cbdMD, Inc. (NYSE American: YCBD, YCBDpA), one of the nation’s

leading and most highly trusted and recognized CBD companies, and

operator of three of the leading CBD brands -- its flagship brand

cbdMD, its animal health brand Paw CBD and its beauty and skincare

brand cbdMD Botanicals, -- today announced its financial results

for the fourth quarter and fiscal year ended September 30,

2021.

“Next week is the three-year anniversary of our company entering

the CBD industry with the acquisition of Cure Based Development,

the owner of our flagship brand, cbdMD. It’s also the three-year

anniversary of the passage of the Farm Bill, which de-criminalized

CBD in the US. In three short years we have grown from an unknown

start-up brand competing against thousands of other CBD brands,

outpacing the pack to firmly positioned at the top of CBD industry,

with our three leading brands,” said Chairman and co-CEO, Martin A.

Sumichrast.

“According to the Brightfield Group, the US CBD market

experienced its most challenging year in 2021, with year-over-year

growth rates expected to be nearly flat at 2.5%. Despite this

anemic industry growth, cbdMD was able to outpace the industry

average and record fiscal 2021 net sales of over 6% and gross sales

of over 10% as compared to fiscal 2020. We were able to maintain

our product pricing and firm up our product purchasing which

resulted in an increase to our gross profit margin to a record high

of 67% in fiscal 2021, from 63% in 2020. While our fiscal 2021 loss

from operations was $19.6 million, we were able to reduce our

non-GAAP adjusted operating loss by 6%. However, slower than

anticipated sales in the second half of our fiscal year, our

increased marketing costs in the first half of the fiscal year,

(which have now been reduced), coupled with our investment into our

therapeutics division, resulted in a GAAP operating loss for the

fiscal 2021. While we are now seeing an increase in consumer demand

as we enter our fiscal 2022 year and are optimistic that calendar

2022 will return to higher sales growth rates as our new products

reach our customers and new distribution channels become available,

we are withdrawing our previously announced sales guidance for the

current quarter ending December 31, 2021. With that said, looking

forward, our goal is to continue to outpace the overall industry

growth, increase our market share, and achieve positive adjusted

EBITDA. For more information about how we intend to achieve these

goals, please listen to our earnings call this afternoon,” said Mr.

Sumichrast.

Financial Highlights for Fiscal

2021:

Net sales increased by 6% year-over-year to a record of $44.5

million in fiscal 2021, from $41.8 million in fiscal 2020.

Our gross profit margin increased to 67% in fiscal 2021 from 63%

in fiscal 2020. Our non-GAAP adjusted gross margin totaled 19.6%

for fiscal 2021, as compared to 67.7% for fiscal 2020.

Our loss from operations was $19.6 million in fiscal 2021 as

compared to a loss of $17.5 million in fiscal 2020 mostly because

of increased in advertising spend and investing in cbdMD

Therapeutics.

Our non-GAAP adjusted loss from operations in fiscal 2021 was

approximately $13.6. million, compared to our non-GAAP adjusted

loss from operations in fiscal 2020 of approximately $11.5

million.

Net loss attributable to common shareholders for fiscal 2021 was

approximately $25.9 million, or $0.41 per share, as compared to a

net income for fiscal 2020 of approximately $12.2 million, or $0.28

per share. The decrease in fiscal 2021 was principally attributable

to an increase of approximately $6.7 million in the non-cash

contingent liability which is associated with earnout shares which

may be issued under the terms of the December 2018 acquisition of

Cure Based Development (which owned the cbdMD brand).

At September 30, 2021, we had working capital of approximately

$29.6 million and cash on hand of approximately $26.4 million as

compared to working capital of approximately $16.0 million and cash

on hand of approximately $14.8 million at September 30, 2020.

We reported record e-commerce, direct to consumer (DTC) net

sales of $32.9 million, or 74.2% of total net sales in fiscal 2021,

an increase of $2.5 million, or 8% increase from fiscal 2020.

Our CBD pet brand, Paw CBD, reported $5.7 million in net sales,

a 27% increase in fiscal 2021, as compared to $4.5 million in

fiscal 2020.

For the Quarter Ended September 30,

2021:

Our net sales for the fourth quarter of fiscal 2021 decreased by

16% year-over-year to $9.8 million from $11.7 million in the fourth

quarter of fiscal 2020.

Our gross profit margin for the quarter increase to 58.6% in the

fourth quarter of fiscal 2021 from 54.4% in the fourth quarter of

fiscal 2020.

Our loss from operations was approximately $7.0 million compared

to $4.5 million from the prior year’s quarter.

Our non-GAAP adjusted operating loss was approximately $4.8

million, compared to a $1.2 million non-GAAP adjusted operating

loss from the prior year’s quarter.

