UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

SCHEDULE

14A

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant

to §240.14a-11(c) or §240.14a-12 |

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

1) |

Title of each class of securities

to which transaction applies: |

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11: |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

Flexible

Solutions International, Inc.

6001

54 Ave.

Taber,

AB

Canada

T1G 1X4

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

TO

BE HELD DECEMBER 30, 2024

To

the Shareholders:

Notice

is hereby given that the annual meeting of the shareholders of Flexible Solutions International, Inc. (“Flexible Solutions”)

will be held at 37 Sonny Powery’s Drive, West Bay, Grand Cayman, Cayman Islands on

December 30, 2024, at 11:00 a.m. Eastern Time, for the following purposes:

(1)

to elect the directors who shall constitute the Company’s Board of Directors for the ensuing year;

(2)

to approve on an advisory basis, the compensation of the Company’s executive officers;

(3)

to approve, on a non-binding advisory basis, the frequency of the advisory vote regarding the compensation of the Company’s executive

officers;

(4)

to ratify the appointment of Assure CPA, LLC as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2024 and

to

transact such other business as may properly come before the meeting.

December

2, 2024 is the record date for the determination of shareholders entitled to notice of and to vote at such meeting. Shareholders are

entitled to one vote for each share held. As of December 2, 2024 there were 12,455,532 outstanding shares of the Company’s common

stock.

| |

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

|

| December 2, 2024 |

Daniel

B. O’Brien, President

|

PLEASE

INDICATE YOUR VOTING INSTRUCTIONS ON THE ATTACHED PROXY CARD, AND SIGN, DATE AND RETURN THE PROXY CARD.

TO

SAVE THE COST OF FURTHER SOLICITATION,

PLEASE

VOTE PROMPTLY

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

6001

54 Ave.

Taber,

AB

Canada

T1G 1X4

(250)

477-9969

PROXY

STATEMENT

The

accompanying proxy is solicited by the Company’s directors for voting at the annual meeting of shareholders to be held on December

30, 2024, at 11:00 a.m. Eastern Time, and at any and all adjournments of such meeting. If the proxy is executed and returned, it will

be voted at the meeting in accordance with any instructions, and if no specification is made, the proxy will be voted for the proposals

set forth in the accompanying notice of the annual meeting of shareholders. Shareholders who execute proxies may revoke them at any time

before they are voted, either by writing to the Company at the address shown above or in person at the time of the meeting. Additionally,

any later dated proxy will revoke a previous proxy from the same shareholder. This proxy statement was posted on the Company’s

website on or about December 2, 2024.

There

is one class of capital stock outstanding. Provided a quorum consisting of 10% of the shares entitled to vote is present at the meeting,

the affirmative vote of a majority of the shares of common stock voting in person or represented by proxy at the meeting is required

to elect directors and to adopt the other proposals to come before the meeting. Cumulative voting in the election of directors is not

permitted.

Shares

of the Company’s common stock represented by properly executed proxies that reflect abstentions or “broker non-votes”

will be counted as present for purposes of determining the presence of a quorum at the annual meeting. “Broker non-votes”

represent shares held by brokerage firms in “street-name” with respect to which the broker has not received instructions

from the customer or otherwise does not have discretionary voting authority. Abstentions and broker non-votes will not be counted as

having voted against the proposals to be considered at the meeting.

PRINCIPAL

SHAREHOLDERS

The

following table lists, as of December 2, 2024, the shareholdings of (i) each person owning beneficially 5% or more of the Company’s

common stock (ii) each officer of the Company, (iii) each person nominated to be a director, and (iv) all officers and nominees to the

Board of Directors as a group. Unless otherwise indicated, each owner has sole voting and investment powers over his shares of common

stock.

| | |

Shares

(1) | | |

Percentage

Ownership | |

| | |

| | |

| |

| Daniel

B. O’Brien | |

| 4,270,156 | | |

| 34.3 | % |

| 6001

54 Ave. | |

| | | |

| | |

| Taber,

AB | |

| | | |

| | |

| Canada

T1G 1X4 | |

| | | |

| | |

| | |

| | | |

| | |

| John

Bientjes | |

| 0 | | |

| 0 | % |

| 46081

Greenwood Dr. | |

| | | |

| | |

| Chilliwack,

BC | |

| | | |

| | |

| Canada

V2R 4C9 | |

| | | |

| | |

| | |

Shares

(1) | | |

Percentage

Ownership | |

| | |

| | |

| |

| Robert

Helina | |

| 75,000 | | |

| 0.6 | % |

| 6001

54 Ave. | |

| | | |

| | |

| Taber,

AB | |

| | | |

| | |

Canada

T1G 1X4

| |

| | | |

| | |

| | |

| | | |

| | |

| Dr.

