RESILIENT PERFORMANCE IN A CHALLENGING

ENVIRONMENT

SOLID CASH FLOW GENERATION

SIGNIFICANT DEBT REDUCTION

STABLE PROPOSED DIVIDEND AT €0.75 PER

SHARE

PARIS, Feb. 13, 2014 (GLOBE NEWSWIRE) --

RESILIENT PERFORMANCE IN A CHALLENGING

ENVIRONMENT

- Sales of €13.012bn, down 3.3% on a reported basis and

down 2.7% on a constant and same-day basis ; sales sequentially

improved in Q4 (-0.9% on a constant and same-day basis after -2.7%

in Q3)

- Adj. EBITA1 margin of 5.4%, down 26bps year-on-year, in

line with the Group's operating efficiency ratio

SOLID CASH FLOW GENERATION AND

SIGNIFICANT DEBT REDUCTION

- Free cash flow of €601m before interest and tax and

€337m after interest and tax, in line with the Group's EBITDA

conversion rate

- Net debt reduced by €407m or 16% year-on-year; improved

indebtedness ratio at 2.72x EBITDA

FULL-YEAR 2014 OUTLOOK

- Sales in a range of around 1% below to around 2% above

2013 sales, on a constant and same-day basis

- Adjusted EBITA margin in a range of around 10bps below

to around 20bps above the 2013 margin, consistent with targeted

annual operating efficiency ratio of around 10bp change in adjusted

EBITA margin for each percentage point change in

sales

- Solid free cash-flow, consistent with targeted

conversion rate of at least 75% of EBITDA, before interest and tax,

and of around 40% of EBITDA, after interest and tax

|

Full-year 2013 key figures1 |

|

YoY change |

| Sales |

€13,011.6m |

|

| On a reported basis |

|

-3.3% |

| On a constant and actual-day basis |

|

-3.0% |

| On a constant and same-day basis |

|

-2.7% |

|

Adjusted EBITA |

€702.2m |

-7.6% |

| As a percentage of sales |

5.4% |

|

| Change in bps as a % of sales |

-26bps |

|

|

Reported EBITA |

€686.9m |

-10.5% |

|

Operating income |

€521.0m |

-19.5% |

|

Net income |

|

|

| Net income |

€211.0m |

-33.8% |

| Recurring net income |

€328.1m |

-15.1% |

|

Free cash flow before interest and tax |

€600.6m |

-4.3% |

|

Net debt at year-end |

€2,192.0m |

-15.7% |

1 See definition in the Glossary section on page

8

Rudy PROVOOST, Chairman of the

Management Board and CEO, said:

"Rexel's 2013 performance once again

confirmed the strength of its business model in a persistently

challenging environment, as well as its structural ability to

generate solid cash flow throughout the cycle. Despite a 3% decline

in organic sales, we delivered resilient profitability, driven by

gross margin discipline and strict cost control.

In line with our policy of paying out at

least 40% of recurring net income, we will propose to our

shareholders to maintain the 2014 dividend at last year's level of

€0.75 per share.

With respect to 2014, the evolution of

our sales and margin will be closely tied to the speed and

magnitude of the recovery in Europe and the US non-residential

end-market. In this context, we will continue to focus on further

developing our high-growth initiatives, enhancing cash generation

and increasing operating efficiency through margin discipline and

cost control.

Given Rexel's strong positions across

the globe, its robust business model and engaged teams, we remain

committed to our medium-term ambitions and are confident we will

drive sustained value creation for all stakeholders."

FINANCIAL REVIEW FOR THE PERIOD ENDED

DECEMBER 31, 2013

- Financial statements as of December 31, 2013 were

authorized for issue by the Management Board on February 6, 2014

and reviewed by the Supervisory Board meeting held on February 12,

2014. They have been audited by statutory auditors.

- The following terms: EBITA, Adjusted EBITA, EBITDA,

Free Cash Flow and Net Debt are defined in the Glossary section of

this document.

- Unless otherwise stated, all comments are on a constant

and adjusted basis and, for sales, at same number of working

days.

Sales of

€3,288m in Q4, down 4.4% year-on-year on a reported basis; down

0.9% year-on-year on a constant and same-day basis, reflecting a

sequential improvement over the 2.7% drop in Q3

Sales of €13,012m in FY 2013, down 3.3%

year-on-year on a reported basis; down 2.7% year-on-year on a

constant and same-day basis, reflecting challenging market

conditions in most geographies throughout the year

In the fourth quarter, Rexel posted

sales of €3,287.7 million, down 4.4% on a reported basis

and down 0.9% on a constant and same-day basis. This 0.9% drop in

Q4 represented a sequential improvement over the previous quarters:

-3.7% in Q1, -3.3% in Q2 and -2.7% in Q3. Excluding the 0.8%

negative impact due to the change in copper-based cable prices,

sales were almost stable (-0.1%) on a constant and same-day

basis.

The 4.4% drop in sales on a reported basis

included:

- A negative currency effect of €138.6 million (mainly due to the

depreciation of the US, Canadian and Australian dollars and British

pound against the euro),

- A positive effect of €22.8 million from last year's

acquisitions (mainly Munro in the US),

- A negative calendar effect of 0.2 percentage point.

The sequential improvement in sales trends on a

constant and same-day basis mainly reflected an improvement in

Europe (-1.4%, after -5.5% in Q1, -5.2% in Q2 and -4.9% in Q3),

driven by first signs of recovery in the UK and Germany, even if

these markets still posted slight sales drops in the quarter.

In the full-year, Rexel posted sales of

€13,011.6 million, down 3.3% on a reported basis and down

2.7% on a constant and same-day basis. Excluding the 0.8% negative

impact due to the change in copper-based cable prices, sales were

down 1.9% on a constant and same-day basis.

The 3.3% drop in sales on a reported basis

included:

- A negative currency effect of €367.9 million (mainly due to the

depreciation of the US, Canadian, and Australian dollars and

British pound against the euro),

- A positive effect of €334.6 million from last year's

acquisitions (mainly Platt and Munro in the US),

- A negative calendar effect of 0.3 percentage point.

