Form 8-K - Current report

05 October 2024 - 7:02AM

Edgar (US Regulatory)

false

0001334933

0001334933

2024-10-01

2024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 1, 2024

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

500 North Shoreline, Ste. 800,

Corpus Christi, Texas, U.S.A.

|

78401

|

|

(U.S. corporate headquarters)

|

(Zip Code)

|

|

1830 – 1188 West Georgia Street

Vancouver, British Columbia, Canada

|

V6E 4A2

|

|

(Canadian corporate headquarters)

|

(Zip Code)

|

(Address of principal executive offices)

(361) 888-8235

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 – Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As set forth in Uranium Energy Corp.’s (the “Company”) news release dated August 9, 2024, effective October 1, 2024, Pat Obara stepped down as the Chief Financial Officer, Secretary and Treasurer of the Company, which allowed the Board of Directors of the Company (the “Board”) to appoint Josephine Man as the Chief Financial Officer, Secretary and Treasurer of the Company. In addition, at the same time the Board appointed Mr. Obara as the Senior Vice-President, Administration of the Company.

Josephine Man (age 50) has served as Chief Financial Officer of Uranium Royalty Corp., a public company listed on the TSX and NASDAQ (TSX: URC, NASDAQ: UROY) since August 2018. Previously, from July 2020 to December 2022, she was Chief Financial Officer of Gold Royalty Corp. (NYSE American: GROY), a precious metals-focused royalty and streaming company, where she was central to its initial public offering and the acquisition of three Canadian listed companies, amongst other achievements. Ms. Man has over 28 years of experience as a finance professional and was previously a partner with Ernst & Young LLP. Ms. Man holds a Bachelor of Business Administration from Simon Fraser University and a Master of Business Administration from the University of British Columbia.

Pat Obara (age 68) has served as the Chief Financial Officer, Secretary and Treasurer of the Company from October 2015 to October 1, 2024, served as the Chief Financial Officer of the Company from August 2006 to January 2011, served as the Vice-President Administration of the Company from January 2011 to October 2015, and now serves as the Senior Vice-President, Administration. Mr. Obara currently serves as the Chief Financial Officer and Secretary of GoldMining Inc., a public company listed on the TSX and NYSE American, and served as a director of GoldMining Inc. from September 2009 to May 2018. Mr. Obara holds a degree in Building Technology, Land and Construction Economics from the British Columbia Institute of Technology.

In connection with Ms. Man’s appointment, the Company and Ms. Man entered into an executive employment services agreement with an initial term commencing on October 1, 2024 and expiring on October 1, 2026 (the “Term” and, collectively, the “Man Agreement”).

The Man Agreement Term is subject to automatic renewal on a 90-day to 90-day renewal basis unless either the Company or Ms. Man provides written notice not to renew the Man Agreement no later than 90 days prior to the end of the then current or renewal Term.

Pursuant to the terms and provisions of the Man Agreement: (i) Ms. Man provides various employment services to the Company which are inclusive of her duties and responsibilities commensurate with her position as our Company’s Chief Financial Officer, Treasurer and Secretary; and (ii) Ms. Man is entitled to: (a) a gross monthly salary of $16,666.67 (the “Monthly Fee”) representing $200,000 on a yearly basis (the “Annual Fee”); (b) a yearly cash bonus (each, a “Bonus”) of up to 50% of her then Annual Fee based upon certain performance goals to be determined from year to year; (c) a short-term incentive payment (each, a “STIP Bonus”) from 0% to up to 50% of her then Annual Fee based upon certain factors to be determined by the Board and the Company’s Compensation Committee from time to time; (d) an initial vesting incentive stock option to purchase up to an aggregate of $100,000 in common shares of the Company and vesting over a period of 24 months from the date of grant (which has now been awarded); (e) an initial vesting restricted stock unit award (the “RSU”) to acquire up to an aggregate of $100,000 in gross value RSU common shares of the Company and vesting equally over a period of three years from the date of grant (which has now been awarded); (f) a long-term incentive payment (each, an “LTIP Bonus”) from 0% to up to 50% of her then Annual Fee based upon certain factors to be determined by the Board and the Compensation Committee from time to time; (g) participation in all Company employee benefit and health insurance plans (each, a “Benefit”) at the Company’s cost; and (h) four weeks of accrued vacation per calendar year (the “Vacation”).

