false

0001643988

0001643988

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 6, 2024

Loop Media, Inc.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

2600 West Olive Avenue, Suite 5470

Burbank, CA |

|

91505 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(213) 436-2100

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common stock, $0.0001 par value per share |

|

LPTV |

|

The NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results

of Operations and Financial Condition.

On

February 6, 2024, Loop Media, Inc. (the “Company”) issued a press release regarding the Company’s financial results

for the three months ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated

by reference herein.

The

information in this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

|

| Date: February 6, 2024 |

LOOP MEDIA, INC. |

| |

|

|

| |

By: |

/s/ Jon Niermann |

| |

|

Jon Niermann, CEO |

| |

|

Exhibit

99.1

Loop

Media Reports 2024 Fiscal First Quarter Financial Results

Q1

Shows Improvement on Top and Bottom Lines

BURBANK, CA – February 6, 2024 –

Loop Media, Inc. ("Loop Media" or "Loop®" or the "Company") (NYSE American: LPTV), a leading

multichannel streaming CTV platform that provides curated music videos, sports, news, premium entertainment channels and digital signage

for businesses, reports financial and operating results for its 2024 fiscal first quarter ended December 31, 2023.

Management Commentary

Jon Niermann, CEO and Co-Founder, stated, "After three quarters

of just over $5 million in revenue, we once again exceeded the $10 million quarterly revenue mark. One key note is that unlike Q1 FY23,

our Q1 FY24 revenue contained no political advertising spend and was purely organic revenue from our core business. Quarter-over-quarter

growth increased 79% from $5.7 million in Q4 of FY 2023 to $10.2 million in Q1 2024. In addition to the strong revenue growth, we saw

the impact of our focus on lowering operating costs and network efficiency, which resulted in a significantly reduced quarterly Adjusted

EBITDA loss, which decreased by 69% from $(4.8) million in Q4 2023 to $(1.5) million in Q1 2024."

"We

have now entered the historically worst advertising quarter of the year between January and March where we’ve learned to be more

conservative in our expectations, but I am optimistic about the revenue ramp for the second half of 2024 and beyond. We believe the

increased awareness of the Loop TV brand, and the expansion of distribution over the past year on our platforms and screens, demonstrates

that our sales and marketing efforts are getting us new client wins. Our approach is to leverage our business model to continue to gain

new customers on a consistent basis while focusing on the venues and markets that we know provide the best return on our investment and

potential for revenue growth."

"Moreover,

we will continue to explore strategic M&A opportunities that can allow us to leverage our platforms and networks further to integrate

our company vertically,” added Mr. Niermann.

"We will continue to focus on tightening the bottom line to achieve

our goal of becoming cashflow positive as soon as possible, so that could mean further cost efficiencies will need to be realized, while

still being careful not to materially dampen future upside in growth. It’s always a tricky balance to accomplish that, but we plan

to keep a consistent eye on it," concluded Mr. Niermann.

2024 Fiscal First Quarter (December 31,

2023) Financial Results

Summary Fiscal Q1 2024 vs. Fiscal Q1 2023

| | ● | Revenue was $10.2 million, compared to $14.8 million. |

| ● | Net loss was $(5.3) million or $(0.09) per share, compared to a loss of $(5.3) million or $(0.09). |

| ● | Adjusted EBITDA (a non-GAAP financial measure defined below) was $(1.5) million, compared to $(1.6) million. |

| ● | Gross profit was $3.6 million, compared to $5.7 million. |

| ● | Gross margin was 35.6%, compared to 38.4%. |

| ● | As of December 31, 2023, we had 33,783 QAUs operating on our O&O Platform, compared to 26,903 QAUs

as of December 31, 2022. |

| ● | As of December 31, 2023, we had approximately 43,000 screens across our Partner Platforms, compared to

17,000 as of December 31, 2022. |

In the 2024 fiscal first quarter, revenue decreased approximately 31%

to $10.2 million compared to $14.8 million for the same period in fiscal 2023. The decrease was primarily driven by the lack of political

advertising in October and November 2023 versus the same period in 2022. We did manage to see growth in our core organic revenue in large

part due to new revenue partnerships that initiated in Q1 FY24.