Europe (55% of Group sales): -1.4% in Q4

and -4.2% in FY on a constant and same-day basis

In the fourth quarter, sales in Europe decreased

by 3.6% on a reported basis and by 1.4% on a constant and same-day

basis.

At zone level, the impact of lower photovoltaic

sales in Q4 2013 vs. Q4 2012 is not relevant; it is only relevant

for Germany and Belgium, as detailed below.

- In France, sales were broadly stable (-0.1%) and continued to

outperform the market. This very solid performance in the quarter

was driven by large projects that continued to mitigate the decline

in new construction and industrial end-market, as well as increased

renovation activity in the residential end-market in anticipation

of an announced increase in VAT (from 7% to 10% as from Jan. 1,

2014).

- In the UK, sales posted a significant sequential improvement

over the previous quarter, reflecting a gradual improvement in

market conditions. They were down 1.9% on a constant and same-day

basis, after a 7.5% drop in Q3. Excluding branch restructuring,

constant and same-day sales increased by 0.7% year-on-year, vs. a

5.7%-drop in Q3.

- In Germany, sales were down 3.9% in Q4, after a 7.6% drop in

Q3. Excluding photovoltaic, sales were down 3.3%, continuing to

reflect low activity in the construction and industrial end-markets

but significantly improving over the 7.0% recorded in Q3.

- In Scandinavia, sales grew by 0.9%, after drops of 7.0% in Q1,

5.4% in Q2 and 2.9% in Q3. This performance mainly reflected a

confirmed return to growth in Sweden (+8.1%, after +4.1% in Q3) and

a sequential improvement in Finland (-3.1%, after -13.8% in

Q3).

- In Belgium, sales declined by 6.2% in Q4 and by 3.9% excluding

photovoltaic sales.

- In the Netherlands, sales posted a 12.3% decline and remained

weak as the business continues to adapt to persistently difficult

market conditions.

- Both Switzerland (+0.9%) and Austria (-1.3%) remained very

resilient and improved performance vs. Q3 (-2.6% and -2.8%

respectively).

- Southern European countries continued to be impacted by tough

macro-economic conditions. Italy posted an 11% drop, while sales in

Spain were down 4.5% and sales in Portugal were broadly stable

(-0.1%).

North America (34% of Group sales):

-0.3% in Q4 and +0.6% in FY on a constant and same-day

basis

In the fourth quarter, sales in North America

were down 3.7% on a reported basis and broadly stable (- 0.3%) on a

constant and same-day basis. Both the US and Canada were impacted

in the quarter by extremely severe weather conditions that

continued in January.

- In the US, sales grew by 0.4% in the quarter, confirming the

recovery in the residential end-market and improved trends in

industry. It is the fourth consecutive quarter of growth resulting

in a 2.1% growth in the full-year.

- In Canada, sales were down 2.3% in the quarter (after a drop of

3.4% in the previous quarter). In the full-year, despite the

significant impact of lower sales to the mining industry in the

first three quarters of the year, sales proved rather resilient

with a 3.4% drop in sales on a constant and same-day basis.

Asia-Pacific (9% of Group sales): -1.5%

in Q4 and -5.4% in FY on a constant and same-day basis

In the fourth quarter, sales in Asia-Pacific

were down 10.7% on a reported basis, including a significant

negative effect of €33.1m from currencies (primarily the Australian

dollar against the euro) and a positive effect of €2.7m from the

acquisition of LuxLight in Singapore.

On a constant and same-day basis, sales were

down 1.5%.

- In China (c. 30% of the region's sales), sales were up 3.4%, in

the quarter, driven by solid activity in the industrial automation

segment.

- In South-East Asia (c. 5% of the region's sales), sales

continued to show strong dynamism, growing by 4.7%.

- In Australia (c. 55% of the region's sales), sales were down

8.2%, still impacted by tough macroeconomic conditions and by the

implementation of a new carbon tax since July 2012, which severely

hit mining projects. This is however a sequential improvement over

the double-digit declines recorded in the previous quarters (-13.4%

in Q1, -15.5% in Q2 and -12.8% in Q3). Excluding the impact of

branch closures, sales were down 7.2% (after -8.7% in Q3).

- In New Zealand (c. 10% of the region's sales), sales decreased

by 4.8% after a limited 0.5% drop in Q3; this deterioration mainly

reflected a more challenging base (Q4 2012 posted a 0.4% drop while

Q3 2012 posted a 14.8% drop).

Latin America (2% of Group sales): +3.5%

in Q4 and -0.5% in FY on a constant and same-day basis

In the fourth quarter, sales in Latin America

were down 9.1% on a reported basis, including a negative currency

effect of €10.2m (mainly attributable to the depreciation of the

Brazilian real and Chilean peso against the euro).

On a constant and same-day basis, sales

increased by 3.5%, reflecting contrasted performances:

- In Brazil (c. 60% of the region's sales), sales were stable and

confirmed slowing momentum already apparent in Q3 (+6.6% in Q1,

+7.8% in Q2 and +2.4% in Q3).

- In Chile (c. 30% of the region's sales), sales confirmed their

return to growth and were up 7.9% in the quarter (after +5.4% in

Q3). This compares to declines of 20.3% and 25.0% respectively in

Q1 and Q2, which were strongly impacted by the slowdown in sales to

the mining industry and challenging comparables.

- In Peru (c. 10% of the region's sales), sales increased by

9.5%.

Resilient profitability, confirming

solid operational efficiency and strict cost control, in a

challenging environment

In the fourth quarter, adjusted EBITA margin

stood at 5.83%. This represented a drop of 27bps year-on-year

(adjusted EBITA margin was 6.10 % in Q4 2012), while sales were

down by 1.1% on a constant and actual-day basis.