If the Company elects to not renew the Man Agreement, and provided that Ms. Man is in compliance with the relevant terms and conditions of the Man Agreement, the Company shall be obligated to provide a termination package to Ms. Man as follows: (i) a cash payment equating to any outstanding Monthly Fee, Vacation pay and annual performance Bonus, STIP Bonus and LTIP Bonus entitlements (if any and calculated pro rata up to the effective termination date) earned by Ms. Man to the effective termination date (collectively, the “Outstanding Amounts”); (ii) a cash payment equal to any Monthly Fee that would be due and owing to the end of, respectively, the then Term or renewal period of the Man Agreement (the “Termination Amount”); (iii) confirmation that all of Ms. Man’s then Benefits coverage would be extended for a period ending three months from the effective termination date (the “Benefits Extension”); and (iv) subject to the applicable provisions of the Man Agreement and the Company’s then Stock Incentive Plan, Ms. Man shall be entitled to then exercise any unexercised and the fully vested portion of any stock options for a period of three months from the effective date of termination (the “Initial Options Extension”).

If the Company elects to terminate the Man Agreement without just cause (as defined therein), or if Ms. Man terminates the Man Agreement for just cause or for good reason as a result of a change of control (each as also defined therein), and provided that Ms. Man is in compliance with the relevant terms and conditions of the same, the Company shall be obligated to provide a termination package to Ms. Man as follows: (i) a cash payment equal to all Outstanding Amounts to the effective termination date; (ii) a cash payment equal to the Termination Amount to the effective date of termination; (iii) confirmation of the Benefits Extension; and (iv) subject to the applicable provisions of the Man Agreement and the Company’s then Stock Incentive Plan, Ms. Man shall be entitled to then exercise any unexercised and the fully vested portion of any stock options for a period of one year from the effective date of termination.

If Ms. Man elects to terminate the Man Agreement, except for just cause, and provided that Ms. Man is in compliance with the relevant terms and conditions of the Man Agreement, or if the Company elects to termination the Man Agreement for just cause, then the Company shall only be obligated to provide Ms. Man a cash payment equal to all Outstanding Amounts to the effective termination date.

The Man Agreement will be deemed terminated on the 30th calendar day following the death or disability of Ms. Man, in which case the Company shall be obligated to provide a termination package to Ms. Man, or Ms. Man’s estate as the case may be, as follows, provided that Ms. Man is or was in compliance with the relevant terms and conditions of the Man Agreement: (i) a cash payment equal to all Outstanding Amounts to the effective termination date; (ii) if disabled only, confirmation of the Benefits Extension; and (iii) subject to the applicable provisions of the Man Agreement and the Company’s Stock Incentive Plan, Ms. Man, or Ms. Man’s estate as the case may be, shall be entitled to then exercise any unexercised and the fully vested portion of any stock options for a period of one year from the effective termination date.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit

|

|

Description

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DATE: October 4, 2024. |

URANIUM ENERGY CORP. |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Josephine Man

|

|

|

|

|

Josephine Man, Chief Financial |

|

|

|

|

Officer, Treasurer and Secretary |

|

v3.24.3

Document And Entity Information

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

URANIUM ENERGY CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 01, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-33706

|

| Entity, Tax Identification Number |

98-0399476

|

| Entity, Address, Address Line One |

500 North Shoreline

|

| Entity, Address, Address Line Two |

Ste. 800

|

| Entity, Address, City or Town |

Corpus Christi

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78401

|

| City Area Code |

361

|

| Local Phone Number |

888-8235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

UEC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001334933

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

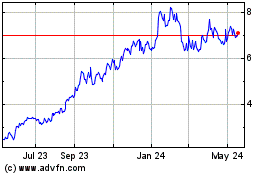

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

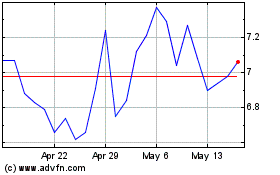

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Dec 2023 to Dec 2024