false

0000065312

0000065312

2025-02-10

2025-02-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

_________________________________

Date of Report

February 10, 2025

(Date of earliest event reported)

EVI Industries, Inc.

(Exact name of registrant as specified in its

charter)

|

Delaware

(State or other jurisdiction of

incorporation

or organization) |

|

001-14757

(Commission File Number) |

|

11-2014231

(IRS Employer Identification No.)

|

| |

|

|

|

|

|

4500 Biscayne Blvd., Suite 340

Miami, Florida

(Address of principal executive offices) |

|

|

|

33137

(Zip Code) |

(305) 402-9300

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $.025 par value |

EVI |

NYSE American |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On February 10, 2025, EVI

Industries, Inc. issued a press release announcing its financial results for the quarter ended December 31, 2024. A copy of the press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current

Report on Form 8-K, including Exhibit 99.1 hereto, is furnished pursuant to Item 2.02 and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EVI INDUSTRIES, INC. |

| |

|

|

| |

|

|

| |

|

|

| Dated: February 10, 2025 |

By: |

/s/ Robert H. Lazar |

| |

|

Robert H. Lazar |

| |

|

Chief Financial Officer |

Exhibit 99.1

EVI Industries Reports Record Second Quarter

Results

Record Revenue and Gross Profits, Continued

Investment in Operations and Completed Acquisition

Miami, Florida – February 10, 2025 –

EVI Industries, Inc. (NYSE American: EVI) announced its operating results for the three and six-month periods ended December 31, 2024,

including record revenue and record gross profit for both periods and record gross margin for the six-month period. The Company also provided

commentary on its results of operations, cash flow and financial position, and investments in furtherance of its technology initiatives.

Click here to listen to the Company’s recorded earnings call.

Since 2016, EVI has established itself as a leader

in the highly fragmented North American commercial laundry distribution and service industry by thoughtfully executing the Company’s

long-term growth strategy, which has resulted in a compounded annual growth rate in revenue, net income and adjusted EBITDA of 31%, 19%

and 28%, respectively.

Henry M. Nahmad, EVI’s Chairman and

CEO, commented: “We are a long-term focused company with ambitious growth plans. The continued confidence in our strategy is derived

from early successes combined with financial strength and wherewithal, our reputation as a knowledgeable and high-quality buyer and successful

builder of businesses, the expected impact of promising technologies, and a heavily invested leadership team to guide the Company into

the future. As part of our long-term focus, we are committed to continuous investment—including in people, processes, and technologies—aimed

at enhancing operational efficiency and driving sustained success.”

Company Achievements for the Three and Six Months Ended December

31, 2024

| § | Continued deployment of EVI’s

field service technology, now deployed to over 70% of the service organization |

| § | Surpassed important milestones

in development of the Company’s e-commerce platform |

| § | New confirmed customer sales

order contracts exceeded the value of those fulfilled during the period |

| § | Completed two acquisitions

adding sales and service expertise to the Company’s Southeast region |

| § | Paid a $4.6 million dividend,

the largest dividend in the Company’s history |

Three-Month Results (compared

to the three months ended December 31, 2023)

| § | Revenue increased 1% to a

second quarter record of $92.7 million |

| § | Gross profit increased 4%

to a second quarter record of $27.5 million |

| § | Gross margin increased to

29.7% compared to 28.9% |

| § | Operating income was $2.4

million compared to $3.0 million |

| § | Net income was $1.1 million,

or 1.2%, compared to $1.3 million, or 1.5% |

| § | Adjusted EBITDA was $5.1 million,

or 5.5%, compared to $5.5 million, or 6.0% |

Six-Month Results (compared

to the six months ended December 31, 2023)

| § | Revenue increased 4% to a

record of $186.3 million |

| § | Gross profit increased 8%

to a record of $56.4 million |

| § | Gross margin increased to

a record of 30.3% compared to 29.0% |

| § | Operating income increased

to $7.4 million compared to $5.6 million |

| § | Net income increased to $4.4

million, or 2.3%, compared to $2.6 million, or 1.5% |

| § | Adjusted EBITDA increased

to a record of $12.7 million, or 6.8%, compared to $11.5 million, or 6.4% |

Operating Results

The Company reported record revenue of approximately

$93 million and $186 million for the three and six-month periods ended December 31, 2024, an increase of 1% and 4%, respectively, compared

to the same periods of the prior fiscal year. The modest increases in revenue during the three and six-month periods is primarily attributed

to the irregular cadence of industrial revenue and in part to delays in the completion of certain large industrial sales order contracts.