The 27 basis point drop year-on-year reflected:

· A 20 basis point

drop in gross margin, mainly reflecting a significant drop

(-170bps) of the gross margin of our Canadian operations, which

were adversely affected by a combination of the increased

proportion of revenues generated by major photovoltaic projects

that carry lower gross margin, lower rebates from suppliers and

increased competitive pressure due to unusually severe weather

conditions that affected the market, · A 7 basis point

increase in distribution and administrative expenses(including

depreciation) as a percentage of sales to 18.95%. Excluding

depreciation, these expenses were reduced by 0.7%, broadly in line

with the 1.1% drop in sales on a constant and actual-day basis.

In the full-year, adjusted EBITA margin

decreased by 26 basis points to 5.40% (compared to 5.66% in 2012),

while sales were down by 3.0% on a constant and actual-day

basis.

This 26 basis point drop reflected:

- A broadly stable gross margin, recording a limited drop of 4

basis points year-on-year at 24.63% (vs. 24.67% in 2012),

- A 22 basis point increase in distribution and administrative

expenses(including depreciation) as a percentage of sales to

19.23%. Excluding depreciation, these expenses were reduced by

2.0%, compared to a 3.0% drop in sales on a constant and actual-day

basis.

Reported EBITA stood at €686.9 million in the

full-year, a decrease of 10.5% year-on-year.

Reported net income impacted by one-off

financial expense, goodwill impairment and expected rise in tax

rate Recurring net income of €328m, down 15.1%

year-on-year

Operating income stood at €521.0 million in the

full-year, down 19.5% year-on-year.

- Amortization of intangibles resulting from purchase price

allocation amounted to €19.7 million (vs. €13.3 million in

2012).

- Other income and expenses amounted to a net charge of €146.2

million (vs. a net charge of €106.7 million in 2012). They included

€63.6 million of restructuring costs (vs. €49.9 million in 2012).

They also included a €67.3 million goodwill impairment charge, of

which €44.0 million were recorded at June 30 (almost entirely

related to operations in The Netherlands) and €23.3 million were

recorded at December 31 (related to operations in Brazil for €21.1

million and in Slovenia for €2.2 million).

Net financial expenses amounted to €213.5

million in the full-year (vs. €200.1 million in 2012). They

included the one-off financial expense of €23.5 million due to the

refinancing operations that took place in the first quarter. The

average effective interest rate was significantly reduced

throughout the year: it stood at 6.3% on net debt (vs. 7.0% in

2012) and at 5.4% on gross debt (vs. 6.3% in 2012).

Income tax represented a charge of €96.9 million

in the full-year. The effective tax rate was 31.5% (vs. 29.4% in

2012).

As a result of the above elements (drop in

operating income, increased restructuring costs, goodwill

depreciation, one-off financial expense and higher tax rate), net

income was down 33.8% in the full-year, at €211.0 million (vs.

€318.6 million in 2012).

Recurring net income amounted to €328.1 million

in the full-year, down 15.1% year-on-year, mainly reflecting the

drop in EBITA (see appendix 2).

Solid generation of free cash-flow

before interest and tax of €601m in the full-year

Net debt reduced by 15.7% to c. €2.2bn and indebtedness

ratio well below 3x (2.72x EBITDA)

In the full-year, free cash flow before interest

and taxwas an inflow of €600.6 million (vs. an inflow of €627.5

million in 2012). This net inflow included:

- Gross capital expenditure of €102.3 million (vs. €90.6 million

in 2012),

- Almost no change in working capital (very limited outflow of

€1.1 million), as working capital has been tightly managed

continuously.

At December 31, 2013, net debt stood at €2,192.0

million, reduced by slightly more than €400 million over the year

(€2,599.2 million at December 31, 2012).

It took into account:

- €169.3 million of net interest paid during the year,

- €94.2 million of income tax paid during the year,

- €103.2 million of favorable currency effect during the

year,

- €53.1 million of dividend paid in cash in the third

quarter.

At December 31, 2013, the indebtedness ratio

(Net financial debt / EBITDA), as calculated under the Senior

Credit Agreement terms, stood at 2.72x, vs. 2.95x at December 31,

2012. This is well in line with our objective of an indebtedness

ratio below 3 times EBITDA at year-end.

Stable proposed dividend of €0.75 per

share, in line with the Group's pay-out policy

Rexel will propose to shareholders a dividend of

€0.75 per share, representing 64% of the Group's recurring net

income (vs. 53% last year). It will be paid in cash or shares,

subject to approval at the Annual Shareholders' Meeting to be held

in Paris on May 22, 2014.

This is in line with Rexel's policy of paying

out at least 40% of recurring net income, reflecting the Group's

confidence in its structural ability to generate strong cash-flow

throughout the cycle.

OUTLOOK

Depending on the speed and magnitude of

the recovery in Europe and in the US non-residential end-market,

Rexel aims at delivering in 2014:

- Sales in a range of around 1% below to around 2% above

2013 sales, on a constant and same-day basis,

- Adjusted EBITA margin in a range of around 10bps below

to around 20bps above the 2013 margin, consistent with targeted

annual operating efficiency ratio of a change of around 10bps in

adjusted EBITA margin for each percentage point change in

sales,

- Solid free cash-flow, consistent with targeted

conversion rate of at least 75% of EBITDA, before interest and tax,

and of around 40% of EBITDA, after interest and tax.

As detailed during its Investor Day,

held on November 26, 2013, Rexel will remain focused on four

business imperatives:

- Accelerate its strategic high-growth

initiatives,

- Enhance its customer-centricity model in its mainstream

electrical distribution business,

- Boost growth through acquisitions and remain a leading

market consolidator,

- Drive operational excellence as an enabler for

profitable growth,

and confirms its medium-term

ambitions:

- Outperform the market through a combination of organic

growth and targeted acquisitions,

- Grow adjusted EBITA margin to around 6.5% within 3 to 5

years,

- Generate strong free cash-flow before interest and tax

of at least 75% of EBITDA and after interest and tax of around 40%

of EBITDA,

- Maintain a sound and balanced financial structure, with

a net-debt-to-EBITDA ratio not exceeding 3 times.

