Tompkins Financial Corporation (NYSE Amex: TMP)

Tompkins Financial Corporation reported record first quarter net

income of $8.8 million for the first quarter of 2011, an increase

of 4.2% from the $8.4 million reported for the same period in 2010.

Diluted earnings per share were $0.80 for the first quarter of

2011, a 2.6% increase from the $0.78 reported for the first quarter

of 2010.

President and CEO Stephen S. Romaine commented, “We are very

pleased to report that first quarter earnings represented the best

first quarter in our Company’s history. Results for the quarter

benefited from our diversified revenue stream, as growth in wealth

management fees, insurance commission, and card services fees

helped offset a decline in net interest income.”

Selected highlights for the first quarter of 2011 are included

below:

- Capital levels showed continued growth

during the quarter and ratios remain well above the regulatory well

capitalized minimums. Tier I capital as a percentage of average

assets was 8.22%; and the ratio of total capital to risk-weighted

assets of 13.66%. These ratios are up from 8.02% and 13.42%,

respectively at December 31, 2010.

- Total loans were $1.9 billion at March

31, 2011, up $27.3 million or 1.5% from March 31, 2010.

- The level of nonperforming assets

declined for the second consecutive quarter, although nonperforming

assets levels remain above the totals reported at March 31, 2010.

The ratio of nonperforming assets to total assets of 1.40% at March

31, 2011, continues to be well below the most recent peer averages

published by the Federal Reserve and we were continuing to receive

regular payments on approximately 69% of loan balances that we

categorize as nonperforming.

- Total deposits were $2.6 billion at

quarter end, up 4.0% from the same period in 2010.

Noninterest-bearing deposits totaled $520.6 million at March 31,

2011, an increase of 18.6% over the first quarter of 2010.

- Other borrowings of $140.4 million at

March 31, 2011 were down 26.3% from March 31, 2010, as deposit

growth was used to pay down overnight borrowings with the

FHLB.

- The net interest margin for the first

quarter of 2011 was 3.78% compared to 3.95% for the first quarter

of 2010. Despite the decline in net interest margin, net interest

income of $27.5 million for the first quarter of 2011 was down less

than 1.5% when compared to the same quarter last year due to growth

in earning assets (primarily in the securities portfolio).

- Noninterest income was $12.5 million

for the quarter, up 10.4% from the same period prior year. Fee

income from investment services, insurance, and card services were

all up for the quarter, while service charges on deposit accounts

declined. Other income in the first quarter of 2011 included a

$504,000 gain related to an investment in a Small Business

Investment Company.

- Noninterest expense was $25.2 million

for the quarter, up 2.9% from the first quarter of 2010. The

increase was mainly centered in salaries and employee

benefits.

- The provision for loan and lease losses

was $1.9 million in the first quarter of 2011, compared to $2.2

million in the first quarter of 2010. Net charge-offs for the

quarter of $1.7 million are up over the $1.2 million recorded for

the same quarter last year, yet remain well below the most recent

peer averages published by the Federal Reserve.

- The Company’s allowance for loan and

lease losses totaled $28.0 million at March 31, 2011, which

represented 1.46% of total loans, compared to $27.8 million and

1.46% at December 31, 2010 and $25.4 million and 1.34% at March 31,

2010. The allowance for loan and lease losses, as a percentage of

nonperforming loans improved during the most recent quarter to

64.33% from 61.46% in December 2010.

Mr. Romaine added, “Although the business and regulatory

climates remain challenging, we are encouraged by these first

quarter results that showed growth in earnings, revenue, and

capital over the same period last year. As we celebrate our

Company’s 175th anniversary in 2011, we remain more committed than

ever to our strategy of long term sustainable growth that has

served us so well during the most recent, and many previous,

economic downturns.”

Tompkins Financial Corporation operates 45 banking offices in

the New York State markets served by the Company's three community

banks - Tompkins Trust Company, The Bank of Castile, and Mahopac

National Bank, insurance through Tompkins Insurance Agencies, Inc.

and wealth management through Tompkins Financial Advisors.

"Safe Harbor" Statement under the Private Securities Litigation

Reform of 1995:

This press release may include forward-looking statements with

respect to revenue sources, growth, market risk, and corporate

objectives. The Company assumes no duty, and specifically disclaims

any obligation, to update forward-looking statements, and cautions

that these statements are subject to numerous assumptions, risks,

and uncertainties, all of which could change over time. Actual

results could differ materially from forward-looking

statements.

_______________________________________________________________________________

1 Federal Reserve peer ratio as of December 31, 2010, includes

banks and bank holding companies with consolidated assets between

$3 billion and $10 billion.

