New Jersey Pension Fund Slashses Emerging Market ETF Exposure - ETF News And Commentary

20 May 2014 - 12:00AM

Zacks

The start of the Fed taper and the gradual end of the cheap money

era have indeed left deep scars on the emerging market nations. In

fact, the outflow of hot money from these developing countries

began with the mere talk of the Fed planning to start tapering in

mid-2013. This outflow continued until the first quarter of 2014

(read: Emerging Market ETFs See Inflows: 3 ETFs to Pick).

Taking the cue, albeit belated, the New Jersey Pension Fund – the

nation’s 12th largest public pension – has reduced its exposure to

emerging market ETFs to less than $1.8 billion from a peak of $3.2

billion at end 2012, according to a Bloomberg article.

The pension fund, which had a total exposure of 7.65% in emerging

market equities at the end of October last year, has reduced it to

6.56% of its assets as of February.

Below we have highlighted two ETFs which have been on the sell

radar for this pension fund. These ETFs have indeed seen their

asset base eroding over the past couple of months, and New Jersey’s

shift could definitely be a culprit for part of their AUM

slides:

Vanguard FTSE Emerging Markets ETF (VWO)

The pension fund has reduced its exposure to VWO, the largest

emerging market ETF, to about $109 million from $1.9 billion in

2012.

The fund saw a total of roughly $12 billion outflows since the

beginning of 2013 till the first quarter of 2014. Meanwhile, for

the same period, VWO has lost nearly 11% as compared to a more than

25% gain for the S&P 500 index.

VWO seeks to passively track the FTSE Emerging Index and has the

largest exposure to Chinese stocks. VWO has roughly 20% exposure to

China, followed by India and Indonesia.

ISHARES MSCI EMERGING MARKETS ETF (EEM)

Asset managers have pulled nearly $12.8 billion from EEM since 2013

till March 31, 2014. The passively managed fund, which tracks the

FTSE Emerging Index, has shed 9.3% during the time frame.

Even after the recently reduced exposure, the pension fund still

holds roughly $1.3 billion worth of assets in EEM (see: all

the Emerging Market ETFs here).

Financials and technology dominate the fund, while country-wise

China once again takes the top spot, followed by South Korea and

Taiwan.

Apart from EEM and VWO, the pension fund also had exposure to

iShares MSCI EAFE ETF (EFA),

iShares Core

MSCI Emerging Markets ETF (IEMG) and

iShares MSCI

South Korea Capped ETF (EWY), at the end of February,

according to the New Jersey Division of Investment.

Bottom Line

New Jersey Pension Fund’s scaling back comes at a time when

emerging market ETFs are again beginning to see huge inflows. In

fact, EEM has been the best ETF in terms of inflow since April this

year. This is especially true given that the fund has attracted

$3.9 billion since April, as per ETF.com. Also, emerging market

ETFs have performed quite well over the past two months

(read: 3 Emerging Market ETFs Off to a Great Start in

2014).

Positive developments in key emerging markets and subdued recovery

in U.S. economic growth seemed to be the major factors for the

sharp U turn in asset inflows. China, the second largest economy,

recently implemented various stimulus measures to revamp growth in

the economy.

Moreover, Indian markets have also been performing very well on the

back of improving fundamentals and optimism regarding the elections

(read: Will India ETFs Election Fever Continue?)

However, it needs to be seen whether the emerging market nations

can continue to keep up their performance for the rest of the year,

and if New Jersey’s decision was a wise one or not.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-EAFE (EFA): ETF Research Reports

ISHARS-S KOREA (EWY): ETF Research Reports

ISHARS-CR MS EM (IEMG): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

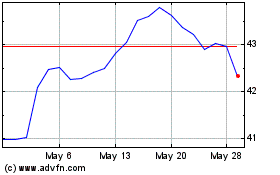

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

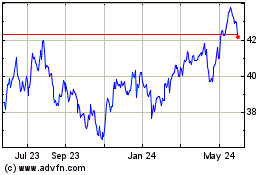

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Dec 2023 to Dec 2024