U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024.

Commission File Number: 001-39566

GoldMining Inc.

(Translation of registrant's name into English)

Suite 1830, 1188 West Georgia Street, Vancouver, British Columbia, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

EXHIBIT INDEX

EXHIBIT 99.1, INCLUDED WITH THIS REPORT, IS HEREBY INCORPORATED BY REFERENCE AS AN EXHIBIT TO THE REGISTRANT’S REGISTRATION STATEMENT ON FORM F-10 (FILE NO. 333-275215), AS AMENDED AND SUPPLEMENTED, AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS SUBMITTED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

GOLDMINING INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Pat Obara

|

|

|

|

Pat Obara

|

|

|

|

Chief Financial Officer

|

|

| |

|

|

| |

|

|

| Date: |

October 8, 2024 |

|

Exhibit 99.1

GoldMining Subsidiary, U.S. GoldMining More Than Doubles Indicated Mineral Resource Estimate to 6.48 Million AuEq Oz with an Additional 4.16 Million AuEq Oz Inferred for the Whistler Project, Alaska

Designated News Release

Vancouver, British Columbia – October 8, 2024 – GoldMining Inc. (the "Company" or "GoldMining") (TSX: GOLD; NYSE American: GLDG) is pleased to highlight an updated Mineral Resource Estimate ("Whistler MRE") that was announced by its publicly traded subsidiary, U.S. GoldMining Inc. (“U.S. GoldMining”) (NASDAQ: USGO) on October 7, 2024 for U.S. GoldMining’s Whistler Gold-Copper Project (the "Project") located in Alaska, U.S.A.

Highlights:

The highlights of U.S. Goldmining’s announcement include:

| |

●

|

Indicated Mineral Resource: 294 million tonnes ("Mt") at 0.68 grams per tonne ("g/t") gold equivalent ("AuEq") for 6.48 million ounces ("Moz") AuEq

|

| |

●

|

Inferred Mineral Resource: 198 Mt at 0.65 g/t AuEq for an additional 4.16 Moz AuEq

|

| |

●

|

Estimated gold equivalent ounces in the indicated category have increased by approximately 117% compared to the 2022 MRE*

|

| |

●

|

The Whistler MRE was constrained using a series of conceptual pit design shells for the Whistler deposit, which assumed a first phase with an estimated 22.4 Mt of mineralized material at a grade of 1.04 g/t AuEq and a strip ratio of 0.08:1 (waste:ore)

|

| |

●

|

The three Au-Cu-Ag porphyry deposits comprised within the Whistler MRE - Whistler, Raintree and Island Mountain - occupy approximately 1% of the U.S. GoldMining’s land holdings and occur within a cluster of high priority targets sharing key geological characteristics with the known deposits, thereby highlighting the broader exploration potential of the Project

|

| |

o

|

U.S. GoldMining is currently systematically exploring nearby targets within the ‘Whistler Orbit’ where an additional 12 potential targets remain under-explored

|

| |

●

|

The Whistler MRE encompasses 2023 drilling as reported earlier this year (see U.S. GoldMining news release January 16, 2024), including the initial intercept contained within WH23-03 which comprised 547 m at 1.06 g/t AuEq

|

| |

o

|

It excludes recently reported confirmatory assays from the re-entry of WH23-01 drilled in 2024 (see U.S. GoldMining announcement September 30, 2024) which now extends the mineralized intercept to 652.5m at 1.00 g/t AuEq

|

| |

o

|

The 2024 core drilling program has now concluded, achieving 4,006 meters of drilling in 6 holes.

|

Alastair Still, Chief Executive Officer of GoldMining, commented: "Since the initial public offering of U.S. GoldMining in April 2023, we are extremely pleased by the progress of its exploration initiatives at the Whistler Project, which have resulted in strengthened confidence of the Whistler MRE by increasing the gold equivalent ounces in the indicated category by approximately 117% from prior estimates. The Project now contains 6.5 Moz AuEq in the indicated resource category and an additional 4.2 Moz AuEq in the inferred resource category. The successful 2023 drilling program and growth of the mineral resources at Whistler is an example of how our spin-out strategy continues to unlock value for GoldMining shareholders. We now hold over $175 million in cash and equities1 that help position us to advance strategic initiatives across our portfolio, which globally holds 12.5 million AuEq ounces of measured and indicated resources and 9.7 million AuEq ounces of inferred resources.2”

1. Cash and Marketable Securities in NevGold Corp., Gold Royalty Corp., and U.S. GoldMining as of October 7, 2024, are presented in Canadian dollars, converted, as applicable, based on current exchange rates.

