

| 182,314 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 9 | Share-based payments (continued) |

| 9.2 | Equity-settled share-based payments |

PUs which are classified as equity-settled (i.e. there is no

option to vest in cash) (“EPUs”) have a performance condition, determined on their grant date, based on gold production, average

normalised controllable cost per ounce of gold, resource development at Blanket Mine, financing and construction of Bilboes sulphide project

and a performance period of three years. The number of EPUs that vest will be the relevant portion of the EPUs granted multiplied by the

performance multiplier, which will reflect the actual performance in terms of the performance conditions compared to expectations on the

date of the award.

EPUs have rights to dividends only after they have vested.

The shares issued are subject to a minimum holding period of

until at least the first anniversary of the EPUs vesting date.

The fair value of the EPUs at the reporting date was based on

the Black Scholes option valuation model less the fair value of the expected dividends during the vesting period multiplied by the performance

percentage. At the reporting date it was assumed that there is a 100% probability that the performance conditions will be met and therefore

a 100% performance multiplier was used in calculating the expense. The equity-settled share-based expense for EPUs as at June 30, 2024

amounted to $414 (2023: $331). An amount of $85 (2023: $Nil) was expensed and classified as production costs; refer to note 6.

The following assumptions were used in estimating the fair value

of the equity-settled share-based payment that are in issue on:

| Grant date | |

January 24, 2022 | | |

April 7, 2023 | | |

April 8, 2024 | | |

May 13, 2024 | |

| Number of units - remaining at reporting date | |

| 113,693 | | |

| 80,773 | | |

| 125,433 | | |

| 14,771 | |

| Share price (USD) - grant date | |

| 11.50 | | |

| 16.91 | | |

| 10.91 | | |

| 10.29 | |

| Fair value (USD) - grant date | |

| 10.15 | | |

| 15.33 | | |

| 9.53 | | |

| 10.02 | |

| Performance multiplier percentage at grant date | |

| 100 | % | |

| 100 | % | |

| 100 | % | |

| 100 | % |

| (b) | Equity Restricted Share Units |

RSUs which are classified as equity-settled (i.e. there is no

option to vest in cash) (“ERSUs”) vest on the date as specified in the RSUs agreement given that the service conditions of

the relevant employees have been fulfilled. The value of the vested RSUs is the number of RSUs vested multiplied by the fair market value

of the Company’s shares, as specified by the OEICP, on the date of settlement.

ERSU holders are entitled to receive dividends over the vesting

period. Such dividends will be reinvested in additional ERSUs at the then applicable share price.

The fair value of the RSUs at the reporting date was based on

the Black Scholes option valuation model less the fair value of the expected dividends during the vesting period multiplied by the performance

multiplier expectation.

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 9 | Share-based payments (continued) |

| 9.2 | Equity-settled share-based payments (continued) |

| (b) | Equity Restricted Share Units (continued) |

The following assumptions were used in estimating the fair value

of the equity-settled share-based payment that are in issue on:

| Grant date | |

May 13, 2024 | |

| Vesting date | |

September 30, 2024 | |

| Number of units - remaining at reporting date | |

| 26,404 | |

| Share price (USD) - grant date | |

| 10.29 | |

| Fair value (USD) - grant date | |

| 10.02 | |

| Performance multiplier percentage at grant date | |

| 100 | % |

The equity-settled share-based expense for ERSUs as at June 30,

2024 amounted to $92 (2023: $Nil).

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Intermediated Money Transaction Tax* | |

| 528 | | |

| 666 | |

| Community and social responsibility cost | |

| 736 | | |

| 582 | |

| Impairment of property, plant and equipment (note 13) | |

| – | | |

| 851 | |

| | |

| 1,264 | | |

| 2,099 | |

| * |

Intermediated Money Transfer Tax ("IMTT”) is

tax chargeable in Zimbabwe on transfer of physical money, electronically or by any other means and ranges from 1% to 2% per transaction

performed in Zimbabwe. |

| 11 | Finance income and finance cost |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Finance income received - Bank | |