TOMPKINS FINANCIAL CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF CONDITION (In thousands,

except share and per share data) (Unaudited)

As of As

of ASSETS 03/31/2011 12/31/2010

Cash and noninterest bearing balances due from banks $ 40,009

$

47,339 Interest bearing balances due from banks 7,605 2,226 Federal

funds sold 17,400 0 Money market funds 100

100

Cash and Cash Equivalents

65,114 49,665 Trading securities, at fair

value 21,831 22,837 Available-for-sale securities, at fair value

1,049,504 1,039,608 Held-to-maturity securities, fair value of

$51,258 at March 31, 2011, and $56,064 at December 31, 2010 50,108

54,973 Loans and leases, net of unearned income and deferred costs

and fees 1,914,344 1,910,358 Less: Allowance for loan and lease

losses 28,035 27,832

Net Loans and Leases 1,886,309 1,882,526

Federal Home Loan Bank stock and Federal Reserve Bank stock

17,575 21,985 Bank premises and equipment, net 44,867 46,103

Corporate owned life insurance 41,935 40,024 Goodwill 41,649 41,649

Other intangible assets, net 4,039 4,207 Accrued interest and other

assets 55,963 56,766

Total Assets $ 3,278,894

$

3,260,343 LIABILITIES Deposits:

Interest bearing: Checking, savings and money market 1,348,182

1,230,815 Time 743,720 741,829 Noninterest bearing

520,615 523,229

Total Deposits

2,612,517 2,495,873 Federal funds purchased

and securities sold under agreements to repurchase 182,009 183,609

Other borrowings, including certain amounts at fair value of

$11,454 at March 31, 2011 and $11,629 at December 31, 2010 140,353

244,193 Trust preferred debentures 25,061 25,060 Other liabilities

36,717 38,200

Total

Liabilities $ 2,996,657

$ 2,986,935 EQUITY Tompkins

Financial Corporation shareholders' equity: Common Stock - par

value $.10 per share: Authorized 25,000,000 shares; Issued:

10,988,320 at March 31, 2011; and 10,934,385 at December 31, 2010

1,099 1,093 Additional paid-in capital 200,444 198,114 Retained

earnings 81,513 76,446 Accumulated other comprehensive income

(loss) 19 (1,260 ) Treasury stock, at cost – 88,400 shares at March

31, 2011, and 92,025 shares at December 31, 2010 (2,323 ) (2,437 )

Total Tompkins Financial Corporation Shareholders’

Equity 280,752 271,956 Noncontrolling interests

1,485 1,452

Total

Equity $ 282,237 $

273,408 Total Liabilities and Equity

$ 3,278,894 $ 3,260,343

TOMPKINS FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME Three Months

Ended (In thousands, except per share data) (Unaudited)

03/31/2011 03/31/2010 INTEREST AND DIVIDEND

INCOME Loans $ 25,701 $ 26,618 Due from banks 6 12 Federal

funds sold 3 4 Trading securities 235 309 Available-for-sale

securities 7,687 9,000 Held-to-maturity securities 365 407 Federal

Home Loan Bank stock and Federal Reserve Bank stock

290 284

Total Interest and Dividend

Income 34,287

36,634 INTEREST EXPENSE Time certificates of

deposits of $100,000 or more 849 1,178 Other deposits 2,625 3,827

Federal funds purchased and repurchase agreements 1,291 1,425 Trust

preferred debentures 405 367 Other borrowings 1,575

1,893

Total Interest Expense

6,745 8,690

Net Interest Income 27,542

27,944 Less: Provision for loan/lease

losses 1,910 2,183

Net

Interest Income After Provision for Loan/Lease Losses

25,632 25,761

NONINTEREST INCOME Investment services income 3,841 3,738

Insurance commissions and fees 3,374 3,166 Service charges on

deposit accounts 1,984 2,057 Card services income 1,245 975

Mark-to-market (loss) gain on trading securities (50 ) 90

Mark-to-market gain (loss) on liabilities held at fair value 174

(128 ) Other income 1,829 1,304 Net gain on securities transactions

95 118

Total

Noninterest Income 12,492

11,320 NONINTEREST EXPENSES Salaries

and wages 10,825 10,339 Pension and other employee benefits 4,031

3,911 Net occupancy expense of premises 1,894 1,881 Furniture and

fixture expense 1,038 1,183 FDIC insurance 1,050 911 Amortization

of intangible assets 170 202 Other operating expense

6,208 6,067

Total Noninterest

Expenses 25,216

24,494 Income Before Income Tax Expense

12,908 12,587

Income Tax Expense 4,102

4,138

Net Income attributable to Noncontrolling Interests

and Tompkins Financial Corporation 8,806

8,449 Less: Net income

attributable to noncontrolling interests 33

33

Net Income Attributable to Tompkins

Financial Corporation $ 8,773

$ 8,416 Basic Earnings Per Share

$ 0.80 $ 0.78 Diluted Earnings Per

Share $ 0.80 $

0.78

Average Consolidated Balance Sheet and Net Interest Analysis

Year to Date Period Ended Year to Date Period Ended

March 31, 2011 March

31, 2010 Average Average Balance Average Balance Average

(Dollar amounts in thousands) (YTD)