2. The above global resource numbers are provided for informational purposes only and are not intended to represent the viability of any project on a standalone or global basis. The exploration and development of each project, project geology and the assumptions and other factors underlying each estimate, are not uniform and will vary from project to project. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues. Please refer to the Company’s most recent annual information form, a copy of which is available under its profile at www.sedarplus.ca and www.sec.gov, for further information regarding such estimates.

The updated Whistler MRE is set forth in a technical report summary titled "S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project, South Central Alaska" with an effective date of September 12, 2024, which was filed by U.S. GoldMining on October 7, 2024 under subpart 1300 of Regulation S-K ("SK-1300") and available under U.S. GoldMining's profile at www.sec.gov (the "S-K 1300 Report"). U.S. GoldMining and GoldMining plan to file a technical report under Canadian National Instrument 43-101 (“NI 43-101”) in respect of the updated Whistler MRE within 45 days of U.S. GoldMining’s announcement.

Updated Mineral Resource Estimate Overview

The Whistler MRE was based on 43,096 meters of drill data available as of January 16, 2024 (refer to U.S. GoldMining’s news release dated January 16, 2024, for further details), prior to the commencement of U.S. GoldMining’s 2024 drill campaign. The author of the report conducted a site visit August 6, 2024, which included collection of independent duplicate samples for umpire laboratory analysis. The effective date for the updated MRE is September 12, 2024. The Whistler MRE is constrained within a revenue factor 1.5 pit shell and reported above a US$10/tonne cut-off value (equivalent to 0.27 g/t AuEq cut-off grade).

The October 2024 updated Whistler MRE incorporates:

| |

●

|

Revised mineral resource reporting at US$10/tonne cut-off (previously the 2022 MRE was reported at US$10.50/t) and using below 3-year trailing average commodity assumptions of US$1,850/oz Au, US$4.00/lb Cu and US$23/oz Ag, across all three Project deposits: Whistler, Raintree and Island Mountain (see Figure 1).

|

| |

●

|

The addition of three 2023 diamond core drill holes for 1,674 meters of drilling within the namesake Whistler Deposit (see Figure 2), with revisions to the geological interpretation and three dimensional mineralization modelling.

|

The following table sets forth a summary of the Whistler MRE update.

Table 1: Mineral Resource Estimate for the Total Whistler Project (Effective date: September 12, 2024)

|

Class

|

Deposit

|

|

Cut-off Value

|

|

|

ROM Tonnage

|

|

|

In situ Grades

|

|

|

In situ Metal

|

|

| |

(US$/t)

|

|

|

(ktonnes)

|

|

|

NSR (US$/t)

|

|

|

AuEqv (g/t)

|

|

|

Au

(g/t)

|

|

|

Cu

(%)

|

|

|

Ag

(g/t)

|

|

|

AuEqv (koz)

|

|

|

Au

(koz)

|

|

|

Cu (mlbs)

|

|

|

Ag (koz)