Gross profit in the 2024 fiscal first quarter

was $3.6 million compared to $5.7 million for the same period in fiscal 2023. Gross margin was 35.6% in the 2024 fiscal first quarter

compared to 38.4% for the same period in fiscal 2023. The decrease in margin rate was primarily driven by revenue mix as the year-ago

period included a smaller portion of our Partner Platform business, which carries lower gross margin.

Total sales,

general, and administrative ("SG&A") expenses (excluding stock-based compensation, depreciation and amortization,

impairment of goodwill and intangible assets, and restructuring costs) in the 2024 fiscal first quarter were $6.2 million compared

to $8.0 million for the same period in fiscal 2023. The decrease was primarily due to a reduction in digital marketing spend,

resulting in lower expenditures and decreased payroll expenses, and a reversal of other compensation-related expenses incurred in a

prior period, partially offset by increased capital raise costs and increased bad debt reserve from growth in our receivables.

Net loss in the 2024 fiscal first quarter

was $(5.3) million or $(0.09) per share, compared to a net loss of $(5.3) million or $(0.09) per share for the same period in fiscal 2023.

Adjusted EBITDA in the 2024 fiscal first quarter

was $(1.5) million compared to $(1.6) million for the same period in fiscal 2023.

On December 31, 2023, cash and cash equivalents

were $3.8 million compared to $3.1 million on September 30, 2023. The increase was primarily driven by increased revenue offset by decreased

expenditures. As of December 31, 2023, we had total net debt of $7.1 million compared to $7.5 million as of September 30, 2023,

a 5% decrease.

For the 2024 fiscal first quarter, we had approximately

77,000 active Loop Players and Partner Screens across the Loop Platform, which includes 33,783 quarterly active Loop Players, or QAUs

across our O&O Platform, an increase of 26% (or 6,880 QAUs) over the 26,903 QAUs for the 2023 fiscal first quarter and a slight decrease

of 3,238 over the 37,021 QAUs for the fiscal 2023 fourth quarter, and approximately 43,000 Partner Screens across our Partner Platforms,

an increase of 153% (or 26,000) over the 17,000 Partner Screens at the end of the 2023 fiscal first quarter and 1,000 Partner Screens

over the 42,000 Partner Screens announced for the 2023 fiscal fourth quarter.

Our QAU footprint for the first quarter of fiscal

2024 was reduced as a result of natural attrition of Loop Players that were not immediately replaced, as we transitioned to a more targeted

distribution model, pivoting our focus to certain designated advertising markets and geographies, as well as more desirable out-of-home

locations and venues, including convenience stores, restaurants, bars, and other retail establishments. We believe this targeted distribution

plan will allow us to grow our active Loop Player numbers quarter on quarter and provide a more robust distribution platform for our advertising

partners over time. In addition, a number of our Loop Players experienced downtime in September 2023 as a result of an operating program

update and technical issues related to outdated WiFi in those venues. Not all of those Loop Players returned to active performance in

the first quarter of fiscal 2024.

Conference Call

The Company will conduct a conference call

today, February 6, 2024, at 5:00 p.m. Eastern Standard Time to discuss financial and operating results for its 2024 fiscal first quarter

ended December 31, 2023.

Loop's management will host the conference

call, followed by a question and answer period.

Date: February 6, 2024

Time: 5:00 p.m. Eastern Time

Participant registration link: Q1 Link

Below are the details for those participants

who would like to dial in and ask questions.

Conference ID: 9046830

Participant Toll-Free Dial-In Number: 1(800)

715-9871

Participant International Dial-In Number: 1(646)

307-1963

The conference call will

also be available for replay on the investor relations section of the Company's website at ir.loop.tv

About Loop Media, Inc.

Loop Media, Inc. ("Loop®")

(NYSE American: LPTV) is a leading connected television (CTV) / streaming / digital out-of-home TV and digital signage platform optimized

for businesses, providing music videos, news, sports, and entertainment channels through its Loop® TV service. Loop Media

is the leading company in the U.S. licensed to stream music videos to businesses through its proprietary Loop® Player.

Loop® TV’s digital

video content is streamed to millions of viewers in CTV / streaming / digital out of home locations including bars/restaurants, office

buildings, retail businesses, college campuses, airports, among many other venues in the United States, Canada, Australia and New Zealand.

Loop® TV is fueled by one

of the largest and most important premium short-form entertainment libraries that includes music videos, movie trailers, branded content,

and live performances. Loop Media’s non-music channels cover a wide range of genres and moods and include movie trailers, sports

highlights, lifestyle and travel videos, viral videos, and more. Loop Media’s streaming services generate revenue from programmatic

and direct advertising, and subscriptions.

