REIT ETFs Rebound; Time to Buy? - ETF News And Commentary

09 October 2013 - 3:14AM

Zacks

After a bull run in the

first four months of the year, the U.S Real Estate Investment Trust

(REIT) industry had nosedived after the onset of “taper talk” which

pushed up interest rates sharply. Since then, the downside risk in

the sector has been acute with S&P/TSX Capped Real Estate Index

trimming about 5.10% in the last six months.

However, the trend recently saw a reversal after the Federal

Reserve’s surprising ‘No Taper’ decision that ended four months of

market speculation (Read: REIT ETFs Rise as Treasury Yields Finally

Tumble).

The Positives

Prior to the recent uptrend in interest rates, these high-dividend

paying stocks were in great demand due to ultra-low interest rates.

After the no-taper shocker, this interest rate

sensitive REIT sector sending it northward. Since then, the sector

has been outperforming the broader market.

The yield on the benchmark U.S. Treasury 10-year note has

declined to 2.63% as of October 4, 2013 from 2.76% as on September

19, 2013.

Investors are once again turning their focus towards this corner of

the investing world in view of the fact that yield on 10-year

Treasury note is still lower than the average rate of 6.4% during

1912 to 2013, even after the spike in interest rates in recent

times should soothe investors’ nerves (Read: Mortgage REIT ETFs: Is

The Plunge Over?).

Dividends still remain an attraction in the sector. With the U.S.

law requiring REITs to distribute 90% of their annual taxable

income in the form of dividends to shareholders, yield-seeking

investors continue to prefer these stocks. A decline in borrowing

costs normally supports REITs dividend profile since the policy is

in favor of servicing debt and accessing capital. This favorable

business environment helps REITs boost their dividends. Recovering

housing and labor markets will also act as major tailwinds.

Market Impact

In such a scenario, investors might want to pay close attention to

the REIT ETF market in the near term. Below, we briefly highlight

the some funds in the space which could be great short-term picks.

Vanguard REIT ETF (VNQ), iShares U.S. Real Estate ETF (IYR), SPDR

Dow Jones REIT ETF (RWR), Schwab U.S. REIT ETF (SCHH), and First

Trust S&P REIT Index Fund (FRI) gained a respective 2.24%,

2.44%, 2.28%, 2.0% and 2.1% in the last month (as of September 25)

while SPDR S&P 500 (SPY) added 1.94% during the time frame (see

more ETFs in the Zacks ETF Center).

VNQ is an extremely popular choice in the space with more than$17.0

billion in assets, but funds like IYR ($4.5 billion) and RWR ($2.0

billion) also attract sufficient investments. Among these, SCHH and

FRI are slightly overlooked options with around $500 million and

150 million of AUM respectively.

Among the five, SCHH is the cheapest charging only 7 basis points

in annual fees while VNQ and RWR cost 10 bps and 25 bps

respectively. However, IYR and FRI are pricier funds charging

48 and 50 basis points individually, slightly higher than the

average expenses charged by their other REIT cousins.

Investors should note that all funds barring SCHH (1.9% as of Sep

25) currently have a dividend yield more than 3%. The funds have

more-or-less 50% investment in large caps giving a leeway for

decent capital appreciation since the remaining 50% of the assets

are invested in mid-to-small-caps which are known for their high

return-high risk criteria.

Road Ahead

Given that REITs were highly beaten down since late May, this could

be a good entry point to the sector. Moreover, with taper talk

coming to rest as of now, REITs are likely to surge higher in the

coming weeks.

Having said all, the duration of this trend is still unclear with

some macro concerns even in a positive scenario. Reacting to Fed’s

surprise announcement last month, investors are now dithered about

the future of QE, a possible government shutdown and the debt

ceiling debate.

A trimmed outlook for 2013 and 2014 US GDP has also added to the

woes. All these had a slightly negative impact on the REIT sector

alongwith the broader market. Hence, after shooting up on September

19, the REIT ETFs began to slide (read: Bet Against Real Estate

with These Short REIT ETFs).

Also one word of caution

is that sooner or later, at least a soft taper will be put into

action. Till then, income seeking investors can reap the return

from REIT investing thanks to the sector’s low valuation. On a

greener side, funds with higher exposure in retail, residential and

healthcare REITs will likely be less ruffled amid rising rates

compared to the funds with increased coverage in mREITs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-SP REIT IDX (FRI): ETF Research Reports

ISHARS-US REAL (IYR): ETF Research Reports

SPDR-DJ W REIT (RWR): ETF Research Reports

SCHWAB-US REIT (SCHH): ETF Research Reports

VIPERS-REIT (VNQ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

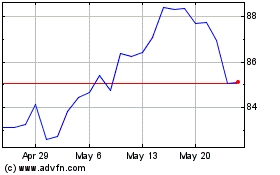

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Jan 2025 to Feb 2025

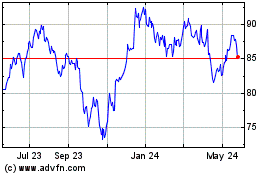

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Feb 2024 to Feb 2025