We reported fourth quarter fiscal 2021 e-commerce, direct to

consumer (DTC) net sales of $7.2 million, a 15% decrease from $8.6

million in the fourth quarter of fiscal 2020.

Our pet brand, Paw CBD, reported approximately $1.2 million in

net sales in the fourth quarter of fiscal 2021, a decrease of 25%

compared to $1.6 million from the prior year’s quarter.

cbdMD, Inc. will host a conference call at 4:15 p.m., Eastern

Time, on Friday, December 17, 2021, to discuss the company’s

September 30, 2021, fourth quarter and fiscal year-end financial

results and business progress.

CONFERENCE CALL DETAILS

Friday, December 17, 2021, 4:15 p.m.

Eastern Time

Domestic:

1-888-506-0062

International:

1-973-528-0011

Teleconference Replay dial in –

Available through Saturday, January 15, 2022

Domestic:

1-877-481-4010

International:

1-919-882-2331

Replay Passcode:

43904

Webcast Link/Webcast Replay link-

available through Friday, December 17, 2022:

https://www.webcaster4.com/Webcast/Page/2206/43904

About cbdMD, Inc.

cbdMD, Inc. is one of the leading and most highly trusted and

most recognized cannabidiol (CBD) brands with a comprehensive line

of U.S. produced, THC-free1 CBD products as well as our new Full

Spectrum products. Our cbdMD brand currently includes over 130 SKUs

of high-grade, premium CBD products including CBD tinctures, CBD

gummies, CBD topicals, CBD capsules, CBD bath bombs, CBD bath

salts, CBD sleep aids and CBD drink mixes. Our Paw CBD brand of pet

products includes over 45 SKUs of veterinarian-formulated products

including tinctures, chews, topicals products in varying strengths,

and our CBD Botanicals brand of beauty and skincare products

features 15 SKUs, including facial oil and serum, toners,

moisturizers, clear skin, facial masks, exfoliants and body care.

To learn more about cbdMD and their comprehensive line of U.S.

grown, THC-free1 CBD oil products, please visit www.cbdmd.com,

follow cbdMD on Instagram and Facebook, or visit one of the 6,000

retail outlets that carry cbdMD products.

Forward-Looking Statements

This press release contains certain forward-looking statements

that are based upon current expectations and involve certain risks

and uncertainties within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements can

be identified using words such as ''should,'' ''may,'' ''intends,''

''anticipates,'' ''believes,'' ''estimates,'' ''projects,''

''forecasts,'' ''expects,'' ''plans,'' and ''proposes.'' These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties, and other factors, some of

which are beyond our control and difficult to predict. You are

urged to carefully review and consider any cautionary statements

and other disclosures, including the statements made under the

heading "Risk Factors" in cbdMD, Inc.'s Annual Report on Form 10-K

for the fiscal year ended September 30, 2021 as filed with the

Securities and Exchange Commission (the "SEC") on December 16, 2021

and our other filings with the SEC. All forward-looking statements

involve significant risks and uncertainties that could cause actual

results to differ materially from those in the forward-looking

statements, many of which are generally outside the control of

cbdMD, Inc. and are difficult to predict. cbdMD, Inc. does not

undertake any duty to update any forward-looking statements except

as may be required by law. The information which appears on our

websites and our social media platforms, including, but not limited

to, Instagram and Facebook, is not part of this press release.

1 THC-free is defined as below the level of detection using

validated scientific analytical methods.

Non-GAAP Financial Measures

This press release includes a financial measure that excludes

the impact of certain items and therefore has not been calculated

in accordance with U.S. generally accepted accounting principles

("GAAP"). cbdMD, Inc. has included adjusted loss from operations

because management uses this measure to assess operating

performance in order to highlight trends in our business that may

not otherwise be apparent when relying on financial measures

calculated in accordance with GAAP. The adjusted operating loss has

not been prepared in accordance with GAAP. This non-GAAP financial

measure should not be considered as an alternative to, or more

meaningful than, net loss from operations as an indicator of our

operating performance. Further, this non-GAAP financial measure, as

presented by cbdMD, Inc., may not be comparable to similarly titled

measures reported by other companies. cbdMD, Inc. has attached to

this press release a reconciliation of this non-GAAP financial

measure to its most directly comparable GAAP financial measure.