| 9 | | |

| 9 | |

| | |

| | | |

| | |

| Unwinding of rehabilitation provision (note 20) | |

| 198 | | |

| 36 | |

| Finance cost - Leases | |

| 5 | | |

| 11 | |

| Finance cost - Overdraft and short term loans | |

| 864 | | |

| 977 | |

| Finance cost - Solar loan notes payable (note 21.1) | |

| 395 | | |

| 197 | |

| Finance cost - Motapa loan notes payable | |

| – | | |

| 612 | |

| Finance cost – Loans and borrowings | |

| 67 | | |

| – | |

| | |

| 1,529 | | |

| 1,833 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 12 | Exploration and evaluation assets |

| | |

Bilboes Gold | | |

Motapa | | |

Maligreen | | |

GG | | |

Sabiwa | | |

Abercorn | | |

Valentine | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at January 1, 2023 | |

| – | | |

| 7,844 | | |

| 5,626 | | |

| 3,723 | | |

| 294 | | |

| 27 | | |

| 65 | | |

| 17,579 | |

| Acquisition costs: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Bilboes Gold | |

| 73,198 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 73,198 | |

| Decommissioning asset estimation adjustment | |

| – | | |

| 1,466 | | |

| 152 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,618 | |

| Exploration costs: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Consumables and drilling | |

| – | | |

| 903 | | |

| 102 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,005 | |

| - Contractor | |

| – | | |

| 2 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 2 | |

| - Labour | |

| – | | |

| 377 | | |

| 111 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 488 | |

| - Power | |

| – | | |

| – | | |

| 7 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 7 | |

| - Other | |

| 375 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 375 | |

| Balance at December 31, 2023 | |

| 73,573 | | |

| 10,592 | | |

| 5,998 | | |

| 3,723 | | |

| 294 | | |

| 27 | | |

| 65 | | |

| 94,272 | |

| Decommissioning asset estimation adjustment* | |

| – | | |

| (899 | ) | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (899 | ) |

| Exploration costs: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Consumables and drilling | |

| – | | |

| 558 | | |

| 2 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 560 | |

| - Contractor | |

| – | | |

| – | | |

| 5 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 5 | |

| - Labour | |

| – | | |

| 285 | | |

| – | | |

| 51 | | |

| – | | |

| – | | |

| – | | |

| 336 | |

| - Power | |

| – | | |

| 2 | | |

| 2 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 4 | |

| - Other | |

| 191 | | |

| 67 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 258 | |

| Balance at June 30, 2024 | |

| 73,764 | | |

| 10,605 | | |

| 6,007 | | |

| 3,774 | | |

| 294 | | |

| 27 | | |

| 65 | | |

| 94,536 | |

| * |

After further review of the Motapa claims the old tailings storage facility, previously included

in the rehabilitation liability, was not within the Caledonia owned claims area. The tailing storage facility was therefore excluded

from the rehabilitation liability footprint. |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 13 | Property, plant and equipment |

| Cost | |

Land

and

Buildings | | |

Right of

use assets | | |

Mine

development,

infrastructure

and other | | |

Assets under

construction and

decommissioning

assets | | |

Plant

and

equipment | | |

Furniture

and

fittings | | |

Motor

vehicles | | |

Solar Plant& | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at January 1, 2023 | |

| 15,194 | | |

| 525 | | |

| 82,154 | | |

| 46,453 | | |

| 70,485 | | |

| 1,563 | | |

| 3,314 | | |

| 14,138 | | |

| 233,826 | |

| Additions* | |

| – | | |

| – | | |

| – | | |

| 28,276 | | |

| 538 | | |

| 335 | | |

| 294 | | |

| 163 | | |

| 29,606 | |

| Impairments | |

| – | | |

| – | | |

| (872 | ) | |

| – | | |

| (36 | ) | |

| – | | |

| – | | |

| – | | |

| (908 | ) |

| Disposals | |

| – | | |

| – | | |

| – | | |

| – | | |

| (33 | ) | |

| – | | |

| – | | |

| – | | |

| (33 | ) |

| Reallocate to assets held for sale | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (14,301 | ) | |

| (14,301 | ) |

| Reallocations between asset classes | |

| 1,492 | | |

| – | | |

| 37,116 | | |

| (39,099 | ) | |

| 491 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Foreign exchange movement | |

