As worries continue to grow over many developing nations around

the globe, some investors have decided to pull back and put assets

to work in safer markets like the United States. This trend and the

general risk off atmosphere as of late has pushed broad emerging

market funds like VWO or EEM below their corresponding American

benchmarks—by a pretty wide margin—in both the YTD and trailing one

year periods.

Furthermore, many of the most popular emerging market individual

country ETFs, such as those tracking nations like Brazil, India, or

China, have struggled lately as well. Funds tracking these markets

are all in the red in the trailing one year period, making many

investors pause before putting more dollars to work in these shaky

markets.

Yet while some nations have seen severe weakness in the

developing world, a few have been able to hold up quite well and

buck the negative trend in this important market segment.

Particularly, those in the Southeast Asian markets have been doing

a superb job, although over the past few years, none have been able

to match the robust returns that were seen in the Thai equity

markets (read Southeast Asia ETF Investing 101).

In fact, over the past three year period, the MSCI

Thailand Investable Market Index Fund (THD) has added over

90% in the time frame, beating the next closest nation by over

2,000 basis points. If that wasn’t enough, the product is still a

top five performing nation from a year-to-date look as well,

suggesting that the country has not only held up well in the market

uncertainty but has been a long term outperformer too.

Clearly, the country and its market have been on to something

over the past few years and investors who are looking for a new

emerging market would be wise to take notice. Below, we highlight

some of the key points from both the fund and the nation in order

to hopefully shed some light on why the Thailand ETF has been

pretty much unstoppable over the past three years (see Three

Overlooked Emerging Market ETFs).

Thai Market Trends

Thailand is still very much dependent on exports to power

growth, relying on a number of Western giants as well as

closer-to-home destinations to import its goods. Still, the country

has a relatively low public debt level and a modest budget gap,

metrics that are far lower than many of their more well-regarded

peers in both the Asia-Pacific region and the West.

Thanks to this, Thailand has a decent number of policy tools

still at its disposal, especially considering that the inflation

rate is very moderate at about 3%. However, these tools seem

unnecessary at this time, as the Thai consumer appears to be

picking up the slack in the nation’s economy (read Forget European

Woes with These Three Country ETFs).

In fact, growth is expected to come in between 5.5%-6% for the

second half of the year despite the fact that export growth looks

to grow at just 7.3%, according to Bloomberg. Furthermore, the

country is planning to spend more than $60 billion on new

infrastructure programs while it is also looking at other

simulative bills as well. "Thailand is one of the more resilient

economies compared with its Asian peers with regards to the risk

and headwinds from the US and Europe," Philip Wee of DBS bank told

the BBC's Asia Business Report.

All of this comes despite no real appreciation of the baht

against the American currency over the past few years. Or,

conversely, perhaps Thailand has seen such strong growth because it

has had such currency stability in the post-recession world,

helping to erase memories of the disastrous 1997 crisis, and

showcase how far the Thailand economy has come since then.

Thailand ETF in Focus

This strong investment climate and robust consumer class has led

the Thai ETF to hold up better than its peers in recent months, as

well as over the past few years. However, the fund is still

somewhat concentrated from both a sector and an individual security

perspective.

Banks comprise roughly one-third of the total assets while

energy companies makeup another fifth of the assets. Beyond this,

basic materials, consumer staples, and telecoms round out the rest

of the top five making up a combined 27% of assets.

Fortunately for Thailand, the country’s banking system is much

more locally and regionally exposed than some of the nation’s peers

in the region. This has allowed the country to ride the wave of the

improved consumer picture while also benefiting from the sound

fiscal position in many of the neighboring countries in the ASEAN

bloc (read Five Emerging Market Infrastructure ETFs for the Coming

Boom).

Investors should also note that the product has a pretty solid

level of AUM and average daily volume, suggesting that bid ask

spreads are relatively tight and that total costs will not come in

much higher than the 59 basis point expense ratio. It also doesn’t

hurt that THD has an annual yield of 2.6%, a level that is quite a

bit higher than both SPY and VWO at time of writing.

So despite the fund’s relatively heavy concentration, the

emerging market ETF still could be a solid choice for investors.

The nation is still growing at a solid clip and it remains well

insulated from many of the Western world’s woes (also see Frontier

Market ETF Investing 101).

Although it does have some exposure via its exports to the West,

the consumer class in the country is coming on strong which should

help to balance out the growth profile of the nation. Add in the

robust yield and the solid volume metrics of THD, and some

investors could still find a winner on their hands with this nearly

unstoppable emerging market ETF tracking the dynamic nation of

Thailand.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Author is long VWO.

ISHARS-EMG MKT (EEM): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHRS-MSCI THAI (THD): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

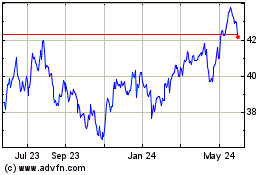

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

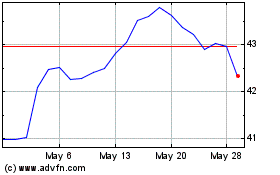

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jan 2024 to Jan 2025