Interest Yield/Rate (YTD)

Interest Yield/Rate

ASSETS Interest-earning assets

Interest-bearing balances due from banks $ 16,151 $ 6 0.15 % $

37,885 $ 12 0.13 % Money market funds 100 - 0.00 % 100 - 0.00 %

Securities (1) U.S. Government securities 928,576 6,988 3.05 %

827,808 8,219 4.03 % Trading securities 22,542 235 4.23 % 31,279

309 4.01 % State and municipal (2) 112,328 1,447 5.22 % 105,139

1,573 6.07 % Other securities (2) 15,237 180

4.79 % 18,563 224

4.89 % Total securities 1,078,683 8,850 3.33 % 982,789

10,325 4.26 % Federal Funds Sold 8,767 3 0.14 % 9,080 4 0.18 %

FHLBNY and FRB stock 18,923 290 6.21 % 19,633 284 5.87 % Loans, net

of unearned income (3) Real estate 1,368,589 18,429 5.46 %

1,327,849 18,840 5.75 % Commercial loans (2) 456,691 6,022 5.35 %

472,900 6,260 5.37 % Consumer loans 72,532 1,254 7.01 % 84,083

1,460 7.04 % Direct lease financing 8,752 131

6.07 % 11,634 176

6.14 % Total loans, net of unearned income 1,906,564

25,836 5.50 % 1,896,466

26,736 5.72 %

Total interest-earning

assets 3,029,188 34,985

4.68 % 2,945,953

37,361 5.14 %

Other assets 223,379 227,111

Total assets

3,252,567 3,173,064

LIABILITIES & EQUITY

Deposits Interest-bearing deposits Interest bearing checking,

savings, & money market 1,309,121 1,171 0.36 % 1,229,168 1,790

0.59 % Time deposits > $100,000 309,746 849 1.11 % 335,260 1,178

1.42 % Time deposits < $100,000 424,028 1,434 1.37 % 429,464

1,873 1.77 % Brokered time deposits < $100,000 6,074

20 1.34 % 37,242

164 1.79 % Total interest-bearing deposits

2,048,969 3,474 0.69 % 2,031,134 5,005 1.00 % Federal funds

purchased & securities sold under agreements to repurchase

185,456 1,291 2.82 % 187,753 1,425 3.08 % Other borrowings 171,659

1,575 3.72 % 199,202 1,893 3.85 % Trust preferred debentures

25,061 405 6.55 % 25,056

367 5.94 %

Total interest-bearing

liabilities 2,431,145 6,745 1.13 %

2,443,145 8,690 1.44 %

Noninterest bearing deposits 507,673 440,113 Accrued expenses and

other liabilities 36,466 40,220

Total liabilities 2,975,284

2,923,478 Tompkins Financial Corporation Shareholders’

equity 275,814 248,119 Noncontrolling interest 1,469 1,467

Total

equity 277,283 249,586 Total

liabilities and equity $ 3,252,567 $

3,173,064 Interest rate spread

3.55

% 3.70 % Net interest

income/margin on earning assets

28,240 3.78 %

28,671 3.95 % Tax Equivalent Adjustment

(698 ) (727 ) Net interest

income per consolidated financial statements

$ 27,542

$ 27,944 (1)

Average balances and yields on available-for-sale securities are

based on historical amortized cost. (2) Interest income includes

the tax effects of taxable-equivalent adjustments using a combined

New York State and Federal effective income tax rate of 40% to

increase tax exempt interest income to taxable-equivalent basis.

(3) Nonaccrual loans are included in the average asset totals

presented above. Payments received on nonaccrual loans have been

recognized as disclosed in Note 1 of the

Company’s condensed consolidated financial statements included in

Part I of the

Company's annual report on Form 10-K for

the fiscal year ended December 31, 2010.