CALENDAR

April 30,

2014

First-quarter results May 22,

2014

Shareholders' Meeting in Paris July 30,

2014

Second-quarter and Half-year results October 29,

2014

Third-quarter and 9-month results

FINANCIAL INFORMATION

The financial report for the period ended

December 31, 2013 is available on the Group's website

(www.rexel.com), in the "Regulated information" section, and has

been filed with the French Autorité des Marchés Financiers.

A slideshow of the fourth-quarter &

full-year 2013 results is also available on the Group's

website.

Rexel, a global leader in the

professional distribution of products and services for the energy

world, addresses three main markets - industrial, commercial and

residential. The Group supports customers around the globe,

wherever they are, to create value and run their businesses better.

With a network of some 2,300 branches in 38 countries, and c.

30,000 employees, Rexel's sales were €13 billion in 2013. Its main

shareholders are an investor group led by Clayton, Dubilier &

Rice and Eurazeo.

Rexel is listed on the Eurolist market

of Euronext Paris (compartment A, ticker RXL, ISIN code

FR0010451203). It is included in the following indices: SBF 120,

CAC Mid 100, CAC AllTrade, CAC AllShares, FTSE EuroMid, STOXX600.

Rexel is also part of the following SRI indices: DJSI Europe,

FTSE4Good Europe & Global, STOXX Europe Sustainability, EURO

STOXX

Sustainability, Euronext Vigeo Europe

120 and ESI Excellence Europe. Finally, Rexel is included on the

Ethibel EXCELLENCE Investment Registers in recognition of its

performance in corporate social responsibility (CSR). For more

information, visit Rexel's web site at www.rexel.com

CONTACTS

|

FINANCIAL ANALYSTS / INVESTORS |

PRESS |

|

Marc MAILLET |

Pénélope

LINAGE |

|

+33 1 42 85 76 12 |

+33 1 42 85 76 28 |

|

marc.maillet@rexel.com |

penelope.linage@rexel.com |

|

Florence MEILHAC |

Brunswick:

Thomas KAMM |

|

+33 1 42 85 57 61 |

+33 1 53 96 83 92 |

|

florence.meilhac@rexel.com |

tkamm@brunswickgroup.com |

GLOSSARY

APPENDICES

Appendix 1: Segment reporting - Constant

and adjusted basis*

* Constant and adjusted = at comparable scope of consolidation

and exchange rates, excluding the non-recurring effect related to

changes in copper-based cables price and before amortization of

purchase price allocation; the non-recurring effect related to

changes in copper-based cables price was, at the EBITA level: - a

loss of €1.3 million in Q4 2012 and a loss of €2.0 million in Q4

2013 ; - a profit of €1.9 million in FY 2012 and a loss of €15.3

million in FY 2013.

|

GROUP |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Constant and adjusted basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

|

Sales |

|

3,324.1 |

3,287.7 |

-1.1% |

13,415.9 |

13,011.6 |

-3.0% |

|

|

on a

constant basis and same days |

|

|

-0.9% |

|

|

-2.7% |

| Gross profit |

830.3 |

814.5 |

-1.9% |

3,309.8 |

3,204.7 |

-3.2% |

|

|

as a % of

sales |

24.98% |

24.77% |

-20bps |

24.67% |

24.63% |

-4 bps |

| Distribution & adm. expenses (incl.

depreciation) |

(627.5) |

(622.9) |

-0.7% |

(2,550.2) |

(2,502.5) |

-1.9% |

|

EBITA |

|

202.8 |

191.6 |

-5.5% |

759.6 |

702.2 |

-7.6% |

|

|

as a % of

sales |

6.10% |

5.83% |

-27bps |

5.66% |

5.40% |

-26bps |

| Headcount (end of period) |

30,444 |

29,852 |

-1.9% |

|

|

|

| |

|

|

|

|

|

|

|

|

EUROPE |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Constant and adjusted basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

|

Sales |

|

1,898.1 |

1,853.0 |

-2.4% |

7,437.8 |

7,078.6 |

-4.8% |

|

|

on a constant basis and

same days |

|

|

-1.4% |

|

|

-4.2% |

|

o/w |

France |

659.1 |

648.1 |

-1.7% |

2,505.2 |

2,423.7 |

-3.3% |

|

|

on a constant basis and same days |

|

|

-0.1% |

|

|

-2.1% |

|

|

United Kingdom |

238.0 |

233.4 |

-1.9% |

1,005.2 |

950.7 |

-5.4% |

|

|

on a constant basis and same days |

|

|

-1.9% |

|

|

-5.8% |

|

|

Germany |

217.0 |

201.9 |

-7.0% |

867.6 |

804.0 |

-7.3% |

|

|

on a constant basis and same days |

|

|

-3.9% |

|

|

-6.0% |

|

|

Scandinavia |

234.5 |

236.6 |

+0.9% |

923.4 |

888.1 |

-3.8% |

|

|

on a constant basis and same days |

|

|

+0.9% |

|

|

-3.6% |

|

Gross |

profit |

516.3 |

500.9 |

-3.0% |

2,006.6 |

1,909.5 |

-4.8% |

|

|

as a % of sales |

27.20% |

27.03% |

-17bps |

26.98% |

26.98% |

stable |

| Distribution & adm. expenses (incl.

depreciation) |

(367.8) |

(363.3) |

-1.2% |

(1,482.9) |

(1,442.4) |

-2.7% |

|

EBITA |

|

148.6 |

137.7 |

-7.3% |

523.7 |

467.1 |

-10.8% |

|

|

as a % of sales |

7.83% |

7.43% |

-40bps |

7.04% |

6.60% |

-44bps |

| Headcount (end of period) |

17,052 |

16,750 |

-1.8% |

|

|

|

|

NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Constant and adjusted basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

|

Sales |

|

1,074.3 |

1,082.6 |

+0.8% |

4,417.6 |

4,441.1 |

+0.5% |

|

|

on a constant basis and same days |

|

|

-0.3% |

|

|

+0.6% |

|

o/w |

United States |

773.6 |

788.8 |

+2.0% |

3,151.0 |

3,217.4 |

+2.1% |

|

|

on a constant basis and same days |

|

|

+0.4% |

|

|

+2.1% |

|

|

Canada |

300.6 |

293.8 |

-2.3% |

1,266.5 |

1,223.7 |

-3.4% |

|

|

on a constant basis and same days |

|

|

-2.3% |

|

|

-3.4% |

|

Gross |

profit |

241.9 |

240.5 |

-0.6% |

969.9 |

982.3 |

+1.3% |

| as a % of sales |

22.52% |

22.21% |

-31bps |

21.96% |

22.12% |

+16bps |

| Distribution & adm. expenses (incl.