cbdMD, INC. CONSOLIDATED BALANCE SHEETS SEPTEMBER

30, 2021 AND SEPTEMBER 30, 2020

September 30,

September 30,

2021

2020

Assets Current assets: Cash and cash equivalents

$

26,411,424

$

14,824,644

Accounts receivable

1,113,372

911,482

Accounts receivable – discontinued operations

10,967

447,134

Marketable securities

33,351

26,472

Investment other securities

1,000,000

250,000

Inventory

5,021,867

4,603,360

Inventory prepaid

551,519

288,178

Prepaid software

-

174,308

Prepaid sponsorship

1,212,682

1,203,300

Prepaid expenses and other current assets

1,147,178

983,374

Total current assets

36,502,360

23,712,252

Other assets: Property and equipment, net

2,561,574

3,183,487

Operating lease assets

5,614,960

6,851,357

Deposits for facilities

529,583

790,708

Intangible assets, net

23,003,929

21,635,000

Goodwill

56,670,970

54,669,997

Total other assets

88,381,016

87,130,549

Total assets

$

124,883,376

$

110,842,801

CONSOLIDATED BALANCE SHEETS SEPTEMBER 30, 2021 AND

SEPTEMBER 30, 2020 (continued)

September 30,

September 30,

2021

2020

Liabilities and shareholders' equity Current

liabilities: Accounts payable

$

2,978,914

$

2,850,421

Deferred revenue

2,727,612

-

Accrued expenses

1,151,150

2,769,920

Operating leases – current portion

-

1,159,098

Paycheck Protection Program loan, current portion

854,000

Note payable

59,470

55,639

Total current liabilities

6,917,146

7,689,078

Long term liabilities: Long term liabilities

108,985

264,367

Paycheck Protection Program loan

-

602,100

Operating leases - long term portion

4,859,058

6,010,208

Contingent liability

9,856,000

16,200,000

Deferred tax liability

-

895,000

Total long term liabilities

14,824,043

23,971,675

Total liabilities

21,741,189

31,660,753

cbdMD, Inc. shareholders' equity: Preferred stock,

authorized 50,000,000 shares, $0.001 par value, 5,000,000 and

500,000 shares issued and outstanding, respectively

5,000

500

Common stock, authorized 150,000,000 shares, $0.001 par value,

57,783,340 and 52,130,870 shares issued and outstanding,

respectively

57,783

52,131

Additional paid in capital

176,417,269

126,517,784

Accumulated deficit

(73,337,865

)

(47,388,367

)

Total cbdMD, Inc. shareholders' equity

103,142,187

79,182,048

Total liabilities and shareholders' equity

$

124,883,376

$

110,842,801

cbdMD, INC. CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED SEPTEMBER 30, 2021 and 2020

September 30,

September 30,

2021

2020

Gross Sales

$

47,332,085

$

43,172,778

Allowances

(2,851,322

)

(1,289,044

)

Total Net Sales

44,480,763

41,883,734

Cost of sales

14,495,063

15,514,727

Gross Profit

29,985,700

26,369,007

Operating expenses

49,601,690

43,950,862

(Loss) from operations

(19,615,990

)

(17,581,855

)

Realized and Unrealized gain (loss) on marketable and other

securities, including impairments

546,878

(932,066

)

Gain on extinguishment of debt

1,466,113

-

Decrease (increase) of contingent liability

(6,687,439

)

29,780,000

Other income

29,479

-

Interest (expense) income

(28,930

)

39,877

Loss (income) before provision for income taxes

(24,289,889

)

11,305,956

Benefit for income taxes

895,000

1,345,300

Net (Loss) Income from continuing operations

(23,394,889

)

12,651,256

Net (Loss) from discontinued operations, net of tax (Note

14)

-

(48,983

)

Net (Loss) Income

(23,394,889

)

12,602,273

Preferred dividends

2,554,609

366,850

Net (Loss) Income attributable to cbdMD, Inc. common

shareholders

$

(25,949,498

)

$

12,235,423

Net (Loss) Income per share: Basic earnings per share

(0.47

)

0.28

Diluted earnings per share

(0.47

)

0.28

Weighted average number of shares Basic:

54,938,128

44,140,360

Weighted average number of shares Diluted:

-

45,171,674

cbdMD, INC. CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) FOR THE YEARS ENDED SEPTEMBER

30, 2021 and 2020

September 30,

September 30,

2021

2020

Net (Loss) Income

$

(23,394,889

)

$

12,602,273

Comprehensive (Loss) Income

(23,394,889

)

12,602,273

Preferred dividends

(2,554,609

)

(366,850

)

Comprehensive (Loss) Income attributable to cbdMD, inc. common

shareholders

$

(25,949,498

)

$

12,235,423

cbdMD, INC. CONSOLIDATED STATEMENT OF CASH

FLOWS FOR THE YEARS ENDED SEPTEMBER 30, 2021 AND 2020

September 30,

September 30,

2021

2020

Cash flows from operating activities: Net (Loss)

Income

$

(23,394,889

)