| – | | |

| (24 | ) | |

| – | | |

| (2 | ) | |

| – | | |

| (37 | ) | |

| (3 | ) | |

| – | | |

| (66 | ) |

| Balance at December 31, 2023 | |

| 16,686 | | |

| 501 | | |

| 118,398 | | |

| 35,628 | | |

| 71,445 | | |

| 1,861 | | |

| 3,605 | | |

| – | | |

| 248,124 | |

| Additions* | |

| – | | |

| – | | |

| 128 | | |

| 8,841 | | |

| 429 | | |

| 38 | | |

| – | | |

| – | | |

| 9,436 | |

| Reallocations between asset classes | |

| – | | |

| – | | |

| 13,409 | | |

| (12,412 | ) | |

| (997 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Foreign exchange movement | |

| – | | |

| 1 | | |

| – | | |

| – | | |

| – | | |

| 2 | | |

| – | | |

| – | | |

| 3 | |

| Balance at June 30, 2024 | |

| 16,686 | | |

| 502 | | |

| 131,935 | | |

| 32,057 | | |

| 70,877 | | |

| 1,901 | | |

| 3,605 | | |

| – | | |

| 257,563 | |

| * |

Included in additions is the change in estimate for the decommissioning

asset of ($868) (2023: $1,962) due to change in the Life of Mine (“LoM”) estimate to 2041. |

| & |

The solar plant was fully commissioned

on February 2, 2023 and the sale agreement between Caledonia Mining Corporation Plc and Caledonia Mining Services (Private) Limited

was concluded for the sale of the solar plant. Depreciation on the solar plant commenced on February 2, 2023 and the power

purchase agreement, between Caledonia Mining Services (Private) Limited and Blanket Mine, became effective. From September 28, 2023

the solar plant is classified as held for sale.

In December 2022, the Caledonia board

approved a proposal for Caledonia Mining Services (Private) Limited (which owns the solar plant) to issue loan notes pursuant to

a loan note instrument (“bonds”) up to a value of $12 million. The decision was taken in order to optimise the capital

structure of the Group and provide additional debt instruments to the Zimbabwean financial market. Refer to note 21.1 for more information

on these loan notes. |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 13 | Property, plant and equipment (continued) |

Accumulated depreciation and

Impairment losses | |

Land and

Buildings | | |

Right of

use assets | | |

Mine

development,

infrastructure

and other | | |

Assets under

construction and

decommissioning

assets | | |

Plant and

equipment | | |

Furniture

and

fittings | | |

Motor

vehicles | | |

Solar

Plant | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at January 1, 2023 | |

| 8,350 | | |

| 230 | | |

| 12,368 | | |

| 693 | | |

| 29,257 | | |

| 1,100 | | |

| 2,845 | | |

| – | | |

| 54,843 | |

| Depreciation for the year | |

| 1,012 | | |

| 124 | | |

| 5,459 | | |

| 93 | | |

| 6,573 | | |

| 185 | | |

| 258 | | |

| 782 | | |

| 14,486 | |

| Accumulated depreciation for assets reallocated to assets held for sale | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (782 | ) | |

| (782 | ) |

| Accumulated depreciation impairments | |

| – | | |

| – | | |

| (21 | ) | |

| – | | |

| (10 | ) | |

| – | | |

| – | | |

| – | | |

| (31 | ) |

| Foreign exchange movement | |

| – | | |

| (9 | ) | |

| – | | |

| – | | |

| – | | |

| (30 | ) | |

| (2 | ) | |

| – | | |

| (41 | ) |

| Balance at December 31, 2023 | |

| 9,362 | | |

| 345 | | |

| 17,806 | | |

| 786 | | |

| 35,820 | | |

| 1,255 | | |

| 3,101 | | |

| – | | |

| 68,475 | |

| Depreciation for the period | |

| 557 | | |

| 62 | | |

| 3,488 | | |

| 46 | | |

| 3,701 | | |

| 87 | | |

| 117 | | |

| – | | |

| 8,058 | |

| Foreign exchange movement | |

| – | | |

| 1 | | |

| – | | |

| – | | |

| – | | |

| 2 | | |

| – | | |

| – | | |

| 3 | |

| Balance at June 30, 2024 | |

| 9,919 | | |

| 408 | | |

| 21,294 | | |

| 832 | | |

| 39,521 | | |

| 1,344 | | |

| 3,218 | | |

| – | | |

| 76,536 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Carrying amounts | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| At December 31, 2023 | |

