false000150237700015023772024-09-162024-09-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 16, 2024 |

Contango Ore, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35770 |

27-3431051 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

516 2nd Avenue Suite 401 |

|

Fairbanks, Alaska |

|

99701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (907) 888-4273 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

CTGO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 16, 2024, Contango ORE, Inc. (“Contango” or the “Company”) entered into an employment agreement with Rick Van Nieuwenhuyse, the Company’s President and Chief Executive Officer (the “Employment Agreement”). The Employment Agreement supersedes the employment offer letter with Mr. Van Nieuwenhuyse, dated December 31, 2019, as amended and modified.

Pursuant to his Employment Agreement, Mr. Van Nieuwenhuyse will continue to receive a base salary of $500,000 per annum. Mr. Van Nieuwenhuyse will continue to be entitled to receive short-term incentive plan and long-term incentive plan bonuses and awards that will be paid in the form of a combination of cash, restricted stock and options, which will be set forth in plans and agreements adopted, or to be adopted, by the Board. He will also receive 12 months of his regular base salary, all bonus amounts paid in the 12 months preceding the termination, and reimbursement for continued group health insurance coverage for 12 months following the termination or the date he becomes eligible for alternative coverage through subsequent employment as severance benefits in the event that his employment with the Company is terminated by the Company other than for just cause or he resigns due to a material, uncured breach of the Employment Agreement by the Company. He is also entitled to enhanced severance benefits if he terminates his employment within 30 days following a change of control. Any payment of severance benefits to him under the Employment Agreement is conditioned on his timely agreement to, and non-revocation of, a full and final release of legal claims in favor of the Company.

The above summary of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement, which is filed as Exhibit 10.1, and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On September 17, 2024, the Company issued a press release announcing the receipt of a $19.5 million cash distribution from the Peak Gold JV relating to production at the Manh Choh gold mine. The Company is a 30% owner of Peak Gold, LLC, which operates the Manh Choh mine near Tok, Alaska. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

Exhibit No. |

Description of Exhibit |

10.1 |

Employment Agreement, dated September 16, 2024. |

99.1 |

Press Release of the Company, dated September 17, 2024. |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CONTANGO ORE, INC. |

|

|

|

|

Date: |

September 17, 2024 |

By: |

/s/ Mike Clark |

|

|

|

Chief Financial Officer and Secretary |

EMPLOYMENT AGREEMENT

BETWEEN:

RICK VAN NIEUWENHUYSE, having an address at 958 Chena Pump Rd, Fairbanks, AK 99701

(the “Executive”)

AND:

CONTANGO ORE, INC., a company incorporated pursuant to the laws of Delaware, USA and having its registered office at 516 2nd Avenue, Suite 401, Fairbanks, AK 99701

(the “Company”)

WHEREAS:

A.The Company and its subsidiaries constitute a publicly-listed natural resource enterprise currently engaged in the acquisition, exploration, development and operation of mineral properties;

B.The Company wishes to continue to employ and the Executive wishes to continue to supply his services in the capacity of President and Chief Executive Officer (“President & CEO”), on the terms and conditions set out in this Agreement; and

C.The Company and the Executive desire that this employment relationship and the terms thereof be formally embodied in this Agreement;

THEREFORE in consideration of the recitals, the following covenants and the payment of one dollar made by each party to the other, the receipt and sufficiency of which are acknowledged by each party, the parties agree on the following terms:

1.ENGAGEMENT AND DURATION

The Company hereby agrees to continue to employ the Executive as President & CEO, and the Executive accepts such employment, subject to the terms and conditions as set forth herein.

The Executive’s employment pursuant to the terms of this Agreement shall commence effective September 16, 2024 and shall continue indefinitely, unless and until terminated as set forth herein (the “Term”). For clarity, the Executive is continuing his employment that was previously entered into on January 6, 2020.

The Executive shall act as the Company’s President & CEO, and the Executive shall perform the services and duties as are normally provided by a President & CEO of a company in a business and of a size similar to the Company’s, and such other services and duties as may reasonably be assigned by the Company’s Board of Directors (the “Board”) from time to time. During the Term, the Executive shall devote his full working time as well as his best efforts, abilities, knowledge, and experience to the business and affairs of the Company as necessary to faithfully perform his duties, responsibilities, and authorities under this Agreement.

2.2Principal Place of Work

The Executive shall perform his duties principally at the Company’s head office located in Fairbanks, Alaska or at the Company’s properties. The Executive acknowledges that his duties and responsibilities may involve a reasonable amount of travelling.

The Executive shall report directly to the Board.

The Executive will, subject to the terms of this Agreement, comply promptly and faithfully with the reasonable and lawful instructions, directions, requests, rules and regulations of the Company’s Board.

3.REMUNERATION AND BENEFITS

The Company shall pay to the Executive for his services under this Agreement an annual base salary equivalent to US$500,000 (the “Base Salary”), subject to all applicable statutory deductions and withholdings, and payable in substantially equal installments on the dates that the Company has established from time to time for paying salaries to its employees.