|

|

|

Indicated

|

Whistler Pit

|

|

10 |

|

|

|

282,205 |

|

|

|

22.84 |

|

|

|

0.68 |

|

|

|

0.41 |

|

|

|

0.16 |

|

|

|

1.89 |

|

|

|

6,201 |

|

|

|

3,724 |

|

|

|

999 |

|

|

|

17,166 |

|

|

Raintree Pit

|

|

10 |

|

|

|

8,905 |

|

|

|

21.08 |

|

|

|

0.63 |

|

|

|

0.46 |

|

|

|

0.08 |

|

|

|

4.81 |

|

|

|

180 |

|

|

|

131 |

|

|

|

16 |

|

|

|

1,378 |

|

|

Indicated Open Pit

|

|

varies

|

|

|

|

291,410 |

|

|

|

22.79 |

|

|

|

0.68 |

|

|

|

0.41 |

|

|

|

0.16 |

|

|

|

1.98 |

|

|

|

6,381 |

|

|

|

3,855 |

|

|

|

1,015 |

|

|

|

18,544 |

|

|

Raintree UG

|

|

25 |

|

|

|

3,064 |

|

|

|

34.41 |

|

|

|

1.03 |

|

|

|

0.79 |

|

|

|

0.13 |

|

|

|

4.49 |

|

|

|

101 |

|

|

|

78 |

|

|

|

9 |

|

|

|

443 |

|

| |

Total Indicated

|

|

varies

|

|

|

|

294,474 |

|

|

|

22.91 |

|

|

|

0.68 |

|

|

|

0.42 |

|

|

|

0.16 |

|

|

|

2.01 |

|

|

|

6,482 |

|

|

|

3,933 |

|

|

|

1,024 |

|

|

|

18,987 |

|

|

Inferred

|

Whistler Pit

|

|

10 |

|

|

|

18,224 |

|

|

|

21.01 |

|

|

|

0.63 |

|

|

|

0.40 |

|

|

|

0.13 |

|

|

|

1.75 |

|

|

|

368 |

|

|

|

233 |

|

|

|

54 |

|

|

|

1,025 |

|

|

Island Mountain Pit

|

|

10 |

|

|

|

124,529 |

|

|

|

18.21 |

|

|

|

0.54 |

|

|

|

0.45 |

|

|

|

0.05 |

|

|

|

1.02 |

|

|

|

2,180 |

|

|

|

1,817 |

|

|

|

139 |

|

|

|

4,084 |

|

|

Raintree Pit

|

|

10 |

|

|

|

15,056 |

|

|

|

23.12 |

|

|

|

0.69 |

|

|

|

0.55 |

|

|

|

0.06 |

|

|

|

4.36 |

|

|

|

335 |

|

|

|

267 |

|

|

|

21 |

|

|

|

2,112 |

|

|

Inferred Open Pit

|

|

varies

|

|

|

|

157,809 |

|

|

|

19.00 |

|

|

|

0.57 |

|

|

|

0.45 |

|

|

|

0.06 |

|

|

|

1.42 |

|

|

|

2,883 |

|

|

|

2,317 |

|

|

|

214 |

|

|

|

7,221 |

|

|

Raintree UG

|

|

25 |

|

|

|

40,432 |

|

|

|

32.81 |

|

|

|

0.98 |

|

|

|

0.76 |

|

|

|

0.12 |

|

|

|

3.31 |

|

|

|

1,275 |

|

|

|

994 |

|

|

|

103 |

|

|

|

4,300 |

|

| |

Total Inferred

|

|

varies

|

|

|

|

198,241 |

|

|

|

21.82 |

|

|

|

0.65 |

|

|

|

0.52 |

|

|

|

0.07 |

|

|

|

1.81 |

|

|

|

4,158 |

|

|

|

3,311 |

|

|

|

317 |

|

|

|

11,521 |

|

Notes to Table 1:

| |

1.

|

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

|

| |

2.

|

Inferred mineral resources are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability.

|

| |

3.

|

The Mineral Resource Estimate for the Whistler, Island Mountain, and the upper portions of the Raintree West deposits have been confined by an open pit with “reasonable prospects of economic extraction” using the following assumptions:

|

| |

●

|

Metal prices of US$1,850/oz Au, US$4.00/lb Cu and US$23/oz Ag;

|

| |

●

|

Payable metal of 95% payable for Au and Ag, and 96.5% payable for Cu

|

| |

●

|

Refining costs for Au of US$8.00/oz, for Ag of US$0.60/oz and for Cu of US$0.05/lb.

|

| |

●

|

Offsite costs for Au of US$77.50/wmt, for Ag of US$3.50/wmt and for Cu of US$55.00/wmt.

|

| |

●

|

Pit slopes are 50 degrees;

|

| |

●

|

Mining cost of US$2.25/t for waste and mineralized material; and

|

| |

●

|

Processing, general and administrative costs of US$7.90/t.