$

12,602,273

Adjustments to reconcile net (income) loss to net cash

used by operating activities: Stock based compensation

1,298,106

1,900,194

Restricted stock expense

1,626,613

138,000

Marketing stock amortization

871,390

-

Issuance of stock / warrants for service

97,720

338,400

Inventory and materials impairment

670,580

233,372

Impairment on discontinued operations asset

-

45,783

Depreciation and amortization

1,017,408

720,755

Other than temporary impairment other securities and other accounts

receivable

-

760,000

Increase/(Decrease) in contingent liability

6,687,439

(29,780,000

)

Realized and unrealized loss of Marketable and other securities

(546,878

)

172,066

Merchant reserve settlement

-

132,657

Termination benefit

196,896

489,381

Extinguishment of Paycheck Protection Program Loan

(1,466,113

)

-

Non-cash lease expense

1,236,397

1,180,213

Changes in operating assets and liabilities: Accounts

receivable

(183,735

)

514,352

Deposits

261,125

(938,112

)

Merchant reserve

-

386,912

Inventory

(1,009,192

)

(535,146

)

Prepaid inventory

(263,341

)

615,280

Prepaid expenses and other current assets

525,670

645,796

Accounts payable and accrued expenses

(104,422

)

1,479,189

Operating lease liability

(1,159,097

)

(1,045,285

)

Deferred revenue / customer deposits

3,723

37,802

Collection on discontinued operations accounts receivable

436,167

587,083

Deferred tax liability

(895,000

)

(1,345,300

)

Cash used by operating activities

(14,093,433

)

(10,664,335

)

Cash flows from investing activities: Proceeds from

sale of other investment securities

540,000

-

Purchase of other investment securities

(750,000

)

(250,000

)

Purchase of DirectCBDOnline.com

(2,000,000

)

-

Purchase of property and equipment

(342,013

)

(1,320,095

)

Cash provided (used) by investing activities

(2,552,013

)

(1,570,095

)

Cash flows from financing activities: Proceeds from

issuance of common stock

-

16,766,106

Proceeds from issuance of preferred stock

30,938,386

4,421,928

Paycheck Protection Program Loan

-

1,456,100

Note payable

(151,551

)

29,629

Preferred dividend distribution

(2,554,609

)

(366,850

)

Deferred issuance costs

-

62,197

Cash provided by financing activities

28,232,226

22,369,110

Net increase (decrease) in cash

11,586,780

10,134,680

Cash and cash equivalents, beginning of period

14,824,644

4,689,966

Cash and cash equivalents, end of period

$

26,411,424

$

14,824,646

Supplemental Disclosures of Cash Flow Information:

2021

2020

Cash Payments for: Interest expense

$

28,930

$

33,693

Non-cash financial activities: Issuance of Contingent

earnout shares:

$

13,520,000

$

4,620,000

Warrants issued to representative

$

499,587

$

524,113

cbdMD, Inc. SUPPLEMENTAL FINANCIAL INFORMATION

RECONCILIATION OF NON-GAAP ADJUSTED INCOME (LOSS) FROM

OPERATIONS

Three Months

Three Months

Year

Year

Ended

Ended

Ended

Ended

September 30,

September 30,

September 30,

September 30,

2021

2020

2021

2020

GAAP (loss) from operations

$

(7,012,702

)

$

(4,531,072

)

$

(19,615,990

)

$

(17,581,855

)

Adjustments: Depreciation

297,552

221,360

1,017,408

720,754

Employee and director stock compensation (1)

1,100,362

537,943

3,149,688

1,985,803

Other non-cash stock compensation for services (2)

-

253,950

97,721

338,400

Inventory adjustment (3)

671,669

1,663,000

671,669

2,207,000

Write down of legacy accounts receivable (4)

-

102,000

-

102,000

Accrual for severance

-

489,381

703,022

489,381

Accrual / expenses for discretionary bonus

150,000

200,000

300,000

200,000

Non-GAAP adjusted (loss) from operations

$

(4,943,118

)

$

(1,263,437

)

$

(13,676,481

)

$

(11,538,517

)

(1)

Represents non-cash expense

related to options, warrants, restricted stock expenses that have

been amortized during the period.

(2)

Represents non-cash expense

related to options, warrants, restricted stock expenses that have

been amortized during the period.

(3)

Represents an operating expense

related to inventory loss related to regulatory changes impacting

labels and packaging and obsolete/expired inventory purchases

during 2019/2020.

(4)

Write down of legacy accounts

receivable.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211216006040/en/

PR: cbdMD, Inc. Robert Pettway Director of Public Relations

rpettway@cbdmd.com (423) 503-5225

Investors: cbdMD, Inc. John Weston Director of Investor

Relations john.weston@cbdmd.com (704) 249-9515

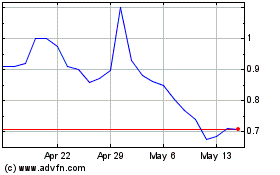

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

cbdMD (AMEX:YCBD)

Historical Stock Chart

From Nov 2023 to Nov 2024