While the U.S. may not be the manufacturing powerhouse that it

once was, the country is still a massive producer of a number of

commodities. These products make up a good chunk of U.S. exports

and, thanks to changing demand pictures in both the energy and

agricultural markets, have been important contributors to the trade

balance for quite some time now.

In particular, the U.S. has developed a great advantage over

many nations in a few commodities; corn, natural gas, and soybeans.

In the case of the agricultural products, both have become

impressive sources of export dollars while natural gas production

threatens to disrupt the energy market by either eventually

becoming a major export to power hungry markets, or by hopefully

reducing crude oil imports at some point in the near future (read

The 5 Best ETFs over the Past Five Years).

Clearly, these three products are increasingly important to the

American economy and look to maintain their significance over the

next several years at least. As a result of this, investors looking

to tap into some of the more important goods for the American

economy could consider taking a look at any of the following three

commodity ETFs:

Corn

Thanks to growing use of biofuels and rising demand for animal

feed for meat consumption, corn demand has been through the roof.

World consumption increased by over 50% over roughly the last 15

years, led by huge gains in usage by China for livestock and

America for ethanol.

Currently, America is still the king of corn, accounting for

over one-third of the total world supply of the crop.

Furthermore, the U.S. exports more in corn each year than the

next three biggest exporters combined. Thanks to these factors,

corn represents one of the best ways to play an American

agricultural boom both via surging emerging market exports and

increased usage on the home front as well.

For investors seeking to play this via ETFs, the

Teucrium Corn ETF (CORN) is one of the only ways

to target the potentially positive trend in this agricultural

commodity. CORN currently has about $60 million in assets and has

expenses of about 1.49% (read Top Commodity ETFs In This Uncertain

Market).

While this may seem somewhat high, investors should note that

the product doesn’t just roll into a new contract every month and

instead uses a more dynamic process in order to hopefully mitigate

contango. This includes holding the second-to-expire,

third-to-expire, and the next December contract that expires

(following the third-to-expire contract).

This approach, and more importantly, the sweltering heat across

much of the Midwest, has helped the fund perform quite well in

recent weeks. In fact, the product is now up 22% in the past month,

although it is more or less flat from a year-to-date look.

Natural Gas

Although the U.S. is just the second biggest producer of natural

gas—trailing Russia by just a bit—the product is generally a local

commodity that doesn’t really stretch across international borders.

This is generally due to the lack of cross-ocean pipelines and the

relative difficulty that comes from transporting a gas quickly and

efficiently across vast distances.

Due to this, pretty much all the natural gas that is produced in

the U.S. stays in America, making the products that are focused on

U.S. natural gas futures a great way to ‘buy American’.

Furthermore, even if new technologies open up the market to

transportation or exports, America could benefit from lower oil

imports or higher exports to natural gas starved markets in the

Asia-Pacific region or even Europe (read Have The Natural Gas ETFs

Finally Bottomed Out?).

For these investors, a look at products which hone in on futures

of natural gas that is delivered to the Henry Hub, Louisiana could

be the way to play the vital commodity with an American focus.

Currently, there are a number of options targeting the natural gas

market in ETF form, although none are as popular as the

United States Natural Gas Fund (UNG).

This ETF tracks Henry Hub Natural Gas Price Index, holding front

month futures for the important commodity. Fees come in at 98 basis

points a year while average daily volume is quite robust at 9.9

million shares a day (see Inside The Forgotten Energy ETFs).

The product has been decimated over the long term, losing a

substantial amount thanks to contango and extreme weakness in

natural gas prices. However, it appears as though natural gas may

have bottomed out, as UNG has actually gained 19% in the past three

month period.

Soybeans

The global soybean market is currently dominated by three

countries; the U.S., Brazil, and Argentina. Of these three, the

U.S. is the largest exporter, putting out just over half of the

world’s exports, followed by a 35% share for Brazil.

Currently, China is the destination for the vast majority of

these exports, helping push US exports of the product up by close

to 81% over the past 15 year period. Given the surging demand for

the crop and the limited supply of soybeans outside a few nations,

soybeans could continue to be a major growth market for the U.S.

for quite some time (read Top Commodity ETFs In This Uncertain

Market).

For investors looking to play this product in ETF form, there is

currently one option, the Teucrium Soybeans ETF

(SOYB). This relatively new fund hasn’t really caught on

with investors as of yet, as it just has $2.4 million in AUM and

trades less than 10,000 shares a day on average.

Part of this could be due to the relatively high fees as the ETF

charges investors 1.53% a year in expenses. However, another issue

could be the relatively unknown quantity that is soybeans, the

product doesn’t get the same amount of press as other more

well-known commodities in the agricultural space.

This is somewhat surprising as returns haven’t been too bad in

SOYB, as much like CORN, this fund spreads out exposure in order to

hopefully mitigate contango problems. Over the fund’s short

lifetime (it debuted in September of 2011), it has added about

1.5%, while it has gained about 11% in the past one month

period.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

TEUCRM-CORN FD (CORN): ETF Research Reports

TEUCRM-SOYBEAN (SOYB): ETF Research Reports

US-NATRL GAS FD (UNG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

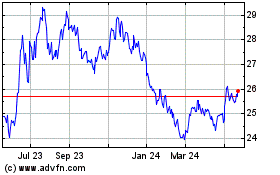

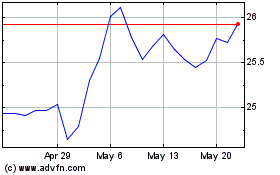

Teucrium Soybean (AMEX:SOYB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Teucrium Soybean (AMEX:SOYB)

Historical Stock Chart

From Feb 2024 to Feb 2025