As American markets continue to struggle thanks to a number of

political issues and growth concerns, many investors have looked

beyond U.S. shores to potentially better investment opportunities.

Yet with Europe still questionable and major emerging markets like

China struggling, some have turned to smaller—and often

overlooked—markets in other regions of the world for growth in

these uncertain times.

This has turned out to be a great decision as some markets in

Latin America and Southeast Asia are still chugging along despite

the developed market concerns and some weakness in the few trillion

dollar economies that are in the developing world. In particular,

one country has stands out for both its strong economy and for how

little most American investors know about the nation; the

Philippines.

Philippines in Focus

The island nation of about 95 million people has been crushing

the competition so far this year with its market greatly

outperforming broad emerging market benchmarks in the year-to-date

period. A number of trends have been responsible for this continued

surge in the market both from a domestic perspective and in terms

of exports as well.

The relatively undeveloped country has become a favorite

destination of firms looking for cheap outsourcing in a country

with a large and young population where English is a popular

language. This segment, along with the electronics, automotive, and

aerospace sectors, has combined with a weak peso to give the

country a more optimistic consumer (read 3 Emerging Market ETFs

Protected from Global Events).

In fact, the Philippines, according to Nielsen, recently came in

second place for a global consumer confidence survey, just being

edged out by Asian emerging markets India and Indonesia. Meanwhile

a recent interest rate cut could also help to spur growth and keep

the peso at a reasonable level in the future, suggesting that as

long as inflation stays under control, the country’s economic

condition could continue to improve.

The weaker currency and the strong diversity of manufacturing in

the country has also helped the Philippines to become a stronger

exporter, a pretty remarkable feat considering the developed market

woes at this time. Recent reports showed that September

exports were 22.8% higher in dollar terms than in the year ago

period, while month-over-month, they increased by 26% (see Buy

These Emerging Asia ETFs to Beat China, India).

"The country's merchandise exports growth momentum remains

robust despite significant threat posed by the crisis in the Euro

area and lethargic state of the US economy," Trade Undersecretary

Cristino Panlilio said, suggesting that the often overlooked

country has shown incredible resilience despite the broadly

uncertain market around the globe.

Thanks to these positive trends in the economy, and a recent

move by Moody’s to push the nation just one notch below investment

grade, it could be time to look to the nation for investment.

How to Play

While the broad market is still small and few Philippines

focused securities are traded in the U.S., investors still have an

ETF option to target the country in diversified form; the

iShares SMCI Philippines Investable market Index Fund

(EPHE).

This product, which tracks MSCI Philippines Investable Market

Index, has been easily beating out broad emerging market ETFs like

EEM or VWO, thanks to some of the

points highlighted above. EPHE is up more than 41% YTD while EEM

and VWO both have added less than 16% on the year, while the one

year look is even more favorable to EPHE, suggesting that the

product has shown a decent history of strong outperformance.

Still, despite these gains, the ETF is relatively unpopular as

just $150 million is invested in EPHE. However, the product does

have solid volume over 150,000 shares a day so bid ask spreads look

to be relatively tight for the fund, suggesting that total costs

will not be much more than the fund’s stated 59 basis point expense

ratio (read Three Overlooked Emerging Market ETFs).

Investors should also note that the fund has a pretty favorable

sector breakdown, and unlike many emerging market ETFs, this one

does not allocate a huge amount to financials. Instead, industrials

take the top spot at 29%, followed by real estate (21%), financials

(17%), and utilities (13%).

Additionally, the ETF is relatively spread out from an

individual company look even though the fund has just 41 stocks in

its basket. Top stocks include SM Investments (10%), Ayala Land

(7.5%), and Philippine Long Distance Telephone (6.6%), while all of

the top ten has at least 3.6% of assets.

So not only are the underlying fundamentals for the Philippines

quite solid but the ETF represents a decent pick on its own as

well. While it is true the product might not offer up much in the

way of yield—just under 1%-- its performance has more than made up

for that, especially when comparing it to broad emerging market

ETFs in recent time frames (see Three Emerging Market ETFs to Limit

BRIC Exposure).

Lastly, the fund also currently receives a favorable Zacks ETF

Rank of 2 or ‘Buy’ so we are expecting it to continue to outperform

over the next few months as well. Given all this, it could be time

for more investors to take a closer look at this often overshadowed

market, particularly if it can continue to surge higher even in the

face of global economic woes and broad market uncertainty.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Long VWO

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS PH IM (EPHE): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

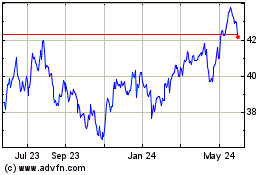

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

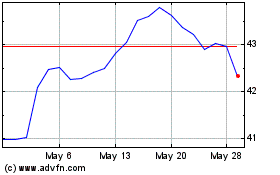

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jan 2024 to Jan 2025