STRUCTURALLY STRENGTHENING GENUS IN A

CHALLENGING YEAR

WEBCAST AVAILABLE AT 7:01AM GMT, 2.01 EST

Genus (LSE:GNS), a leading global animal genetics company, today

announces its preliminary results for the year ended 30 June 2024.

The full report has been made available on the investors section of

the Genus plc website. The Company will discuss its corporate,

operational and financial highlights in a pre-recorded webcast at

7:01 AM GMT, 2.01 EST.

Commenting on the performance and outlook, Jorgen Kokke,

Chief Executive Officer, said:

“Genus made significant progress against its strategic

priorities during FY24. I am confident that our decisive actions to

structurally strengthen the Group will yield significant benefits

in the years to come.

In FY25, we will continue to execute against our strategic

priorities and we expect to achieve significant growth in Group

adjusted profit before tax in constant currency, in-line with

market expectations. However, Sterling has continued to appreciate

against key foreign currencies since our trading update on 17 July

2024, and we now expect a currency headwind of approximately £8-9m

in FY25, if current exchange rates continue throughout the fiscal

year.”

Outlook

- Market conditions stable to slowly improving although we remain

cautious, particularly in China

- Solid adjusted operating profit growth expected from PIC in

constant currency

- ABS expected to return to adjusted operating profit growth in

constant currency, a stronger business with actions from VAP

- Management expects significant growth in FY25 Group adjusted

profit before tax in constant currency, in-line with current market

expectations

- Currency headwind of approximately £8-9m in FY25 if current

exchange rates continue throughout the fiscal year

Results presentation and live Q&A session today

A pre-recorded investors, analysts and bankers briefing to

discuss the preliminary results for the year ended 30 June 2024

will be accessible via the following link from 7:01am UK time

today:

https://webcasting.buchanan.uk.com/broadcast/66b0dea408f685532e0148c7

This will be followed by at 10.30 UKT time by a live Q&A

session by invitation at Peel Hunt, 100 Liverpool Street, EC2M 2AT.

Those unable to attend in person can also join via Zoom. Please

contact Verity Parker at Buchanan for details:

verity.parker@buchanancomms.co.uk

Results Highlights

Adjusted results1

Statutory results

Actual currency

Constant currency

change2

Actual currency

Year ended 30 June

2024

2023

Change

2024

2023

Change

£m

£m

%

%

£m

£m

%

Revenue

668.8

689.7

(3)

2

668.8

689.7

(3)

Operating profit

67.0

74.6

(10)

(3)

6.4

40.5

(84)

Operating profit inc JVs

78.1

85.8

(9)

(3)

n/a

n/a

n/a

Profit before tax

59.8

71.5

(16)

(8)

5.5

39.4

(86)

Net cash flows from operating

activities

55.1

45.9

20

n/m5

29.8

50.4

(41)

Free cash flow6

(3.2)

9.1

n/m5

n/m5

Basic earnings per share (pence)

65.5

84.8

(23)

(15)

12.0

50.8

(76)

Dividend per share (pence)

32.0

32.0

-

Strategic progress achieved despite challenging

markets

- Management actions limited the impact on adjusted operating

profit in a difficult year for volumes:

- ABS Value Acceleration Programme (“VAP”) initiated to

structurally improve Bovine’s margins, cash generation and returns

profile; Phase 1 delivered £7.3m of adjusted operating profit

benefit in FY24 (£10m annualised benefit); Phase 2 underway and

expected to deliver £5m of adjusted operating profit benefit in

FY25 (£10m annualised)

- R&D strategic review completed, resulting in a sharper

focus on key workstreams and savings of £2.4m realised in FY24 (£5m

of annualised adjusted operating profit benefit in FY25)

- Exceptional restructuring costs related to management actions

of £6.7m in FY24

- Encouraging regulatory progress on the PRRS3 Resistant Pig

(“PRP”):

- Favourable regulatory determinations from Brazil (April 2024)

and Colombia (October 2023)

- Continuing positive engagement with the US FDA4, with approval

expected in 2025

- Initial submissions to Canadian and Japanese authorities made,

as planned

- PIC PRPs arriving in China imminently for in-country

testing

Financial performance as expected, with structural changes

driving stronger performance in the second half

- Second half adjusted operating profit including JVs of £40.0m,

15% higher year on year in constant currency, with £9.4m of benefit

from management actions. Compares with first half adjusted

operating profit including JVs of £38.1m, 17% lower year on year in

constant currency

- Adjusted operating profit including JVs 3%2 lower in constant

currency (9% lower in actual currency). Good PIC ex-China growth

and the realisation of benefits across ABS and R&D were offset

by poor China performances and ABS volume trends

- Adjusted profit before tax (PBT) of £59.8m, 8%2 lower in

constant currency (16% lower in actual currency). Statutory PBT of

£5.5m, 86% lower in actual currency, primarily due to a £8.6m

decrease in the non-cash fair value IAS41 valuation of Group

biological assets (including JV’s) and net exceptional expenses of

£24.6m8 (2023: £3.5m net expense)