The Base Salary referred to in Section 3.1 shall be reviewed at least annually by the Company through the Compensation Committee of the Board (the “Compensation Committee”) of the Company. The Company reserves the right to modify the Base Salary, not to be reduced below $500,000 without consent by the Executive, and modify other remuneration entitlements based upon the Executive’s performance of his duties as set forth in this Agreement and in accordance with the Company’s Policy Regarding the Mandatory Recovery of Compensation (the “Clawback Policy”). All such modifications shall be provided to the Executive in writing.

3.3Reimbursement of Expenses

The Company shall reimburse the Executive for all reasonable expenses incurred by him in the performance of his duties as set forth in this Agreement, on a basis consistent with the Company’s expense reimbursement policies in effect from time to time and provided that the Executive provides the Company with appropriate substantiating documentation and written expense accounts with respect to each calendar month. The Company will provide the Executive with, or reimburse the Executive for, services and fees reasonably necessary for the performance of the Executive's duties including, but not limited to, membership in any professional institute relevant to the performance of the Executive’s duties.

3.4Medical and Life Insurance

To the extent Executive is eligible under the terms of the applicable plans, the Company shall provide, or cause its subsidiary to provide, the Executive with the opportunity to participate in group life, long-term disability, extended medical and dental insurance coverage in accordance with the policies and procedures of the Company in effect from time to time and the Company or its subsidiary shall extend medical and dental insurance coverage opportunities to the Executive's spouse and child dependents. The Executive acknowledges that the Company or its subsidiary, as applicable, may modify or terminate any or all their benefit plans at any time. If the Executive is not eligible to participate in the Company’s or its subsidiary’s benefit plans, the Company shall pay or reimburse the Executive for the premiums reasonably necessary for the Executive to obtain individual medical, dental, and vision insurance plan(s) to provide insurance coverage for the Executive and his dependents during the Term that is reasonably comparable in the aggregate to the benefits available under the Company’s applicable group medical, dental, and insurance plan(s). Any reimbursements shall be provided by the last day of the month following the month in which the applicable premiums were paid by the Executive.

3.5Directors and Officers Liability Insurance

The Company shall provide the Executive with director’s and officer's liability insurance in amounts the Company determines to be appropriate to the nature of his responsibilities under this Agreement.

The Executive shall be entitled to 20 days of paid vacation annually earned on a pro rata basis over the year. Vacation time may be taken at such times as the Executive and the Company may determine, having regard to the operations of the Company. Unless otherwise specifically permitted under the Company’s paid time off policy applicable to similarly situated employees, and subject to applicable law, any accrued and unused paid time off shall not be carried over from year to year. In addition, the Executive shall be entitled to statutory holidays and the number of paid holidays provided for under the policies and procedures of the Company, as they exist from time to time.

3.7Discretionary Bonuses and Equity Awards

(a)Short-Term Incentive Plan Bonuses. The Executive shall be eligible receive annual cash bonuses (each, a “Bonus”) in accordance with the Company’s short-term incentive arrangement or plan (as such arrangement or plan, if any, may be amended, the “STIP”). The target percentages of Base Salary for each Bonus that the Executive shall be eligible to receive during the Term in accordance with the STIP based on performance (each, a “Target Bonus”) shall be determined by the Compensation Committee and shall initially be up to 100% of Executive’s Base Salary in effect during the year upon which such Bonus is based. Notwithstanding any other provision in this Agreement, the amount of any Bonus shall be determined by the Compensation Committee in its sole discretion based on its assessment of Executive’s performance against performance objectives set by the Board and communicated to the Executive. The Board shall have the sole discretion to determine whether such performance objectives have been achieved. The Executive shall not be eligible to receive any Bonus unless he remains actively employed by the Company through to, and including, the date on which any such Bonus is paid. All Bonuses and other short-term discretionary compensation payable to the Executive by the Company shall be paid to the Executive in a lump sum no later than 4 months following the end of the taxable year upon which the applicable Bonus or other compensation was based and shall be subject to all applicable statutory deductions and withholdings. The Compensation Committee may adjust the Target Bonus levels in its sole discretion during the Term but shall not decrease the Target Bonus levels. The Compensation Committee may settle all or a portion of any Bonus in shares of the Company.

(b)Long-Term Incentive Plan Awards. The Executive shall be eligible to participate in the Company’s 2023 Omnibus Incentive Plan (as it has been and may be amended, the “LTIP”) and receive annual awards of restricted stock units and/or stock options (each, an “Award”) in accordance with the LTIP and any applicable award agreement which must be executed by Executive in accordance with the Company’s Compensation Policy as determined by the Compensation Committee and approved by the Board (each, an “Award Agreement”). The Awards shall initially be issued as all restricted stock units and shall be governed by the vesting, forfeiture, termination, repurchase, and other terms, conditions, and restrictions of the LTIP and each applicable Award Agreement. The target percentages of Base Salary for each Award that the Executive shall be eligible to receive during the Term in accordance with the LTIP based on performance (each, a “Target Award”) shall be determined by the Compensation Committee and shall initially be up to 150% of Executive’s Base Salary in effect during the year upon which such Award is based. The Executive shall not be eligible to receive any Award unless he remains actively employed by the Company through to, and including, the date on which any such Award is granted. All Awards shall be granted to the Executive no later than 2½ months following the end of the taxable year upon which the applicable

Award was based. The Compensation Committee may increase the Target Award levels in its sole discretion during the Term.

