Friedman Industries, Incorporated (NYSE American: FRD) announced

today its results of operations for the quarter and fiscal year

ended March 31, 2024.

March 31, 2024 Quarter

Highlights:

- Net earnings of $5.0 million

- Sales of $132.2 million

- 13% increase in sales volume over the preceding third

quarter

- 9% increase in sales volume over the prior year fourth

quarter

Fiscal Year March 31, 2024

Highlights:

- Net earnings of $17.3 million - second most profitable

fiscal year in Company history

- Sales of $516.3 million

- 19% increase in sales volume over prior fiscal

year

- Working capital balance at year-end of $116.0

million

“We ended fiscal 2024 with a strong fourth

quarter that made it our second most profitable fiscal year in

Friedman’s history,” said Michael J. Taylor, President and Chief

Executive Officer. “This result is evidence of the quality of our

assets and our strategy, as well as the hard work and dedication of

our team members, who make and deliver our products to customers

every day.”

Taylor continued, “Our sales volume increased

approximately 19% in fiscal 2024 compared to our previous fiscal

year with the growth driven by output from our new Sinton, TX

facility. We expect further growth from our Sinton facility in

fiscal 2025 as we approach full production capacity. At the end of

fiscal 2024, we neared completion of an upgrade to our Decatur, AL

processing line that will allow us to increase the sales volume

from that facility in fiscal 2025. The Company’s market share

continues to expand with our products being a vital part of the

defined supply chain for more of the country’s top steel consumers.

Fiscal 2024 was another year of considerable steel price volatility

but we maintained profitability in each quarter of fiscal 2024,

demonstrating our ability to analyze and respond appropriately to

changing market conditions.”

“I am pleased that investors are starting to

recognize the value of our Company. Our stock began fiscal 2024

trading in the $11 per share range and ended the fiscal year

considerably higher. We have more value to unlock by delivering

consistent profitability across price cycles and maximizing output

from our current assets. In addition, our strategy remains focused

on opportunities that will deliver long-term value to the Company

and its shareholders. Our dividend increase in March reflects our

favorable outlook; I see value in Friedman today along with

significant opportunities for growth in the future,” Taylor

concluded.

For the quarter ended March 31, 2024 (the “2024

quarter”), the Company recorded net earnings of approximately $5.0

million ($0.71 diluted earnings per share) on sales of

approximately $132.2 million compared to net earnings of

approximately $6.3 million ($0.86 diluted earnings per share) on

net sales of approximately $124.2 million for the quarter ended

March 31, 2023 (the “2023 quarter”). Sales volume increased from

approximately 146,000 tons for the 2023 quarter to approximately

159,000 tons for the 2024 quarter.

For the year ended March 31, 2024 (“fiscal

2024”), the Company recorded net earnings of approximately $17.3

million ($2.39 diluted earnings per share) on sales of

approximately $516.3 million. For the year ended March 31, 2023

(“fiscal 2023”), the Company recorded net earnings of approximately

$21.3 million ($2.91 diluted earnings per share) on sales of

approximately $547.5 million.

The table below provides our statements of

operations for the quarters and fiscal years ended March 31, 2024

and 2023:

