Form S-3 - Registration statement under Securities Act of 1933

28 November 2024 - 8:06AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 27, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SENSEONICS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

47-1210911

(I.R.S. Employer

Identification Number)

|

|

20451 Seneca Meadows Parkway

Germantown, MD 20876-7005

(301) 515-7260

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Timothy T. Goodnow

Chief Executive Officer

Senseonics Holdings, Inc.

20451 Seneca Meadows Parkway

Germantown, MD 20876-7005

(301) 515-7260

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Darren K. DeStefano

Reid Hooper

Cooley LLP

11951 Freedom Drive

Reston, VA 20190-5640

(703) 456-8000

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☐

|

|

|

Accelerated filer

☐

|

|

|

Non-accelerated filer

☒

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 27, 2024

Senseonics Holdings, Inc.

Up to 45,714,286 Shares of Common Stock Issuable Upon Exercise of Warrants

This prospectus relates to the resale from time to time by the selling stockholder identified in this prospectus (the “Selling Stockholder”) of up to 45,714,286 shares of our common stock, par value $0.001 per share, comprising 45,714,286 shares of common stock issuable upon exercise of warrants (the “Warrants,” and such shares of common stock issuable upon exercise of the Warrants, the “Warrant Shares”). The Warrants were acquired by the Selling Stockholder pursuant to a securities purchase agreement, dated October 24, 2024 (the “Purchase Agreement”), in a transaction more fully described in the section titled “Selling Stockholder.”

We are not selling any shares of common stock under this prospectus and will not receive any proceeds from any sale by the Selling Stockholder of the shares of common stock offered by this prospectus and any prospectus supplement. We will, however, receive proceeds on the exercise by the Selling Stockholder of the Warrants for shares of common stock covered by this prospectus if such Warrants are exercised for cash. The Selling Stockholder will bear all commissions and discounts, if any, attributable to the sales of shares of common stock offered by this prospectus and any prospectus supplement. We will bear all other costs, expenses and fees in connection with the registration of the shares of common stock offered by this prospectus and any prospectus supplement. Our registration of the securities covered by this prospectus does not mean that the Selling Stockholder will exercise the Warrants or offer or sell any of the Warrant Shares. The Selling Stockholder identified in this prospectus and any of its pledgees, donees, transferees, assignees or other successors-in-interest may sell the Warrant Shares in a number of different ways and at varying prices. We provide more information about how the Selling Stockholder may sell or otherwise dispose of the Warrant Shares in the section titled “Plan of Distribution.” See the section entitled “Selling Stockholder” for additional information regarding the Selling Stockholder.

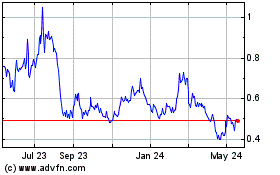

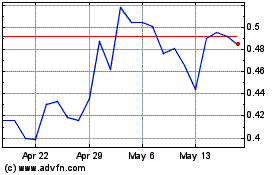

Our common stock is listed on the NYSE American under the symbol “SENS.” On November 26, 2024, the last reported sale price of our common stock was $0.30 per share.

We are a “smaller reporting company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our securities involves risks. You should carefully read and consider the risk factors included in our periodic reports, in any applicable prospectus supplement relating to a specific offering of securities and in any other documents we file with the Securities and Exchange Commission (“SEC”). See the sections entitled “Risk Factors” below on page 10, in the documents incorporated by reference in this prospectus and in the applicable prospectus supplement, if any.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

18

|

|

|

ABOUT THIS PROSPECTUS

Neither we nor the Selling Stockholder or the underwriters, if any, have authorized anyone to provide you with any information or to make any representation other than as may be contained in or incorporated by reference into this prospectus, any prospectus supplement or in any free writing prospectus that we may file with the SEC. We do not, and the Selling Stockholder or the underwriters, if any, do not, take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. This prospectus and any applicable prospectus supplement or free writing prospectus do not constitute an offer to sell any securities in any jurisdiction where such offer and sale are not permitted. The information contained in or incorporated by reference into this prospectus or any prospectus supplement, free writing prospectus or other offering material is accurate only as of the respective dates of those documents or information, regardless of the time of delivery of the documents or information or the time of any sale of the securities. Neither the delivery of this prospectus or any applicable prospectus supplement nor any distribution of securities pursuant to such documents shall, under any circumstances, create any implication that there has been no change in the information set forth in this prospectus or any applicable prospectus supplement or in our affairs since the date of this prospectus or any applicable prospectus supplement.

This prospectus is part of a registration statement that we filed with the SEC utilizing a shelf registration process or continuous offering process. Under this shelf registration process, the Selling Stockholder may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities that may be offered, from time to time, by the Selling Stockholder. Each time the Selling Stockholder sells securities, the Selling Stockholder may be required to provide you with this prospectus and, in certain cases, a prospectus supplement containing specific information about the Selling Stockholder and the terms of the securities being offered. That prospectus supplement may include additional risk factors or other special considerations applicable to those securities. Any prospectus supplement may also add, update, or change information in the prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in that prospectus supplement.

You should read this prospectus and any prospectus supplement for a specific offering of securities, together with additional information described in the sections entitled “Where You Can Find More Information” and “Incorporation by Reference” below, before making an investment decision. You should rely only on the information contained in or incorporated by reference into this prospectus, any accompanying prospectus supplement or any free writing prospectus prepared by or on behalf of us to which we have referred you.

