Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

24 October 2024 - 7:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to §240.14a-12

radiant logistics, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Triton Towers Two

700 S. Renton Village Place, Seventh Floor

Renton, Washington 98057

Dear Shareholder,

We have recently mailed to our shareholders a copy of our 2024 Annual Report, as it accompanied the mailing of our 2024 Notice of Annual Meeting of Stockholders and Proxy Statement. The Proxy Statement has been provided in connection with our 2024 Annual Meeting scheduled to be conducted at our headquarters in Renton, Washington, on November 15, 2024, at 9:00 local time.

We have determined that the Annual Shareholders Letter within the 2024 Annual Report contained a typographical error identifying our Adjusted EBITDA Margin for the fiscal year ended June 30, 2024, at 19.6%. Rather, the actual Adjusted EBITDA Margin for the fiscal year ended June 30, 2024, was 13.2%(1). While clerical errors of this nature are always regrettable, we are confident that this error has not had an impact on our shareholders as the actual Adjusted EBITDA Margin of 13.2% was correctly reported in other places within the 2024 Annual Report; namely, the Financial Highlights section, and on page 33 of our Management’s Discussion and Analysis of Financial Condition and Results of Operations. As well, the correct Adjusted EBITDA Margin was reported within our Press Release dated September 12, 2024, announcing financial results for the fiscal quarter and year ended June 30, 2024.

On behalf of the Board of Directors and management of Radiant Logistics, we look forward to hearing from you at our 2024 Annual Meeting and continuing to deliver meaningful value for you during fiscal 2025 and beyond.

With regards,

Bohn H. Crain

Chairman of the Board and Chief Executive Officer

October 23, 2024

(1) We note that Adjusted EBITDA is a non-GAAP measure of income management considers useful in analyzing our results. A reconciliation of our non-GAAP financial measures presented to our GAAP-based net income, as well as a description of our non-GAAP measures, is included on the last page of our 2024 Annual Report and generally copied on Annex I attached hereto, for the convenience of our shareholders. Our non-GAAP measures are not intended to replace any presentation included within our consolidated financial statements.

Radiant Logistics, Inc. – Proxy Statement Supplemental Materials 2

ANNEX I – RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

In our 2024 Annual Report and accompanying Proxy Statement, we use the terms adjusted EBITDA, adjusted EBITDA margin, adjusted net income, and adjusted gross profit, which are non-GAAP financial measures. These non-GAAP financial measures are presented to provide stockholders additional information to facilitate the comparison of our past and present operations. We believe non-GAAP financial measures provide useful information to investors because they are used to evaluate our performance on a comparable year-over-year basis. Non-GAAP financial measures are not in accordance with, or an alternative for, measures calculated in accordance with U.S. generally accepted accounting principles (GAAP) and may be different from non-GAAP financial measures used by other companies. In addition, non-GAAP financial measures are not based on any comprehensive or standard set of accounting rules or principles. Accordingly, the calculation of our non-GAAP financial measures may differ from the definitions of other companies using the same or similar names limiting, to some extent, the usefulness of such measures for comparison purposes. Non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with our financial results as determined in accordance with GAAP. These measures should only be used to evaluate our financial results in conjunction with the corresponding GAAP measures. Accordingly, we qualify our use of non-GAAP financial information in a statement when non-GAAP financial information is presented.

ADJUSTED GROSS PROFIT

The following table presents a reconciliation of our adjusted gross profit and adjusted gross profit percentage, which are non-GAAP financial measures, to the most directly comparable GAAP measure.

|

|

|

|

|

|

|

|

|

Year Ended June 30, |

|

(In thousands) |

2024 |

|

|

2023 |

|

Revenues |

$ |

802,470 |

|

|

$ |

1,085,486 |

|

Cost of transportation and other services (exclusive of depreciation and amortization, shown

separately below) |

|

(565,947 |

) |

|

|

(801,646 |

) |

Depreciation and amortization |

|

(13,055 |

) |

|

|

(12,961 |

) |

GAAP gross profit |

$ |

223,468 |

|

|

|

270,879 |

|

Depreciation and amortization |

|

13,055 |

|

|

|

12,961 |

|

Adjusted gross profit |

$ |

236,523 |

|

|

$ |

283,840 |

|

|

|

|

|

|

|

GAAP gross margin (GAAP gross profit as a percentage of revenues) |

|

27.8 |

% |

|

|

25.0 |

% |

Adjusted gross profit percentage (adjusted gross profit as a percentage of revenues) |

|

29.5 |

% |

|

|

26.1 |

% |

Radiant Logistics, Inc. – Proxy Statement Supplemental Materials 3

ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

The following table presents a reconciliation of our adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP financial measures, to the most directly comparable GAAP measure.

|

|

|

|

|

|

|

|

|

Year Ended June 30, |

|

(In thousands) |

2024 |

|

|

2023 |

|

Net income attributable to Radiant Logistics, Inc |

$ |

7,685 |

|

|

$ |

20,595 |

|

Income tax expense |

|

1,523 |

|

|

|

6,305 |

|

Depreciation and amortization |

|

18,552 |

|

|

|

23,157 |

|

Net interest expense |

|

(1,277 |

) |

|

|

1,889 |

|

|

|

|

|

|

|

EBITDA |

|

26,483 |

|

|

|

51,946 |

|

|

|

|

|

|

|

Share-based compensation |

|

2,611 |

|

|

|

2,503 |

|

Change in fair value of contingent consideration |

|

(450 |

) |

|

|

(646 |

) |

Acquisition related costs |

|

526 |

|

|

|

185 |

|

Cybersecurity event |

|

266 |

|

|

|

6 |

|

Litigation costs |

|

594 |

|

|

|

1,208 |

|

Transition, lease termination, and other costs |

|

76 |

|

|

|

30 |

|

Change in fair value of interest rate swap contracts |

|

1,197 |

|

|

|

(383 |

) |

Restatement cost |

|

— |

|

|

|

1,544 |

|

Foreign currency transaction gain |

|

(143 |

) |

|

|

(755 |

) |

|

|

|

|

|

|

Adjusted EBITDA |

$ |

31,160 |

|

|

$ |

55,638 |

|

Adjusted EBITDA as a % of adjusted gross profit(1) |

|

13.2 |

% |

|

|

19.6 |

% |

(1) Adjusted gross profit is revenues net of cost of transportation and other services.

Radiant Logistics, Inc. – Proxy Statement Supplemental Materials 4

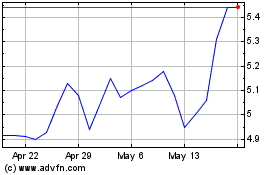

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Jan 2025 to Feb 2025

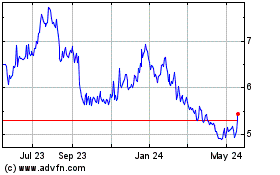

Radiant Logistics (AMEX:RLGT)

Historical Stock Chart

From Feb 2024 to Feb 2025