depreciation) |

(180.5) |

(186.7) |

+3.4% |

(738.4) |

(748.7) |

+1.4% |

|

EBITA |

|

61.4 |

53.8 |

-12.3% |

231.5 |

233.5 |

+0.9% |

|

|

as a % of sales |

5.71% |

4.97% |

-74bps |

5.24% |

5.26% |

+2bps |

| Headcount (end of period) |

8,647 |

8,613 |

-0.4% |

|

|

|

| |

|

|

|

|

|

|

|

|

ASIA-PACIFIC |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Constant and adjusted basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

|

Sales |

|

285.5 |

282.1 |

-1.2% |

1,265.7 |

1,196.8 |

-5.4% |

|

|

on a constant basis and

same days |

|

|

-1.5% |

|

|

-5.4% |

|

o/w |

China |

86.7 |

89.6 |

+3.2% |

350.9 |

369.5 |

+5.3% |

|

|

on a constant basis and same days |

|

|

+3.4% |

|

|

+4.6% |

|

|

Australia |

145.4 |

134.0 |

-7.9% |

696.4 |

605.1 |

-13.1% |

|

|

on a constant basis and same days |

|

|

-8.2% |

|

|

-12.7% |

|

|

New Zealand |

32.2 |

30.7 |

-4.8% |

130.9 |

124.6 |

-4.8% |

|

|

on a constant basis and same days |

|

|

-4.8% |

|

|

-4.8% |

|

Gross |

profit |

56.8 |

57.6 |

+1.4% |

264.9 |

244.8 |

-7.6% |

|

|

as a % of sales |

19.90% |

20.43% |

+53bps |

20.93% |

20.45% |

-47bps |

| Distribution & adm. expenses (incl.

depreciation) |

(47.4) |

(46.5) |

-1.9% |

(207.0) |

(195.9) |

-5.4% |

|

EBITA |

|

9.4 |

11.2 |

+18.5% |

57.9 |

48.9 |

-15.5% |

|

|

as a % of sales |

3.30% |

3.95% |

+66bps |

4.57% |

4.09% |

-48bps |

| Headcount (end of period) |

2,758 |

2,705 |

-1.9% |

|

|

|

|

LATIN AMERICA |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Constant and adjusted basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

| Sales |

|

66.2 |

69.8 |

+5.4% |

294.6 |

294.8 |

+0.1% |

| |

on a constant basis and same days |

|

|

+3.5% |

|

|

-0.5% |

| o/w |

Brazil |

38.5 |

38.7 |

+0.3% |

166.0 |

174.8 |

+5.3% |

| |

on a constant basis and same days |

|

|

+0.0% |

|

|

+4.4% |

| |

Chile |

22.3 |

25.0 |

+12.2% |

106.2 |

95.6 |

-10.0% |

| |

on a constant basis and same days |

|

|

+7.9% |

|

|

-10.0% |

| |

Peru |

5.4 |

6.1 |

+13.6% |

22.4 |

24.4 |

+9.0% |

|

|

on a constant basis and same days |

|

|

+9.5% |

|

|

+8.0% |

| Gross |

profit |

14.9 |

15.2 |

+1.9% |

66.6 |

67.9 |

+1.9% |

|

|

as a % of sales |

22.54% |

21.78% |

-75bps |

22.61% |

23.03% |

+42bps |

| Distribution & adm. expenses (incl.

depreciation) |

(14.2) |

(15.7) |

+10.6% |

(60.5) |

(67.0) |

+10.8% |

| EBITA |

|

0.7 |

(0.5) |

-179.6% |

6.2 |

0.9 |

-85.2% |

| |

as a % of sales |

1.03% |

-0.78% |

-181bps |

2.09% |

0.31% |

-178bps |

| Headcount (end of period) |

1,775 |

1,552 |

-12.6% |

|

|

|

Appendix 2: Extract of Financial

Statements

Consolidated Income Statement

|

|

Reported basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

| Sales |

3,439.8 |

3,287.7 |

-4.4% |

13,449.2 |

13,011.6 |

-3.3% |

| Gross profit |

855.7 |

812.4 |

-5.1% |

3,315.0 |

3,188.5 |

-3.8% |

|

|

as a % of sales |

24.9% |

24.7% |

|

24.6% |

24.5% |

|

| Distribution & adm. expenses (excl.