While the Company generates a recurring base of industrial business, the timing of revenue related to industrial projects is subject to

longer sales cycles and complex installations that from time to time are uneven as compared to revenue derived from other commercial laundry

categories. Record revenues for the quarter were achieved notwithstanding the fact that during the second quarter only one customer was

invoiced for an amount in excess of $1 million, as compared to five in the same period of the prior year. These results demonstrate the

incremental positive impact derived from our investment in additional sales professionals and service technicians, which are core to the

Company’s long-term market share strategy. Over the longer term, these investments in growth are expected to reduce the overall

sensitivity of the Company’s results and operating performance to the irregular cadence of larger industrial sales order contracts.

Looking forward, we expect to benefit from the completion of confirmed sales order contracts across the industrial, on-premise, and vended

laundry categories, which together contribute to our over $100 million equipment sales backlog.

During the three and six-month periods ended December

31, 2024, the Company set second quarter and six month records for gross profit at $28 million and $56 million, respectively. The Company

also set a gross margin record for the six-month period of 30%. These results reflect in part a slight shift in mix to higher margin parts

and services, as well as the benefit derived from solution selling, which has resulted in new sales of machinery aimed to lower the operating

costs of a commercial laundry by automating historically labor-intensive tasks and new sales in consumables.

The variability in the timing of sales across

certain laundry categories is expected to, from time to time, impact the amount of operating leverage achieved on a quarter-by-quarter

basis. The Company’s investments in scalable technologies and investments in additional businesses remains central to the execution

of its growth strategy. Specifically, the “build” component of its strategy focuses on encouraging growth at its acquired

businesses through the addition of product lines, growing its sales teams, expanding installation and service operations, investing in

scalable technologies, and promoting the exchange of ideas and business concepts between the management teams of its businesses.

Given steady demand for the products and services

the Company provides, a strong backlog of confirmed customer sales orders, and an acquisition pipeline that has delivered new growth opportunities,

the Company increased investments across areas which it believes are critical to drive growth and scale its operations. The Company grew

its sales team by 3% to over 190 professionals and increased its service team by 10% to over 425 professionals, and it implemented new

field service technologies to most of its regional service operations. Additions to the Company’s sales team aim to support the

Company’s OEM representations, increase penetration in existing distribution territories, expand into new distribution territories,

and ensure sales continuity. The addition of service technicians aims to capture growing demand for the Company’s installation and

maintenance capabilities across its growing installed base. The implementation of the Company’s field service technologies is designed

to improve the efficiency of the Company’s service operations and improve customer satisfaction. While the expenses incurred in

connection with these investments adversely impacted the Company’s operating profits and are expected to continue through at least

the remainder of the fiscal year ending June 30, 2025, the Company expects that these investments will yield positive returns in the future.

Technology Investments

In 2020, the Company commenced a comprehensive

technology initiative to transform EVI into a modern, data-driven company. Since that time, EVI’s technology group has grown significantly,

various third-party technology professionals have been retained. This growing team is leading efforts to consolidate business units into

end-state Enterprise Resource Planning (ERP) Systems, enriching numerous data sets, building master databases, and configuring and implementing

multiple softwares, including our field service technologies and future e-commerce platform. These technology initiatives were undertaken

with a goal to accelerate sales and profit growth, increase the speed, convenience and efficiency in serving customers, extend our reach

into new geographies and sales channels, and create scalable operating processes. While the time, costs and expenses associated with these

and other modernization initiatives has adversely impacted EVI’s financial performance in the near-term, the Company continues to

believe that these technological capabilities will be a catalyst to achieving its long-term growth and profitability goals.

