2013 was a great year for the U.S. equity markets which returned

more than 30%. And with political deadlock averted and the U.S.

economy regaining momentum, the stock market will likely continue

its upward trend in 2014 as well (read: Best ETF Strategies for

2014).

This is especially true as activity is picking up faster in the

U.S. economy. The string of economic data such as increasing

manufacturing activity, rising exports, upbeat GDP growth,

narrowing trade deficit, declining unemployment rate, recovering

housing market and increasing consumer sentiment indicate strength

in the economy.

However, the recent job report confirmed that the U.S. added

fewer-than-expected jobs in December, marking the slowest job

growth rate in three years. This news has raised some concerns on

the continuation of Fed’s taper plans and it has taken a toll on

the surging stock market (read: 3 ETFs Surging on Weak Jobs

Data).

U.S. stocks have seen some sluggish trading to open up the year,

thanks in part the Fed, but also profit worries. Investors are

concerned since many companies lowered their estimates ahead of the

earnings announcement.

Despite this, several ETFs from various sectors/industries are

performing extremely well and are outpacing the broad market

indices. Let’s take a look to three top performing ETFs that could

be interesting picks for investors to play in the coming days.

These funds not only managed to stay in the green, but also

provided handsome returns YTD:

Biotech - SPDR S&P Biotech ETF

(XBI)

Being a high growth and high beta sector, biotech continued its

strong performance this year as well. This is largely thanks to

increasing merger & acquisition activities, new investment

havens in the untapped emerging markets, new drug approvals,

steadily rising global health care spending and the new Affordable

Care Act provisions.

XBI is the biggest winner in this space and by far the most popular

choice in the biotech corner of the healthcare segment. The fund

tracks the S&P Biotechnology Select Industry Index. The product

has roughly $1.1 million in AUM and trades about 314,000 in volume

a day, while its cost is just 35 basis points a year.

Holding 71 securities in its basket, the product is largely

concentrated in the top firm –

Intercept Pharmaceuticals

(ICPT) – with an 8.75%

allocation. Other securities do not account for more than 2.55% of

assets. About 60% of the fund’s holding goes to small cap

securities while mid caps take 30% share.

In terms of performance, the product generated 61% last year and

nearly 17% returns year-to-date. XBI has a Zacks ETF Rank of 1 or

’Strong Buy’ with a ‘High’ risk outlook (read: Intercept Pharma

(ICPT) Pushes SPDR Biotech ETF Ahead of Rivals).

Solar - Guggenheim Solar ETF

(TAN)

Solar is one of the best performing sectors in 2013 and continues

its bull run this year. Most of the gains in this corner of the

market stem from robust panel installations, a focus on high beta

and small cap stocks, and investors’ desire to add growing

companies to their portfolios.

Though both the solar ETFs generated double-digit returns so far in

the year, the

Guggenheim Solar ETF

(TAN) is up more than

11%. The fund has amassed $356.4 million in AUM and charges

investors 70 bps in fees per year. Volume is good as it exchanges

447,000 shares in hand on a daily basis (read: Are Solar ETFs in

Trouble?).

The product tracks the MAC Global Solar Energy Index, holding 31

stocks in its basket. The ETF is somewhat concentrated in its top

10 holdings with 54% of assets. Chinese firms dominate the fund’s

portfolio with nearly 37%, closely followed by U.S. (31.30%) and

Hong Kong (12.26%).

The product has a Zacks ETF Rank of 2 or ‘Buy’ rating, suggesting

that the product would outperform over the next one-year

period.

Mining - PureFunds ISE Junior Silver ETF

(SILJ)

Acting as a leveraged play on underlying metal prices, mining

stocks tend to experience more profits than their bullion cousins

in the rising metal market. Mining firms were under immense

pressure in 2013 on Fed tapering talks but rebounded nicely at the

start of 2014 as investors are again hunting for safe

investments.

Most of the mining stocks held up strongly of late, driving up many

ETFs in the space. A big winner here is SILJ which provides true

small cap play on the silver mining space. The fund has managed

assets worth $1.5 million and trades in paltry volume of less than

5,000 shares a day. The ETF charges 69 bps in annual fees.

The product tracks the ISE Junior Silver Small Cap Miners/Explorers

Index. In total, the fund holds about 26 companies with the largest

allocation going to the top three firms – Fortuna Silver Mines

(FSM), Endeavour Silver (EXK) and Silvercorp Metal (SVM) – which

make up for nearly 12% each (see: all the materials ETFs here).

In terms of country exposure, Canadian firms dominate the fund at

76% of the total, while U.S. securities make up for 20% share. SILJ

was down 52% last year but added about 8% in the year-to-date time

frame.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

INTERCEPT PHARM (ICPT): Free Stock Analysis Report

PF ISE-JS SC ME (SILJ): ETF Research Reports

GUGG-SOLAR (TAN): ETF Research Reports

SPDR-SP BIOTECH (XBI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

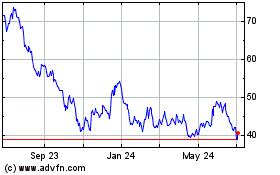

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

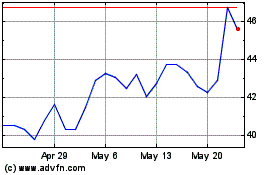

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Jan 2024 to Jan 2025