Unless we state otherwise or the context otherwise requires, references to “Senseonics,” the “Company,” “us,” “we” or “our” in this prospectus mean Senseonics Holdings, Inc. and, where appropriate, our subsidiaries. When we refer to “you” in this section, we mean all purchasers of the securities being offered by this prospectus and any accompanying prospectus supplement, whether they are the holders or only indirect owners of those securities. We use Senseonics, the Senseonics logo, Eversense, Eversense E3 and Eversense 365 as trademarks in the United States and other countries. All other trademarks or trade names referred to in this prospectus and the accompanying prospectus supplement are the property of their respective owners.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings, including the Registration Statement and the exhibits and schedules thereto, are also available to the public from the SEC’s website at http://www.sec.gov. You can also access our SEC filings through our website at http://www.senseonics.com. Information contained in or accessible through our website does not constitute a part of this prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The SEC file number for the documents incorporated by reference in this prospectus is 001-37717. The documents incorporated by reference into this prospectus contain important information that you should read about us.

The following documents are incorporated by reference into this document:

•

our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 1, 2024;

•

•

•

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 12, 2024 (other than the portions thereof that are furnished and not filed); and

•

We also incorporate by reference into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness of the registration statement, or (ii) after the date of this prospectus but prior to the termination of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated by reference into such documents. You should direct any requests for documents to Senseonics Holdings, Inc., Attn: Investor Relations, 20451 Seneca Meadows Parkway, Germantown, MD 20876-7005, telephone: (301) 515-7260.

Any statement contained in this prospectus or contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed supplement to this prospectus, or document deemed to be incorporated by reference into this prospectus modifies or supersedes such statement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the information incorporated by reference herein and therein contain forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this prospectus, any accompanying prospectus and the information incorporated by reference herein and therein, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this prospectus, any accompanying prospectus supplement and the information incorporated by reference herein and therein include, among other things, statements about:

•

the success of our collaboration and commercialization agreement with Ascensia Diabetes Care Holdings AG (“Ascensia”);

•

the timing of product launches;

•

the clinical utility of Eversense;

•

our ability to develop future generations of Eversense;

•

our ability to service our outstanding indebtedness;

•

the timing and availability of data from our clinical trials;

•

the timing of our planned regulatory filings and potential regulatory approvals and CE Certificates of Conformity;

•

our future development priorities;

•

our ability to obtain adequate reimbursement and third-party payor coverage for Eversense;

•

our expectations about the willingness of healthcare providers to recommend Eversense to people with diabetes;

•

our commercialization, marketing and manufacturing capabilities and strategy;

•

our ability to comply with applicable regulatory requirements;

•

our ability to maintain our intellectual property position;

•

our estimates regarding the size of, and future growth in, the market for continuous glucose monitoring systems;

•

our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations; and

•

our estimates regarding our future expenses and needs for additional financing.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly in the “Risk Factors” section of the documents incorporated by reference herein, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus, any accompanying prospectus supplement and the information incorporated by reference herein and therein completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and in the documents we incorporate by reference herein. This summary does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, especially the risks of investing in our securities discussed under “Risk Factors” contained in any applicable prospectus supplement and any related free writing prospectus and under similar headings in our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the period ended September 30, 2024, as well as any amendments thereto reflected in our subsequent filings with the SEC, which are incorporated by reference in this prospectus, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus, before making an investment decision.

Company Overview

We are a medical technology company focused on the development and manufacturing of glucose monitoring products designed to transform lives in the global diabetes community with differentiated, long-term implantable glucose management technology. Our implantable CGM (“Eversense”), including Eversense E3 and Eversense 365 CGM systems are designed to continually and accurately measure glucose levels in people with diabetes via an under-the-skin sensor, a removable and rechargeable smart transmitter, and a convenient app for real-time diabetes monitoring and management for a period of up to six months in the case of Eversense E3 and up to twelve months in the case of Eversense 365, as compared to seven to 14 days for non-implantable CGM systems. In February 2022, the 180-day Eversense E3 CGM system was approved by the FDA and Ascensia began commercializing Eversense E3 in the United States in the second quarter of 2022. In June 2022, we affixed the CE mark to the extended life Eversense E3 CGM system and Ascensia began commercialization in select markets in Europe during the third quarter of 2022. In September 2024, the 365-day extended life Eversense E3 CGM system was approved by the FDA and Ascensia began commercializing Eversense 365 in the United States in the fourth quarter of 2024. Eversense 365 is the world’s first one year CGM system.

Our net revenues are derived from sales of the Eversense system which is sold in two separate kits: the disposable Eversense Sensor Pack which includes the sensor, insertion tool, and adhesive patches, and the durable Eversense Smart Transmitter Pack which includes the transmitter and charger.