Cash Flow, Financial Strength, and

Special Cash Dividend

During the six-month period ended December 31,

2024, operating activities provided cash of $2.2 million compared to $10.9 million of cash provided by operating activities during the

six months ended December 31, 2023. This $8.7 million decrease in cash provided by operating activities was primarily attributable to

changes in working capital, partially offset by an increase in net income. Given the Company’s growth and profitability prospects,

solid cash flows, and strong balance sheet with over $100 million of available liquidity, on September 11, 2024, the Company’s Board

of Directors declared a special cash dividend on the Company’s common stock of $0.31 per share, which was paid on October 7, 2024.

As a result of these investments in working capital, the cash paid in connection with business acquisitions consummated during the six-month

period (as described in further detail below) and the payment of the special cash dividend, the Company’s net debt increased from

$8.3 million at June 30, 2024 to $24.0 million at December 31, 2024

Acquisitions

During the six-month period ended December

31, 2024, the Company completed the acquisition of two commercial laundry distributors and service providers, one in Florida and the other

in Indiana. In addition, on January 31, 2025, the Company acquired a business located in Illinois, the Company’s first acquisition

in the Midwest region of the United States. In each case, the Company added distribution and service businesses comprised of experienced

sales and service professionals with a loyal customer base in geographic areas where the Company believes there are market share growth

opportunities.

Important Fundamentals and Growth

Drivers

The Company

believes that the essential nature of commercial laundry products and continuous demand and growth across end-user markets of the commercial

laundry industry are catalysts for a growing installed base of commercial laundry systems across North America. These systems require

advanced planning, thoughtful design, knowledgeable installation, and post-installation services, including the replacement of equipment,

parts, and accessories and the performance of maintenance and repair services. EVI’s large and growing sales and service network

represents and services a broad range of products sourced from various domestic and international suppliers to support industrial, on-premise,

vended, and multi-family customers serving a wide array of end-user categories. The Company believes its fundamentals, financial strength,

market strategy, entrepreneurial culture, technology initiatives, and strong supplier relations are important competitive advantages that

will continue to support the Company’s ability to grow profitability and capture market share going forward.

EVI’s Core Principles

EVI upholds specific core values and principles

for its business, including:

| § | Invest and manage with a long-term

perspective |

| § | Uphold financial discipline

with a view towards ensuring financial strength and flexibility |

| § | Respect the entrepreneurs

and management teams that join the EVI family |

| § | Operate each business as a

local business and empower its leaders to make local decisions |

| § | Promote an entrepreneurial

culture |

| § | Instill a growth mindset and

culture of continuous improvement |

| § | Incentivize and reward performance

with equity participation |

| § | Establish strong relationships

with our OEM partners |

Earnings Call and Additional Information

The Company has provided a pre-recorded earnings

conference call, including a business update, which can be accessed under “Financial Info” in the “Investors”

section of the Company’s website at www.evi-ind.com or by visiting https://ir.evi-ind.com/message-from-the-ceo. For additional information

regarding the Company’s results for the three and six months ended December 31, 2024, please see the Company’s Quarterly Report

on Form 10-Q for the quarter ended December 31, 2024, as filed with the Securities and Exchange Commission on or about the date hereof.

Use of Non-GAAP Financial Information

In this press release, EVI discloses the non-GAAP

financial measure of adjusted EBITDA, which EVI defines as earnings before interest, taxes, depreciation, amortization, and amortization

of stock-based compensation. Adjusted EBITDA is determined by adding interest expense, income taxes, depreciation, amortization, and amortization

of stock-based compensation to net income, as shown in the attached statement of Condensed Consolidated Earnings before Interest, Taxes,

Depreciation, Amortization, and Amortization of Stock-based Compensation. EVI considers adjusted EBITDA to be an important indicator of

its operating performance. Adjusted EBITDA is also used by companies, lenders, investors and others because it excludes certain items

that can vary widely across different industries or among companies within the same industry. For example, interest expense can be dependent

on a company’s capital structure, debt levels and credit ratings, and the tax positions of companies can vary because of their differing

abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. Adjusted EBITDA

should not be considered as an alternative to net income or any other measure of financial performance or liquidity, including cash flow,

derived in accordance with GAAP, or to any other method of analyzing EVI’s results as reported under GAAP.