To learn more about Loop Media products and

applications, please visit us online at Loop.tv

Follow us on social:

Instagram: @loopforbusiness

X (Twitter): @loopforbusiness

LinkedIn: https://www.linkedin.com/company/loopforbusiness/

Safe Harbor Statement and Disclaimer

This

news release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, Loop Media's expected performance,

ability to compete in the highly competitive markets in which it operates, statements regarding Loop Media's ability to develop talent

and attract future talent, the success of strategic actions Loop Media is taking, and the impact of strategic transactions. Forward-looking

statements give our current expectations, opinion, belief or forecasts of future events and performance. A statement identified by the

use of forward-looking words including "will," "may," "expects," "projects," "anticipates,"

"plans," "believes," "estimate," "should," and certain of the other foregoing statements may

be deemed forward-looking statements. Although Loop Media believes that the expectations reflected in such forward-looking statements

are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially

different from those suggested or described in this news release. Investors are cautioned that any forward-looking statements are not

guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking statements

in this press release are made as of the date hereof. Loop Media takes no obligation to update or correct its own forward-looking statements,

except as required by law, or those prepared by third parties that are not paid for by Loop Media. Loop Media's Securities and Exchange

Commission filings are available at www.sec.gov.

Non-GAAP Measures

Loop Media uses non-GAAP financial measures,

including adjusted EBITDA and quarterly active units or QAUs, as supplemental measures of the performance of the Company's business.

Use of these financial measures has limitations, and you should not consider them in isolation or use them as substitutes for analysis

of Loop Media's financial results under generally accepted accounting principles in the United States of America ("U.S. GAAP").

The tables below provide a reconciliation of adjusted EBITDA to the most nearly comparable measure under U.S. GAAP.

The Company defines an "active unit"

as (i) an ad-supported Loop Player (or DOOH location using our ad-supported service through our "Loop for Business" application

or using a DOOH venue-owned computer screening our content) that is online, playing content, and has checked into the Loop analytics

system at least once in the 90-day period or (ii) a DOOH location customer using our paid subscription service at any time during the

90-day period. The Company uses "QAU" to refer to the number of such active units during such period.

Loop Media Investor Contact

Andrew J. Barwicki

andrew@barwicki.com

ir@loop.tv

Loop Media Press Contact

Jon Lindsay Phillips

loop@phillcomm.global

LOOP MEDIA, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

Three months ended December 31, | |

| | |

2023 | | |

2022 | |

| Revenue | |

$ | 10,171,256 | | |

$ | 14,825,831 | |

| Cost of revenue | |

| | | |

| | |

| Cost of revenue - Advertising and Legacy and other revenue | |

| 5,739,710 | | |

| 8,457,633 | |

| Cost of revenue - depreciation and amortization | |

| 807,007 | | |

| 682,167 | |

| Total cost of revenue | |

| 6,546,717 | | |

| 9,139,800 | |

| Gross profit | |

| 3,624,539 | | |

| 5,686,031 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Sales, general and administrative | |

| 6,170,977 | | |

| 7,958,134 | |

| Stock-based compensation | |

| 1,328,225 | | |

| 1,790,807 | |

| Depreciation and amortization | |

| 381,875 | | |

| 187,716 | |

| Total operating expenses | |

| 7,881,077 | | |

| 9,936,657 | |

| | |

| | | |

| | |

| Loss from operations | |

| (4,256,538 | ) | |

| (4,250,626 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Interest expense | |

| (1,002,189 | ) | |

| (1,007,583 | ) |

| Loss on extinguishment of debt | |

| (25,424 | ) | |

| — | |

| Other expense | |

| (1,251 | ) | |

| — | |

| Total other income (expense) | |

| (1,028,864 | ) | |

| (1,007,583 | ) |

| Loss before income taxes | |

| (5,285,402 | ) | |

| (5,258,209 | ) |

| Income tax (expense)/benefit | |

| — | | |

| (1,230 | ) |

| Net loss | |

$ | (5,285,402 | ) | |

$ | (5,259,439 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (0.09 | ) | |

