Bushveld Minerals Limited Further Update on Outstanding Funds (3519A)

20 January 2024 - 3:32AM

UK Regulatory

TIDMBMN

RNS Number : 3519A

Bushveld Minerals Limited

19 January 2024

Market Abuse Regulation ("MAR") Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

19 January 2024

Bushveld Minerals Limited

("Bushveld" or the "Company")

Further update on Outstanding Funds

Further to the Company's announcement on 15 January 2024,

Bushveld Minerals Limited (AIM: BMN), the integrated primary

vanadium producer, remains in regular communication with Southern

Point Resources ("SPR"). Despite previous assurances provided by

SPR regarding late transfer of funds to the Company being a result

of processing delays, SPR has since identified and informed the

Company that the delay in settlement of funds is due to one of its

institutional funding partners defaulting on an agreement with SPR

to commit the funds to satisfy SPR's obligations to the Company. In

order to mitigate its breach, SPR is working with its partners to

provide an alternative source of funding to resolve the default as

soon as possible.

The Company has today received payment of ZAR40 million (US$2

million) from SPR which has been provided on an interest free basis

and will be repaid once SPR provides Bushveld with the entire

US$12.5 million, pursuant to the SPR subscription agreement (the

"Subscription Agreement"). Under the Subscription Agreement, SPR

was due to transfer the US$12.5 million from an offshore bank

account into Bushveld's UK bank account. However, due to the events

that have recently transpired, the payment received today has been

paid into a Bushveld subsidiary's South African bank account from

SPR's bank account in South Africa. If the funds received today

were to be used to satisfy SPR's obligation under the Subscription

Agreement, approval of the South African Reserve Bank would have

been required, which would have resulted in further delays in flow

of funds. Until the entire US$12.5 million is received SPR remains

in default of the Subscription Agreement.

As a result of the delayed settlement, the Company estimates

that approximately two weeks production will be lost in January. In

addition, the kiln at Vametco is currently being shutdown in order

to be refurbished. Additionally, the Company is assessing the

impact on production levels beyond January. Based on the Company's

current working capital requirements, the Board anticipates

Bushveld to have sufficient working capital to sustain the business

until the end of February 2024, albeit at reduced production

levels. SPR have communicated that the full US$12.5 million will be

paid no later than the 28 February 2024.

The Board continues to monitor the situation closely and is

working with its creditors and stakeholders, including Orion Mine

Finance, to manage the financial condition of the Company.

Craig Coltman, CEO of Bushveld Minerals commented :

"While very frustrating that the full funds have to date failed

to materialise, the Board and Management continue to engage

actively and constructively with SPR. We are encouraged to receive

this first payment from SPR whilst they work with one of their

founding partners to resolve the default. We will provide further

updates as appropriate with a view to resolving this as quickly as

possible."

SPR commented:

"The delay in payment of committed funds from an institutional

investor is disappointing, and has caused us a delay in settling

our equity funding commitment, we continue to engage in promising

discussions with senior representatives at the institution to make

good upon their commitment.

Notwithstanding the difficult situation we are fully committed

to our package of investments into Bushveld, and in lieu of the

committed institutional capital, we have worked urgently to make

arrangements with alternative limited partner funding to make good

on our contractual commitments to the Company. We look forward to

concluding the remaining transactions and crystalising our long

term partnership with Bushveld Minerals."

Enquiries : info@Bushveldminerals.com

Bushveld Minerals Limited +27 (0) 11 268 6555

Craig Coltman, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance Nominated Adviser +44 (0) 20 3470

LLP & Joint Broker 0470

Richard Morrison / Charlie

Bouverat

Grant Barker / Richard Parlons

+44 (0) 20 7907

Hannam & Partners Joint Broker 8500

Andrew Chubb / Matt Hasson

/ Jay Ashfield

+44 (0) 207 920

Tavistock Financial PR 3150

Gareth Tredway / Tara Vivian-Neal

/ James Whitaker

ENDS

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a vertically integrated primary vanadium

producer, it is one of only three operating primary vanadium

producers. Bushveld has a diversified vanadium product portfolio

serving the needs of the steel, energy and chemical sectors.

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQKLFFZFLXBBF

(END) Dow Jones Newswires

January 19, 2024 11:32 ET (16:32 GMT)

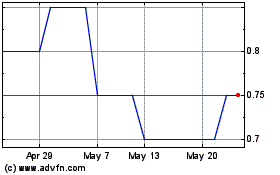

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025