About EVI Industries

EVI Industries, Inc., through its wholly owned

subsidiaries, is a value-added distributor and a provider of advisory and technical services. Through its vast sales organization, the

Company provides its customers with planning, designing, and consulting services related to their commercial laundry operations. The Company

sells and/or leases its customers commercial laundry equipment, specializing in washing, drying, finishing, material handling, water heating,

power generation, and water reuse applications. In support of the suite of products it offers, the Company sells related parts and accessories.

Additionally, through the Company’s robust network of commercial laundry technicians, the Company provides its customers with installation,

maintenance, and repair services. The Company’s customers include retail, commercial, industrial, institutional, and government

customers. Purchases made by customers range from parts and accessories to single or multiple units of equipment, to large complex systems

as well as the purchase of the Company’s installation, maintenance, and repair services.

Safe Harbor Statement

Except for the historical matters contained herein,

statements in this press release are forward-looking and are made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Words such as “may,” “should,” “could,” “seek,” “believe,”

“expect,” “anticipate,” “estimate,” “project,” “intend,” “strategy”

and similar expressions are intended to identify forward looking statements. Forward looking statements may relate to, among other things,

events, conditions, and trends that may affect the future plans, operations, business, strategies, operating results, financial position

and prospects of the Company. Forward looking statements are subject to a number of known and unknown risks and uncertainties that may

cause actual results, trends, performance or achievements of the Company, or industry trends and results, to differ materially from the

future results, trends, performance or achievements expressed or implied by such forward looking statements. These risks and uncertainties

include, among others, those associated with: general economic and business conditions in the United States and other countries where

the Company operates or where the Company’s customers and suppliers are located; industry conditions and trends; credit market volatility;

risks related to supply chain delays and disruptions and their impact on the Company’s business and results, including the Company’s

ability to deliver products and provide services to its customers on a timely basis; risks relating to inflation, including the current

inflationary trend, and the impact of inflation on the Company’s costs and its ability to increase the price of its products and

services to offset such costs, and on the market for the Company’s products and services; risks related to labor shortages and increases

in the costs of labor, and the impact thereof on the Company, including its ability to deliver products, provide services or otherwise

meet customers’ expectations; risks associated with international relations and international hostilities and the impact thereof

on economic conditions, including supply chain constraints and inflationary trends; risks relating to rising interest rates, including

the impact thereof on the cost of the Company’s indebtedness and the Company’s ability to raise capital if deemed necessary

or advisable; risks related to the Company’s ability to implement its business and growth strategies and plans, including changes

thereto, and the risk that the Company may not be successful in achieving its goals; risks and uncertainties associated with the Company’s

”buy-and-build” growth strategy, including, without limitation, that the Company may not be successful in identifying or consummating,

or have the liquidity to or otherwise be financially positioned or able to consummate, acquisitions or other strategic transactions, integration

risks, risks related to indebtedness incurred by the Company in connection with the financing of acquisitions, dilution experienced by

the Company’s existing stockholders as a result of the issuance of shares of the Company’s common stock in connection with

acquisitions or other strategic transactions (or for other

purposes), risks related to the business, operations and prospects of acquired

businesses, risks that suppliers of the acquired business may not consent to the transaction or otherwise continue its relationship with

the acquired business following the transaction and the impact that the loss of any such supplier may have on the results of the Company

and the acquired business, risks that the Company’s goals or expectations with respect to acquisitions and other strategic transactions

may not be met, and risks related to the accounting for acquisitions; risks related to organic growth initiatives, including that they

may not result in the benefits anticipated; risks that the Company’s investments, including in sales and service personnel, technology

investments, the Company’s planned e-commerce business, and other modernization and optimization initiatives, and investments in

acquired businesses or otherwise in support of growth, and initiatives in furtherance thereof may not result in the benefits anticipated

and may result in disruptions to the Company’s operations, expenses in connection with these investments and initiatives may be

more costly than anticipated and the implementation of these initiatives may not be completed when expected; technology changes; competition,

including the Company’s ability to compete effectively and the impact that competition may have on the Company and its results,