(c)Other Incentive Compensation Plans, Programs, and Arrangements. On an annual basis during the Term, Executive shall also be eligible to participate in all of the Company’s discretionary short-term and long-term incentive compensation plans, programs, and arrangements, if any, as shall be adopted and/or modified from time to time by the Board or the Compensation Committee and generally made available to other similarly situated senior executive officers of the Company.

(d)For the purposes of this Agreement, “actively employed” means the Executive’s period of actual and active employment with the Company, including any period of paid time off or other approved leave of absence, but, except as expressly required by applicable employment standards legislation, excluding any period of notice or payment in lieu of notice that is given (or ought to have been given) by or to the Executive which follows or is in respect of a period which follows the Executive’s last day of actual and active employment with the Company. For greater certainty, the Executive shall have no entitlement to damages or other compensation arising from or related to not receiving any Bonus, Award or other incentive compensation which may have been awarded or paid after the Executive’s last day of active employment with the Company or if working notice of termination had been given, including but not limited to damages in lieu of notice at common law.

The Company shall provide the Executive with such equipment as the Board of the Company agree is necessary for performance of the Executive’s duties which shall include but not be limited to a computer and a cell phone for use in carrying out Company business.

3.9 Benefits

All benefits the Company provides to the Executive shall be governed by the applicable plan documents, insurance policies, or employment policies, and may be modified, suspended, or revoked in accordance with the terms of the applicable documents or policies without violating this Agreement.

4.CONFIDENTIALITY AND NON-DISCLOSURE

4.1Confidential Information

The term “Confidential Information” means any and all information concerning any aspect of the business of the Company and its subsidiaries not publicly disclosed, which the Executive may receive or develop as a result of his engagement by or involvement with the Company, and including all technical data, concepts, reports, programs, processes, technical information, trade secrets, systems, business strategies, financial information and

other information unique to the Company. All Confidential Information, including notes, diagrams, maps, reports, notebook pages, memoranda, sample materials and any excerpts thereof that include Confidential Information are the property of the Company, as the case may be, and are strictly confidential to the Company. The Executive shall not make any unauthorized disclosure or use of and shall use his best efforts to prevent unauthorized disclosure or use of such Confidential Information.

The Executive acknowledges that any breach or threatened breach of his obligations concerning Confidential Information by the Executive may result in irreparable harm to the Company that could not be adequately compensated by damages and that in addition to all other remedies at law or in equity, the Company shall be entitled as a matter of right to injunctive relief or any other legal or equitable remedy to prohibit, prevent or enjoin unauthorized disclosure or use of Confidential Information by the Executive.

4.3Use of Confidential Information

Except as authorized by the Company or as reasonably required in the performance of the Executive’s employment duties, the Executive will not:

(a)duplicate, transfer or disclose nor allow any other person to duplicate, transfer or disclose any of the Company’s Confidential Information; or

(b)use the Company’s Confidential Information.

4.4Protection of Confidential Information

The Executive will safeguard all Confidential Information at all times so that it is not exposed to or used by unauthorized persons and will exercise at least the same degree of care used to protect the Executive’s own confidential information.

The obligations set forth above shall not apply to the disclosure or use of any information which:

(a)is or later becomes publicly known under circumstances involving no breach of this Agreement by the Executive;

(b)is already known to the Executive at the time of receipt of the Confidential Information;

(c)is lawfully made available to the Executive by a third party;

(d)is disclosed by the Executive pursuant to a requirement of a governmental department or agency or disclosure is otherwise required by operation of law, provided that, unless prohibited by law, the Executive gives notice in writing to the Company of the required disclosure immediately upon him

becoming advised of such required disclosure and provided also that the Executive delays such disclosure so long as it is reasonably possible in order to permit the Company to appeal or otherwise oppose such required disclosure and provides the Company with such assistance as the Company may reasonably require in connection with such appeal or other opposition;

(e)is disclosed to a third party under an approved confidentiality agreement; or

(f)is disclosed in the course of the Executive’s proper performance of the Executive's duties under this Agreement.

4.6Removal of Information

The Executive will not, without the written consent of the Board, remove any information relating to the Company or its subsidiaries, or any third party with which they are conducting business, from the premises where the Executive is working, unless required in the normal course of his duties.

(a)During the Term, Executive shall promptly disclose to the Company all Business Opportunities and Intellectual Property (as such terms are defined below).