We primarily sell directly to our network of distributors and strategic fulfillment partners, who provide the Eversense system to healthcare providers and patients through a prescribed request and invoice insurance payors for reimbursement. In addition, we sell our product through a consignment model through arrangements with our network of healthcare professionals. Sales of the Eversense system are widely dependent on the ability of patients to obtain coverage and adequate reimbursement from third-party payors or government agencies. We leverage and target regions where we have coverage decisions for patient device use and provider insertion and removal procedure payment. We have reached approximately 300 million covered lives in the United States through positive insurance payor coverage decisions. In June 2023, we received positive payor coverage decision from UnitedHealthcare, the largest healthcare insurance company in the United States that effective July 1, 2023, Eversense E3 CGM system would be covered. On August 3, 2020, the Center for Medicare and Medicaid Services (“CMS”) released its Calendar Year 2021 Medicare Physician Fee Schedule Proposed Rule that announces proposed policy changes for Medicare payments, including the proposed establishment of national payment amounts for the three CPT© Category III codes describing the insertion (CPT 0446T), removal (0447T), and removal and insertion (0048T) of an implantable interstitial glucose sensor, which describes our Eversense CGM systems, as a medical benefit, rather than as part of the Durable Medical Equipment channel that includes other CGMs. In December 2021, CMS released its Calendar Year 2022 Medicare Physician Fee Schedule that updated global payments for the device cost and procedure fees. In November 2022, CMS released its Calendar Year 2023 Medicare Physician Fee Schedule Proposed Rule that updates the payment amounts for the three CPT© III codes to account for the longer 6-month sensor. The Calendar Year 2024 Medicare Physician Fee Schedule continues to include the three CPT© Category III codes. In February 2024, we announced that Medicare coverage was expanded for Eversense E3 to include all people with diabetes using insulin and non-insulin users who have a history of problematic hypoglycemia providing access to millions of Medicare patients. All of Medicare administrative contractor (“MAC”) expansion are effective as of November 4, 2024.

We are in the early commercialization stages of the Eversense brand and are focused on driving awareness of our CGM system amongst people with diabetes and their healthcare providers. In both the United States and our overseas markets, we have entered into strategic partnerships and distribution agreements that allow third party collaborators with direct sales forces and established distribution systems to market and promote Senseonics CGM systems, including 90-day Eversense, Eversense E3 and future generation products, including our “Gemini” product variation to allow for a 2-in-1 glucose monitoring system combining the functionality of CGM and Flash Glucose Monitoring, in an implantable sensor with battery that may be utilized with a smart transmitter to get continuous glucose readings and alerts, or be utilized through a swipe over the sensor with a smart phone to get on-demand glucose reading without a smart transmitter and our “Freedom” product variation which would include Bluetooth in the sensor eliminating the on-body component.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary and in the “Risk Factors” sections in our Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which are incorporated by reference in this prospectus. These risks include the following:

•

We have incurred significant operating losses since inception and cannot assure you that we will ever achieve or sustain profitability. Our results of operations may fluctuate significantly from quarter to quarter or year to year.

•

We expect that a substantial majority of our future revenue will result from our Commercialization Agreement with Ascensia. If Ascensia fails to perform satisfactorily under this agreement, including among other things if they are delayed or unsuccessful in growing the adoption of our product, our commercialization efforts and financial results would be directly and adversely affected.

•

The markets in which we participate are highly competitive, and our primary competitors, as well as a number of other companies, medical researcher and existing medical device companies, are pursuing new delivery devices, delivery technologies, sensing technologies, procedures, drugs and other therapies for the monitoring, treatment and prevention of diabetes. Any technological breakthroughs in diabetes monitoring, treatment or prevention could reduce the potential market for Eversense or render Eversense less competitive or obsolete, which would significantly reduce our potential sales.

•

We have limited operating history as a commercial-stage company and may face difficulties encountered by companies early in their commercialization in competitive and rapidly evolving markets.

•

Our actual operating results may differ significantly from any guidance provided. If our actual results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline significantly.

•

Due to our recurring losses and uncertainty regarding our ability to maintain liquidity sufficient to operate our business effectively, there is substantial doubt about our ability to continue as a going concern.

•

Medical device development involves a lengthy and expensive process, with an uncertain outcome. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, ongoing development for lifecycle management of our products.

•

Our products and operations are subject to extensive governmental regulation, and failure to comply with applicable requirements could cause our business to suffer. In particular, the FDA and other foreign regulatory clearance, certification, or approval processes are expensive, time-consuming and uncertain, and the failure to maintain required regulatory clearances, certifications and approvals could prevent us from commercializing Eversense and future versions of Eversense.

•

The ongoing military action by Russia in Ukraine and Israel in Gaza could have negative impact on the global economy which could materially adversely affect our business, operations, operating results and financial condition. There is uncertainty regarding the ultimate impact the conflict, including

any escalation or further expansion of the conflict’s current scope, will have on our customers, the global economy, supply chains, logistics, fuel prices, raw material pricing and our business.

•

Surging natural gas and electricity costs in Europe poses a threat to our contract manufacturers ability to maintain operations in Europe which can adversely affect or business supply chain. If the energy crisis or other supply chain challenges impact our ability to obtain raw materials on a timely basis or without significant increases in costs, our financial results and business operations may be adversely affected.

•

Failure to secure or retain coverage or adequate reimbursement for Eversense or future versions of Eversense systems, including the related insertion and removal procedures, by third-party payors could adversely affect our business, financial condition and operating results.

•

We have established and are establishing wholly-owned subsidiaries, as well as partnerships and other arrangements with third parties, to develop broad inserter networks and as the number of insertions increase so does our reliance on these inserter networks. If these inserter networks fail to perform satisfactorily, our commercialization efforts and financial results would be directly and adversely affected.