Thomas Fyles | |

| 20,000 | | |

| 0.1 | % |

| Box

3065 | |

| | | |

| | |

| Victoria,

BC | |

| | | |

| | |

| Canada

V8W 3V6 | |

| | | |

| | |

| | |

| | | |

| | |

| Ben

Seaman | |

| 0 | | |

| 0 | % |

| Unit

605 5 E. Cordova St. | |

| | | |

| | |

| Vancouver

BC | |

| | | |

| | |

| Canada

V6A 0A5 | |

| | | |

| | |

| | |

| | | |

| | |

| David

Fynn | |

| 0 | | |

| 0 | % |

| 202-2526

Yale Court, | |

| | | |

| | |

| Abbotsford,

BC | |

| | | |

| | |

| Canada

V2S 8G9 | |

| | | |

| | |

| | |

| | | |

| | |

| All

officers and directors as a group (6 persons) | |

| 4,365,156 | | |

| 35 | % |

| | |

| | | |

| | |

| Other

Principal Shareholders | |

| 1,351,221 | | |

| 10.9 | % |

| Comprehensive

Financial Planning, Inc. | |

| | | |

| | |

| (1) |

Includes

shares which may be acquired on the exercise of the stock options, all of which were exercisable as of December 2, 2024, listed below. |

| Name | |

No.

of Options | | |

Exercise

Price | | |

Expiration

Date |

| | |

| | |

| | |

|

| Robert Helina | |

| 5,000 | | |

$ | 2.44 | | |

December 31, 2024 |

| | |

| 5,000 | | |

$ | 2.44 | | |

December 31, 2025 |

| | |

| 5,000 | | |

$ | 3.61 | | |

December 31, 2026 |

| | |

| 5,000 | | |

$ | 3.55 | | |

December 31, 2027 |

Each

option allows for the purchase of one share of the Company’s common stock.

ELECTION

OF DIRECTORS

Unless

the proxy contains contrary instructions, it is intended that the proxies will be voted for the election of the persons listed below

to serve as members of the board of directors until the next annual meeting of shareholders and until their successors shall be elected

and shall qualify.

All

nominees to the Board of Directors have consented to stand for re-election. In case any nominee shall be unable or shall fail to act

as a director by virtue of an unexpected occurrence, the proxies may be voted for such other person or persons as shall be determined

by the persons acting under the proxies in their discretion.

Daniel

O’Brien and John Bientjes have served as directors for a significant period of time and each of those directors’ long-standing

experience with the Company benefits both the Company and its shareholders. Robert Helina is qualified to act as a director due to his

longstanding financial experience. Dr. Fyles is qualified to act as a director due to his experience in chemistry. Ben Seaman is familiar

with the Company and is qualified to act as a director due to his experience in marketing and distribution. David Fynn has accounting

experience which benefits both the Company and its shareholders.

Information

concerning the nominees to the Company’s Board of Directors follows:

| Name |

|

Age |

|

Position |

| |

|

|

|

|

| Daniel

B. O’Brien |

|

68 |

|

President,

Director |

| John

H. Bientjes |

|

72 |

|

Director |

| Robert

Helina |

|

59 |

|

Director |

| Thomas

Fyles |

|

72 |

|

Director |

| Ben

Seaman |

|

44 |

|

Director |

| David

Fynn |

|

67 |

|

Director |

Directors

are elected annually and hold office until the next annual meeting of our stockholders and until their successors are elected and qualified.

All executive offices are chosen by the board of directors and serve at the board’s discretion.

Daniel

B. O’Brien has served as the Company’s President and Chief Executive Officer, as well as a director of the Company since

June 1998. He has been involved in the swimming pool industry since 1990, when he founded the Company’s subsidiary, Flexible Solutions

Ltd. From 1990 to 1998 Mr. O’Brien was also a teacher at Brentwood College where he was in charge of outdoor education.

John

H. Bientjes has been a director since 2000. From 1984 to 2018, Mr. Bientjes served as the manager of the Commercial Aquatic Supplies

Division of D.B. Perks & Associates, Ltd., located in Vancouver, British Columbia, a company that markets supplies and equipment

to commercial swimming pools which are primarily owned by municipalities. Mr. Bientjes retired in 2018. Mr. Bientjes graduated in 1976

from Simon Fraser University in Vancouver, British Columbia with a Bachelor of Arts Degree in Economics and Commerce.

Robert

T. Helina has been a director since October 2011. Mr. Helina has been involved in the financial services industry for over 25 years which

has given him extensive knowledge in business, economics and finance. His specially is in corporate finance and capital markets. Mr.

Helina holds a Bachelor of Arts degree from Trinity Western University.