(b)Executive hereby assigns and agrees to assign to the Company, its successors, assigns, or designees, all of Executive’s right, title, license and interest in and to all Business Opportunities and Intellectual Property, and further acknowledges and agrees that all Business Opportunities and Intellectual Property constitute the exclusive property of the Company. If Executive cannot assign all or any portion of his right, title, license or interest in or to such Intellectual Property, Executive shall and hereby does grant to the Company an exclusive perpetual, world-wide, fully paid, royalty free, non-revocable license in and to such Intellectual Property.

(c)For purposes hereof, “Business Opportunities” shall mean all business ideas, prospects, proposals and other opportunities pertaining the exploration, acquisition, and ownership of minerals and mineral that are developed by Executive: (i) during the Term, or before the Term, if such opportunities were developed in connection with Executive’s activities in the mineral industry, directly or indirectly, related to the Company’s properties or assets; and (ii) originated by the Company or third parties and brought to the attention of Executive, whether before or during the Term, except to the extent that (A) such opportunities are not applicable, directly or indirectly, to any of the Company’s properties or assets, and (B) third parties possess valid and enforceable rights to such opportunities.

(d)For purposes hereof, “Intellectual Property” shall mean all ideas, inventions, discoveries, processes, designs, methods, substances, articles, computer programs, and improvements (including, without limitation,

enhancements to, or further interpretation or processing of, information that was in the possession of Executive prior to the Term), whether or not patentable or copyrightable, which do not fall within the definition of Business Opportunities, and which are discovered, conceived, invented, created, or developed by Executive, alone or with others (and all derivative products thereof) if such discovery, conception, invention, creation, or development (i) occurs in the course of Executive’s employment with the Company, or (ii) occurs with the use of any of the Company’s time, materials, assets, or facilities, or (iii) in the opinion of at least a majority of the Board relates or pertains in any way to the Company’s properties, assets or business.

(e)Executive acknowledges and agrees that all original works of authorship protectable by copyright that are produced by Executive in the performance of the services for the Company are “works made for hire” as defined in the United States Copyright Act (17 U.S.C. § 101). ). In addition, to the extent that any such works are not works made for hire under the United States Copyright Act, Executive hereby assigns without further consideration all right, title, and interest in such works to the Company.

The provisions of this Article 4 shall survive the termination of this Agreement.

4.9 Permitted Activities

Nothing in this Agreement (or any policy or procedure of the Company) is intended to, or does, prohibit the Executive from contacting, filing a charge or complaint with, providing information to, or cooperating with an investigation being conducted by, a governmental or regulatory agency or body (such as the U.S. Securities Exchange Commission (the “SEC”), occupational health and safety, workers’ compensation or employment standards), regarding a possible or alleged violation of law, in each instance without prior notice to or authorization from the Company. In accordance with applicable law, and notwithstanding any other provision of this Agreement, nothing in this Agreement or any of any policies or agreements of the Company applicable to the Executive impedes his right to communicate with the SEC or any other governmental or regulatory agency or body about possible violations of federal securities or other laws or regulations or requires him to provide any prior notice to the Company or obtain their prior approval before engaging in any such communications.

5.CONTANGO CODE OF BUSINESS CONDUCT AND ETHICS AND OTHER POLICIES

Executive acknowledges that while an employee of the Company, and in addition to any other provisions in this Agreement, Executive is required to comply at all times with (a) the Contango Code of Business Conduct and Ethics and any amendment or successor code thereto, and agrees to provide written certification of compliance with the code as and when requested by the Company; and (b) all other applicable rules and policies of the Company as a condition of

employment, including without limitation the Company’s zero-tolerance policies with regards to drug or alcohol use on or in any of its sites.

6.DELIVERY OF RECORDS AND COMPANY PROPERTY

Upon any termination of the Executive’s employment with the Company or whenever requested by the Company, the Executive will deliver to the Company all books, records, lists, brochures and other property belonging to the Company and its subsidiaries or developed in connection with the business of the Company and will execute such transfer documentation as is necessary to transfer such property or intellectual property to the Company.

7.1The Executive’s Right to Terminate

The Executive may terminate his employment with the Company and this Agreement:

(a)at any time upon providing a minimum of 60 days’ notice in writing to the Company;

(b)upon a material breach or default of any term of this Agreement by the Company, provided that Executive has notified the Company in writing of his belief that a material breach or default has occurred within 30 days of the initial breach or default, and such material breach or default has not been remedied within 30 days after such written notice has been delivered by the Executive to the Company; and

(c)at any time within 30 days following a Change of Control Termination Event (as defined in Section 7.2(b)) upon providing a minimum of one months’ notice in writing to the Company.

The Company may waive the notice requirements set out in paragraph (a) and (c) above in whole or in part, in which case the Executive will cease to be actively employed as of the date the Company waives the notice requirements, and the Executive will be entitled to receive only his regular remuneration and benefits through to the end of the original period of notice.