depreciation) |

(630.1) |

(604.3) |

-4.1% |

(2,473.9) |

(2,424.6) |

-2.0% |

| EBITDA |

225.6 |

208.1 |

-7.7% |

841.1 |

763.9 |

-9.2% |

|

|

as a % of sales |

6.6% |

6.3% |

|

6.3% |

5.9% |

|

| Depreciation |

(19.4) |

(18.5) |

|

(73.7) |

(77.0) |

|

| EBITA |

206.2 |

189.7 |

-8.0% |

767.4 |

686.9 |

-10.5% |

|

|

as a % of sales |

6.0% |

5.8% |

|

5.7% |

5.3% |

|

| Amortization of intangibles

resulting

from purchase price allocation |

(4.0) |

(3.9) |

|

(13.3) |

(19.7) |

|

| Operating income bef. other inc. and

exp. |

202.2 |

185.7 |

-8.2% |

754.1 |

667.2 |

-11.5% |

|

|

as a % of sales |

5.9% |

5.6% |

|

5.6% |

5.1% |

|

| Other income and expenses |

(37.0) |

(51.3) |

|

(106.7) |

(146.2) |

|

| Operating income |

165.2 |

134.4 |

-18.6% |

647.4 |

521.0 |

-19.5% |

| Financial expenses (net) |

(51.1) |

(50.0) |

|

(200.1) |

(213.5) |

|

| Share of profit (loss) in associates |

1.6 |

0.0 |

|

3.1 |

0.4 |

|

| Net income (loss) before income

tax |

115.6 |

84.3 |

-27.1% |

450.3 |

307.9 |

-31.6% |

| Income tax |

(33.4) |

(24.4) |

|

(131.7) |

(96.9) |

|

| Net income (loss) |

82.2 |

59.9 |

-27.1% |

318.6 |

211.0 |

-33.8% |

| Net income (loss) attr. to non-controlling

interests |

(0.2) |

0.0 |

|

0.5 |

0.4 |

|

| Net income (loss) attr. to equity holders of the

parent |

82.4 |

59.9 |

-27.3% |

318.1 |

210.6 |

-33.8% |

Bridge Between Operating Income Before Other Income And

Other Expenses And Adjusted EBITA

|

in €m |

Q4 2012 |

Q4 2013 |

FY 2012 |

FY 2013 |

|

Operating income before other income and other

expenses |

202.2 |

185.7 |

754.1 |

667.2 |

|

Change in scope effects |

2.5 |

|

13.1 |

|

|

Foreign exchange effects |

-7.1 |

|

-19.0 |

|

|

Non-recurring effect related to copper |

1.3 |

2 |

-1.9 |

15.3 |

|

Amortization of intangibles resulting from PPA |

4 |

3.9 |

13.3 |

19.7 |

|

Adjusted EBITA on a constant basis |

202.8 |

191.6 |

759.6 |

702.2 |

Recurring Net Income

|

In millions of euros |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

|

Reported net income |

82.2 |

59.9 |

-27.1% |

318.6 |

211.0 |

-33.8% |

|

Non-recurring copper effect |

1.3 |

2.0 |

|

-1.8 |

15.3 |

|

|

Other expense & income |

36.9 |

51.3 |

|

106.7 |

146.2 |

|

|

Financial expense |

0.0 |

0.0 |

|

-7.4 |

23.5 |

|

|

Tax expense |

-20.4 |

-42.7 |

|

-29.4 |

-67.8 |

|

|

Recurring net income |

100.1 |

70.6 |

-29.5% |

386.7 |

328.1 |

-15.1% |

Sales And Profitability By Segment

|

|

Reported basis (€m) |

Q4 2012 |

Q4 2013 |

Change |

FY 2012 |

FY 2013 |

Change |

| Sales |

3,439.8 |

3,287.7 |

-4.4% |

13,449.2 |

13,011.6 |

-3.3% |

|

|

Europe |

1,923.0 |

1,853.0 |

-3.6% |

7,448.6 |

7,078.6 |

-5.0% |

|

|

North America |

1,124.2 |

1,082.6 |

-3.7% |

4,348.6 |

4,441.1 |

+2.1% |

|

|

Asia-Pacific |

315.9 |

282.1 |

-10.7% |

1,341.9 |

1,196.8 |

-10.8% |

|

|

Latin

America |

76.7 |

69.8 |

-9.1% |

310.0 |

294.8 |

-4.9% |

| Gross profit |

855.7 |

812.4 |

-5.1% |

3,315.0 |

3,188.5 |

-3.8% |

|

|

Europe |

521.0 |

499.1 |

-4.2% |

2,015.2 |

1,897.4 |

-5.8% |

|

|

North America |

253.5 |

240.3 |

-5.2% |

945.7 |

978.5 |

+3.5% |

|

|

Asia-Pacific |

63.6 |

57.6 |

-9.4% |

281.2 |

244.8 |

-13.0% |

|

|

Latin

America |

17.2 |

15.2 |

-11.7% |

70.9 |

67.5 |

-4.8% |

| EBITA |

206.2 |

189.7 |

-8.0% |

767.4 |

686.9 |

-10.5% |

|

|

Europe |

148.2 |

135.9 |

-8.3% |

535.4 |

455.5 |

-14.9% |

|

|

North America |

64.1 |

53.7 |

-16.3% |

225.6 |

230.2 |

+2.0% |

|

|

Asia-Pacific |

10.5 |

11.2 |

+5.9% |

60.0 |

48.9 |

-18.6% |

|

|

Latin

America |

0.7 |

(0.6) |

-180.5% |

6.2 |

0.5 |

-91.1% |

Impact On Sales From Acquisitions

|

Acquisitions |

Country |

Conso. |

Q1 2013 |

Q2 2013 |

H1 2013 |

Q3 2013 |

Q4 2013 |

FY 2013 |

|

|

|

as from |

|

|

|

|

|

|

|

Europe |

France, UK, Spain, Belgium |

misc. |

49.9 |

9.6 |

59.5 |

0.0 |

0.0 |

59.5 |

|

North America |

USA |

misc. |

97.3 |

105.7 |

203.0 |

27.2 |

20.4 |

250.6 |

|

Asia-Pacific |

Singapore |

01/01/13 |

2.8 |

2.8 |

5.7 |

2.7 |

2.7 |

11.1 |

|

Latin America |

Brazil, Peru |

misc. |

10.3 |

1.9 |

12.2 |

1.5 |

-0.3 |

13.4 |

|

Total acquisitions |

|

|

160.3 |

120.1 |

280.4 |

31.4 |

22.8 |

334.6 |

Consolidated Balance Sheet

|

Assets (€m) |

December 31, 2012 |

December 31, 2013 |

|

Goodwill |

4,369.2 |

4,111.2 |

|

Intangible assets |

1,035.8 |

1,038.3 |

|

Property, plant & equipment |

282.7 |

278.1 |

|

Long-term investments(1) |

79.5 |

51.7 |

|