Thomas

M. Fyles has been a director since 2012. Dr. Fyles holds chemistry degrees from the University of Victoria (B.Sc. 1974) and York University

(Ph.D. 1977). Following postdoctoral work in France, he joined the Chemistry Department at the University of Victoria in 1979 where he

progressed through the academic ranks to Professor (1992) , Chair (2001 – 2006; 2008), and, on his retirement, Professor Emeritus

(2017). His research program spanned analytical, synthetic, and physical chemistry with an emphasis on sensors, membranes, and water

treatment processes.

Ben

Seaman has been a director of the Company since October 2016. Mr. Seaman has been the CEO of Eartheasy.com Sustainable Living Ltd since

2007, growing the company from $50K to over $25M in annual revenue. His company has contributed over $1M towards clean water projects

in Kenya since 2013, and has been recognized internationally by the Stockholm Challenge Award and the Outdoor Industry Inspiration Award

in 2016. Prior to that, he worked in sales and investor relations at Flexible Solutions. Mr. Seaman graduated from the University of

Victoria with a Bachelor of Science degree in 2004. He has significant experience in launching new products, marketing, distribution

and e-commerce in both the US and Canada. He’s a strong believer in the triple bottom line approach to business, giving consideration

to social and environmental issues in addition to financial performance.

David

Fynn has been a director of the Company since October 2016. Mr. Fynn is a Canadian Chartered Professional Accountant and services individuals/companies

in many sectors including mining and commodities in his private practice. David worked as a senior manager with KPMG in Canada and Ernst

& Young in the United Kingdom and Saudi Arabia. Since 1996 he has been the principal of D.A. Fynn & Associates Inc., an accounting

firm.

Daniel

B. O’Brien devotes substantially all of his time to the Company’s business.

The

Company’s Board of Directors met on two occasions during the year ended December 31, 2023. All of the Directors attended these

meetings either in person, by telephone conference call or by email.

The

Company’s Board of Directors does not have a “leadership structure”, as such, since each director is entitled to introduce

resolutions to be considered by the Board and each director is entitled to one vote on any resolution considered by the Board. The Company’s

Chief Executive Officer is not the Chairman of the Company’s Board of Directors.

The

Company’s Board of Directors has the ultimate responsibility to evaluate and respond to risks facing the Company. The Company’s

Board of Directors fulfills its obligations in this regard by meeting on a regular basis and communicating, when necessary, with the

Company’s officers.

John

Bientjes, Dr. Thomas Fyles, Ben Seaman and David Flynn are independent directors as that term is defined in section 803 of the listing

standards of the NYSE American.

For

purposes of electing directors at its annual meeting the Company does not have a nominating committee or a committee performing similar

functions. The Company’s Board of Directors does not believe a nominating committee is necessary since the Company’s Board

of Directors is small and the board of directors as a whole performs this function. The current nominees to the Board of Directors were

selected by a majority vote of the Company’s independent directors.

The

Company does not have any policy regarding the consideration of director candidates recommended by shareholders since a shareholder has

never recommended a nominee to the board of directors. However, the Company’s board of directors will consider candidates recommended

by shareholders. To submit a candidate for the board of directors the shareholder should send the name, address and telephone number

of the candidate, together with any relevant background or biographical information, to the Company’s Chief Executive Officer,

at the address shown on the cover page of this proxy statement. The board has not established any specific qualifications or skills a

nominee must meet to serve as a director. Although the board does not have any process for identifying and evaluating director nominees,

the board does not believe there would be any differences in the manner in which the board evaluates nominees submitted by shareholders

as opposed to nominees submitted by any other person. There have been no material changes to the procedures by which security holders

may recommend nominees to the Company’s board of directors during the past three years.

The

Company does not have a policy with regard to board member’s attendance at annual meetings. A majority of board members attended

in person or via conference the last annual shareholder’s meeting held on December 6, 2023.

Holders

of the Company’s common stock can send written communications to the Company’s entire board of directors, or to one or more

board members, by addressing the communication to “the Board of Directors” or to one or more directors, specifying the director

or directors by name, and sending the communication to the Company’s offices in Taber, Alberta. Communications addressed to the

Board of Directors as whole will be delivered to each board member. Communications addressed to a specific director (or directors) will

be delivered to the director (or directors) specified.

Security

holder communications not sent to the board of directors as a whole or to specified board members are not relayed to board members.

The

Company has adopted a Code of Ethics that applies to its Principal Financial and Accounting Officer, as well as the other company employees.

The Code of Ethics is available at the Company’s website at www.flexiblesolutions.com.