- New cash conversion1 metric introduced which includes

investments in biological assets, capital expenditure, lease

repayments and cash received from JVs; 71% achieved in FY24 (2023:

53%)

- Net Debt1 increased to £248.7m with a net debt to adjusted

EBITDA1 ratio of 2.0x, as expected, within our target range of 1.0x

to 2.0x

Divisional headlines7

- PIC – Resilient growth ex-China, in a difficult market PIC

China doubled its royalty customer numbers:

- Continued genetic improvement, delivering $4.39/pig of genetic

profit gain (2023: $3.74/pig)

- PIC volumes increased 3%, revenue decreased 1%2 and

strategically important royalty revenue increased 4%2, in constant

currency

- PIC trading regions ex-China adjusted operating profit

increased 4%2 in constant currency

- PIC China adjusted operating profit decreased 60%2 in constant

currency due to the challenging market environment and planned

supply chain investments; good commercial progress – 13 new royalty

customers won since June 2023

- ABS – Challenging markets, particularly China; VAP delivering

structural improvements and significant cost efficiencies:

- Volumes decreased 6% (ABS ex-China volumes decreased 1%) with

sexed volumes up 3%, beef volumes decreased 6%

- Revenue increased 4%2 in constant currency as price actions,

mix and IntelliGen growth offset volume declines

- Adjusted operating profit decreased 3%2 in constant currency

mitigated by VAP actions

- VAP Phase 1 achieved £10m run-rate of annualised adjusted

operating profit improvement by the end of FY24; Phase 2 underway

and expected to deliver £5m of savings in FY25 (£10m

annualised)

1 Adjusted results are the Alternative

Performance Measures (‘APMs’) used by the Board to monitor

underlying performance at a Group and operating segment level,

which are applied consistently throughout. These APMs should be

considered in addition to statutory measures, and not as a

substitute for or as superior to them.

2 Constant currency percentage movements

are calculated by representing the results for the year ended 30

June 2024 at the average exchange rates applied to adjusted

operating profit for the year ended 30 June 2023

3 Porcine Reproductive and Respiratory

Syndrome

4 United States Food and Drug

Administration

5 n/m = not meaningful

6 Free cash flow definition has changed

this year to include lease repayments, the 2023 comparative has

also been restated

7 Prior year period restated.

8 Net exceptional expenses of £24.6m

predominantly comprised £10.4m related to ST litigation and

settlements, £6.7m related to restructuring activity and £7.4m

related to a number of potential corporate transactions which are

no longer active

About Genus

Genus advances animal breeding and genetic improvement by

applying biotechnology and sells added value products for livestock

farming and food producers. Its technology is applicable across

livestock species and is currently commercialised by Genus in the

dairy, beef and pork food production sectors.

Genus's worldwide sales are made in over 80 countries under the

trademarks 'ABS' (dairy and beef cattle) and 'PIC' (pigs) and

comprise semen, embryos and breeding animals with superior genetics

to those animals currently in farms. Genus's customers' animals

produce offspring with greater production efficiency and quality,

and our customers use them to supply the global dairy and meat

supply chains. Genus thereby enables its customers to produce

greater volumes of high quality animal protein whilst using fewer

inputs such as feed, water and land. This is both good for the

environment and the sustainability of our customers’

operations.

Genus’s competitive edge comes from the ownership and control of

proprietary lines of breeding animals, the biotechnology used to

improve them and its global supply chain, technical service and

sales and distribution network.

Headquartered in Basingstoke, United Kingdom, Genus companies

operate in over 24 countries on six continents, with research

laboratories located in Madison, Wisconsin, USA.

Forward-looking Statements

This Announcement may contain, and the Company may make verbal

statements containing “forward-looking statements” with respect to

certain of the Company’s plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this Announcement.