Investments in associates |

10.8 |

- |

|

Deferred tax assets |

171.9 |

162.9 |

|

Total non-current assets |

5,949.9 |

5,642.2 |

|

Inventories |

1,426.7 |

1,389.5 |

|

Trade receivables |

2,123.9 |

2,062.8 |

|

Other receivables |

502.5 |

486.1 |

|

Assets classified as held for sale |

21.2 |

3.4 |

|

Cash and cash equivalents |

291.9 |

957.8 |

|

Total current assets |

4,366.2 |

4,899.7 |

|

Total assets |

10,316.1 |

10,541.9 |

| |

|

|

|

Liabilities (€m) |

December 31, 2012 |

December 31, 2013 |

|

Total equity |

4,117.6 |

4,224.7 |

|

Long-term debt |

2,303.2 |

2,908.2 |

|

Deferred tax liabilities |

152.3 |

172.1 |

|

Other non-current liabilities |

474.6 |

351.4 |

|

Total non-current liabilities |

2,930.1 |

3,431.7 |

|

Interest bearing debt & accrued interests |

627.6 |

216.8 |

|

Trade payables |

1,937.2 |

2,009.9 |

|

Other payables |

703.7 |

658.8 |

|

Liabilities classified as held for sale |

- |

- |

|

Total current liabilities |

3,268.5 |

2,885.5 |

|

Total liabilities |

6,198.6 |

6,317.2 |

|

Total equity & liabilities |

10,316.1 |

10,541.9 |

1 Includes Debt hedge derivatives for €(39.8)m at December 31,

2012 and for €25.1m at December 31, 2013

Change in Net Debt

|

€m |

Q4 2012 |

Q4 2013 |

FY 2012 |

FY 2013 |

|

EBITDA |

225.6 |

208.1 |

841.1 |

763.9 |

|

Other operating revenues & costs(1) |

(27.9) |

(29.5) |

(92.6) |

(90.0) |

|

Operating cash flow |

197.7 |

178.7 |

748.5 |

674.0 |

|

Change in working capital(2) |

230.8 |

257.8 |

(37.2) |

(1.1) |

|

Net capital expenditure, of which: |

(29.6) |

(24.0) |

(83.8) |

(72.1) |

|

Gross capital expenditure |

(36.8) |

(34.5) |

(90.6) |

(102.3) |

|

Disposal of fixed assets & other |

7.2 |

10.5 |

6.8 |

30.2 |

|

Free cash flow before interest and tax |

398.9 |

412.4 |

627.5 |

600.6 |

|

Net interest paid / received(3) |

(43.6) |

(40.3) |

(169.7) |

(169.3) |

|

Income tax paid |

(48.5) |

(13.4) |

(143.4) |

(94.2) |

|

Free cash flow after interest and tax |

306.8 |

358.7 |

314.4 |

337.2 |

|

Net financial investment |

(125.9) |

(1.0) |

(617.5) |

(5.4) |

|

Dividends paid |

0.0 |

0.0 |

(143.0) |

(53.1) |

|

Net change in equity |

0.0 |

0.0 |

0.0 |

0.0 |

|

Other |

(35.3) |

54.1 |

(83.4) |

25.3 |

|

Currency exchange variation |

28.4 |

40.0 |

8.5 |

103.2 |

|

Decrease (increase) in net debt |

174.0 |

451.9 |

(521.0) |

407.2 |

|

Net debt at the beginning of the period |

2,773.2 |

2,643.9 |

2,078.2 |

2,599.2 |

|

Net debt at the end of the period |

2,599.2 |

2,192.0 |

2,599.2 |

2,192.0 |

1 Includes restructuring outflows:

- of €14.0m in Q4 2012 and €25.8m in Q4 2013

- and of €46.9m in FY2012 and €71.5m in FY 2013

2 Working Capital adjustment to reflect suppliers payments

scheduled on Dec. 31, 2013 and executed only on Jan.2nd, 2014 for

€51.9m 3 Excluding settlement of fair value hedge derivatives

Appendix 3: Working Capital

Analysis

|

Constant basis |

December 31, 2012 |

December 31, 2013 |

|

Net inventories |

|

|

|

as a % of sales 12 rolling months |

10.5% |

11.0% |

|

as a number of days |

48.2 |

49.4 |

|

Net trade receivables |

|

|

|

as a % of sales 12 rolling months |

16.0% |

16.7% |

|

as a number of days |

54.6 |

55.1 |

|

Net trade payables |

|

|

|

as a % of sales 12 rolling months |

14.1% |

15.2% |

|

as a number of days |

58.3 |

60.8 |

|

Trade working capital |

|

|

|

as a % of sales 12 rolling months |

12.4% |

12.4% |

|

Total working capital |

|

|

|

as a % of sales 12 rolling months |

11.2% |

11.4% |

Appendix 4: Headcount and branches by

geography

|

FTEs at end of period |

31/12/2012 |

31/12/2013 |

Year-on-Year Change |

|

comparable |

|

Europe |

17,052 |

16,750 |

-1.8% |

|

USA |

6,241 |

6,234 |

-0.1% |

|

Canada |

2,406 |

2,379 |

-1.1% |

|

North America |

8,647 |

8,613 |

-0.4% |

|

Asia-Pacific |

2,758 |

2,705 |

-1.9% |

|

Latin America |

1,775 |

1,552 |

-12.6% |

|

Other |

212 |

232 |

9.4% |

|

Group |

30,444 |

29,852 |

-1.9% |

| |

|

|

|

|

Branches |

31/12/2012 |

31/12/2013 |

Year-on-Year Change |

|

comparable |

|

Europe |

1,359 |

1,306 |

-3.9% |

|

USA |

401 |

401 |

0.0% |

|

Canada |

218 |

216 |

-0.9% |

|

North America |

619 |

617 |

-0.3% |

|

Asia-Pacific |

262 |

259 |

-1.1% |

|

Latin America |

96 |

90 |

-6.3% |

|

Group |

2,336 |

2,272 |

-2.7% |

Appendix 5: Calendar, scope and change

effects on sales

To be comparable to 2014 sales, 2013 sales must

take into account the following impacts:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