If

a violation of the code of ethics act is discovered or suspected, an officer of the Company must (anonymously, if desired) send a detailed

note, with relevant documents, to the Company’s Audit Committee, c/o John Bientjes, 46081 Greenwood Drive, Chilliwack, BC Canada

V2R 4C9

We

believe our directors benefit us for the following reasons:

| Name |

|

Reason |

| |

|

|

| Daniel B. O’Brien |

|

Long standing relationship with us. |

| John J. Bientjes |

|

Long standing relationship with us. |

Robert

Helina

|

|

Corporate finance experience. |

| Dr. Thomas Fyles |

|

Scientific expertise. |

| Ben Seaman |

|

Younger generation businessman increases our

awareness of internet sales and adds value to our audit and compensation committees |

| David Fynn |

|

Experienced accountant adds value to our audit

and compensation committees |

Executive

Compensation

The

following table shows in summary form the compensation earned by (i) our Chief Executive Officer and (ii) by each other executive officer

who earned in excess of $100,000 during the two fiscal years ended December 31, 2023.

| Name and Principal Position | |

Fiscal Year | |

Salary

(1) | | |

Bonus

(2) | | |

Restricted

Stock Awards (3) | | |

Options

Awards (4) | | |

All

Other Annual Compensation (5) | | |

Total | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Daniel B. O’Brien | |

2023 | |

$ | 785,368 | | |

| — | | |

| — | | |

$ | (660,000 | ) | |

| — | | |

$ | 125,368 | |

| President, Chief Executive Financial and Accounting

Officer | |

2022 | |

$ | 769,293 | | |

| — | | |

| — | | |

$ | 660,000 | | |

| — | | |

$ | 1,429,293 | |

| (1) |

The

dollar value of base salary (cash and non-cash) earned. |

| |

|

| (2) |

The

dollar value of bonus (cash and non-cash) earned. |

| |

|

| (3) |

During

the periods covered by the table, the value of the shares of restricted stock issued as compensation for services to the persons

listed in the table. |

| |

|

| (4) |

The

value of all stock options granted during the periods covered by the table. The options granted to Daniel O’Brien in 2022 were

cancelled in 2023. |

| |

|

| (5) |

All

other compensation received that we could not properly report in any other column of the table. |

During

the year ended December 31, 2012, the Company determined that Daniel B. O’Brien, the Company’s President and Chief Executive

Officer, was underpaid. Accordingly, the Company increased Mr. O’Brien’s annual salary to twice that which was paid to the

highest paid employee of the Company. Mr. O’Brien requested his salary be dropped by $100,000/year during 2019 and the Compensation

committee agreed. The Company expects that Mr. O’Brien’s salary for the year ending December 31, 2023 will again be twice

the annual salary, less $100,000, paid to the Company’s highest paid employee, excluding Mr. O’Brien.

In

the fall of 2023, Daniel O’Brien, CEO, relocated to Grand Cayman in order to help with international sales. He requested that his

salary be reduced to a flat $600,000 per year with annual increases at the same rate as other employees receive. The compensation committee

agreed and granted Mr. O’Brien’s request.

Non-Qualified

Stock Option Plan

In

August 2014 we adopted a Non-Qualified Stock Option Plan which authorizes the issuance of up to 1,500,000 shares of our common stock

to persons that exercise options granted pursuant to the Plan. Our employees, directors and officers, and consultants or advisors are

eligible to be granted options pursuant to the Non-Qualified Plan.

The

Plan is administered by our Compensation Committee. The Committee is vested with the authority to determine the number of shares issuable

upon the exercise of the options, the exercise price and expiration date of the options, and when, and upon what conditions options granted

under the Plan will vest or otherwise be subject to forfeiture and cancellation.

During

the fiscal year ended December 31, 2023 we did not issue any options pursuant to the Non-Qualified Plan (2022 – 5,000).

As

of December 31, 2023, options to purchase 542,000 shares of our common stock were outstanding under our Non-Qualified Stock Option Plan.

The exercise price of these options varies between $1.75 and $3.61 per share and the options expire at various dates between on January

31, 2024 and December 31, 2026.

Stock

Option Plans

In

2022 we adopted a Stock Incentive Plan which authorizes the issuance of up to 1,500,000 shares of our common stock to persons that exercise

options granted pursuant to the Plan. Our employees, directors and officers, and consultants or advisors are eligible to be granted options

pursuant to the Stock Incentive Plan.

The

Plan is administered by our Compensation Committee. The Committee is vested with the authority to determine the number of shares issuable

upon the exercise of the options, the exercise price and expiration date of the options, and when, and upon what conditions options granted

under the Plan will vest or otherwise be subject to forfeiture and cancellation.

During

the fiscal year ended December 31, 2023 we did not issue any options pursuant to the Stock Incentive Plan (2022 – 976,000).

As

of December 31, 2023, options to purchase 572,000 shares of our common stock were outstanding under our Stock Incentive Plan. The exercise

price of these options are $3.55 per share and the options expire on December 31, 2027.