For the purposes of this Agreement:

(a)A “Change of Control” shall have the same meaning as assigned by the LTIP.

(b)A “Change of Control Termination Event” means the occurrence of any of the following events within 12 months after a Change of Control:

(i)a material reduction in the Executive’s authorities, duties or responsibilities as an employee of the Company;

(ii)a material reduction in Base Salary in effect at the time of the Change of Control;

(iii)a relocation of the Executive’s principal place of employment more than 50 miles outside the City of Fairbanks, Alaska or

(iv)a material breach by the Company of this Agreement;

provided however, that, to exercise his right to terminate for any such reasons in (i)-(iv), the Executive must provide written notice to the Company of his belief that the applicable condition exists within 30 days of the initial existence of such condition, and that notice shall describe the condition believed to give the Executive the right to terminate his employment. The Company shall have 30 days to remedy such condition. If not remedied within that 30-day period, the Executive may terminate his employment; provided, further, that such termination must occur no later than 90 days after the date of the initial existence of the condition(s) giving rise to the termination; otherwise, the Executive shall be deemed to have accepted the condition, or the Company’s correction of such condition, that may have given rise to the existence of a reason for termination.

7.3Company’s Right to Terminate

The Company may terminate the Executive’s employment with the Company and this Agreement at any time:

(a)for just cause which shall include, without limitation, any of the following events:

(i)theft, dishonesty or fraud by the Executive with respect to the business of the Company;

(ii)the conviction, or plea of no contest with respect to any crime involving moral turpitude, including any criminal offence that gives rise or is likely to give rise to any member of the Company’s stock becoming ineligible for listing on any stock exchange or market or any member of the Company’s stock being subject to a cease-trade order by a Canadian or US securities regulatory authority;

(iii)any material breach by the Executive of this Agreement or any other Agreement between Executive and the Company;

(iv)any other acts or omissions by the Executive that will result in material injury to the interests of the Company, including its reputation; or

(v)any and all other omissions, commissions or other conduct which would constitute just cause at law; or

(b)upon the Executive dying or becoming physically or mentally incapable of performing his essential job functions under this Agreement with or without reasonable accommodation as required by law for a period exceeding 180 consecutive days or 180 non-consecutive days calculated on a cumulative basis over any one-year period during the Term; or

(c)at any time other than due to death, disability, or just cause, subject to making the severance payment contemplated in Section 7.4 to the Executive.

In the event of the termination of the Executive’s employment:

(a)by the Executive pursuant to Subsection 7.1(b) of this Agreement; or

(b)by the Company pursuant to Subsection 7.3(c) of this Agreement;

the Company shall have no other obligation to the Executive under this Agreement other than to provide the Executive with the Accrued Benefits (as defined below) and pay to the Executive a severance payment within 60 days of the date of termination equal to:

the Severance Amount multiplied by 1;

where “Severance Amount” is defined as one year of Base Salary plus all Bonus amounts actually paid by the Company to the Executive within the 12 months immediately preceding the date of termination. For the purpose of this definition, “one year of Base Salary” shall mean the Base Salary in effect on the date of termination.

In addition, the Company shall reimburse the Executive for the premiums reasonably necessary for the Executive to obtain individual health insurance coverage on a monthly basis until the earlier of 12 months following the termination date or the date when he becomes eligible for group health insurance coverage, if any, through subsequent employment; provided, however, that the Executive shall notify the Company in writing within five days after he becomes eligible for group health insurance coverage, if any, through subsequent employment or otherwise. Such reimbursements shall be provided by the last day of the month following the month in which the applicable premiums were paid by the Executive.

7.5Severance Payment Following Change of Control

In the event of the termination of the Executive’s employment by the Executive pursuant to Subsection 7.1(c) of this Agreement, the Company shall have no other obligation to the Executive under this Agreement other than to provide the Executive with the Accrued Benefits (as defined below) and, in lieu of any severance payment or benefits otherwise due under Subsection 7.4, pay the Executive within 60 days of such termination a severance payment equal to:

the Severance Amount multiplied by 2;

In addition, the Company shall reimburse the Executive for the premiums reasonably necessary for the Executive to obtain individual health insurance coverage on a monthly basis until the earlier of 12 months following the termination date or the date when he becomes eligible for group health insurance coverage, if any, through subsequent employment; provided, however, that the Executive shall notify the Company in writing within five days after he becomes eligible for group health insurance coverage, if any, through subsequent employment or otherwise. Such reimbursements shall be provided by the last day of the month following the month in which the applicable premiums were paid by the Executive.