|

| |

4.

|

The lower portion of the Raintree West deposit has been constrained by a mineable shape with “reasonable prospects of eventual economic extraction” using a US$25.00/t cut-off.

|

| |

5.

|

Metallurgical recoveries are: 70% for Au, 83% for Cu, and 65% Ag for Ag grades below 10g/t. The Ag recovery is 0% for values above 10g/t for all deposits.

|

| |

6.

|

The NSR equations are: below 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$54.646/t) + (Cu*83%*US$3.702*2204.62 + Ag*65%*US$0.664)), and above 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$56.646g/t) + (Cu*83%*US$3.702*2204.62))

|

| |

7.

|

The Au Equivalent equations are: below 10g/t Ag: AuEq=Au + Cu*1.771 +0.0113Ag, and above 10g/t Ag: AuEq=Au + Cu*1.771

|

| |

8.

|

The specific gravity for each deposit and domain ranges from 2.76 to 2.91 for Island Mountain, 2.60 to 2.72 for Whistler with an average value of 2.80 for Raintree West.

|

| |

9.

|

The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions).

|

| |

10.

|

Numbers may not add due to rounding.

|

Additional details of the mineral resource estimate are set forth in the S-K 1300 Report and U.S. GoldMining’s news release dated October 7, 2024.

*For comparison, the previous 2022 MRE (Effective Date September 22, 2022) comprised 118 Mt at 0.79 g/t AuEq for 2.99 Moz AuEq Indicated resources, and 317 Mt at 0.63 g/t Au for 6.45 Moz AuEq Inferred resources, at a US$10.50/t cutoff value for open pit resources and US$25/t for underground resources.

Figure 1 – Plan map of the Whistler Project showing the location of the Whistler, Raintree and Island Mountain gold-copper-silver deposits which cumulatively make up the Whistler MRE.

Figure 2 – Plan view map of the Whistler Deposit showing the geological interpretation of the Whistler Intrusive Suite and highlighting the location of 2023 drilling used in the October 2024 Whistler MRE.

Whistler Project High-Grade Core

The updated 2024 Whistler MRE is underpinned by a significant component of higher-grade mineralization within the core of the three deposits. Table 2 illustrates the Whistler MRE at a range of cut-offs which provide optionality for potential future mine development scenarios. For example, using an elevated cut-off value of US$20/t (equivalent to 0.37 g/t AuEq cut-off grade) for open pit resources, the Whistler MRE contains a robust higher grade subset resource of:

| |

o

|

134 Mt at 0.98 g/t AuEq for 4.2 Moz AuEq Indicated (includes Raintree UG resource)

|

| |

o

|

87 Mt at 0.96 g/t AuEq for 2.7 Moz AuEq Inferred (includes Raintree UG resource)

|

Table 2: Whistler MRE sensitivity to cut-off values. The Whistler MRE which is stated at $10/t cutoff value for open pit resources (equivalent to 0.27 g/t AuEq cutoff grade), and $25/t cutoff value for underground resources, is highlighted.

|

Class

|

Source

|

|

Cutoff

|

|

|

ROM Tonnage

|

|

|

In situ Grades

|

|

|

In situ metal

|

|

| |

(US$/t)

|

|

|

(ktonnes)

|

|

|

NSR (US$/t)

|

|

|

AuEqv (g/t)

|

|

|

Au

(g/t)

|

|

|

Cu

(%)

|

|

|

Ag

(g/t)

|

|

|

AuEqv (Koz)

|

|

|

Au (koz)

|

|

|

Cu (klbs)

|

|

|

Ag

(koz)

