FALSE000138419500013841952024-07-082024-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________________________________________________________________________________________________

FORM 8-K

_____________________________________________________________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: July 8, 2024

(Date of earliest event reported)

______________________________________________________________________________________

RING ENERGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________

| | | | | | | | | | | | | | |

Nevada | | 001-36057 | | 90-0406406 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1725 Hughes Landing Blvd., Suite 900

The Woodlands, TX 77380

(Address of principal executive offices) (Zip Code)

(281) 397-3699

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.001 par value | REI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On July 8, 2024, Ring Energy, Inc. (the “Company”) issued a press release providing updated sales guidance and debt reduction results for the second quarter of 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, the Company makes no admission as to the materiality of any information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RING ENERGY, INC. |

| | | |

Date: | July 12, 2024 | By: | /s/ Travis T. Thomas |

| | | Travis T. Thomas |

| | | Chief Financial Officer |

FOR IMMEDIATE RELEASE NYSE American – REI

RING ENERGY INCREASES SALES GUIDANCE AND ANNOUNCES DEBT REDUCTION RESULTS FOR SECOND QUARTER 2024

~ Reaffirms Borrowing Base at $600 Million

The Woodlands, TX – July 8, 2024 – Ring Energy, Inc. (NYSE American: REI) (“Ring” or the “Company”) today updated second quarter of 2024 sales guidance and end-of-period debt, and announced reaffirmation of the $600 million borrowing base.

Key Highlights

•Increases second quarter 2024 sales guidance range above its high end of prior guidance for both barrels of oil per day (“Bopd”) and barrels of oil equivalent per day (“Boepd”).

◦New Oil Sales Guidance: 13,500 to 13,700 Bopd compared to prior guidance of 13,000 to 13,400 Bopd;

◦New Boepd Sales Guidance: 19,500 to 19,700 Boepd versus guidance of 18,500 to 19,100 Boepd;

•Reduced debt by $15 million during second quarter 2024;

◦Driving further debt reduction was sales volumes outperformance, continued capital and technical efficiency in Ring’s drilling program, and benefits from the Company’s ongoing cost structure enhancement initiatives;

◦Ended the period with $407 million of outstanding borrowings, reflecting a paydown of $48 million since closing the Founders Acquisition in August 2023;

•Reaffirmed the $600 million borrowing base under Ring’s $1.0 billion senior revolving credit facility (the “Credit Facility”) during the second quarter of 2024;

◦No changes to the terms under the Credit Facility, with next regularly scheduled bank redetermination for the Company to occur during the fall of 2024; and

◦

◦Exited the second quarter with $193 million of borrowing availability under the Credit facility.

Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer, commented, “The second quarter represents another period of strong performance on multiple key fronts for the Company. Contributing to the increased sales volumes that exceeded expectations was the success of our ongoing 2024 capital program and our continued focus on improving efficiencies of our base production. As discussed previously, we are utilizing a phased versus continuous drilling program seeking to maximize free cash flow on a quarterly basis. The ongoing capital program and improvements of our production operations are helping us deliver strong financial returns and maximize adjusted free cash flow

generation that we intend to apply towards reducing debt. We paid down $15 million during this year’s second quarter and plan to reduce debt meaningfully in the remaining quarters of this year, subject to oil prices remaining at current levels. We also look forward to releasing our full second quarter results early next month and revised guidance for the rest of the year that reflects the outperformance during the first two quarters. We thank our team for their steadfast efforts leading to our success and appreciate the continued support of our stockholders.”

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration, development, and production company with current operations focused on the development of its Permian Basin assets. For additional information, please visit www.ringenergy.com.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without limitation, statements with respect to the Company’s strategy and prospects. The forward-looking statements include statements about Ring’s expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Ring and its management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities particularly in the winter; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base and interest rates under the Company’s credit facility; Ring’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; the impacts of hedging on results of operations; Ring’s ability to replace oil and natural gas reserves; and, the Company’s ability to attract and retain competent employees. Such statements are subject to certain risks and uncertainties which are disclosed in the Company’s reports filed with the Securities and Exchange Commission, including its Form 10-K for the fiscal year ended December 31, 2023, and its other filings. Ring undertakes no obligation to revise or update publicly any forward-looking statements, except as required by law.

Contact Information

Al Petrie Advisors

Al Petrie, Senior Partner

Phone: 281-975-2146

Email: apetrie@ringenergy.com

v3.24.2

Cover

|

Jul. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 08, 2024

|

| Entity Registrant Name |

RING ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-36057

|

| Entity Tax Identification Number |

90-0406406

|

| Entity Address, Address Line One |

1725 Hughes Landing Blvd

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

The Woodlands

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

397-3699

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

REI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001384195

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

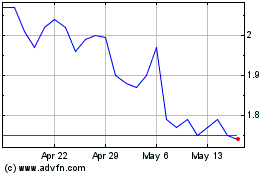

Ring Energy (AMEX:REI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ring Energy (AMEX:REI)

Historical Stock Chart

From Nov 2023 to Nov 2024