Summary

The

following table shows the weighted average exercise price of the outstanding options granted pursuant to both our Non-Qualified Stock

Option Plan and Stock Incentive Plan as of December 31, 2023, our most recently completed fiscal year.

| Plan Category | |

Number

of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights | | |

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights | | |

Number

of Securities

Remaining Available for Future Issuance Under Equity

Compensation

Plans (Excluding

Securities Reflected

in Column (a)) | |

| | |

(a) | | |

(b) | | |

(c) | |

| Non-Qualified Stock Option Plan | |

| 542,000 | | |

$ | 2.40 | | |

| 57,000 | |

| Stock Incentive Plan | |

| 572,000 | | |

$ | 3.55 | | |

| 524,000 | |

Our

Non-Qualified Stock Option Plan and our Stock Incentive Plan had been approved by our shareholders.

No

options were exercised by our executive officers during the fiscal year ended December 31, 2023.

Director

Compensation

We

reimburse directors for any expenses incurred in attending board meetings. We also compensate directors $6,000 annually for each year

that they serve with an additional $4,000 paid to the head of the Audit Committee -

Our

directors received the following compensation in 2023:

| Name | |

Paid

in Cash | | |

Stock

Awards (1) | | |

Option

Awards (2) | |

| | |

| | |

| | |

| |

| John H. Bientjes | |

$ | 10,000 | | |

| — | | |

| — | |

| Robert Helina | |

$ | 6,000 | | |

| | | |

| | |

| Tom Fyles | |

$ | 6,000 | | |

| — | | |

| — | |

| Ben Seaman | |

$ | 6,000 | | |

| — | | |

| — | |

| David Fynn | |

$ | 6,000 | | |

| — | | |

| — | |

| (1) |

The

fair value of stock issued for services computed in accordance with ASC 718 on the date of grant. |

| |

|

| (2) |

The

fair value of options granted computed in accordance with ASC 718 on the date of grant. |

Daniel

B. O’Brien was not compensated for serving as a director during 2023.

Insider

Trading Arrangements and Policies

We

are committed to promoting high standards of ethical business conduct and compliance with applicable laws, rules and regulations. As

part of this commitment, we have adopted our Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities

by our directors, officers, employees and others that we believe is reasonably designed to promote compliance with insider trading laws,

rules and regulations. A copy of our Insider Trading Policy was filed as Exhibit 19 to our Annual Report on Form 10-K for the year ended

December 31, 2023.

The

following shows the terms of outstanding options held by the Company’s directors on December 2, 2024.

| | |

Shares Issuable Upon |

| Name | |

Option

Price | | |

Exercise

of Options | | |

Expiration

Date |

| Robert Helina | |

$ | 2.44 | | |

| 5,000 | | |

December 31, 2024 |

| | |

$ | 2.44 | | |

| 5,000 | | |

December 31, 2025 |

| | |

$ | 3.61 | | |

| 5,000 | | |

December 31, 2026 |

| | |

$ | 3.55 | | |

| 5,000 | | |

December 31, 2027 |

| | |

$ | 2.00 | | |

| 5,000 | | |

December 31, 2028 |

| | |

$ | 2.00 | | |

| 50,000 | | |

July 1, 2029 |

| Dan O’Brien | |

$ | 2.00 | | |

| 400,000 | | |

December 31, 2028 |

Compensation

Committee

The

Company’s Compensation Committee consists of John Bientjes, Ben Seaman and David Fynn, all of whom are independent as that term

is defined in Section 803 of the listing standards of the NYSE American.

The

Compensation Committee is empowered to review and approve the annual compensation and compensation procedures for the Company’s

officers and determines the total compensation level for the Company’s Chief Executive Officer. The total proposed compensation

of the Company’s Chief Executive Officer is formulated and evaluated by its Chief Executive Officer and submitted to the Company’s

Compensation Committee for consideration.

During

the year ended December 31, 2023 the Compensation Committee met on one occasion. All members of the Compensation Committee attended this

meeting.

During

the year ended December 31, 2023, Daniel B. O’Brien, the Company’s only executive officer, did not participate in deliberations

of the Company’s Compensation Committee concerning executive officer compensation.

During

the year ended December 31, 2023, no director of the Company was also an executive officer of another entity, which had an executive

officer of the Company serving as a director of such entity or as a member of the Compensation Committee of such entity.

The

following is the report of the Compensation Committee:

The

key components of the Company’s executive compensation program include annual base salaries and long-term incentive compensation

consisting of stock options. It is the Company’s policy to target compensation (i.e., base salary, stock option grants and other

benefits) at approximately the median of comparable companies in the industries in which the Company competes. Accordingly, data on compensation

practices followed by other companies in the industries in which the Company competes is considered.