•

Our stock price has been highly volatile and may continue to be highly volatile. The stock market in general and the market for innovative, emerging medtech and biotechnology companies in particular, has experienced volatility that has often been unrelated to the operating performance of particular companies. We cannot predict the action of market participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

•

Our operating results are subject to significant fluctuations.

•

We contract with third parties for the manufacture of Eversense. Risks associated with the manufacturing of our products, loss of key suppliers or disruption to their facilities could reduce our gross margins and negatively affect our operating results.

•

We operate in a regulated industry and our business, operations and the business and operations of our third-party manufacturers are subject to various foreign, U.S. federal, state and local laws and regulations, including those promulgated by the FDA and equivalent foreign regulatory authorities, among others. Failure to comply with applicable laws and regulations should harm our business and we may incur significant expenditures related to compliance efforts.

•

Failure or perceived failure to comply with existing or future laws, regulations, contracts, self-regulatory schemes, standards, and other obligations related to data privacy and security (including security incidents) could harm our business. Compliance or the actual or perceived failure to comply with such obligations could increase the costs to our products, limit their use or adoption, and otherwise negatively affect our operating results and business.

•

Holders of debt instruments may exert substantial influence over us and may exercise their control in a manner adverse to the interests of our common stockholders.

•

The medical device industry is characterized by patent litigation, and we could become subject to litigation that could be costly, result in the diversion of management’s time and efforts, stop our development and commercialization measures, harm our reputation or require us to pay damages.

Company Information

We were originally incorporated as ASN Technologies, Inc. in Nevada on June 26, 2014. On December 7, 2015, pursuant to the Merger Agreement and the transactions contemplated thereby (the “Acquisition”), we acquired Senseonics, Incorporated, a medical technology company focused on the design, development and commercialization of glucose monitoring systems to improve the lives of people with diabetes by enhancing their ability to manage their disease with relative ease and accuracy. From its inception in 1996 until 2010, Senseonics, Incorporated devoted substantially all of its resources to researching various sensor technologies and platforms. Beginning in 2010, the company narrowed its focus to designing, developing and refining a commercially viable glucose monitoring system.

In connection with the Acquisition, we reincorporated in Delaware and changed our name to Senseonics Holdings, Inc. Upon the closing of the Acquisition, Senseonics, Incorporated merged with a wholly owned subsidiary of ours formed solely for that purpose and became our wholly owned subsidiary.

In April 2024 and July 2024, Eon Care Services, LLC and Eon Management Services, LLC, (collectively “Eon Care”) were formed as wholly owned subsidiaries of Senseonics, Incorporated. In conjunction with the formation of Eon Care, in November 2024, several variable interest entities were established to support patient access to the Eversense system by providing convenient Eversense insertion and training services.

Our principal executive offices are located at 20451 Seneca Meadows Parkway, Germantown, Maryland 20876-7005. Our telephone number is (301) 515-7260. Our common stock is listed on the NYSE American under the symbol “SENS.”

Available Information

Our internet website address is http://www.senseonics.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements and reduced disclosure obligations regarding executive compensation. To the extent we take advantage of any reduced disclosure obligations, it may make the comparison of our financial statements with other public companies difficult or impossible.

The Offering

Common stock offered by the Selling Stockholder

45,714,286 shares

The Selling Stockholder, including its transferees, donees, pledgees or successors-in-interest, may sell, transfer or otherwise dispose of any or all of the shares of common stock offered by this prospectus from time to time on the NYSE American or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The shares of common stock may be sold at fixed prices, at prevailing market prices, at prices related to prevailing market prices or at negotiated prices. See “Plan of Distribution” on page 14.

We will not receive any proceeds from the sale of the shares of common stock covered by this prospectus.

See “Risk Factors” and other information included in this prospectus for a discussion of the factors you should carefully consider before deciding to invest in shares of our common stock.

SENS

RISK FACTORS

Investing in our common stock involves risks. You should carefully consider the risk factors described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, our Quarterly Report on Form 10-Q for the period ended September 30, 2024, and any updates to those risk factors or new risk factors contained in our subsequent filings with the SEC, all of which is incorporated by reference into this prospectus, as the same may be amended, supplemented or superseded from time to time by our filings under the Exchange Act, as well as any prospectus supplement relating to a specific offering or resale. Before making any investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus or in any applicable prospectus supplement or free writing prospectus. For more information, see the sections entitled “Where You Can Find More Information” and “Incorporation by Reference” above. These risks could materially affect our business, results of operations or financial condition and affect the value of our common stock. You could lose all or part of your investment. Additionally, the risks and uncertainties discussed in this prospectus or in any document incorporated by reference into this prospectus are not the only risks and uncertainties that we face, and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, results of operations or financial condition.

USE OF PROCEEDS

The Selling Stockholder will receive all of the proceeds from its sale from time to time under this prospectus and any accompanying prospectus supplement of the common stock described herein. We will not receive any proceeds from these sales.

SELLING STOCKHOLDERS

On October 24, 2024, we entered into the Purchase Agreement with the Selling Stockholder pursuant to which we issued and sold (i) in a registered direct offering an aggregate of 45,714,286 shares of our common stock and (ii) in a concurrent private placement (the “Private Placement”), the Warrants to purchase up to an aggregate of 45,714,286 shares of our common stock. Each share of our common stock sold pursuant to the Purchase Agreement and issued in the registered direct offering was accompanied by one Warrant issued in the Private Placement.