Tompkins Financial

Corporation - Summary Financial Data (Unaudited)

(In thousands, except per

share data

Quarter-Ended Year-Ended

Mar-11 Dec-10 Sep-10

Jun-10 Mar-10 Dec-10

Period End Balance Sheet

Securities $ 1,121,443 $

1,117,418 $ 1,053,038 $ 1,023,220 $ 1,026,301

$ 1,117,418 Loans and leases, net of unearned income and

deferred costs and fees 1,914,344

1,910,358 1,914,064 1,900,303

1,887,038 1,910,358 Allowance for loan and

lease losses 28,035 27,832

28,684 26,530 25,366

27,832 Total assets 3,278,894

3,260,343 3,247,111 3,161,648

3,206,763 3,260,343

Total deposits

2,612,517 2,495,873

2,528,528 2,460,223 2,512,201

2,495,873 Federal funds purchased and securities sold under

agreements to repurchase 182,009

183,609 191,596 175,336

181,255 183,609 Other borrowings

140,353 244,193 182,779

189,561 190,545 244,193 Trust preferred

debentures 25,061 25,060

25,059 25,058 25,057

25,060 Shareholders' equity 282,237

273,408 276,495 268,683

254,444 273,408

Average Balance Sheet

Average earning assets $ 3,029,188 $ 3,010,361

$ 2,937,795 $ 2,953,673 $ 2,945,953 $

2,962,056 Average assets 3,252,567

3,243,822 3,168,478 3,181,476

3,173,064 3,191,840 Average interest-bearing

liabilities 2,431,145 2,424,998

2,372,630 2,424,245 2,443,145

2,416,085 Average equity 277,283

280,051 273,517 260,197

249,586 265,943

Share data

Weighted average shares outstanding (basic)

10,905,197 10,888,138 10,845,106

10,818,218 10,724,644 10,812,502

Weighted average shares outstanding (diluted)

10,955,430 10,936,042 10,893,642

10,876,421 10,776,934 10,864,450

Period-end shares outstanding 10,953,410

10,898,475 10,878,813 10,830,001

10,793,573 10,898,475 Book value per

share 25.77 25.09 25.42

24.81 23.57 25.09

Income Statement

Net interest income $ 27,542 $

27,861 $ 27,864 $ 28,106 $ 27,944 $

111,775 Provision for loan/lease losses 1,910

1,433 3,483 1,408

2,183 8,507 Noninterest income 12,492

12,281 11,227 11,331

11,320 46,159 Noninterest expense

25,216 25,183 24,852

24,516 24,494 99,045

Income tax expense 4,102 4,602

3,233 4,447 4,138

16,420 Net income attributable to Tompkins Financial Corporation

8,773 8,892 7,490

9,033 8,416 33,831

Noncontrolling interests 33 32

33 33 33 131 Basic

earnings per share $ 0.80 $ 0.82 $ 0.69

$ 0.84 $ 0.78 $ 3.13 Diluted earnings per share

$ 0.80 $ 0.81 $ 0.69 $ 0.83 $

0.78 $ 3.11

Asset Quality

Net charge-offs

1,707 2,285 1,329

244 1,167 5,025 Nonaccrual loans and

leases 39,902 41,501

48,966 33,645 29,521

41,501 Loans and leases 90 days past due and accruing

1,266 1,217 1,737 1,758

51 1,217 Troubled debt restructurings

not included above 2,411 2,564

3,264 3,264 3,703

2,564 Total nonperforming loans and leases 43,579

45,282 53,967 38,667

33,275 45,282 OREO 2,270

1,255 1,845 1,638

558 1,255 Nonperforming assets

45,849 46,537 55,812

40,305 33,833 46,537

RATIO

ANALYSIS Quarter-Ended Year-Ended

Credit Quality Mar-11 Dec-10

Sep-10 Jun-10 Mar-10

Dec-10 Net loan and lease losses/ average loans

and

leases * 0.36% 0.48%

0.28% 0.05% 0.25% 0.26%

Nonperforming loans and leases/loans and leases 2.28%

2.37% 2.82% 2.03%

1.76% 2.37% Nonperforming assets/assets

1.40% 1.43% 1.72%

1.27% 1.06% 1.43%

Allowance/nonperforming loans and leases 64.33%

61.46% 53.15% 68.61%

76.23% 61.46% Allowance/loans and

leases 1.46% 1.46% 1.50%

1.40% 1.34% 1.46%

Capital Adequacy (period-end)

Tier I capital / average assets

8.22% 8.02% 8.01%

7.77% 7.56% 8.02% Total capital

/ risk-weighted assets 13.66% 13.42%

13.14% 13.10% 12.56%

13.42%

Profitability

Return on average

assets * 1.09% 1.09%

0.94% 1.14% 1.08% 1.06%

Return on average equity * 12.83%

12.60% 10.86% 13.92%

13.68% 12.72% Net interest margin (TE) *

3.78% 3.75% 3.85%

3.91% 3.95% 3.86% * Quarterly ratios

have been annualized

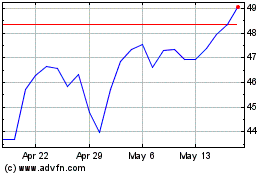

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

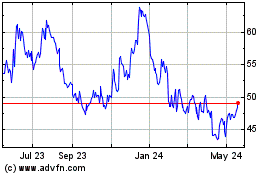

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Jul 2023 to Jul 2024