7.6Accrued Obligations Otherwise Due to the Executive on Termination of Employment

In the event of the termination of the Executive’s employment under this Agreement, the Company shall have no further obligation to the Executive under this Agreement, except for (a) payment to the Executive of all earned but unpaid Base Salary through the termination date and any accrued but unused vacation entitlement as at the date of termination for that portion of the calendar year in which the Executive was actively employed; (b) provision to the Executive, in accordance with the terms of the applicable benefit plan of the Company or to the extent required by law, of any benefits to which the Executive has a vested entitlement as of the termination date, (c) payment to the Executive of any approved but unreimbursed business expenses incurred through the termination date in accordance with applicable Company policy and this Agreement, and (d) if applicable, the severance payment and benefits due under Sections 7.4 or 7.5, as applicable. The payments and benefits just described in (a)-(c) shall constitute the “Accrued Obligations” and shall be paid when due under this Agreement, the Company’s plans and policies, and/or applicable law.

If the Executive’s employment with the Company is terminated, and within one year of such termination the Executive acquires directly or indirectly other than from the Company or its subsidiaries any present or future interest in any mining claims or properties or mineral interests within 10 miles of the external boundaries of any mineral property held by the Company at the time the Executive’s employment with the Company was terminated, the Executive will offer the Company, in writing the right to acquire such interest in exchange for reimbursement of his direct and indirect acquisition costs. The Company shall have 30 days after receipt of such offer to accept the offer and 90 days after receipt of such offer to reimburse such costs.

Upon termination of the Executive’s employment with the Company for whatever reason, the Executive shall be deemed to have resigned from all positions with the Company and its affiliates and shall forthwith execute and deliver to the Company his written resignation

from any and all offices of the Company and its affiliates, without claim for compensation for loss of office.

7.9Payments in Full Settlement and Other Conditions on Receipt of Severance Payment and Benefits

The Executive acknowledges and agrees that the payments pursuant to this Article 7 shall be in full satisfaction of all claims, losses, costs, damages or expenses in connection with his employment and the termination thereof, including termination pay and severance pay pursuant to statute, common law, contract, policy or otherwise. Except as provided in this Article, the Executive shall not be entitled to any further termination payments, damages or compensation whatsoever from the Company or its subsidiaries in connection with the employment of the Executive and the termination thereof. As a condition precedent to any applicable severance payment and benefits pursuant to this Article in excess of employment standards minimums, and notwithstanding any other provision of this Agreement, the Executive agrees (a) to deliver to the Company, prior to any such payment, a full and final release from all actions and claims, including claims in connection with the termination of his employment or any losses, costs, damages or expenses resulting therefrom in favour of the Company, its affiliates, subsidiaries, directors, officers, employees and agents in a form provided by the Company to the Executive; and (b) to fully comply with all applicable restrictive covenants under this Agreement.

8.1Covenant not to Compete

In consideration for the Company providing the Executive with previously undisclosed Confidential Information, the Awards and the other good and valuable consideration under this Agreement, during the Term and for a period of twelve (12) months after the termination of the Executive’s employment with the Company, for any reason (the “Restricted Period”), the Executive shall not, without the prior written consent of the Company, do any of the following in any capacity similar to the capacity in which he provided services to the Company: (a) serve (whether paid or unpaid) a Restricted Entity (as defined below) as a partner, employee, consultant, contractor, officer, director, manager, agent, associate, investor, or advisor; or (b) own, purchase, acquire, finance, invest in, operate, or organize a Restricted Entity, or take preparatory steps for the organization of a Restricted Entity. For purposes of this Agreement, the term “Restricted Entity” means any entity that engages or plans to engage in the business of acquiring, exploring, developing, or operating mineral properties in the Restricted Territory (as defined below). The restrictions set forth in this Section 8.1 shall only apply to the Executive’s activities to the extent such activities, occur within 10 miles of the external boundaries of any mining operations or properties held by the Company during the Term and on the termination date, as applicable (the “Restricted Territory”).

8.2 Covenant not to Solicit

In consideration for the Company providing the Executive with previously undisclosed Confidential Information, the Awards and the other good and valuable consideration under this Agreement, during the Restricted Period, the Executive shall not, in any manner, directly or indirectly solicit, induce, or encourage any person who is an employee of the Company, or was an employee of the Company at any time in the two years preceding the termination of the Executive’s employment, to terminate his or her employment relationship with the Company or to provide services to any Restricted Entity or other person or entity.

8.3 Survival of Covenants; Reformation; and Remedies

The Executive’s covenants in this Article 8 shall survive the termination of this Agreement according to their terms, regardless of the reason for such termination, and shall be construed as agreements independent of any other provision of this Agreement, and the existence of any claim or cause of action of the Executive against the Company (whether under this Agreement or otherwise) shall not constitute a defense to the enforcement by the Company of those covenants.

The Executive further acknowledges and agrees that the limitations as to time, geographical area, and scope of activity to be restrained by the covenants in this Article 8 are reasonable and acceptable to him and do not include any greater restraint than is reasonably necessary to protect the Confidential Information, goodwill, and other legitimate business interests of the Company. The Executive further agrees that, if at some later date, a court of competent jurisdiction determines that any such covenants are unreasonable, any such covenants shall be reformed by the court and enforced to the maximum extent permitted under applicable law.