|

|

|

|

|

|

6 |

|

|

|

333,200 |

|

|

|

20.98 |

|

|

|

0.63 |

|

|

|

0.37 |

|

|

|

0.15 |

|

|

|

1.99 |

|

|

|

6,717 |

|

|

|

3,999 |

|

|

|

1,088,419 |

|

|

|

20,822 |

|

| |

|

|

7 |

|

|

|

327,336 |

|

|

|

21.24 |

|

|

|

0.63 |

|

|

|

0.38 |

|

|

|

0.15 |

|

|

|

1.99 |

|

|

|

6,680 |

|

|

|

3,983 |

|

|

|

1,080,877 |

|

|

|

20,541 |

|

| |

|

|

7.9 |

|

|

|

319,301 |

|

|

|

21.59 |

|

|

|

0.65 |

|

|

|

0.39 |

|

|

|

0.15 |

|

|

|

1.99 |

|

|

|

6,623 |

|

|

|

3,958 |

|

|

|

1,068,264 |

|

|

|

20,024 |

|

| |

Open Pit

|

|

10 |

|

|

|

291,410 |

|

|

|

22.79 |

|

|

|

0.68 |

|

|

|

0.41 |

|

|

|

0.16 |

|

|

|

1.99 |

|

|

|

6,381 |

|

|

|

3,855 |

|

|

|

1,015,095 |

|

|

|

18,544 |

|

| Indicated |

|

15 |

|

|

|

206,236 |

|

|

|

27.03 |

|

|

|

0.81 |

|

|

|

0.51 |

|

|

|

0.18 |

|

|

|

1.99 |

|

|

|

5,356 |

|

|

|

3,382 |

|

|

|

798,024 |

|

|

|

13,449 |

|

| |

|

20 |

|

|

|

131,449 |

|

|

|

32.55 |

|

|

|

0.97 |

|

|

|

0.65 |

|

|

|

0.19 |

|

|

|

2.08 |

|

|

|

4,111 |

|

|

|

2,728 |

|

|

|

561,495 |

|

|

|

8,809 |

|

| |

|

|

25 |

|

|

|

85,710 |

|

|

|

38.03 |

|

|

|

1.14 |

|

|

|

0.79 |

|

|

|

0.21 |

|

|

|

2.18 |

|

|

|

3,132 |

|

|

|

2,166 |

|

|

|

393,659 |

|

|

|

5,985 |

|

| |

|

|

30 |

|

|

|

57,629 |

|

|

|

43.30 |

|

|

|

1.29 |

|

|

|

0.92 |

|

|

|

0.22 |

|

|

|

2.27 |

|

|

|

2,397 |

|

|

|

1,706 |

|

|

|

281,879 |

|

|

|

4,184 |

|

| |

Underground

|

|

25 |

|

|

|

3,064 |

|

|

|

34.41 |

|

|

|

1.03 |

|

|

|

0.79 |

|

|

|

0.13 |

|

|

|

4.49 |

|

|

|

101 |

|

|

|

78 |

|

|

|

8,613 |

|

|

|

443 |

|

| |

Total Indicated

|

|

varies

|

|

|

|

294,474 |

|

|

|

22.91 |

|

|

|

0.68 |

|

|

|

0.42 |

|

|

|

0.16 |

|

|

|

2.02 |

|

|

|

6,482 |

|

|

|

3,933 |

|

|

|

1,023,708 |

|

|

|

18,987 |

|

|

|

|

|

6 |

|

|

|

247,250 |

|

|

|

14.99 |

|

|

|

0.45 |

|

|

|

0.36 |

|

|

|

0.05 |

|

|

|

1.24 |

|

|

|

3,563 |

|

|

|

2,827 |

|

|

|

276,142 |

|

|

|

9,874 |

|

| |

|

|

7 |

|

|

|

222,529 |

|

|

|

15.94 |

|

|

|

0.48 |

|

|

|

0.38 |

|

|

|

0.05 |

|

|

|

1.28 |

|

|

|

3,408 |

|

|

|

2,718 |

|

|

|

260,061 |

|

|

|

9,168 |

|

| |

|

|

7.9 |

|

|

|

202,534 |

|

|

|

16.78 |

|

|

|

0.50 |

|

|

|

0.40 |

|

|

|

0.06 |

|

|

|

1.31 |

|

|

|

3,267 |