The

Company’s long-term incentive program consists exclusively of periodic grants of stock options with an exercise price equal to

the fair market value of the Company’s common stock on the date of grant. To encourage retention, the ability to exercise options

granted under the program may be subject to vesting restrictions. Decisions made regarding the timing and size of option grants take

into account the performance of both the Company and the employee, “competitive market” practices, and the size of the option

grants made in prior years. The weighting of these factors varies and is subjective. Current option holdings are not considered when

granting options.

The

foregoing report has been approved by the members of the Compensation Committee:

John

Bientjes

Ben

Seaman

David Fynn

Audit

Committee

The

Company’s Audit Committee presently consists of John Bientjes, Ben Seaman and David Fynn all of whom are independent directors

and have strong financial backgrounds. The purpose of the Audit Committee is to review and approve the selection of the Company’s

auditors and review the Company’s financial statements with the Company’s independent registered public accounting firm.

The Audit Committee also serves as an independent and objective party to monitor the Company’s financial reporting process and

internal control systems. The Audit Committee meets periodically with management and the Company’s independent auditors.

During

the fiscal year ended December 31, 2023, the Audit Committee met on four occasions. All members of the Audit Committee attended these

meetings.

The

following is the report of the Audit Committee:

| |

(1) |

The Audit Committee reviewed

and discussed the Company’s audited financial statements for the year ended December 31, 2023 with the Company’s management. |

| |

|

|

| |

(2) |

The Audit Committee discussed

with the Company’s independent registered public accounting firm the matters required to be discussed by Statement on Accounting

Standards (SAS) No. 61 “Communications with Audit Committee” as amended by SASs 89 and 90. |

| |

|

|

| |

(3) |

The Audit Committee has received

the written disclosures and the letter from the Company’s independent registered public accounting firm required by PCAOB (Public

Company Accounting Oversight Board) standards, and had discussed with the Company’s independent registered public accounting

firm the independent registered public accounting firm’s independence. |

| |

|

|

| |

(4) |

Based on the review and discussions

referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for filing with the Securities and Exchange Commission. |

| |

|

|

| |

(5) |

The Audit Committee is of

the opinion that the fees paid to the Company’s independent public accountants are consistent with the Company’s accounting

firm maintaining its independence from the Company. |

The

foregoing report has been approved by the members of the Audit Committee:

John Bientjes

Ben Seaman

David Fynn

The

Company’s Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available on the Company’s

website: www.flexiblesolutions.com.

ADVISORY

VOTE ON EXECUTIVE COMPENSATION

The

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enables the Company’s shareholders to

vote to approve, on a nonbinding advisory basis, the compensation of the Company’s executive officers.

Accordingly,

the Company will ask shareholders to vote for the following resolution at the annual meeting:

“RESOLVED,

that the Company’s shareholders approve, on a nonbinding advisory basis, the compensation of the Company’s executive officers,

as disclosed in the Company’s Proxy Statement for the Annual Meeting of Shareholders to be held December 30, 2024 pursuant to the

compensation disclosure rules of the Securities and Exchange Commission, including the Executive Compensation Table and the other related

tables and narrative disclosure in the Company’s proxy statement.”

To

the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, the Company’s

Board of Directors and its Compensation Committee will consider shareholders’ concerns and the Company’s Compensation Committee

will evaluate whether any actions are necessary to address those concerns.

The

Board of Directors recommends that the shareholders approve on a nonbinding advisory basis the resolution approving the compensation

of the Company’s executive officers set forth in this proxy statement.

The

Company has elected to have the advisory vote on executive compensation submitted to its shareholders at each annual meeting.

ADVISORY

VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

The

Company is offering its shareholders an opportunity to cast an advisory vote on whether a non-binding advisory vote to approve the compensation

of the Company’s executive officers should occur every one, two or three years. Although the vote is non-binding, the Company values

continuing and constructive feedback from its shareholders on executive compensation and other important matters. The Company’s

Board of Directors will take into consideration the voting results when determining how often a non-binding advisory vote to approve

the compensation of the Company’s named executive officers should occur.

The

Company’s Board of Directors recommends that the shareholders of the Company cast a vote of “one Year” on the frequency

of holding an advisory vote on executive compensation.

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Smythe

LLP examined our financial statements for the years ended December 31, 2023 and 2022.

Audit

Fees

Smythe

LLP was paid $127,487 during the fiscal year ended December 31, 2023 for professional services rendered in the audit of our annual financial

statements and for the review of our financial statements included in our quarterly reports on Form 10-Q during that fiscal year.

Smythe

LLP was paid $128,456 during the fiscal year ended December 31, 2022 for professional services rendered in the audit of our annual financial

statements and for the review of our financial statements included in our quarterly reports on Form 10-Q during that fiscal year.

Tax

Fees

Smythe,

LLP was paid $14,079 in the fiscal year ended December 31, 2023 for preparing our tax returns.