In the event of breach by the Executive of any of his covenants in this Article 8, the Company shall suffer irreparable damage in amounts difficult to ascertain and therefore will be entitled to equitable relief (without the need to post a bond or prove actual damages) by temporary restraining order, temporary injunction, or permanent injunction or otherwise, in addition to all other legal and equitable relief to which it may be entitled, including any and all monetary damages, which it may incur as a result of such breach or violation. The Company may pursue any remedy available to it concurrently or consecutively in any order as to any breach or violation, and the pursuit of one of such remedies at any time shall not be deemed an election of remedies or waiver of the right to pursue any other of such remedies as to such breach or violation, or as to any other breach or violation. If the Executive breaches any such covenants, the time periods pertaining to such covenants shall also be suspended and shall not run in favor of him from the time he first breached such covenants until the time when he ceases such breach.

The obligations and rights of the Executive under this Agreement are personal in nature, based upon the singular skill, qualifications and experience of the Executive.

10.RIGHT TO USE EXECUTIVE’S NAME AND LIKENESS

During the Term of this Agreement, the Executive hereby grants to the Company the right to use the Executive’s name, likeness and/or biography in connection with the services performed by the Executive under this Agreement and, with the agreement of the Executive, in connection with the advertising or exploitation of any project with respect to which the Executive performs services for the Company.

The Executive hereby represents, warrants and acknowledges to the Company that he has been permitted the opportunity to seek at his sole discretion independent legal advice prior to the execution and delivery of this Agreement and has either obtained such independent legal advice with regard to this Agreement, or has expressly determined not to seek such advice.

No consent or waiver, express or implied, by any party to this Agreement of any breach or default by any other party in the performance of its obligations under this Agreement or of any of the terms, covenants or conditions of this Agreement shall be deemed or construed to be a consent or waiver of any subsequent or continuing breach or default in such party’s performance or in the terms, covenants and conditions of this Agreement. The failure of any party to this Agreement to assert any claim in a timely fashion for any of its rights or remedies under this Agreement shall not be construed as a waiver of any such claim and shall not serve to modify, alter or restrict any such party’s right to assert such claim at any time thereafter.

Any notice relating to this Agreement or required or permitted to be given in accordance with this Agreement shall be in writing and shall be personally delivered or mailed by registered mail, postage prepaid to the address of the parties set out on the first page of this Agreement. Any notice shall be deemed to have been received if delivered, when delivered, and if mailed, on the fifth day (excluding Saturdays, Sundays and holidays) after the mailing thereof. If normal mail service is interrupted by strike, slowdown, force majeure or other cause, a notice sent by registered mail will not be deemed to be received until actually received and the party sending the notice shall utilize any other services which have not been so interrupted or shall deliver such notice in order to ensure prompt receipt thereof.

Each party to this Agreement may change its address for the purpose of this Article 13 by giving written notice of such change in the manner provided for in Section 13.1.

14.APPLICABLE LAW; VENUE; AND JURY-TRIAL WAIVER

This Agreement shall be governed by the laws of the State of Alaska and the federal laws of the United States of America as applicable therein, without regard to its conflict-of-laws principles. The parties hereby irrevocably consent to the binding and exclusive venue for any dispute, controversy, claim, or cause of action between them arising out of or related to this Agreement being in the courts of the State of Alaska. EACH PARTY SHALL, AND HEREBY DOES, IRREVOCABLY WAIVE THE RIGHT TO TRIAL BY JURY WITH RESPECT TO ANY DISPUTE, CONTROVERSY, CLAIM, OR CAUSE OF ACTION AGAINST THE OTHER PARTY OR ITS OR HIS AFFILIATES, ARISING OUT OF OR RELATING TO THE EXECUTIVE’S EMPLOYMENT WITH THE COMPANY, THE TERMINATION OF THAT EMPLOYMENT, OR THIS AGREEMENT (EITHER ALLEGED BREACH OR ENFORCEMENT).

If any provision of this Agreement for any reason is declared by any court of competent jurisdiction to be invalid, such declaration shall not affect the validity of any remaining portion of the Agreement, which remaining portion shall remain in full force and effect as if this Agreement had been executed with the invalid portion thereof eliminated, and it is hereby declared the intention of the parties that they would have executed the remaining portions of this Agreement without including therein any such part, parts or portion which may, for any reason, be hereafter declared invalid.

This Agreement constitutes the entire agreement between the parties hereto concerning its subject matter, supersedes all prior and contemporaneous agreements and understandings, both written and oral, between the parties with respect to such subject matters, including without limitation to the letter agreement dated January 6, 2020 from the Company to the Executive outlining the terms and conditions of employment, and there are no representations or warranties, express or implied, statutory or otherwise other than set forth in this Agreement and there are no agreements collateral hereto other than as are expressly set forth or referred to herein. This Agreement cannot be amended or supplemented except by a written agreement executed by all parties hereto. The Executive acknowledges and agrees that, in signing this Agreement, he is not relying on any prior oral or written statement or representation by the Company or its representatives outside of this Agreement but is instead relying solely on his own judgment and his legal and tax advisors, if any.