including the prices which the Company may charge for its products and services and on the Company’s profit margins, and competition

for qualified employees; to the extent applicable, risks relating to the Company’s ability to enter into and compete effectively

in new industries, as well as risks and trends related to those industries; risks related to the Company’s planned e-commerce business;

risks relating to the Company’s relationships with its principal suppliers and customers, including concentration risks and the

impact of the loss of any such relationship; risks related to the Company’s indebtedness, including that amounts available for borrowing

under the Company’s credit facility are subject to the terms and conditions of the facility and, accordingly, the amount of liquidity

available to the Company may be less than the amount set forth herein; the availability, terms and deployment of debt and equity capital

if needed for expansion or otherwise; the availability and cost of inventory purchased by the Company, and the risk that inventory management

initiatives may not be successful; risks relating to the recognition of revenue, including the amount and timing thereof (including potential

delays resulting from, among other circumstances, delays in installation); the risk that orders in the Company’s backlog may not

be fulfilled as or when expected; the risk that dividends may not be paid in the future; risks of cybersecurity threats or incidents,

including the potential misappropriation or use of assets or confidential information, corruption of data or operational disruptions;

and other economic, competitive, governmental, technological and other risks and factors discussed elsewhere in the Company’s filings

with the SEC, including, without limitation, in the “Risk Factors” section of the Company’s Annual Report on Form 10-K

for the fiscal year ended June 30, 2024. Many of these risks and factors are beyond the Company’s control. Further, past performance

and perceived trends may not be indicative of future results. The Company cautions that the foregoing factors are not exclusive. The reader

should not place undue reliance on any forward-looking statement, which speaks only as of the date made. The Company does not undertake

to, and specifically disclaims any obligation to, update, revise or supplement any forward-looking statement, whether as a result of changes

in circumstances, new information, subsequent events or otherwise, except as may be required by law.

EVI Industries, Inc.

Condensed

Consolidated Results of Operations (in thousands, except per share data)

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| | |

6-Months

Ended | | |

6-Months

Ended | | |

3-Months

Ended | | |

3-Months

Ended | |

| | |

12/31/24 | | |

12/31/23 | | |

12/31/24 | | |

12/31/23 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 186,336 | | |

$ | 179,438 | | |

$ | 92,711 | | |

$ | 91,364 | |

| Cost of Sales | |

| 129,959 | | |

| 127,340 | | |

| 65,189 | | |

| 64,958 | |

| Gross Profit | |

| 56,377 | | |

| 52,098 | | |

| 27,522 | | |

| 26,406 | |

| SG&A | |

| 48,998 | | |

| 46,530 | | |

| 25,132 | | |

| 23,455 | |

| Operating Income | |

| 7,379 | | |

| 5,568 | | |

| 2,390 | | |

| 2,951 | |

| Interest Expense, net | |

| 1,152 | | |

| 1,593 | | |

| 670 | | |

| 823 | |

| Income before Income Taxes | |

| 6,227 | | |

| 3,975 | | |

| 1,720 | | |

| 2,128 | |

| Provision for Income Taxes | |

| 1,867 | | |

| 1,352 | | |

| 591 | | |

| 787 | |

| Net Income | |

$ | 4,360 | | |

$ | 2,623 | | |

$ | 1,129 | | |

$ | 1,341 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Earnings per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.29 | | |

$ | 0.18 | | |

$ | 0.08 | | |

$ | 0.09 | |

| Diluted | |

$ | 0.29 | | |

$ | 0.17 | | |

$ | 0.07 | | |

$ | 0.09 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 12,712 | | |

| 12,621 | | |

| 12,739 | | |

| 12,659 | |

| Diluted | |

| 13,124 | | |

| 13,245 | | |

| 13,182 | | |

| 13,273 | |

| | |

| | | |

| | | |

| | | |

| | |

EVI Industries, Inc.