| SUMMARY OF

OPERATIONS |

|

|

|

|

|

|

|

| (In thousands, except

for per share data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

Year Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Net Sales |

$ |

132,232 |

|

|

$ |

124,186 |

|

|

$ |

516,251 |

|

|

$ |

547,542 |

|

| |

|

|

|

|

|

|

|

| Cost of materials sold |

|

(104,724 |

) |

|

|

(97,075 |

) |

|

|

(417,143 |

) |

|

|

(456,419 |

) |

| Processing and warehousing

expense |

|

(7,285 |

) |

|

|

(5,557 |

) |

|

|

(26,690 |

) |

|

|

(21,146 |

) |

| Delivery expense |

|

(6,356 |

) |

|

|

(7,187 |

) |

|

|

(23,791 |

) |

|

|

(24,483 |

) |

| Selling, general and

administrative expenses |

|

(6,156 |

) |

|

|

(6,525 |

) |

|

|

(21,039 |

) |

|

|

(21,894 |

) |

| Depreciation and

amortization |

|

(778 |

) |

|

|

(588 |

) |

|

|

(3,070 |

) |

|

|

(2,526 |

) |

| |

|

|

|

|

|

|

|

| Earnings from operations |

|

6,933 |

|

|

|

7,254 |

|

|

|

24,518 |

|

|

|

21,074 |

|

| |

|

|

|

|

|

|

|

| Gain on economic hedges of

risk |

|

1,142 |

|

|

|

1,980 |

|

|

|

1,848 |

|

|

|

9,306 |

|

| Interest expense |

|

(937 |

) |

|

|

(720 |

) |

|

|

(3,072 |

) |

|

|

(2,218 |

) |

| Other income |

|

3 |

|

|

|

3 |

|

|

|

20 |

|

|

|

27 |

|

| |

|

|

|

|

|

|

|

| Earnings before income

taxes |

|

7,141 |

|

|

|

8,517 |

|

|

|

23,314 |

|

|

|

28,189 |

|

| |

|

|

|

|

|

|

|

| Income tax expense |

|

(2,183 |

) |

|

|

(2,206 |

) |

|

|

(5,969 |

) |

|

|

(6,845 |

) |

| |

|

|

|

|

|

|

|

| Net earnings |

$ |

4,958 |

|

|

$ |

6,311 |

|

|

$ |

17,345 |

|

|

$ |

21,344 |

|

| |

|

|

|

|

|

|

|

| Net earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.71 |

|

|

$ |

0.86 |

|

|

$ |

2.39 |

|

|

$ |

2.91 |

|

|

Diluted |

$ |

0.71 |

|

|

$ |

0.86 |

|

|

$ |

2.39 |

|

|

$ |

2.91 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The table below provides summarized balance

sheets as of March 31, 2024 and 2023:

|

SUMMARIZED BALANCE SHEETS |

|

|

|

|

|

|

|

| (In

thousands) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

March 31, 2024 |

|

March 31, 2023 |

| ASSETS: |

|

|

|

|

|

|

|

| Current Assets |

|

170,064 |

|

|

|

143,656 |

|

| Noncurrent Assets |

|

59,955 |

|

|

|

55,656 |

|

| Total Assets |

|

230,019 |

|

|

|

199,312 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

| Current Liabilities |

|

54,107 |

|

|

|

45,088 |

|

| Noncurrent Liabilities |

|

48,437 |

|

|

|

38,792 |

|

| Total Liabilities |

|

102,544 |

|

|

|

83,880 |

|

| |

|

|

|

|

|

|

|

| Total Stockholders'

Equity |

|

127,475 |

|

|

|

115,432 |

|

| |

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

230,019 |

|

|

|

199,312 |

|

| |

|

|

|

|

|

|

|

FLAT-ROLL SEGMENT

OPERATIONS

Flat-roll segment sales for the 2024 quarter

totaled approximately $120.6 million compared to approximately

$112.8 million for the 2023 quarter. The flat-roll segment had

sales volume of approximately 120,000 tons from inventory and

another 29,500 tons of toll processing for the 2024 quarter

compared to approximately 124,000 tons from inventory and 14,000

tons of toll processing for the 2023 quarter. The average per ton

selling price of flat-roll segment inventory increased from

approximately $915 per ton in the 2023 quarter to

approximately $993 per ton in the 2024 quarter. The flat-roll

segment recorded operating profits of approximately $9.6

million and $7.7 million for the 2024 quarter and

2023 quarter, respectively.

TUBULAR SEGMENT OPERATIONS

Tubular segment sales for the 2024 quarter

totaled approximately $11.6 million compared to approximately $11.4

million for the 2023 quarter. Tons sold increased from

approximately 8,000 tons for the 2023 quarter to

approximately 9,500 tons for the 2024 quarter. The average per ton

selling price of tubular segment inventory decreased from

approximately $1,404 per ton in the 2023 quarter to

approximately $1,216 per ton in the 2024 quarter. The tubular

segment recorded operating profits of approximately $0.8 million

and $2.5 million for the 2024 quarter and 2023 quarter,

respectively.

HEDGING ACTIVITIES

We utilize hot-rolled coil (“HRC”) futures to

manage price risk on unsold inventory and longer-term fixed price

sales agreements. We typically account for our hedging activities

under mark-to-market (“MTM”) accounting treatment and all hedging

decisions are intended to protect the value of our inventory and

produce more consistent financial results over price cycles. With

MTM accounting treatment it is possible that hedging related gains

or losses might be recognized in a different fiscal year or fiscal

quarter than the corresponding improvement or contraction in our

physical margins. For the 2024 quarter, we recognized a gain on

hedging activities of approximately $1.1 million. For fiscal 2024,

we recognized a total hedging gain of approximately $1.4

million.

OUTLOOK

“Friedman had a strong fiscal 2024 and we

believe we can deliver continued success in fiscal 2025,” Taylor

said. “We have one of the best teams in the industry and a solid

company with the foundation to grow long-term shareholder

value.”