All

Other Fees

Smythe

LLP was not paid any other fees for professional services during the fiscal years ended December 31, 2023 and 2022.

Audit

Committee Pre-Approval Policies

Rules

adopted by the SEC in order to implement requirements of the Sarbanes-Oxley Act of 2002 require public company audit committees to pre-approve

audit and non-audit services. Our Audit Committee has adopted a policy for the pre-approval of all audit, audit-related and tax services,

and permissible non-audit services provided by our independent auditors. The policy provides for an annual review of an audit plan and

budget for the upcoming annual financial statement audit, and entering into an engagement letter with the independent auditors covering

the scope of the audit and the fees to be paid. Our Audit Committee may also from time-to-time review and approve in advance other specific

audit, audit-related, tax or permissible non-audit services. In addition, our Audit Committee may from time-to-time give pre-approval

for audit services, audit-related services, tax services or other non-audit services by setting forth such pre-approved services on a

schedule containing a description of, budget for, and time period for such pre-approved services. The policy requires our Audit Committee

to be informed of each service and the policies do not include any delegation of our Audit Committee’s responsibilities to management.

Our Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated

will report any pre-approval decisions to our Audit Committee at its next scheduled meeting.

During

the year ended December 31, 2023 our Audit Committee approved all of the fees paid to Smyth. Our Audit Committee has determined that

the rendering of all non-audit services by Smythe is compatible with maintaining its independence. During the year ended December 31,

2023, none of the total hours expended on our financial audit by Smythe were provided by persons other than Smythe’s full-time

permanent employees.

AVAILABILITY

OF ANNUAL REPORT ON FORM 10-K

The

Company’s Annual Report on Form 10-K for the year ending December 31, 2023 will be sent to any shareholder of the Company upon

request. Requests for a copy of this report should be addressed to the Company’s Secretary at the address provided on the first

page of this proxy statement.

SHAREHOLDER

PROPOSALS

Any

shareholder proposal which may properly be included in the proxy solicitation material for the annual meeting of shareholders following

the Company’s year ending December 31, 2024 must be received by the Company’s Secretary no later than August 31, 2025.

GENERAL

The

cost of preparing, printing and mailing the enclosed proxy, accompanying notice and proxy statement, and all other costs in connection

with solicitation of proxies will be paid by the Company including any additional solicitation made by letter, telephone or email. Failure

of a quorum to be present at the meeting will necessitate adjournment and will subject the Company to additional expense. The Company’s

annual report, including financial statements for the 2023 fiscal year, is available at the Company’s website: www.flexiblesolutions.com.

The

Company’s Board of Directors does not intend to present and does not have reason to believe that others will present any other

items of business at the annual meeting. However, if other matters are properly presented to the meeting for a vote, the proxies will

be voted upon such matters in accordance with the judgment of the persons acting under the proxies.

Please

complete, sign and return the attached proxy promptly.

PROXY

CARD

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

This

Proxy is solicited by the Company’s Board of Directors

The

undersigned stockholder of Flexible Solutions International, Inc. acknowledges receipt of the Notice of the Annual Meeting of Stockholders

to be held December 30, 2024, at 4:00 p.m. Eastern Time, at 37 Sonny Powery’s Drive, West

Bay, Grand Cayman, Cayman Islands and hereby appoints Daniel O’Brien with the power of substitution, as Attorney and Proxy

to vote all the shares of the undersigned at said annual meeting of stockholders and at all adjournments thereof, hereby ratifying and

confirming all that said Attorney and Proxy may do or cause to be done by virtue hereof. The above named Attorney and Proxy is instructed

to vote all of the undersigned’s shares as follows:

| (1) |

To

elect the persons who shall constitute the Company’s Board of Directors for the ensuing year. |

| |

☐ |

FOR

all nominees listed below |

☐ |

WITHHOLD

AUTHORITY to vote for all nominees listed below |

| |

|

(except

as marked to the contrary below) |

|

|

(INSTRUCTION:

TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE, STRIKE A LINE THROUGH THE NOMINEE’S NAME IN THE LIST BELOW)

| |

Nominees:

|

|

Daniel

B. O’Brien |

|

John

H. Bientjes |

|

Robert

Helina |

|

Thomas

Fyles |

|

Ben

Seaman |

|

David

Fynn |

| (2)

|

To

approve on an advisory basis, the compensation of the Company’s executive officers. |

|

☐

FOR |

|

☐AGAINST |

|

☐

ABSTAIN |

|

|

| |

|

|

|

|

|

|

|

|

|

| (3) |

To

approve on a non-binding advisory basis, the frequency of the advisory vote regarding the compensation of the Company’s executive

officers. |

|

☐

1 YEAR |

|

☐

2 YEARS |

|

☐

3 YEARS |

|

☐

ABSTAIN |

| |

|

|

|

|

|

|

|

|

|

| (4) |

To

ratify the appointment of Assure CPA, LLC as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2024. |

|

☐

FOR |

|

☐

AGAINST |

|

☐

ABSTAIN |

|

|

To transact such other business as may properly come before the meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DISCRETION IS INDICATED, THIS