Condensed Consolidated Balance Sheets (in thousands, except per share data)

| | |

Unaudited | | |

| |

| | |

12/31/24 | | |

06/30/24 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 3,905 | | |

$ | 4,558 | |

| Accounts receivable, net | |

| 46,663 | | |

| 40,932 | |

| Inventories, net | |

| 50,487 | | |

| 47,901 | |

| Vendor deposits | |

| 2,835 | | |

| 1,657 | |

| Contract assets | |

| 978 | | |

| 1,222 | |

| Other current assets | |

| 8,231 | | |

| 5,671 | |

| Total current assets | |

| 113,099 | | |

| 101,941 | |

| Equipment and improvements, net | |

| 14,648 | | |

| 13,950 | |

| Operating lease assets | |

| 8,207 | | |

| 8,078 | |

| Intangible assets, net | |

| 24,124 | | |

| 22,022 | |

| Goodwill | |

| 79,473 | | |

| 75,102 | |

| Other assets | |

| 9,251 | | |

| 9,566 | |

| Total assets | |

$ | 248,802 | | |

$ | 230,659 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 31,240 | | |

$ | 30,904 | |

| Accrued employee expenses | |

| 10,779 | | |

| 11,370 | |

| Customer deposits | |

| 26,247 | | |

| 24,419 | |

| Current portion of operating lease liabilities | |

| 3,426 | | |

| 3,110 | |

| Total current liabilities | |

| 71,692 | | |

| 69,803 | |

| Deferred income taxes, net | |

| 5,537 | | |

| 5,498 | |

| Long-term operating lease liabilities | |

| 5,644 | | |

| 5,849 | |

| Long-term debt, net | |

| 27,920 | | |

| 12,903 | |

| Total liabilities | |

| 110,793 | | |

| 94,053 | |

| | |

| | | |

| | |

| Shareholders' equity | |

| | | |

| | |

| Preferred stock, $1.00 par value | |

| — | | |

| — | |

| Common stock, $.025 par value | |

| 324 | | |

| 322 | |

| Additional paid-in capital | |

| 108,857 | | |

| 106,540 | |

| Treasury stock | |

| (5,122 | ) | |

| (4,439 | ) |

| Retained earnings | |

| 33,950 | | |

| 34,183 | |

| Total shareholders' equity | |

| 138,009 | | |

| 136,606 | |

| Total liabilities and shareholders' equity | |

$ | 248,802 | | |

$ | 230,659 | |

EVI Industries, Inc.

Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited)

| | |

For the six months ended | |

| | |

12/31/24 | | |

12/31/23 | |

| Operating activities: | |

| | | |

| | |

| Net income | |

$ | 4,360 | | |

$ | 2,623 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 3,107 | | |

| 3,000 | |

| Amortization of debt discount | |

| 17 | | |

| 17 | |

| Provision for expected credit losses | |

| 602 | | |

| 283 | |

| Non-cash lease expense | |

| (18 | ) | |

| 49 | |

| Stock compensation | |

| 2,263 | | |

| 2,924 | |

| Inventory reserve | |

| 647 | | |

| 274 | |

| Provision (benefit) for deferred income taxes | |

| 39 | | |

| (19 | ) |

| Other | |

| (104 | ) | |

| 25 | |

| (Increase) decrease in operating assets: | |

| | | |

| | |

| Accounts receivable | |

| (5,952 | ) | |

| 3,910 | |

| Inventories | |

| (518 | ) | |

| 3,193 | |

| Vendor deposits | |

| (1,178 | ) | |

| 562 | |

| Contract assets | |

| 244 | | |

| (2,388 | ) |

| Other assets | |

| (2,100 | ) | |

| 1,269 | |

| (Decrease) increase in operating liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| (7 | ) | |

| (4,172 | ) |

| Accrued employee expenses | |

| (591 | ) | |

| 104 | |

| Customer deposits | |

| 1,365 | | |

| (349 | ) |

| Contract liabilities | |

| — | | |

| (447 | ) |

| Net cash provided by operating activities | |

| 2,176 | | |

| 10,858 | |

| | |

| | | |

| | |

| Investing activities: | |

| | | |

| | |

| Capital expenditures | |

| (2,124 | ) | |

| (2,376 | ) |

| Cash paid for acquisitions, net of cash acquired | |

| (10,485 | ) | |

| (987 | ) |

| Net cash used by investing activities | |

| (12,609 | ) | |

| (3,363 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Dividends paid | |

| (4,593 | ) | |

| (4,071 | ) |

| Proceeds from borrowings | |

| 45,000 | | |

| 35,500 | |

| Debt repayments | |

| (30,000 | ) | |

| (39,500 | ) |

| Repurchases of common stock in satisfaction of employee tax withholding obligations | |