Forward-looking statements sometimes use words such as “aim”,

“anticipate”, “target”, “expect”, “estimate”, “intend”, “plan”,

“goal”, “believe”, “seek”, “may”, “could”, “outlook”, “will” or

other words of similar meaning. By their nature, all

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances which are beyond the

control of the Company, including amongst other things, diverse

factors such as domestic and global economic business conditions,

market-related risks such as fluctuations in commodity prices,

interest rates and exchange rates, the policies and actions of

governmental and regulatory authorities, the effect of sanctions on

the ability to trade, the effect of competition, inflation,

deflation, the timing effect and other uncertainties of future

acquisitions or combinations within relevant industries, the effect

of the spread of African Swine Fever and other animal diseases, the

continued development and improvement of our IntelliGen®

technology, the development and registration of our innovative new

products, such as our gene edited porcine reproductive and

respiratory syndrome virus resistant pigs, the continued growth in

emerging markets, the effect of tax and other legislation and other

regulations in the jurisdictions in which the Company and its

respective affiliates operate, the effect of volatility in the

equity, capital and credit markets on the Company’s profitability

and ability to access capital and credit, a decline in the

Company’s credit ratings; the effect of operational risks; and the

loss of key personnel. As a result, the actual future financial

condition, performance and results of the Company may differ

materially from the plans, goals and expectations set forth in any

forward-looking statements. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company’s expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

No statement in this Announcement is intended to be a profit

forecast, and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

Information contained in this Announcement should not be relied

upon as a guide to the Company’s future performance.

This announcement is available on the Genus website

www.genusplc.com

GROUP INCOME STATEMENT

For the year ended 30 June 2024

2024 £m

2023 £m

REVENUE

668.8

689.7

Adjusted operating profit

67.0

74.6

Adjusting items:

– Net IAS 41 valuation movement on

biological assets

(23.2)

(16.9)

– Amortisation of acquired intangible

assets

(5.8)

(7.7)

– Share-based payment expense

(7.0)

(6.0)

(36.0)

(30.6)

Exceptional items (net)

(24.6)

(3.5)

Total adjusting items

(60.6)

(34.1)

OPERATING PROFIT

6.4

40.5

Share of post-tax profit of joint ventures

and associates retained

19.1

10.5

Other gains and losses

(1.7)

2.7

Finance costs

(22.2)

(15.4)

Finance income

3.9

1.1

PROFIT BEFORE TAX

39.4

Taxation

(3.1)

(7.6)

PROFIT FOR THE YEAR

2.4

31.8

ATTRIBUTABLE TO:

Owners of the Company

7.9

33.3

Non-controlling interest

(5.5)

(1.5)

2.4

31.8

EARNINGS PER SHARE

Basic earnings per share

12.0p

50.8p

Diluted earnings per share

11.9p

50.5p

2024 £m

2023 £m

Alternative Performance

Measures

Adjusted operating profit

67.0

74.6

Adjusted operating loss attributable to

non-controlling interest

0.9

0.4

Pre-tax share of profits from joint

ventures and associates excluding net IAS 41 valuation movement

10.2

10.8

Adjusted operating profit including

joint ventures and associates

78.1

85.8

Net finance costs

(18.3)

(14.3)

Adjusted profit before tax

59.8

71.5

Adjusted earnings per share

Basic adjusted earnings per share

65.5p

84.8p

Diluted adjusted earnings per share

65.0p

84.2p

Adjusted results are the Alternative

Performance Measures (‘APMs’) used by the Board to monitor

underlying performance at a Group and operating segment level,

which are applied consistently throughout. These APMs should be

considered in addition to statutory measures, and not as a

substitute for or as superior to them.

GROUP STATEMENT OF COMPREHENSIVE

INCOME

For the year ended 30 June 2024

2024 £m

2024 £m

2023 £m

2023 £m

PROFIT FOR THE YEAR

2.4

31.8

Items that may be reclassified

subsequently to profit or loss

Foreign exchange translation

differences

(16.0)

(27.2)

Fair value movement on net investment

hedges

0.4

–

Fair value movement on cash flow

hedges

(1.6)

0.8

Tax relating to components of other

comprehensive expense/(income)

(0.1)

3.1

(17.3)

(23.3)

Items that may not be reclassified

subsequently to profit or loss

Actuarial loss on retirement benefit

obligations

(6.0)

(40.4)

Movement on pension asset recognition

restriction

3.9

38.3

Release of additional pension

liability

2.1

3.0

(Loss)/gain on equity instruments measured

at fair value

(2.8)

1.7

Tax relating to components of other

comprehensive expense/(income)

(0.1)

(1.2)

(2.9)

1.4

OTHER COMPREHENSIVE EXPENSE FOR THE

YEAR

(20.2)

(21.9)

TOTAL COMPREHENSIVE (EXPENSE)/INCOME

FOR THE YEAR

(17.8)