|

|

|

2,614 |

|

|

|

245,757 |

|

|

|

8,536 |

|

| |

Open Pit

|

|

10 |

|

|

|

157,809 |

|

|

|

19.00 |

|

|

|

0.57 |

|

|

|

0.45 |

|

|

|

0.06 |

|

|

|

1.43 |

|

|

|

2,883 |

|

|

|

2,317 |

|

|

|

213,970 |

|

|

|

7,221 |

|

| Inferred |

|

15 |

|

|

|

83,445 |

|

|

|

24.97 |

|

|

|

0.75 |

|

|

|

0.60 |

|

|

|

0.08 |

|

|

|

1.74 |

|

|

|

2,003 |

|

|

|

1,611 |

|

|

|

149,376 |

|

|

|

4,638 |

|

| |

|

20 |

|

|

|

46,184 |

|

|

|

31.30 |

|

|

|

0.94 |

|

|

|

0.76 |

|

|

|

0.10 |

|

|

|

1.98 |

|

|

|

1,389 |

|

|

|

1,129 |

|

|

|

99,917 |

|

|

|

2,923 |

|

| |

|

|

25 |

|

|

|

28,112 |

|

|

|

37.12 |

|

|

|

1.11 |

|

|

|

0.91 |

|

|

|

0.11 |

|

|

|

2.19 |

|

|

|

1,003 |

|

|

|

827 |

|

|

|

68,000 |

|

|

|

1,983 |

|

| |

|

|

30 |

|

|

|

16,408 |

|

|

|

44.16 |

|

|

|

1.32 |

|

|

|

1.11 |

|

|

|

0.12 |

|

|

|

2.35 |

|

|

|

696 |

|

|

|

590 |

|

|

|

41,316 |

|

|

|

1,242 |

|

| |

Underground

|

|

25 |

|

|

|

40,432 |

|

|

|

32.81 |

|

|

|

0.98 |

|

|

|

0.76 |

|

|

|

0.12 |

|

|

|

3.31 |

|

|

|

1,275 |

|

|

|

994 |

|

|

|

102,953 |

|

|

|

4,300 |

|

| |

Total Inferred

|

|

varies

|

|

|

|

198,241 |

|

|

|

21.82 |

|

|

|

0.65 |

|

|

|

0.52 |

|

|

|

0.07 |

|

|

|

1.81 |

|

|

|

4,158 |

|

|

|

3,311 |

|

|

|

316,923 |

|

|

|

11,521 |

|

In particular, U.S. GoldMining’s flagship Whistler Deposit, a component of the Whistler MRE, contains a high-grade core defined by coincident approximately ≥0.40 g/t gold and ≥0.20% Cu grade contours that extend approximately 500 m in the north-south dimension, 250 m in the east-west dimension and extend to 600 m depth (from surface), where it remains open down dip. The Whistler Deposit high-grade core offers the option to consider low strip ratio, higher – grade starter-pit scenarios. Table 3 provides an incremental breakdown of the Whistler Deposit as contained within sequentially expanding pit shells which are illustrated in Figure 3.

Table 3: Whistler Deposit incremental breakdown within conceptual phased pit shells contained within the Whistler MRE.

|

PIT PHASE

|

CLASS

|

|

Mineralized Tonnage

|

|

|

NSR

|

|

|

AuEQ

|

|

|

Au

|

|

|

Cu

|

|

|

Ag

|

|

|

In Situ Metal

|

|

|

Waste Tonnage

|

|

|

Strip Ratio

|

|

| |

(ktonnes)

|

|

|

(US$/tonne)

|

|

|

(g/t)

|

|

|

(g/t)

|

|

|

(%)

|

|

|

(g/t)

|

|

|

(AuEq koz)

|

|

|

(ktonnes)

