Solid Growth Puts Philippines ETF in Focus - ETF News And Commentary

19 February 2014 - 12:00AM

Zacks

Emerging markets (EM) have fallen out of the favor on the Fed’s

escalation of the QE taper which has left many investors

apprehensive about the near term outlook. Amid such a

backdrop, some nations with robust exports and sound macroeconomic

fundamentals held up pretty well.

The Philippines is one such country. This is especially true given

the nation's robust GDP growth rate (Read: Emerging Market ETFs:

Any Bright Spots?).

Economic Indicators Round Up

The Philippines economy has expanded at the fastest clip since the

1950s over the last two years logging GDP growth of 7.2% in 2013 on

top of 6.8% in 2012. This towering growth rate – despite the

multi-billion peso wreckage from Super Typhoon Haiyan (which hit

the island nation in early November) tagged it the second fastest

growing major economy in Asia placing it just behind the China

which grew 7.7% in 2013 (read: Super Typhoon Haiyan Puts

Philippines ETF in Focus).

The uptick in service and industry sectors was given credit for

this impressive gain. Also, expansion of business process

outsourcing firms and flocking tourists contributed to the nation’s

success story.

The country reiterated its growth projection of 6.5% to 7.5% for

this year. The growth outlook was raised by the IMF which expects

the country to be supported by higher exports and reconstruction of

areas thumped by the typhoon. IMF upgraded the 2014 growth outlook

to 6.3% from 6% in September while the nation is expected to grow

in the range of 6.5% to 7.0% in 2015.

Another research organization, Citigroup, anticipates the

Philippines’ GDP growth to be 6.8% this year and strike a 7.3%

growth rate next year, aided by some huge public-private

partnership projects underway. President Benigno Aquino aims to

attain 8.5% growth by 2016.

Exports comprise about one third of Philippine GDP which makes the

country vulnerable to the health of its major trading partners. The

country trades a great deal with Japan (around 28%), and the U.S.

(15%) ensuring that it is heavily exposed to two countries which

are growing at a reasonably solid clip (read: Is Another Great Year

Ahead for Japan ETFs?).

The Philippines is among the very few countries in Southeast Asia

that have a decent current account balance – less than 3% of GDP –

at present. Remittances from abroad – accounting for 8% to 10% of

country’s GDP – is another striking part of the economy which drove

its forex reserves and shored up its currency to a large extent.

Thanks to these respectable economic indicators, the Philippines

attracted the second biggest foreign direct investment (FDI) inflow

for the first half of 2013.

The Philippines currently boasts foreign exchange reserves of about

$80 billion. Its currency peso slipped only 2.3% so far in the year

(as of February 10, 2014). The rate of decline is quite limited in

contrast to the broader emerging market currency ETF

WisdomTree Emerging Currency

Fund’s (

CEW) loss of

7.08% in the past one month. Thus, the country appears to be in a

position to withstand the effects of foreign capital reversal in

the future.

Market Impact

Since the release of its 2013 GDP numbers (in January 2014), the

broader market fund on Philippines economy –

iShares MSCI

Philippines Investable Market Index

(EPHE) – gained

1.7%. This is the only one pure-play ETF in the

Philippines market.

iShares MSCI Philippines Investable Market Index

(EPHE)

Launched in September 2010, this ETF looks to track the MSCI

Philippines Investable Market Index. The fund invests about $254.4

million of assets in 44 securities.

The financial sector takes the top spot in the fund with about 40%

exposure and is closely followed by industrials (27%). No other

sector gets a double-digit allocation in the fund.

It is worth noting that the fund has considerable concentration

risk with about 57.62% of assets invested in the top 10 holdings.

Ayala Land (8.4%), BDO Unibank (6.56%) and Philippine Long Distance

Telephone (6.49%) make up the top three holdings.

The fund charges an expense ratio of 62 basis points. EPHE lost

about 7.93% in 2013. Over the last one month, EPHE gained about

1.25% while

iShares MSCI Emerging Markets ETF

(EEM) shed about 2.64%. EPHE currently has Zacks ETF Rank #2

(Buy).

Risks

While the overall picture is rosy, one should also be wary of

near-term drags. Analysts are expecting the Philippines to post a

sluggish first-quarter in 2014 hurt by weaker agriculture output

bearing the impact of the colossal typhoon. Also, the inflation

which was contained at less than 3% level in 2013 will likely spike

to over 4% this year on rising energy and food costs.

In fact, the IMF raised its inflation outlook to 4.4% for 2014 from

the earlier guidance of 3.5% but has a moderate projection of 3.8%

for 2015. Notably, the Philippines central bank has an inflation

target of 3% to 5% for this year and 2% to 4% for 2015. Apart

from this, overall emerging market weakness will also be in place,

but EPHE has clearly set itself apart from the rest and could

remain a solid emerging market pick for investors in what has

otherwise been a choppy market segment (read: Time to Panic

About Emerging Markets?).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

WISDMTR-EMG CUR (CEW): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS PHILP (EPHE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

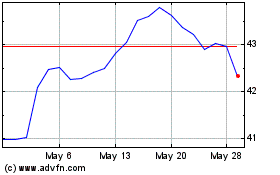

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

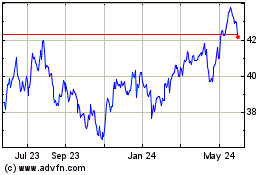

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Feb 2024 to Feb 2025