Economic uncertainty all over the world has taken a toll on

equity markets, rendering them highly unpredictable at this time.

Some respite comes from commodities like precious metals, but even

these have seen some weakness thanks to a stronger

dollar.

Beyond a strong dollar, commodities have also experienced

weakness thanks to a sluggish global economic outlook. Concerns

have centered on the deepening Euro zone debt crisis and a dismal

U.S. job scenario, both of which have kept commodity prices under

pressure in 2012 (Read: Precious Metal ETFs Slump On Bernanke

Testimony).

Despite these conditions, there have been a couple winners so

far this year, although they have been few and far between.

Seemingly, these top performers could act as a safe haven in the

current market storm or could at least hold up better than their

counterparts if the markets continue to remain sluggish (Read:

Cocoa ETFs: The Safe Haven In Agricultural Commodities?)

Interestingly, the top performers haven’t been focused on any

particular sector but have been spread out among the various

commodity groups. This suggests that there have been winners in

every corner of the space, implying that investors who have been

burned by broader based commodity funds this year may want to

consider looking at any of the following commodity ETFs that we

have highlighted below:

E-TRACS Natural Gas Futures Contango ETN

(GASZ)

Though the ramp up of natural gas production and subsequent

supply glut weighed on natural gas prices, this fund generated

exciting returns of more than 11% during the last five months in

the current turmoil. (Read: Have The Natural Gas ETFs Finally

Bottomed Out?) This is primarily driven by its contango effect in

natural gas markets, where longer-dated contracts are more

expensive.

The fund takes short positions in the near-term expiry futures

contracts and long positions in the mid-term expiry futures

contracts. As mid-term contracts are priced at higher prices than

near-term contracts, the fund capitalizes on the price difference

in the form of higher returns.

With AUM of $12.2 million, the ETN seeks to match the

performance of the ISE Natural Gas Futures Spread Index. The

product is less volatile and trades in small volumes say nearly

10,000 per share on a daily basis. The fund seems costly relative

to other ETFs in the space, charging investors a fee of 85 bps

annually, although it does arguably have a more advanced

strategy.

Teucrium Soybean Fund

(SOYB)

This fund surged more than 7% in the past five months since

soybean prices reached an all-time high due to lower plantings of

the key crop. The fund also benefited from the reduced effects of

backwardation and contango.

Investors seeking direct exposure to soybean may find this fund

an intriguing option. The product invests in three soybean futures

contracts, each having their own weightings in the basket. These

three futures contracts expiring November 2012, January 2013 and

November 2013 have weightings of 35%, 30%, and 35%,

respectively.

The fund has assets of about $4.5 million under its management

and is less liquid with small daily trading volume. The product is

the high cost choice in the space as it charges a fee of about 100

bps per year. Further, a large bid/ask spread increases the cost of

investment to those who are looking to make a quick trade.

Silver ETFs

Another segment which has been strong in the commodity world

this year has been that of the silver market. The white metal has

managed to add about 6% on the year, outpacing many other products

in the space.

Silver has largely been assisted by the fact that not only is it

a precious metal and a store of wealth, but it also has a number of

key industrial applications as well. Thanks to this, the metal can

perform better during uncertain market conditions where industries

haven’t gone down the tubes, making it a solid investment during

this type of market (Read: Silver ETFs Outshine Gold).

In order to play silver, ETF investors have a variety of options

at their disposal. Three of the most popular are DBS, SIVR, and

SLV, each of which we have briefly highlighted below:

PowerShares DB Silver Fund

(DBS)

DBS seeks to replicate the performance of the Deutsche Bank

Liquid Commodity Index - Optimum Yield Silver Excess Return, before

fees and expenses. The fund provides exposure in the futures market

rather than spot market.

The product has $68.9 million of assets under its management and

uses the passive approach. It charges an annual fee of 50 bps per

year and is highly volatile. The fund trades good volumes of about

17,000 per share on average daily basis.

ETFS Physical Silver Shares

(SIVR)

With AUM of $472.2 million, the fund tracks the spot price of

silver bullion, net of fees and expenses and own silver bars to

back the shares. SIVR is backed by physical silver under the

custody of HSBC Bank USA in London.

The fund is highly traded and provides ample flexibility. It

offers simple and cost-efficient ways to investors seeking exposure

to silver bullion. The product is the low cost choice in the

commodity space charging investors a fee of 30 bps per year with

low bid/ask spread and good tracking error.

iShares Silver Trust ETF

(SLV)

The fund seeks to match the spot price of silver bullion, net of

fees and expenses. It is backed by physical silver under the

custody of JP Morgan Chase Bank in London (See more ETFs in the

Zacks ETF Center).

The product is highly traded and is one of the largest ETFs in

the space with assets of $8.5 billion under its management. It

offers investors an easy and potentially lucrative method for

gaining exposure to the price of silver. Unlike SLVR, this fund is

quite expensive with an expense ratio of 0.50%.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DB SILVER (DBS): ETF Research Reports

E-TRC NAT GAS (GASZ): ETF Research Reports

ETF-SILVER TRST (SIVR): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

TEUCRM-SOYBEAN (SOYB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

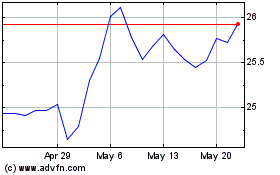

Teucrium Soybean (AMEX:SOYB)

Historical Stock Chart

From Jan 2025 to Feb 2025

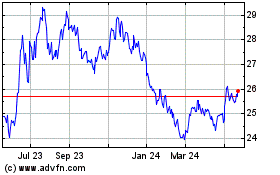

Teucrium Soybean (AMEX:SOYB)

Historical Stock Chart

From Feb 2024 to Feb 2025