9.9

ATTRIBUTABLE TO:

Owners of the Company

(12.3)

11.1

Non-controlling interest

(5.5)

(1.2)

(17.8)

9.9

GROUP STATEMENT OF CHANGES IN

EQUITY

For the year ended 30 June 2024

Called up share capital

£m

Share premium account

£m

Own shares £m

Trans- lation reserve

£m

Hedging reserve £m

Retained earnings £m

Total £m

Non- controlling interest

£m

Total equity £m

BALANCE AT 30 June 2022

6.6

179.1

(0.1)

50.9

1.4

340.6

578.5

(6.4)

572.1

Foreign exchange translation differences,

net of tax

–

–

–

(24.2)

–

–

(24.2)

0.3

(23.9)

Fair value movement on net investment

hedges, net of tax

–

–

–

–

–

–

–

–

–

Fair value movement on cash flow hedges,

net of tax

–

–

–

–

0.6

–

0.6

–

0.6

Gain on equity instruments measured at

fair value, net of tax

–

–

–

–

–

0.7

0.7

–

0.7

Actuarial loss on retirement benefit

obligations, net of tax

–

–

–

–

–

(30.3)

(30.3)

–

(30.3)

Movement on pension asset recognition

restriction, net of tax

–

–

–

–

–

28.7

28.7

–

28.7

Recognition of additional pension

liability, net of tax

–

–

–

–

–

2.3

2.3

–

2.3

Other comprehensive (expense)/income

for the year

–

–

–

(24.2)

0.6

1.4

(22.2)

0.3

(21.9)

Profit/(loss) for the year

–

–

–

–

–

33.3

33.3

(1.5)

31.8

Total comprehensive income/(expense)

for the year

–

–

–

(24.2)

0.6

34.7

11.1

(1.2)

9.9

Recognition of share-based payments, net

of tax

–

–

–

–

–

6.3

6.3

–

6.3

Dividends

–

–

–

–

–

(21.0)

(21.0)

–

(21.0)

Adjustment arising from change in

non-controlling interest and written put option

–

–

–

–

–

–

–

(0.1)

(0.1)

BALANCE AT 30 June 2023

6.6

179.1

(0.1)

26.7

2.0

360.6

574.9

(7.7)

567.2

Foreign exchange translation differences,

net of tax

–

–

–

(16.6)

–

–

(16.6)

–

(16.6)

Fair value movement on net investment

hedges, net of tax

–

–

–

0.4

–

–

0.4

–

0.4

Fair value movement on cash flow hedges,

net of tax

–

–

–

–

(1.1)

–

(1.1)

–

(1.1)

Loss on equity instruments measured at

fair value, net of tax

–

–

–

–

–

(2.8)

(2.8)

–

(2.8)

Actuarial loss on retirement benefit

obligations, net of tax

–

–

–

–

–

(4.6)

(4.6)

–

(4.6)

Movement on pension asset recognition

restriction, net of tax

–

–

–

–

–

2.9

2.9

–

2.9

Recognition of additional pension

liability, net of tax

–

–

–

–

–

1.6

1.6

–

1.6

Other comprehensive (expense)/income

for the year

–

–

–

(16.2)

(1.1)

(2.9)

(20.2)

–

(20.2)

Profit/(loss) for the year

–

–

–

–

–

7.9

7.9

(5.5)

2.4

Total comprehensive income/(expense)

for the year

–

–

–

(16.2)

(1.1)

5.0

(12.3)

(5.5)

(17.8)

Recognition of share-based payments, net

of tax

–

–

–

–

–

6.6

6.6

–

6.6

Dividends

–

–

–

–

–

(21.0)

(21.0)

–

(21.0)

Adjustment arising from change in

non-controlling interest and written put option

–

–

–

–

–

–

–

8.9

8.9

BALANCE AT 30 June 2024

6.6

179.1

(0.1)

10.5

0.9

351.2

548.2

(4.3)

543.9

GROUP BALANCE SHEET

As at 30 June 2024

2024 £m

2023 £m

ASSETS

Goodwill

110.3

107.8

Other intangible assets

65.4

66.2

Biological assets

297.4

318.2

Property, plant and equipment

182.0

164.4

Interests in joint ventures and

associates

60.5

53.5

Other investments

1.1

8.8

Derivative financial assets

1.2

4.9

Other receivables

11.8

8.2

Deferred tax assets

28.1

16.5

TOTAL NON-CURRENT ASSETS

757.8

748.5

Inventories

57.1

61.3

Biological assets

32.3

23.8

Trade and other receivables

135.2

132.1

Cash and cash equivalents

42.5

36.3

Income tax receivable

2.1

4.0

Derivative financial assets

1.9

1.5

TOTAL CURRENT ASSETS

271.1

259.0

TOTAL ASSETS

1,028.9

1,007.5

LIABILITIES

Trade and other payables

(123.2)