|

|

|

Waste:Minz

|

|

|

PHASE 1

|

Indicated

|

|

|

22,425 |

|

|

|

34.81 |

|

|

|

1.04 |

|

|

|

0.65 |

|

|

|

0.23 |

|

|

|

2.30 |

|

|

|

750 |

|

|

|

1,776 |

|

|

|

0.08 |

|

|

Inferred

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

--- |

|

|

|

|

|

|

|

|

PHASE 2

|

Indicated

|

|

|

42,703 |

|

|

|

29.4 |

|

|

|

0.88 |

|

|

|

0.56 |

|

|

|

0.19 |

|

|

|

2.00 |

|

|

|

1,206 |

|

|

|

17,684 |

|

|

|

0.41 |

|

|

Inferred

|

|

|

910 |

|

|

|

16.28 |

|

|

|

0.49 |

|

|

|

0.26 |

|

|

|

0.13 |

|

|

|

2.00 |

|

|

|

14 |

|

|

|

|

|

|

|

|

PHASE 3

|

Indicated

|

|

|

106,892 |

|

|

|

23.71 |

|

|

|

0.71 |

|

|

|

0.43 |

|

|

|

0.16 |

|

|

|

1.80 |

|

|

|

2,435 |

|

|

|

117,922 |

|

|

|

1.04 |

|

|

Inferred

|

|

|

6,722 |

|

|

|

22.39 |

|

|

|

0.67 |

|

|

|

0.44 |

|

|

|

0.14 |

|

|

|

1.70 |

|

|

|

145 |

|

|

|

|

|

|

|

|

PHASE 4

|

Indicated

|

|

|

69,425 |

|

|

|

17.61 |

|

|

|

0.53 |

|

|

|

0.29 |

|

|

|

0.14 |

|

|

|

1.80 |

|

|

|

1,175 |

|

|

|

145,808 |

|

|

|

1.96 |

|

|

Inferred

|

|

|

4,944 |

|

|

|

19.81 |

|

|

|

0.59 |

|

|

|

0.36 |

|

|

|

0.14 |

|

|

|

1.60 |

|

|

|

94 |

|

|

|

|

|

|

|

|

PHASE 5

|

Indicated

|

|

|

41,061 |

|

|

|

16.08 |

|

|

|

0.48 |

|

|

|

0.257 |

|

|

|

0.13 |

|

|

|

1.8 |

|

|

|

634 |

|

|

|

238,127 |

|

|

|

5.10 |

|

|

Inferred

|

|

|

5,648 |

|

|

|

21.18 |

|

|

|

0.633 |

|

|

|

0.409 |

|

|

|

0.13 |

|

|

|

1.9 |

|

|

|

115 |

|

|

|

|

|

|

|

|

Total Indicated

|

|

|

282,506 |

|

|

|

22.84 |

|

|

|

0.68 |

|

|

|

0.41 |

|

|

|

0.16 |

|

|

|

1.87 |

|

|

|

6,201 |

|

|

|

521,317 |

|

|

|

1.73 |

|

|

Total Inferred

|

|

|

18,224 |

|

|

|

21.01 |

|

|

|

0.63 |

|

|

|

0.40 |

|

|

|

0.13 |

|

|

|

1.75 |

|

|

|

368 |

|

|

|

|

|

|

|

Figure 3 – Cross section through Whistler Deposit showing the September 2024 block model and conceptual phased pit shells corresponding with Table 3.

Whistler Project Geology

The Whistler Deposit is hosted within the Whistler Intrusive Suite (see Figure 2), a composite suite of diorite stocks and dykes with cross-cutting relationships that divide the suite broadly into an early Main Stage Porphyry ("MSP"), a later cross-cutting Intermineral Porphyry Suite ("IMP") and the latest cross-cutting intrusive phase referred to as the Late Stage Porphyry ("LSP"). Gold and copper mineralization is characterized by presence of disseminated sulphide and quartz + sulphide vein stockworks (including classic porphyry diagnostic ‘A’, ‘B’, ‘D’, and ‘M’ type veins), and potassic alteration which is variably overprinted by later phyllic alteration. The early-stage MSP suite is most strongly altered, veined and mineralized, with the IMP being less intensely altered and veined but remaining consistently mineralized, and the late or post-mineralization LSP generally being below cutoff grade or unmineralized. The ‘high-grade core’ correlates with intense potassic alteration and highest frequency of A and B veining within the MSP.

Based on re-logging of historical drill core in conjunction with the 2023 drilling program, the Whistler Deposit three-dimensional geological model was re-interpreted to include adjustments to geometry, extents and continuity of the MSP, IMP and LSP suites. These were used as a guide to create mineralization shells for both Au-Ag and Cu separately. The shells include a higher grade ‘core’, with lower grade shells also generated to constrain both Au-Ag and Cu mineralization. A significant change in the 2024 geological model is the removal of the ‘Divide Fault’, which defined a hard boundary between geological and geostatistical domains in previous iterations of the Whistler deposit model. Relogging and 2023 drilling has confirmed there is no compelling evidence for this fault, thus the previously modelled Divide Fault is no longer seen to influence the mineralization. Subsequently, gold and copper grade shells have been constructed to constrain the Whistler Deposit mineral block model, honoring the geological boundaries defined by the limits of the productive MSP and ISP, and taking into account the weakly to non-mineralized LSP.