PROXY WILL BE VOTED IN FAVOR OF ALL DIRECTORS, ITEMS 2, 3 (ONE YEAR) AND 4.

| |

Dated

this ___ day of _______ , 2024. |

|

| |

|

|

| |

(Signature) |

|

| |

|

|

| |

(Signature) |

|

Please

sign your name exactly as it appears on your stock certificate. If shares are held jointly, each holder should sign. Executors, trustees,

and other fiduciaries should so indicate when signing.

Please

Sign, Date and Return this Proxy so that your shares may be voted at the meeting.

Send

the proxy card by regular mail, email, or fax to:

Flexible

Solutions International, Inc.

Attn:

Daniel B. O’Brien

6001

54 Ave.

Taber,

AB

Canada

T1G 1X4

Phone:

403 223 2995

Fax:

403 223 2905

Email:

damera@flexiblesolutions.com

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

NOTICE

OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important

Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on December 30, 2024.

| |

1. |

This notice is not a form

for voting. |

| |

|

|

| |

2. |

This communication presents

only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review

all of the important information contained in the proxy materials before voting. |

| |

|

|

| |

3. |

After December 2, 2024,

the Proxy Statement, Information Statement, Annual Report to Shareholders is available at http://flexiblesolutions.com/investor/AGM_2024.shtml |

| |

|

|

| |

4. |

If you want to receive

a paper or email copy of these documents, you must request one. There is no charge to you for requesting a copy. Please make your request

for a copy as instructed below on or before December 2, 2024 to facilitate timely delivery. |

The

2024 annual meeting of the Company’s shareholders will be held at 37 Sonny Powery’s

Drive, West Bay, Grand Cayman, Cayman Islands on December 30, 2024, at 11:00 a.m. Eastern Time, for the following purposes:

| |

(1) |

to elect the directors who

shall constitute the Company’s Board of Directors for the ensuing year; |

| |

|

|

| |

(2) |

to approve on an advisory

basis, the compensation of the Company’s executive officers; |

| |

|

|

| |

(3) |

to approve, on a non-binding

advisory basis, the frequency of the advisory vote regarding the compensation of the Company’s executive officers; |

| |

|

|

| |

(4) |

to ratify the appointment

of Assure CPA, LLC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024;

and |

to

transact such other business as may properly come before the meeting.

The

Board of Directors recommends that shareholders vote FOR all directors and proposals 2 through 5.

December

2, 2024 is the record date for the determination of shareholders entitled to notice of and to vote at such meeting. Shareholders may

cast one vote for each share held.

After

December 2, 2024, shareholders may access the following documents at or http://flexiblesolutions.com/ investor/ AGM_2024.shtml:

| |

● |

Notice of the 2024 Annual

Meeting of Shareholders |

| |

● |

Company’s 2024 Proxy

Statement; |

| |

● |

Proxy Card |

| |

● |

Company’s Annual Report

on form 10-K for the year ended December 31, 2023 |

Shareholders

may request a paper copy of the Proxy Materials and Proxy Card by calling 1-800-661-3560, by emailing the Company at http://flexiblesolutions.com/investor/

AGM_2024.shtml, or by visiting http://flexiblesolutions.com/investor/AGM_2024.shtml and indicating if you want a paper copy

of the proxy materials and proxy card:

| |

● |

for this meeting only, or |

| |

● |

for this meeting and all

other meetings. |

If

you have a stock certificate registered in your name, or if you have a proxy from a shareholder of record on December 2, 2024, you can,

if desired, attend the Annual Meeting and vote in person. Shareholders can obtain directions to the 2023 annual shareholders’ meeting

at http://flexiblesolutions.com/investor/AGM_2024.shtml.

Please

visit www.flexiblesolutions.com to print and fill out the Proxy Card. Complete and sign the proxy card and mail the Proxy Card to:

Flexible

Solutions International, Inc.

6001

54 Ave.

Taber,

AB

Canada

T1G 1X4

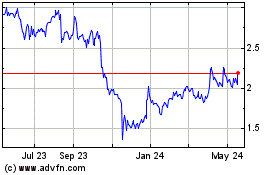

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Nov 2024 to Dec 2024

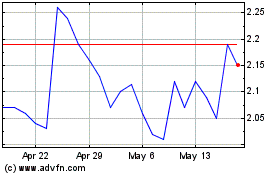

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Dec 2023 to Dec 2024