(122.0)

Interest-bearing loans and borrowings

(4.9)

(4.2)

Provisions

(1.0)

(1.8)

Deferred consideration

(0.6)

–

Obligations under leases

(14.0)

(10.0)

Tax liabilities

(5.2)

(7.4)

Derivative financial liabilities

(1.7)

(1.8)

TOTAL CURRENT LIABILITIES

(150.6)

(147.2)

Trade and other payables

(4.2)

–

Interest-bearing loans and borrowings

(228.2)

(196.0)

Retirement benefit obligations

(6.6)

(6.9)

Provisions

(0.4)

(10.3)

Deferred consideration

(0.2)

(0.6)

Deferred tax liabilities

(44.4)

(51.2)

Derivative financial liabilities

(6.3)

(6.2)

Obligations under leases

(44.1)

(21.9)

TOTAL NON-CURRENT LIABILITIES

(334.4)

(293.1)

TOTAL LIABILITIES

(485.0)

(440.3)

NET ASSETS

543.9

567.2

EQUITY

Called up share capital

6.6

6.6

Share premium account

179.1

179.1

Own shares

(0.1)

(0.1)

Translation reserve

10.5

26.7

Hedging reserve

0.9

2.0

Retained earnings

351.2

360.6

EQUITY ATTRIBUTABLE TO OWNERS OF THE

COMPANY

548.2

574.9

Non-controlling interest

1.2

(2.2)

Put option over non-controlling

interest

(5.5)

(5.5)

TOTAL NON-CONTROLLING INTEREST

(4.3)

(7.7)

TOTAL EQUITY

543.9

567.2

GROUP STATEMENT OF CASH FLOWS

For the year ended 30 June 2024

2024 £m

2023 £m

NET CASH FLOW FROM OPERATING

ACTIVITIES

29.8

50.4

CASH FLOWS FROM INVESTING

ACTIVITIES

Dividends received from joint ventures and

associates

4.7

2.6

Joint venture and associate loan

investment

(2.2)

(1.9)

Acquisition of joint venture and

associate

-

(1.0)

Sale of other investments

5.1

3.4

Acquisition of Xelect Limited

(2.9)

-

Acquisition of other investments

-

(0.4)

Payment of deferred consideration

-

(0.8)

Purchase of property, plant and

equipment

(14.8)

(25.9)

Purchase of intangible assets

(9.9)

(9.3)

Proceeds from sale of property, plant and

equipment

0.7

2.4

NET CASH OUTFLOW FROM INVESTING

ACTIVITIES

(19.3)

(30.9)

CASH FLOWS FROM FINANCING

ACTIVITIES

Drawdown of borrowings

140.4

126.8

Repayment of borrowings

(108.5)

(111.7)

Payment of lease liabilities

(13.7)

(11.1)

Equity dividends paid

(21.0)

(21.0)

Dividend to non-controlling interest

-

(0.1)

Debt issue costs

-

(1.1)

NET CASH OUTFLOW FROM FINANCING

ACTIVITIES

(2.8)

(18.2)

NET INCREASE IN CASH AND CASH

EQUIVALENTS

7.7

1.3

Cash and cash equivalents at start of the

year

36.3

38.8

Net increase in cash and cash

equivalents

7.7

1.3

Effect of exchange rate fluctuations on

cash and cash equivalents

(1.5)

(3.8)

TOTAL CASH AND CASH EQUIVALENTS AT 30

JUNE

42.5

36.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904874140/en/

Enquiries: Genus plc (Jorgen Kokke, Chief Executive

Officer / Alison Henriksen, Chief Financial Officer / Anand Date,

Investor Relations Director) Tel: 01256 345970 Buchanan (Charles

Ryland / Toto Berger / Sophie Wills / Verity Parker) Tel: 0207

4665000

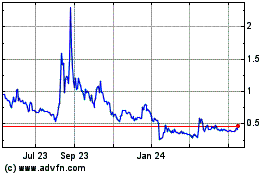

Genius (AMEX:GNS)

Historical Stock Chart

From Feb 2025 to Mar 2025

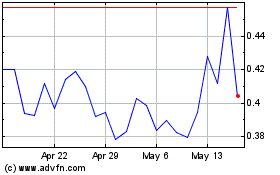

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Mar 2025