This Agreement shall not be assigned by any party to this Agreement without the prior written consent of the other party to this Agreement.

This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, executors, administrators, successors and permitted assigns.

Time is of the essence of this Agreement.

Each party shall do and perform all such acts and execute and deliver all such instruments and documents as may be necessary to ensure that the provisions of this Agreement comply with and conform in all respect with the requirements of the applicable federal, state, and local tax-related laws and regulations.

To the extent that the Internal Revenue Code of 1986, as amended (the “Code”), and Treasury Regulation Section 1.409A-1(h), would apply to any remuneration paid to the Executive by the Company under this Agreement, it is the parties’ intention that all such payments be exempt from or comply with the provisions of Code Section 409A and not be subject to the tax imposed by Code Section 409A. The provisions of this Agreement shall be interpreted in a manner consistent with this intent. Notwithstanding any contrary provision in this Agreement, the Executive shall be solely responsible for any risk that the tax treatment of all or part of any payments provided by this Agreement may be affected by Code Section 409A, which may impose significant adverse tax consequences on him. The Executive therefore has the right, and is encouraged, to consult with a tax advisor of his choice before signing this Agreement.

Any provision of this Agreement which expressly states that it is to continue in effect after termination of this Agreement or the Executive’s employment, or which by its nature would survive the termination of this Agreement or the Executive’s employment, shall do so, regardless of the manner or cause of termination.

22.REPRESENTATIONS OF THE EXECUTIVE

The Executive represents and warrants that (a) he has not previously assumed any obligations inconsistent with those in this Agreement; (b) his execution of this Agreement, and his employment with the Company and services to the Company, shall not violate any other contract or obligation between the Executive and any former employer or other third party; and (c) during the Term, he shall not use or disclose to anyone within the Company any proprietary information or trade secrets of any former employer or other third party. The Executive further represents and warrants that he has entered into this Agreement pursuant to his own initiative and that the Company did not induce him to execute this Agreement in contravention of any existing commitments. The Executive further acknowledges that the Company has entered into this Agreement in reliance upon the foregoing representations of the Executive.

22. COUNTERPARTS

This Agreement may be executed in counterparts (including by facsimile and other electronic transmission and electronic signature), each of which when so executed and delivered by either party will be deemed to be an original and such counterparts will together constitute one and the same instrument.

IN WITNESS WHEREOF the parties hereto have executed this agreement on the 16th day of September, 2024.

|

CONTANGO ORE, INC. /s/ Brad Juneau Per: Brad Juneau Chairman of Contango Ore, Inc. |

|

|

/s/ Rick Van Nieuwenhuyse Per: Rick Van Nieuwenhuyse |

NEWS RELEASE

CONTANGO ORE, INC.

Contango Announces $19.5 Million Cash Distribution Received from the Peak Gold JV

FAIRBANKS, AK -- (September 17, 2024) -- Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American: CTGO) is pleased to announce that the Peak Gold JV paid a cash distribution of $19.5 million. These proceeds relate to Contango’s 30% of profits from the processing Manh Choh ore from Campaign #1. The Peak Gold JV is planning two further campaigns in 2024, the second currently underway, with at least one more cash distribution expected to occur before the end of the year. Contango estimates its share of gold production from the Peak Gold JV for 2024 to be between 30,000 and 40,000 ounces of gold.

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in the Peak Gold JV, which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by KG Mining (Alaska), Inc., an indirect subsidiary of Kinross, operator of the Peak Gold JV. The Company also has a lease on the Johnson Tract project from the underlying owner, CIRI Native Corporation, a lease on Lucky Shot project from the underlying owner, Alaska Hardrock Inc. and, through its subsidiary, 100% ownership of approximately 8,600 acres of peripheral State of Alaska mining claims. In addition, Contango also owns a 100% interest in an additional approximately 145,000 acres of State of Alaska mining claims through its wholly owned subsidiary, which gives Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding Contango that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions,

strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for and developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

CONTACTS

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(907) 888-4273

www.contangoore.com

v3.24.3

Document And Entity Information

|

Sep. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 16, 2024

|

| Entity Registrant Name |

Contango Ore, Inc.

|

| Entity Central Index Key |

0001502377

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35770

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-3431051

|

| Entity Address, Address Line One |

516 2nd Avenue

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

Fairbanks

|

| Entity Address, State or Province |

AK

|

| Entity Address, Postal Zip Code |

99701

|

| City Area Code |

(907)

|

| Local Phone Number |

888-4273

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

CTGO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

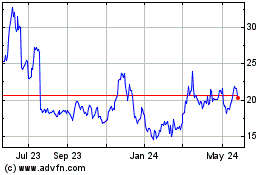

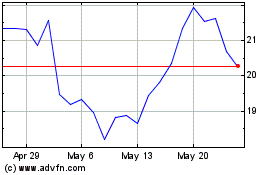

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Nov 2023 to Nov 2024