The Warrants have an exercise price of $0.35 per share, and are non-exerciseable in the first six months after issuance. The Warrants expire five years from the date of initial exercisability.

We are registering the resale of the Warrant Shares to permit the Selling Stockholder and its pledgees, donees, assignees, transferees or other successors-in-interest that receive their shares of common stock after the date of this prospectus to resell or otherwise dispose of the shares in the manner contemplated under “Plan of Distribution” below.

The following table sets forth the name of the Selling Stockholder, the number of shares beneficially owned by the Selling Stockholder, the number of shares that may be offered under this prospectus and the number of shares of our common stock owned by the Selling Stockholder after this offering, assuming all of the shares covered hereby are sold. The number of shares in the column “Number of Shares Being Offered” represents all of the shares that the Selling Stockholder may offer under this prospectus, consisting of the Warrant Shares. The Selling Stockholder may sell some, all or none of its shares. We do not know how long the Selling Stockholder will hold the shares before selling them, and, except as described in this prospectus, we currently have no agreements, arrangements or understandings with the Selling Stockholder regarding the sale or other disposition of any of the shares. The shares covered hereby may be offered from time to time by the Selling Stockholder.

The information set forth below is based upon information obtained from the Selling Stockholder and upon information in our possession regarding the issuance of the Warrants in the Private Placement. The percentages of common stock owned are based on 595,327,172 shares of common stock outstanding as of November 15, 2024.

Based upon information provided by the Selling Stockholder, neither the Selling Stockholder, nor any of its affiliates, officers, directors or principal equity holders, has held any position or office or has had any material relationship with us within the past three years.

In addition, except as indicated in the table below, the Selling Stockholder has represented to us that it is not, nor is it affiliated with, a registered broker-dealer.

|

Name and Address of Selling Stockholder

|

|

|

Shares of

Common Stock

Beneficially

Owned Prior to

Offering(1)

|

|

|

Shares of

Common Stock

Being Offered(2)

|

|

|

Shares of

Common Stock

Beneficially Owned

After Offering(3)

|

|

| |

Number

|

|

|

Percent

|

|

|

Armistice Capital, LLC(4)

|

|

|

|

|

45,714,286 |

|

|

|

|

|

45,714,286 |

|

|

|

|

|

45,714,286 |

|

|

|

|

|

7.7% |

|

|

(1)

Consists of 45,714,286 shares of common stock held by the Selling Stockholder. Excludes 45,714,286 shares of common stock issuable upon exercise of outstanding Warrants, which are not currently exercisable by virtue of the exercise limitations described in footnote (4).

(2)

The number of shares of common stock being offered are comprised of the Warrant Shares.

(3)

Assumes that the Selling Stockholder exercises all of the Warrants for cash and sells all shares of the Warrant Shares registered under this prospectus, but that the Selling Stockholder doesn’t sell or otherwise dispose of any of the other shares of common stock that it beneficially owns as of the date hereof.

(4)

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the

Managing Member of Armistice Capital. The Warrants are not exercisable until April 28, 2025 and are subject to a beneficial ownership limitation of 4.99%, which limitation restricts the Selling Stockholder from exercising that portion of the Warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022.

PLAN OF DISTRIBUTION

We are registering the resale of the shares of common stock covered by this prospectus on behalf of the Selling Stockholder. All costs, expenses and fees connected with the registration of these shares will be borne by us. Any brokerage commissions and similar expenses connected with selling the shares will be borne by the Selling Stockholder. The Selling Stockholder may offer and sell the shares covered by this prospectus from time to time in one or more transactions. The term “Selling Stockholder” includes pledgees, donees, transferees and other successors-in-interest who may acquire the shares of common stock covered by this prospectus through a pledge, gift, partnership distribution or other non-sale related transfer from the Selling Stockholder. The Selling Stockholder will act independently of us in making decisions with respect to the timing, manner and size of each sale. These transactions include:

•

through one or more underwriters or dealers in a public offering and sale by them, whether individually or through an underwriting syndicate led by one or more managing underwriters;

•

in “at the market offerings” within the meaning of Rule 415(a)(4) under the Securities Act, to or through a market maker or into an existing trading market, on an exchange or otherwise;

•

directly to a limited number of purchasers or to a single purchaser;

•

through agents;

•

by delayed delivery contracts or by remarketing firms;

•

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its own account pursuant to this prospectus;

•

exchange or over-the-counter distributions in accordance with the rules of the exchange or other market;

•

block trades in which the broker-dealer attempts to sell the Securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

transactions in options, swaps or other derivatives that may or may not be listed on an exchange;

•

a combination of any such method of sale; or

•

any other method permitted pursuant to applicable law.

In connection with distributions of the shares or otherwise, the Selling Stockholder may:

•

sell the shares:

•

in negotiated transactions;

•

in one or more transactions at a fixed price or prices, which may be changed from time to time;

•

at market prices prevailing at the times of sale;

•

at prices related to such prevailing market prices; or

•

at negotiated prices;

•

sell the shares:

•

on a national securities exchange;

•

in the over-the-counter market; or

•

in transactions otherwise than on an exchange or in the over-the-counter market, or in combination;

•

sell the shares short and/or deliver the shares to close out short positions;

•

enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to them of Securities covered by this prospectus, which they may in turn resell; and

•

pledge shares to broker-dealers or other financial institutions, which, upon a default, they may in turn resell.