Calendar effect |

0.0% |

-0.5% |

-0.3% |

+1.1% |

0.0% |

|

Scope effect (1) |

c. €14m |

c. €11m |

c. €12m |

c. €11m |

c. 48m |

|

Change effect (2) |

-2.6% |

-2.6% |

-1.0% |

+0.2% |

-1.5% |

(1) Based on acquisitions made in 2013 (mainly Lenn in Singapore

and Quality Trading in Thailand) (2) Based on following main

assumptions:

- 1 USD = €1.35

- 1 AUD = €1.50

- 1 CAD = €1.40

Appendix 6: Changes due to the

enforcement of IFRIC 21 as from January 1, 2014

IFRIC Interpretation 21 "Levies" clarifies that

the obligating event that gives rise to a liability to pay a levy

is the activity described in the relevant legislation that triggers

the payment of the levy. IFRIC Interpretation 21 applies for

accounting period starting from January, 1 2014 with retrospective

application as of January, 1 2013. In 2013, the Group reviewed the

impact of applying IFRIC Interpretation 21 and estimated the

adjustment to be an increase in shareholders' equity of € 2.6

million after tax (€3.9 million before tax) as of January 1, 2013

as a result of a timing difference in the liability recognition. In

addition, IFRIC Interpretation 21 prohibits the progressive

recognition of a liability for tax levies over the fiscal year and

rather requires the one-time recognition of the liability when the

obligating event for the payment of the levy is met. As a result of

this guidance, the Group expects that 2014 interim financial

statements will be impacted by timing differences in the

recognition of tax levies due to the adoption of IFRIC

Interpretation 21.

|

€m |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2013 EBITA as reported on Feb. 13, 2014 |

148.8 |

172.4 |

175.9 |

189.7 |

686.9 |

|

IFRIC 21 restatement |

c. (6) |

c. 2 |

c. 2 |

c. 2 |

c. 0 |

|

2013 EBITA as proforma for 2014 accounts |

c. 143 |

c. 174 |

c. 178 |

c. 192 |

c. 687 |

Appendix 7: PV, Wind and Mining sales in

2013

|

YoY change |

H1 2013 |

H2 2013 |

FY 2013 |

|

Photovoltaic sales |

-8.2% |

+16.8% |

+3.4% |

|

Wind sales |

-46.4% |

+7.4% |

-22.0% |

|

Mining sales |

-21.0% |

+6.2% |

-8.9% |

DISCLAIMER

The Group is exposed to fluctuations in copper

prices in connection with its distribution of cable products.

Cables accounted for approximately 15% of the Group's sales, and

copper accounts for approximately 60% of the composition of cables.

This exposure is indirect since cable prices also reflect copper

suppliers' commercial policies and the competitive environment in

the Group's markets. Changes in copper prices have an estimated

so-called "recurring" effect and an estimated so called

"non-recurring" effect on the Group's performance, assessed as part

of the monthly internal reporting process of the Rexel Group: - the

recurring effect related to the change in copper-based cable prices

corresponds to the change in value of the copper part included in

the sales price of cables from one period to another. This effect

mainly relates to the Group's sales; - the non-recurring effect

related to the change in copper-based cables prices corresponds to

the effect of copper price variations on the sales price of cables

between the time they are purchased and the time they are sold,

until all such inventory has been sold (direct effect on gross

profit). Practically, the non-recurring effect on gross profit is

determined by comparing the historical purchase price for

copper-based cable and the supplier price effective at the date of

the sale of the cables by the Rexel Group. Additionally, the

non-recurring effect on EBITA corresponds to the non-recurring

effect on gross profit, which may be offset, when appropriate, by

the non-recurring portion of changes in the distribution and

administrative expenses.

The impact of these two effects is assessed for

as much of the Group's total cable sales as possible, over each

period. Group procedures require that entities that do not have the

information systems capable of such exhaustive calculations to

estimate these effects based on a sample representing at least 70%

of the sales in the period. The results are then extrapolated to

all cables sold during the period for that entity. Considering the

sales covered, the Rexel Group considers such estimates of the

impact of the two effects to be reasonable.

This document may contain statements of future

expectations and other forward-looking statements. By their nature,

they are subject to numerous risks and uncertainties, including

those described in the Document de Référence registered with the

French Autorité des Marchés Financiers (AMF) on March 13, 2013

under number D.13-0130. These forward-looking statements are not

guarantees of Rexel's future performance. Rexel's actual results of

operations, financial condition and liquidity as well as

development of the industry in which Rexel operates may differ

materially from those made in or suggested by the forward-looking

statements contained in this release. The forward-looking

statements contained in this communication speak only as of the

date of this communication and Rexel does not undertake, unless

required by law or regulation, to update any of the forward-looking

statements after this date to conform such statements to actual

results, to reflect the occurrence of anticipated results or

otherwise.

The market and industry data and forecasts

included in this document were obtained from internal surveys,

estimates, experts and studies, where appropriate, as well as

external market research, publicly available information and

industry publications. Rexel, its affiliates, directors, officers,

advisors and employees have not independently verified the accuracy

of any such market and industry data and forecasts and make no

representations or warranties in relation thereto. Such data and

forecasts are included herein for information purposes only.

This document includes only summary information

and must be read in conjunction with Rexel's Document de Référence

registered with the AMF March 13, 2013 under number D.13-0130, as

well as the consolidated financial statements and activity report

for the 2013 fiscal year, which may be obtained from Rexel's

website (www.rexel.com).

FULL-YEAR 2013 RESULTS

http://hugin.info/143564/R/1761511/596437.pdf

HUG#1761511

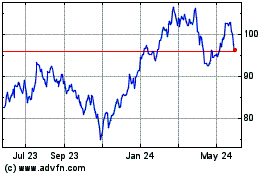

ProShares Ultra Health C... (AMEX:RXL)

Historical Stock Chart

From Dec 2024 to Jan 2025

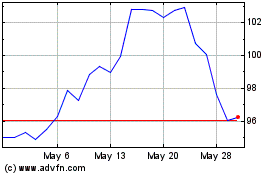

ProShares Ultra Health C... (AMEX:RXL)

Historical Stock Chart

From Jan 2024 to Jan 2025