Gold ETFs Surge On Fed Outlook - ETF News And Commentary

26 January 2012 - 8:17PM

Zacks

Although the American economy seems to be holding its own to

start the year, significant risks remain to growth. European

worries are always a step away and still high American unemployment

and the potential volatility of the presidential election could

derail stocks at any time. Thanks to this uncertainty coupled with

the lack of inflation in the market, the Fed has seen no reason to

test the market with higher rates, preferring instead to be as

accommodative as possible. Given these trends, the Federal Reserve

announced on Wednesday that it was pushing the prospect of an

eventual rate hike further into the future, now until late

2014.

This move extends their previous pledge by more than a year and

suggests that the Fed believes more sluggish growth levels are

poised to hit the economy over the next few years. The central

bank, however, did not release any plans to expand its bond buying

program but suggested that it will still be ‘highly accommodative’

since the economy is still up against ‘significant downside risks’.

Yet, with that being said, the voting members of the FOMC seem very

split on when the first hike should be. Three asked for one next

year, five in 2014, and the other four members look to have rates

rise in 2015. Thanks to this split and the tilt towards later

years, some believe more easing—QE3—could be coming down the pike

sooner rather than later in another attempt for the Federal Reserve

to jumpstart the lethargic economy (read Three Outperforming Active

ETFs).

With this report, investors pushed yields on T-Bills sharply

lower with the benchmark 10 year note falling to a yield of just

1.91% before rebounding up close to the 2.00% level near the end of

the session. These anemic yields have coupled with the lack of both

more easing or tightening on the horizon to push many into

commodities and stocks instead. While blue chips were up sharply

after the news, arguably one of the biggest winners was in the

commodity space with gold (read Five Cheaper ETFs You Probably

Overlooked).

The yellow metal gained close to $30/oz. in the session before

surging in the final few minutes of the day to soar close to the

$1,711/oz mark—and a near $50/oz. gain—in Wednesday trading. This

key $1,700/oz. level has not been seen in more than a month, and

suggested to some that gold was back on track after its late

December swoon. “The Fed telling us no rate increase to at

least 2014 is a sharp rally promoter for gold, as low interest

rates to continue will make gold a good alternative hold and not

expensive to maintain,” wrote George Gero, a vice president with

RBC Capital Markets, in an emailed note.

As a result major gold tracking ETFs—such as IAU, GLD, and

SGOL—all rose markedly higher after the release, pretty much

matching the gains that front month futures saw in the session.

Beyond commodity ETPs though, the biggest winners were in the gold

equity space as these securities often trade as a leveraged play on

the price of gold. In this space, there are currently four ETFs

including the large cap focused GDX and PSAU which added 6.6% and

4.7%, respectively after the report. Additionally, investors saw

the small cap-centric GDXJ beat all other funds in the space with a

7.6% return on the day, and then finally the Pure Gold Miners ETF

(GGGG) which, ironically, added the least at 4.41% despite only

targeting firms that derive a significant majority of their

production from gold (read Top Three Precious Metal Mining

ETFs).

Meanwhile, in the other key precious metal silver, the report

was having an equally impressive impact on ETF prices. This was

likely due to the fact that silver is also seen as a hedge against

currency debasement but thanks in part to its low price per ounce

and more ubiquitous nature, is often subject to greater price

swings in a short period of time. This means that the white metal

can often outperform on the upside and underperform on the downside

when compared to its more stable gold cousin. This trend also

seemed to be the case today as silver-backed ETFs such as SLV and

SIVR added about 4.14% in the session while the Silver Miners ETF

(SIL) gained nearly 4.6% for the day—barely pacing its underlying

metal in the period (read Time To Consider The Silver Miners

ETF).

Overall, the recent report from the Fed could suggest that gold,

and to a lesser extent silver, have seen a near-term bottom,

especially given how lengthy the period of heavy accommodation will

be in terms of monetary policy. Clearly, the precious metals

markets liked the Fed report so further accommodations from a

monetary perspective, be it in the form of more asset purchases or

bond buying, could add to returns of these ETFs into the future as

well and make the late year slide in the products a distant

memory.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Disclosure: Long IAU, gold bullion, and silver bullion.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

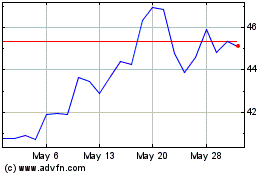

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

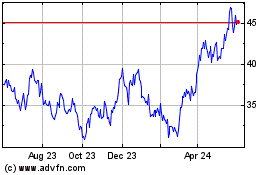

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Nov 2023 to Nov 2024