The Selling Stockholder may also resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, as amended, or the Securities Act, as permitted by that rule, Section 4(a)(1) under the Securities Act, if available, or any other exemption from the registration requirements that become available, rather than under this prospectus.

If underwriters are used in the sale of any shares covered by this prospectus, such shares will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions described above. Shares may be either offered to the public through underwriting syndicates represented by managing underwriters or directly by underwriters. The Selling Stockholder may use underwriters with whom we have a material relationship. As applicable, we will describe in each accompanying prospectus supplement the name of the underwriter(s) and the nature of any such relationship(s).

If a dealer is used in an offering of the shares covered by this prospectus, the dealer may purchase the shares, as principal. The dealer may then resell the shares to the public at varying prices to be determined by the dealer at the time of sale.

Shares may be sold directly or through agents designated from time to time. We will name any agent involved in the offering and sale of such shares and we will describe any commissions paid to the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, the agent will act on a best-efforts basis for the period of its appointment.

Underwriters, dealers and agents may be entitled to indemnification by us against certain civil liabilities, including liabilities under the Securities Act, or to contribution with respect to payments made by the underwriters, dealers or agents, under agreements between us and the underwriters, dealers and agents.

Underwriters who participate in the distribution of shares covered by this prospectus may be granted an option to purchase additional shares in connection with the distribution.

Underwriters, dealers or agents may receive compensation in the form of discounts, concessions or commissions from the Selling Stockholder or the purchasers, as their agents in connection with the sale of shares covered by this prospectus. These underwriters, dealers or agents may be considered to be underwriters under the Securities Act. As a result, discounts, commissions or profits on resale received by the underwriters, dealers or agents may be treated as underwriting discounts and commissions. Each accompanying prospectus supplement will identify any such underwriter, dealer or agent and describe any compensation received by them. Any initial public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

In connection with sales of the shares covered by this prospectus, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our securities in the course of hedging any positions they assume. The Selling Stockholder may also sell shares of our common stock short and the Selling Stockholder may deliver the shares covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The Selling Stockholder may also loan or pledge the shares covered by this prospectus to broker-dealers that in turn may sell such shares, to the extent permitted by applicable law. The Selling Stockholder may also enter into options or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the shares covered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholder may, from time to time, pledge or grant a security interest in some or all of the shares covered by this prospectus and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending, if necessary, the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as a Selling Stockholder under this prospectus. The Selling Stockholder may also transfer and

donate the shares covered by this prospectus in other circumstances, in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

Any underwriter may engage in over-allotment transactions, stabilizing transactions, short- covering transactions and penalty bids in accordance with Regulation M under the Exchange Act of 1934.

Underwriters, broker-dealers or agents who may become involved in the sale of the shares covered by this prospectus may engage in transactions with, and perform other services for, us in the ordinary course of their business for which they receive compensation.

In effecting sales, the Selling Stockholder may engage broker-dealers or agents, who may in turn arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Stockholder and/or from the purchasers of Securities for whom the broker-dealers may act as agents or to whom they sell as principal, or both. The compensation to a particular broker-dealer may be in excess of customary commissions. To our knowledge, there is currently no plan, arrangement or understanding between the Selling Stockholder and any broker-dealer or agent regarding the sale of any of the shares covered by this prospectus by the Selling Stockholder.

The Selling Stockholder, any broker-dealers or agents and any participating broker-dealers that act in connection with the sale of the shares covered by this prospectus may be “underwriters” under the Securities Act with respect to those shares and will be subject to the prospectus delivery requirements of the Securities Act. Any profit that the Selling Stockholder realizes, and any compensation that any broker-dealer or agent may receive in connection with any sale, including any profit realized on resale of the shares covered by this prospectus acquired as principal, may constitute underwriting discounts and commissions. If the Selling Stockholder is deemed to be an underwriter, the Selling Stockholder may be subject to certain liabilities under statutes including, but not limited to, Sections 11, 12 and 17 of the Securities Act and Section 10(b) and Rule 10b-5 under the Exchange Act.

The securities laws of some states may require the Selling Stockholder to sell the shares covered by this prospectus in those states only through registered or licensed brokers or dealers. These laws may also require that we register or qualify the shares for sale in those states unless an exemption from registration and qualification is available and the Selling Stockholder and we comply with that exemption. In addition, the anti-manipulation rules of Regulation M under the Securities Exchange Act of 1934 may apply to sales of the shares in the market and to the activities of the Selling Stockholder and its affiliates. Regulation M may restrict the ability of any person engaged in the distribution of the shares covered by this prospectus to engage in market-making activities with respect to our Common Stock. All of the foregoing may affect the marketability of the shares covered by this prospectus and the ability of any person to engage in market-making activities with respect to our Common Stock.