| 7,324 | | |

| 156 | | |

| 100,592 | | |

| 34,842 | | |

| 35,625 | | |

| 606 | | |

| 504 | | |

| – | | |

| 179,649 | |

| At June 30, 2024 | |

| 6,767 | | |

| 94 | | |

| 110,641 | | |

| 31,225 | | |

| 31,356 | | |

| 557 | | |

| 387 | | |

| – | | |

| 181,027 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| | |

2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| Consumable stores* | |

| 19,437 | | |

| 18,001 | |

| Gold in progress @ | |

| 964 | | |

| 2,303 | |

| | |

| 20,401 | | |

| 20,304 | |

| * |

Included in consumables stores is an amount of ($1,793) (December 31, 2023: ($1,793)) for provision

for obsolete stock for items that are not compatible with plant and equipment currently in use. |

| @ |

Gold work in progress balance as at June 30, 2024 consists of 1,066 ounces (December 31, 2023: 3,057

ounces). |

| 15 | Trade and other receivables |

| | |

2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| Bullion sales receivable | |

| 3,844 | | |

| 5,403 | |

| VAT receivables | |

| 3,612 | | |

| 4,259 | |

| Deposits for stores, equipment and other receivables | |

| 426 | | |

| 290 | |

| | |

| 7,882 | | |

| 9,952 | |

The carrying value of trade and other receivables are considered

a reasonable approximation of fair value are due to the short term nature of the receivables. No provision for expected credit losses

was recognised in the current or prior period as none of the debtors were past due and there has been no doubtful debt on debtors. Up

to the date of approval of these financial statements all of the outstanding bullion sales receivable were settled in full. The Company

allocated the VAT receivables equating to $1.8 million in the period against liabilities due for the period Quarterly Payment Dates (“QPD’s”)

administrated by the Zimbabwe Revenue Authority.

| | |

2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| Caledonia Mining South Africa (Proprietary) Limited (“CMSA”) suppliers | |

| 681 | | |

| 527 | |

| Blanket Mine third party suppliers - USD | |

| 1,482 | | |

| 808 | |

| Blanket Mine third party suppliers - ZiG | |

| 2,947 | | |

| – | |

| Blanket Mine third party suppliers - RTGS$ | |

| – | | |

| 938 | |

| Other prepayments | |

| 177 | | |

| 265 | |

| | |

| 5,287 | | |

| 2,538 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 17 | Cash and cash equivalents |

| | |

2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| Bank balances | |

| 15,412 | | |

| 4,252 | |

| Restricted cash | |

| – | | |

| 2,456 | |

| Cash and cash equivalents | |

| 15,412 | | |

| 6,708 | |

| Bank overdrafts and short term loans used for cash management purposes | |

| (16,778 | ) | |

| (17,740 | ) |

| Net cash and cash equivalents | |

| (1,366 | ) | |

| (11,032 | ) |

| |

|

Loan

initiated |

|

Expiry |

|

Repayment

term |

|

Principal

value |

|

Balance

drawn

at

June 30, 2024 |

|

Undrawn

amount at

June 30,

2024 |

| Overdraft facilities and term loans |

|

Stanbic Bank - ZiG denomination |

|

Sep-2023 |

|

Sep-2024 |

|

On demand |

|

ZiG 6.5 million |

|

ZiG Nil |

|

ZiG 6.5 million |

| Stanbic Bank - USD denomination |

|

Sep-2023 |

|

Sep-2024 |

|

On demand |

|

$4 million |

|

$3.4 million |

|

$0.6 million |

| CABS Bank – USD denomination& |

|

Aug-2023 |

|

Jul-2024 |

|

On demand |

|

$2 million |

|

$1.9 million |

|

$0.1 million |

| CABS Bank– USD denomination* |

|

Mar-2024 |

|

Mar-2027 |

|

On demand |

|

$3 million |

|

$3 million |

|

$Nil million |

| Ecobank - USD denomination |

|

Mar-2024 |

|

Feb-2025 |

|

On demand |

|

$4 million |

|

$4 million |

|

$Nil million |

| Nedbank Zimbabwe - USD denomination |

|

Apr-2024 |

|

Apr-2025 |

|

On demand |

|

$7 million |

|

$4.5 million |

|

$2.5 million |

| Total USD |

|

|

|

|

|

|

|

$20 million |

|

$16.8 million |

|

$3.2 million |

| * |

Included in Loans and borrowing is a term loan from CABS that is repayable over three years. |