The Company expects sales volume for its first

quarter of fiscal 2025 to be similar to the sales volume for the

fourth quarter of fiscal 2024 despite the first quarter having half

a month of planned downtime for new equipment installation at our

Decatur facility and our Sinton facility having a week of planned

maintenance downtime. The Company expects first quarter margins to

be lower than fourth quarter margins due to declining HRC prices

during the first quarter but anticipates the lower margin to be

offset by hedging gains. As of the date of this release, hedging

gains for the first quarter of fiscal 2025 totaled approximately

$5.3 million.

ABOUT FRIEDMAN INDUSTRIES

Friedman Industries, Incorporated (“Company”),

headquartered in Longview, Texas, is a manufacturer and processor

of steel products with operating plants in Hickman, Arkansas;

Decatur, Alabama; East Chicago, Indiana; Granite City, Illinois;

Sinton, Texas and Lone Star, Texas. The Company has two reportable

segments: flat-roll products and tubular products. The flat-roll

product segment consists of the operations in Hickman, Decatur,

East Chicago, Granite City and Sinton where the Company processes

hot-rolled steel coils. The Hickman, East Chicago and Granite City

facilities operate temper mills and corrective leveling

cut-to-length lines. The Sinton and Decatur facilities operate

stretcher leveler cut-to-length lines. The Sinton facility is a

newly constructed facility with operations commencing in October

2022. The East Chicago and Granite City facilities were acquired

from Plateplus, Inc. on April 30, 2022. The tubular product segment

consists of the operations in Lone Star where the Company

manufactures electric resistance welded pipe and distributes pipe

through its Texas Tubular Products division.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, and such statements involve

risk and uncertainty. Forward-looking statements include those

preceded by, followed by or including the words “will,” “expect,”

“intended,” “anticipated,” “believe,” “project,” “forecast,”

“propose,” “plan,” “estimate,” “enable,” and similar expressions,

including, for example, statements about our business strategy, our

industry, our future profitability, growth in the industry sectors

we serve, our expectations, beliefs, plans, strategies, objectives,

prospects and assumptions, future production capacity, product

quality and estimates and projections of future activity and trends

in the oil and natural gas industry. These forward-looking

statements may include, but are not limited to, everything under

the header “Outlook” above, including sales volumes, margins,

hedging results, and potential price increases, expectations as to

financial results during the Company’s upcoming fiscal quarters,

future changes in the Company’s financial condition or results of

operations, future production capacity, product quality and

proposed expansion plans. Forward-looking statements may be made by

management orally or in writing including, but not limited to, this

news release.

Forward-looking statements are not guarantees of

future performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. Although forward-looking statements

reflect our current beliefs, reliance should not be placed on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which may cause our actual

results, performance or achievements to differ materially from

anticipated future results, performance or achievements expressed

or implied by such forward-looking statements.

Actual results and trends in the future may

differ materially depending on a variety of factors including, but

not limited to, changes in the demand for and prices of the

Company’s products, changes in government policy regarding steel,

changes in the demand for steel and steel products in general and

the Company’s success in executing its internal operating plans,

changes in and availability of raw materials, our ability to

satisfy our take or pay obligations under certain supply

agreements, unplanned shutdowns of our production facilities due to

equipment failures or other issues, increased competition from

alternative materials and risks concerning innovation, new

technologies, products and increasing customer requirements.

Accordingly, undue reliance should not be placed on our

forward-looking statements. Such risks and uncertainty are also

addressed in our Management’s Discussion and Analysis of Financial

Condition and Results of Operations and other sections of the

Company’s filings with the U.S. Securities and Exchange Commission

(the “SEC”) under the Securities Act of 1933, as amended, and the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

including the Company’s Annual Report on Form 10-K and its other

Quarterly Reports on Form 10-Q. We undertake no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, changed circumstances

or otherwise, except to the extent law requires.

For further information, please refer to the

Company’s Form 10-K as filed with the SEC on June 11, 2024 or

contact Alex LaRue, Chief Financial Officer – Secretary and

Treasurer, at (903)758-3431.

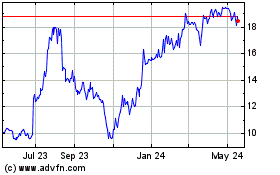

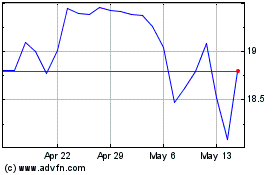

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Friedman Industries (AMEX:FRD)

Historical Stock Chart

From Feb 2024 to Feb 2025