Can Gold Mining ETFs Dazzle in 2014? - ETF News And Commentary

28 December 2013 - 4:00AM

Zacks

Investments in gold have seen appalling results this year with

physically backed gold ETFs like the

SPDR Gold

Shares (

GLD) losing 26% in 2013 and

Market Vectors Gold Miners ETF

(

GDX) shedding a massive 55% so far. The latter

put up with more pain as it often trades as a leveraged play on

gold, raising question on where this downtrend will stop.

While the Fed’s super-easy monetary policy and upbeat economic data

have made equities a darling investment avenue, persistent concerns

about the taper timeline also played its share of role in dulling

the charm of gold investing in most of 2013.

Gold Mining ETF Fate in 2014?

Fed Taper Finally Comes: Putting an end

to almost year-long speculation, the Fed has finally opted for a

modest scale-back in QE in January. Monthly purchases of both

mortgage and Treasury bonds would now be cut down by $5 billion

each, leading to a $10 billion reduction in the bond buying

program.

The Fed chairman, Ben Bernanke commented that the bond buying

program will be curtailed in phases in 2014, if improvement in the

labor market moves in accordance with their expectations, and QE

might be fully completed by late 2014 (read: Fed Tapers Bond

Purchases: 3 ETFs in Focus on the News).

A trimming in the easy monetary policy will likely send the price

of the greenback higher and dampen the safe haven status of the

yellow metal. In fact, after the Fed’s announcement of first

withdrawal from the stimulus, GDX slipped 1.56% (on December

18).

Record Production: While demand for gold

is fragile currently, the sector has come up with record production

this year leading to about 25% fall in prices. As per Reuters,

despite falling prices, gold miners are binging on volumes to

improve revenues in order to spread out its huge fixed asset base.

Analysts are expecting gold mining output to cross 3,000 tons a

year for the first time in 2014. There is little chance of

production cuts before 2015.

Technical Look

While fundamentals are certainly not encouraging, technical

indicators show some signs of hope. The Relative Strength Index for

GDX is presently 44.7 following the threatening taper announcement,

up a bit, but still within the key middle range.

These indicators are actually hovering higher than the low-30’s

level seen in early-December. This means although the fund is by no

means overbought, the upturn signifies that investors’ faith is

returning to the space, though very slowly.

However, other indicators are still lagging. GDX is currently

lingering around its 52-week low. Its short-term moving average is

well below the long-term average. GDX is also trading pretty much

at the parabolic SAR level, suggesting there isn’t much of a signal

from this look (read: Pain or Gain Ahead for Gold Mining

ETFs?).

Final Take

Final Take

As much of the taper concerns are factored in by now and gold

mining products are hovering at the 5-year low level, we don’t

expect much of a downside for these products in the New Year,

though the journey will be pretty rough (see all the Materials ETFs

here).

If gold mining ETFs try to turn around at any point next year, they

can only recoup some of the gigantic losses incurred throughout

2013. Further, the production and cost scenario will likely remain

unfavorable for these products next year, indicating a dearth of

positive fundamentals in the space.

Having said that, we believe, investors that have a strong stomach

for risks can consider buying gold mining products. These products

saw heavy sell-offs in the recent past and might offer a good entry

point now on the buy side.

Investors should also note that the selling of gold-related

investments has also been slower of late thus indicating that we

are close to a bottom. The Fed has announced a modest trimming, but

easy money will be very much in the economy (see A Comprehensive

Guide to Gold Mining ETFs).

Thus, even if next year proves to be a tough one for gold mining

funds with each measured taper announcement, the year after should

dazzle investors in this in-focus corner of the market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

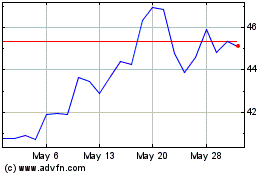

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Feb 2025 to Mar 2025

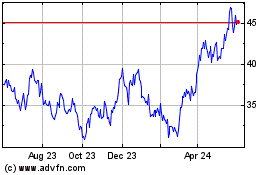

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Mar 2024 to Mar 2025