If the Selling Securityholder notifies us that it has entered into any material arrangement with a broker-dealer for the sale of the shares covered by this prospectus through a block trade, special offering, exchange distribution, over-the-counter distribution or secondary distribution, or a purchase by a broker or dealer, we will file any necessary supplement to this prospectus to disclose:

•

the number of shares involved in the arrangement;

•

the terms of the arrangement, including the names of any underwriters, dealers or agents who purchase shares, as required;

•

the proposed selling price to the public;

•

any discount, commission or other underwriting compensation;

•

the place and time of delivery for the shares being sold;

•

any discount, commission or concession allowed, reallowed or paid to any dealers; and

•

any other material terms of the distribution of the shares.

LEGAL MATTERS

The validity of the shares of common stock being offered hereby will be passed upon for us by Cooley LLP, Reston, Virginia. Any underwriters will also be advised about the validity of the shares of common stock and other legal matters by their own counsel, which will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Senseonics Holdings, Inc. as of December 31, 2023 and 2022, and for each of the years in the two-year period ended December 31, 2023, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth an estimate of the fees and expenses, other than underwriting discounts and commissions, payable by the registrant in connection with the issuance and distribution of the securities being registered. All the amounts shown are estimates, except for the SEC registration fee.

| |

Registration Fee

|

|

|

|

$ |

2,240 |

|

|

| |

Legal Fees and Expenses

|

|

|

|

|

100,000 |

|

|

| |

Accounting Fees and Expenses

|

|

|

|

|

30,000 |

|

|

| |

Miscellaneous Fees and Expenses

|

|

|

|

|

10,000 |

|

|

| |

Total

|

|

|

|

$ |

142,240 |

|

|

Item 15. Indemnification of Officers and Directors

Under Section 145 of the Delaware General Corporation Law (“DGCL”), we have broad powers to indemnify our directors and officers against liabilities they may incur in such capacities, including liabilities under the Securities Act. Section 145 of the DGCL generally provides that a Delaware corporation has the power to indemnify its present and former directors, officers, employees and agents against expenses incurred by them in connection with any suit to which they are or are threatened to be made, a party by reason of their serving in such positions so long as they acted in good faith and in a manner they reasonably believed to be in or not opposed to, the best interests of the corporation and, with respect to any criminal action, they had no reasonable cause to believe their conduct was unlawful.

Our amended and restated certificate of incorporation and amended and restated bylaws include provisions that (i) eliminate the personal liability of our directors for monetary damages resulting from breaches of their fiduciary duty to the fullest extent permitted under applicable law, (ii) require us to indemnify our directors and executive officers to the fullest extent permitted by the DGCL or other applicable law and (iii) provide us with the power, in our discretion, to indemnify our other officers, employees and other agents as set forth in the DGCL or other applicable law. We believe that these provisions of our amended and restated certificate of incorporation and amended and restated bylaws are necessary to attract and retain qualified persons as directors and officers. These provisions do not eliminate our directors’ or officers’ duty of care, and, in appropriate circumstances, equitable remedies such as injunctive or other forms of non-monetary relief will remain available under the DGCL. In addition, each director will continue to be subject to liability pursuant to Section 174 of the DGCL, for breach of such director’s duty of loyalty to us, for acts or omissions not in good faith or involving intentional misconduct, for knowing violations of law, for acts or omissions that such director believes to be contrary to our best interests or the best interests of our stockholders, for any transaction from which such director derived an improper personal benefit, for acts or omissions involving a reckless disregard for such director’s duty to us or to our stockholders when such director was aware or should have been aware of a risk of serious injury to us or to our stockholders, for acts or omission that constitute an unexcused pattern of inattention that amounts to an abdication of such director’s duty to us or to our stockholders, for improper transactions between such director and us and for improper loans to directors and officers. These provisions also do not affect a director’s responsibilities under any other law, such as the federal securities law or state or federal environmental laws.

As permitted by Delaware law, we have entered into indemnification agreements with each of our current directors and officers pursuant to the foregoing provisions. We have an insurance policy covering our officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act or otherwise.

The underwriting agreement, if any, entered into with respect to an offering of securities registered hereunder will provide for indemnification by any underwriters of any offering, our directors and officers who sign the registration statement and our controlling persons for some liabilities, including liabilities arising under the Securities Act.

Item 16. Exhibits and Financial Statement Schedules

| |

Exhibit

Number

|

|

|

Description of Document

|

|

| |

3.1

|

|

|

Amended and Restated Certificate of Incorporation of the Registrant of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K (File No. 001-37717), filed with the SEC on March 23, 2016).

|

|

| |

3.2

|

|

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.3 to the Registrant’s Quarterly Report on Form 10-Q (File No 001-37717), filed with the SEC on August 8, 2018).

|

|

| |

3.3

|

|

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K (File No. 001-37717) filed on October 26, 2020).

|

|

| |

3.4

|

|

|

Certificate of Designation of Preferences, Rights and Limitations of Series B Convertible Preferred Stock (incorporated herein by reference to Exhibit 3.5 to the Registrant’s Quarterly Report on Form 10-Q (File No. 001-37717), filed with the Commission on November 8, 2022).

|

|

| |

3.5

|

|

|

|

|

| |

3.6

|

|

|

Amendment to Bylaws of the Registrant (incorporated herein by reference to Exhibit 3.7 to the Registrant’s Annual Report on Form 10-K (File No. 001-37717) filed with the Commission on March 5, 2021).

|

|

| |

4.1

|

|

|

Securities Purchase Agreement dated October 24, 2024 between Senseonics Holdings, Inc. and the purchasers party thereto. (incorporated herein by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K (File No. 001-37717), filed with the Commission on October 28, 2024).

|

|

| |

5.1

|

|

|

|

|

| |

23.1

|

|

|

|

|

| |

23.2

|

|

|

|

|

| |

24.1

|

|

|

|

|

| |

107

|

|

|

|

|

Item 17. Undertakings

The undersigned Registrant hereby undertakes:

(a)

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that paragraphs

(a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post- effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the Registration Statement as of the date the filed prospectus was deemed part of and included in the Registration Statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the Registration Statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the Registration Statement relating to the securities in the Registration Statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the Registration Statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the Registration Statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the Registration Statement or made in any such document immediately prior to such effective date.