| (683 | ) | |

| (1,144 | ) |

| Issuances of common stock under employee stock purchase plan | |

| 56 | | |

| 63 | |

| Net cash provided (used) by financing activities | |

| 9,780 | | |

| (9,152 | ) |

| Net decrease in cash | |

| (653 | ) | |

| (1,657 | ) |

| Cash at beginning of period | |

| 4,558 | | |

| 5,921 | |

| Cash at end of period | |

$ | 3,905 | | |

$ | 4,264 | |

| | |

| | | |

| | |

EVI

Industries, Inc.

Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited)

| | |

For the six months ended | |

| | |

| 12/31/24 | | |

| 12/31/23 | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 1,017 | | |

$ | 1,578 | |

| Cash paid during the period for income taxes | |

$ | 1,090 | | |

$ | 3,631 | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash financing activities: | |

| | | |

| | |

| Issuances of common stock for acquisitions | |

| — | | |

$ | 229 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

The following table reconciles net income, the most comparable GAAP

financial measure, to Adjusted EBITDA.

EVI Industries, Inc.

Condensed

Consolidated Earnings before Interest, Taxes, Depreciation, Amortization, and Amortization of Stock-based Compensation (in thousands)

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| | |

6-Months

Ended | | |

6-Months

Ended | | |

3-Months

Ended | | |

3-Months

Ended | |

| | |

12/31/24 | | |

12/31/23 | | |

12/31/24 | | |

12/31/23 | |

| | |

| | |

| | |

| | |

| |

| Net Income | |

$ | 4,360 | | |

$ | 2,623 | | |

$ | 1,129 | | |

$ | 1,341 | |

| Provision for Income Taxes | |

| 1,867 | | |

| 1,352 | | |

| 591 | | |

| 787 | |

| Interest Expense, Net | |

| 1,152 | | |

| 1,593 | | |

| 670 | | |

| 823 | |

| Depreciation and Amortization | |

| 3,107 | | |

| 3,000 | | |

| 1,557 | | |

| 1,454 | |

| Amortization of Stock-based Compensation | |

| 2,263 | | |

| 2,924 | | |

| 1,196 | | |

| 1,068 | |

| Adjusted EBITDA | |

$ | 12,749 | | |

$ | 11,492 | | |

$ | 5,143 | | |

$ | 5,473 | |

| | |

| | | |

| | | |

| | | |

| | |

EVI Industries, Inc.

4500 Biscayne Blvd., Suite 340

Miami, Florida 33137

(305) 402-9300

Henry M. Nahmad

Chairman and CEO

(305) 402-9300

Craig Ettelman

Director of Finance and Investor Relations

(305) 402-9300

info@evi-ind.com

v3.25.0.1

Cover

|

Feb. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 10, 2025

|

| Entity File Number |

001-14757

|

| Entity Registrant Name |

EVI Industries, Inc.

|

| Entity Central Index Key |

0000065312

|

| Entity Tax Identification Number |

11-2014231

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4500 Biscayne Blvd.

|

| Entity Address, Address Line Two |

Suite 340

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33137

|

| City Area Code |

(305)

|

| Local Phone Number |

402-9300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.025 par value

|

| Trading Symbol |

EVI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

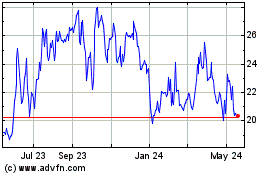

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Feb 2025 to Mar 2025

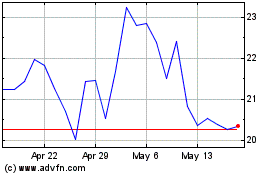

EVI Industries (AMEX:EVI)

Historical Stock Chart

From Mar 2024 to Mar 2025