Mineralization at Raintree West occurs as two main types: 1) porphyry-style gold-copper mineralization hosted by diorite porphyry stocks and consisting of quartz and magnetite stockwork veining, with vein and disseminated chalcopyrite associated with potassic alteration, and 2) later cross-cutting silver-gold-lead-zinc mineralization in quartz-carbonate veins with occasional banded epithermal-like textures. The early gold-copper mineralization is best developed within, and controlled by, early diorite porphyry intrusions (akin to MSP at the Whistler Deposit), whereas the later silver-gold-lead-zinc veins surround and locally overprint the porphyry mineralization and are most abundant in the host andesitic composition volcanic.

The Island Mountain deposit, located 20 km south of the Whistler-Raintree deposits, is comprised of a suite of nested intrusions, ranging compositionally from hornblende diorite to hornblende-biotite monzonite, with mineralization occurring predominantly within the ‘Breccia Zone’, comprising intrusive breccias occurring as sub-vertical 100-150 m diameter ‘pipes’ with pyrrhotite-pyrite-chalcopyrite mineralization, that host the bulk of gold-copper porphyry mineralization.

Visit www.goldmining.com or www.usgoldmining.us for more information, including Technical Reports.

Technical Information

The technical work of the Whistler MRE was completed by Sue Bird, P.Eng., of Moose Mountain Technical Services (“MMTS”), an independent qualified person as defined by NI 43-101. Sue Bird has reviewed, verified and approved the technical information related to the Whistler MRE in this news release.

Tim Smith, P.Geo., Vice President Exploration, GoldMining, has supervised reviewed and approved the preparation of all other scientific and technical information contained herein. Mr. Smith is a qualified person as defined by in NI 43-101.

About GoldMining Inc.

The Company is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, the Company now controls a diversified portfolio of resource-stage gold and gold-copper projects and strategic investments in Canada, U.S.A., Brazil, Colombia, and Peru. The Company also owns approximately 21.5 million shares of Gold Royalty Corp. (NYSE American: GROY), 9.9 million shares of U.S. GoldMining Inc. (Nasdaq: USGO), and 26.7 million shares of NevGold Corp. (TSXV: NAU). See www.goldmining.com for additional information.

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Co-Chairman, David Garofalo, Co-Chairman

Alastair Still, CEO

Telephone: (855) 630-1001

Email: info@goldmining.com

Cautionary Statement on Forward-looking Statements

Certain of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting potential future plans and expectations of the Company and/or U.S. GoldMining regarding the Whistler Project and the Company's strategies and plans, including to unlock value for shareholders. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: the inherent risks involved in the exploration and development of mineral properties, fluctuating metal prices, unanticipated costs and expenses, risks related to government and environmental regulation, social, permitting and licensing matters, any inability to commence and complete work as expected, the Company’s and U.S. GoldMining's exploration and development plans may change in the future as a result of further planning or otherwise, and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs Annual Information Form for the year ended November 30, 2023, and other filings with Canadian securities regulators and the SEC, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that forward-looking statements, or the material factors or assumptions used to develop such forward-looking statements, will prove to be accurate. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities law.

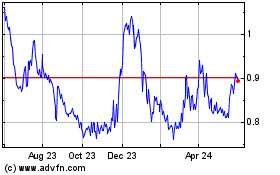

GoldMining (AMEX:GLDG)

Historical Stock Chart

From Feb 2025 to Mar 2025

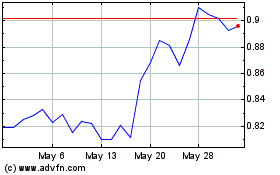

GoldMining (AMEX:GLDG)

Historical Stock Chart

From Mar 2024 to Mar 2025