| & |

$2 million CABS Bank USD denominated loan expiring in July 2024 was fully repaid. |

| 18 | Assets and liabilities associated with assets held for sale |

| | |

2024 | | |

December 31,

2023 | |

| Non-current assets held for sale | |

| | | |

| | |

| Solar plant | |

| 13,484 | | |

| 13,519 | |

| | |

| | | |

| | |

| Liabilities associated with assets held for sale | |

| | | |

| | |

| Site restoration liability | |

| 93 | | |

| 128 | |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

| 18 | Assets and liabilities associated with assets held for sale (continued) |

In the second quarter of 2023 management embarked on a marketing

process to locate a buyer for the Company’s solar plant located next to Blanket Mine. Various offers were received and a counterparty

with a non-binding offer was given exclusivity to further negotiate the sale of the plant after proving their ability to operate and fund

solar plants of similar size and complexity. The offer was received from a reputable global renewable energy operator and management is

in an advanced stage of executing agreements to sell the solar plant. It is proposed that the new owners will exclusively supply Blanket

with electricity from the plant, on a take-or-pay basis and in doing so secure Blanket’s future power supply. This has the benefit

of realising a cash profit on the sale of the plant and generate cash for reinvestment in our gold projects. In addition, management can

focus on Caledonia’s core business of gold mining.

On September 28, 2023 the Board approved management to negotiate

the sale of the solar plant with the potential buyer. The assets were available for sale in their condition on September 28, 2023 and

therefore met the criteria to be classified as held for sale.

Management determined the value of the carrying amount as the

lower of the fair value less cost to sell and the carrying amount. The proceeds of the disposal are expected to substantially exceed the

carrying amount of the related net assets and accordingly no impairment losses have been recognised on the classification of the solar

plant. The asset was classified as property, plant and equipment before the reclassification to assets held for sale.

The change in estimate for the liability held for sale is due

to the Blanket Mine’s LoM that was extended to 2041 (that is inclusive of inferred resources and is based on an internal estimate

representing management’s best estimate of the LoM inclusive of the latest drilling results).

Authorised

Unlimited number of ordinary shares of no par value.

Unlimited number of preference shares of no par value.

Issued ordinary shares

| | |

Number of

fully paid

shares | | |

Amount | |

| | |

| | |

| |

| January 1, 2023 | |

| 12,833,126 | | |

| 83,471 | |

| Shares issued: | |

| | | |

| | |

| - share-based payment - employees (note 9.1(a)) | |

| 24,389 | | |

| 351 | |

| - equity raise | |

| 1,207,514 | | |

| 15,569 | |

| - Bilboes Gold Limited acquisition | |

| 5,123,044 | | |

| 65,677 | |

| December 31, 2023 | |

| 19,188,073 | | |

| 165,068 | |

| Shares issued: | |

| | | |

| | |

| - share-based payment - employees (note 9.1(a)) | |

| 6,787 | | |

| 83 | |

| - options exercised* | |

| 5,000 | | |

| 37 | |

| June 30, 2024 | |

| 19,199,860 | | |

| 165,188 | |

| * |

A consultant of Caledonia signed his option exercise notice on June

14, 2024 to purchase 5,000 shares at the exercise price of $7.35 per option share. The shares were issued on July 5, 2024

when his payment was received in the bank account of Caledonia. |

Caledonia Mining Corporation Plc Notes to the Condensed Consolidated Interim Financial Statements For the period ended June 30, 2024 and 2023 (in thousands of United States Dollars, unless indicated otherwise) |

Site restoration

Site restoration relates to the estimated cost of closing down

the mines and projects and represent the site and environmental restoration costs, estimated to be paid as a result of mining activities

or previous mining activities. For the Blanket Mine site restoration costs are capitalised in property, plant and equipment with an increase

in the provision at the net present value of the estimated future and inflated cost of site rehabilitation. Subsequently the capitalised

cost is amortised over the life of the mine and the provision is unwound over the period to estimated restoration. For properties in the

exploration and evaluation phase, such as the Bilboes, Maligreen and Motapa projects, site restoration costs are capitalised in exploration