$ | (0.09 | ) |

| | |

| | | |

| | |

| Weighted average number of basic and diluted common shares outstanding | |

| 66,787,371 | | |

| 56,381,209 | |

LOOP MEDIA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

December 31, 2023 | | |

September 30, 2023 | |

| | |

| (UNAUDITED) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 3,811,159 | | |

$ | 3,068,696 | |

| Accounts receivable, net | |

| 7,941,430 | | |

| 6,211,815 | |

| Prepaid expenses and other current assets | |

| 669,360 | | |

| 987,605 | |

| Content assets - current | |

| 1,937,900 | | |

| 2,218,894 | |

| Total current assets | |

| 14,359,849 | | |

| 12,487,010 | |

| Non-current assets | |

| | | |

| | |

| Deposits | |

| 12,145 | | |

| 12,054 | |

| Content assets - non current | |

| 304,180 | | |

| 448,726 | |

| Deferred costs - non current | |

| 1,710,583 | | |

| 744,408 | |

| Property and equipment, net | |

| 2,533,829 | | |

| 2,711,558 | |

| Intangible assets, net | |

| 449,778 | | |

| 477,889 | |

| Total non-current assets | |

| 5,010,515 | | |

| 4,394,635 | |

| Total assets | |

$ | 19,370,364 | | |

$ | 16,881,645 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 6,627,014 | | |

$ | 4,978,920 | |

| Accrued liabilities | |

| 2,318,599 | | |

| 3,546,338 | |

| Accrued royalties and revenue share | |

| 6,277,646 | | |

| 4,930,329 | |

| License content liabilities - current | |

| 521,746 | | |

| 489,157 | |

| Deferred Income | |

| 19,565 | | |

| — | |

| Revolving line of credit - current | |

| 4,907,573 | | |

| 2,985,298 | |

| Non-revolving line of credit | |

| 1,760,000 | | |

| 2,124,720 | |

| Total current liabilities | |

| 22,432,143 | | |

| 19,054,762 | |

| Non-current liabilities | |

| | | |

| | |

| License content liabilities - non current | |

| 184,000 | | |

| 208,000 | |

| Non-revolving line of credit | |

| 441,390 | | |

| 475,523 | |

| Non-revolving line of credit, related party | |

| — | | |

| 1,959,693 | |

| Total non-current liabilities | |

| 625,390 | | |

| 2,643,216 | |

| Total liabilities | |

| 23,057,533 | | |

| 21,697,978 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| — | | |

| — | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common Stock, $0.0001 par value, 150,000,000 shares authorized, 70,851,214 and 65,620,151 shares issued and outstanding as of December 31, 2023 and September 30, 2023, respectively | |

| 7,085 | | |

| 6,562 | |

| Additional paid in capital | |

| 129,876,691 | | |

| 123,462,648 | |

| Accumulated deficit | |

| (133,570,945 | ) | |

| (128,285,543 | ) |

| Total stockholders' equity | |

| (3,687,169 | ) | |

| (4,816,333 | ) |

| Total liabilities and stockholders' equity | |

$ | 19,370,364 | | |

$ | 16,881,645 | |

LOOP MEDIA, INC.

ADJUSTED EBITDA RECONCILIATION

| | |

Three months ended December 31, | |

| | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (5,285,402 | ) | |

$ | (5,259,439 | ) |

| Adjustments to reconcile to Adjusted EBITDA: | |

| | | |

| | |

| Interest expense | |

| 1,002,189 | | |

| 1,007,583 | |

| Depreciation and amortization expense* | |

| 1,188,882 | | |

| 869,883 | |

| Income tax expense (benefit) | |

| — | | |

| 1,230 | |

| Stock-based compensation** | |

| 1,328,225 | | |

| 1,790,807 | |

| Non-recurring expense | |

| 257,242 | | |

| — | |

| Loss on extinguishment of debt | |

| 25,424 | | |

| — | |

| Other expense | |

| 1,251 | | |

| — | |

| Adjusted EBITDA | |

$ | (1,482,189 | ) | |

$ | (1,589,936 | ) |

* Includes amortization of content assets and for cost of revenue and operating expenses and ATM facility.

** Includes options, Resticted Stock Units ("RSUs") and warrants.

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600 West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 5470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

213

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

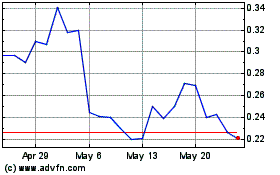

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Jan 2024 to Jan 2025