(5)

That for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b)

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Germantown, State of Maryland, on November 27, 2024.

SENSEONICS HOLDINGS, INC.

By:

/s/ TIMOTHY T. GOODNOW

Timothy T. Goodnow

President and Chief Executive Officer

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Timothy T. Goodnow and Rick Sullivan, and each of them, his true and lawful agent, proxy and attorney-in-fact, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to (i) act on, sign and file with the Securities and Exchange Commission any and all amendments (including post-effective amendments) to this registration statement together with all schedules and exhibits thereto and any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, together with all schedules and exhibits thereto, (ii) act on, sign and file such certificates, instruments, agreements and other documents as may be necessary or appropriate in connection therewith, (iii) act on and file any supplement to any prospectus included in this registration statement or any such amendment or any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and (iv) take any and all actions which may be necessary or appropriate to be done, as fully for all intents and purposes as he might or could do in person, hereby approving, ratifying and confirming all that such agent, proxy and attorney-in-fact or any of his substitutes may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ TIMOTHY T. GOODNOW, PH.D.

Timothy T. Goodnow, Ph.D.

|

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

|

November 27, 2024

|

|

| |

/s/ RICK SULLIVAN

Rick Sullivan

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

November 27, 2024

|

|

| |

/s/ DOUGLAS S. PRINCE

Douglas S. Prince

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ DOUGLAS A. ROEDER

Douglas A. Roeder

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ EDWARD J. FIORENTINO

Edward J. Fiorentino

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ STEPHEN P. DEFALCO

Stephen P. DeFalco

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ STEVEN EDELMAN

Steven Edelman

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ FRANCINE KAUFMAN

Francine Kaufman

|

|

|

Chief Medical Officer and Director

|

|

|

November 27, 2024

|

|

| |

/s/ KOICHIRO SATO

Koichiro Sato

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ ANTHONY RAAB

Anthony Raab

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ BRIAN HANSEN

Brian Hansen

|

|

|

Director

|

|

|

November 27, 2024

|

|

| |

/s/ SHARON LARKIN

Sharon Larkin

|

|

|

Director

|

|

|

November 27, 2024

|

|

Exhibit 5.1

Darren K. DeStefano

+1: 703 456 8034

ddstefano@cooley.com

November 27, 2024

Senseonics Holdings, Inc.

20451 Seneca Meadows Parkway

Germantown, Maryland 20876

Ladies and Gentlemen:

We

have acted as counsel to Senseonics Holdings, Inc., a Delaware corporation (the “Company”), in connection

with the filing by the Company of a Registration Statement on Form S-3 (the “Registration Statement”) with the

Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities

Act”), including a related prospectus included in the Registration Statement (the “Prospectus”),

covering the registration for resale of up to 45,714,286 shares (the “Warrant Shares”) of the Company’s

common stock, $0.001 par value (“Common Stock”), issuable upon the exercise of outstanding warrants (the “Warrants”).

The Warrants were issued by the Company pursuant to that certain Securities Purchase Agreement (the “Purchase Agreement”)

dated October 24, 2024.

In connection with this opinion, we have examined

and relied upon the Registration Statement, the Prospectus, the Purchase Agreement, the Warrants, the Company’s certificate of incorporation

and bylaws, each as currently in effect, and such other records, documents, opinions, certificates, memoranda and instruments as in our

judgment are necessary or appropriate to enable us to render the opinion expressed below. We have assumed the genuineness of all signatures,

the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as copies,

the accuracy, completeness and authenticity of certificates of public officials and the due authorization, execution and delivery of all

documents by all persons other than the Company where authorization, execution and delivery are prerequisites to the effectiveness thereof.

As to certain factual matters, we have relied upon a certificate of an officer of the Company and have not independently verified such

matters.

Our opinion is expressed only with respect to

the General Corporation Law of the State of Delaware. We express no opinion to the extent that any other laws are applicable to the subject

matter hereof and express no opinion and provide no assurance as to compliance with any federal or state antifraud law, rule or regulation

relating to securities or to the sale or issuance thereof.

With respect to the Warrant Shares, we express

no opinion to the extent that future issuances of securities of the Company, adjustments to outstanding securities of the Company or other

matters cause the Warrants to be exercisable for more shares of Common Stock than the number available for issuance by the Company or

that the consideration paid upon exercise of the Warrants is below the par value of the Common Stock.

On the basis of the foregoing, and in reliance

thereon, we are of the opinion that the Warrant Shares, when issued and paid for in accordance with the terms of the Warrants, will be

validly issued, fully paid and nonassessable.

Our opinion is limited to the matters expressly