TIDMCAML

RNS Number : 3068G

Central Asia Metals PLC

29 March 2022

29 March 2022

CENTRAL ASIA METALS PLC

('CAML' or the 'Company')

2021 Full Year Results

Central Asia Metals plc (AIM: CAML) today announces its full

year results for the 12 months ended 31 December 2021.

Financial highlights

Increased dividend

-- 2021 final dividend of 12 pence per share (2020: 8 pence)

o 2021 full year dividend of 20 pence per share (2020: 14

pence)

o Represents 45% of 2021 free cash flow(1) ('FCF'), in line with

stated dividend policy

o Payable on 30 May 2022 to shareholders registered on 6 May

2022

Record financial results

-- Group gross revenue [1] of $235.2 million (2020: $170.3 million)

o Group net revenue of $223.4 million (2020: $160.1 million)

-- Group EBITDA 1 of $141.5 million (2020: $95.7 million)

-- EBITDA margin 1 of 60% (2020: 56%)

-- Group profit before tax of $109.3 million (2020: $59.8 million)

-- EPS from continuing operations of 47.69 cents (2020: 24.78 cents)

Strong balance sheet

-- Group FCF 1 of $103.8 million (2020: $58.9 million)

-- Group net cash1 as at 31 December 2021 of $22.7 million (2020: net debt of $36.2 million)

o Cash in the bank as at 31 December 2021 of $59.2 million(2)

(2020: $47.9 million)

o 2021 gross debt repayments of $48.4 million (2020: $38.4

million)

Sustainability and operational overview

-- Zero lost time injuries at Kounrad during 2021 (2020: zero)

-- Four lost time injuries at Sasa during 2021 (2020: zero)

-- Target of 50% reduction in Scope 1 and Scope 2 greenhouse gas

('GHG') emissions by 2030 versus 2020 and to achieve net zero

emissions by 2050

-- Copper production of 14,041 tonnes (2020: 13,855 tonnes)

-- Zinc in concentrate production of 22,167 tonnes (2020: 23,815 tonnes)

-- Lead in concentrate production of 27,202 tonnes (2020: 29,742 tonnes)

2022 outlook

-- Kounrad copper production guidance, between 12,500 and 13,500 tonnes

-- Sasa production guidance, zinc in concentrate, between 20,000

and 22,000 tonnes and lead in concentrate, between 27,000 and

29,000 tonnes

[1] See Financial Review section for definition of non-IFRS

alternative performance measures

[2] The cash balance figure disclosed includes restricted cash

balance

Nigel Robinson, Chief Executive Officer, commented:

"I am pleased to report a strong set of financial results for

2021, which represents our most profitable year to date with Group

EBITDA of $141.5 million at a margin of 60%. We ended 2021 with a

strong balance sheet, having made an additional $10 million early

repayment on our corporate debt facility, which brings total 2021

debt repayments to $48.4 million. As of 31 December 2021, we were

in a net cash position of $22.7 million, with cash in the bank

(including restricted cash) of $59.2 million.

"Following this strong performance, we are delighted to propose

a 12 pence per share final dividend, resulting in a full year

dividend of 20 pence per share. Once the final dividend is paid,

the Company will have returned $256.9 million to its shareholders

in the last 10 years. The full year dividend represents 45% of our

2021 FCF and is therefore within our stated policy of 30% to 50% of

FCF.

"We have continued to focus our efforts on the most important

sustainability aspects of our business and have in particular

worked on our climate change strategy during 2021. We ended the

year having firmed up a strategy, and are confident in our ability

to commit to a 50% reduction in our Group Scope 1 and Scope 2

emissions by 2030, and are committing to a net zero target by 2050.

Our forthcoming 2021 annual and sustainability reports contain more

information on our efforts in this regard, and our initial

reporting towards Taskforce for Climate-Related Financial

Disclosures ('TCFD').

"We look forward to another positive year for CAML in 2022 and,

in particular, progressing the Cut and Fill Project at Sasa. We now

expect this project, which will ensure maximum extraction of Sasa's

resources, in the safest way, with minimal water usage and improved

tailings management, to be completed in 2023. Our business

development efforts continue into 2022. We also look forward to

celebrating 10 years of copper production from Kounrad on 30 April

2022.

"It is clearly too soon to ascertain how the events in Ukraine

will affect the wider world and global economy, but in the meantime

our thoughts are with all of those directly affected.

"On a final note, I am delighted that Louise Wrathall, our

Director of Corporate Relations, will join the CAML Board as an

additional Executive Director at the conclusion of our forthcoming

AGM."

Analyst conference call and webcast

A live conference call and webcast hosted by Nigel Robinson

(Chief Executive Officer) and Gavin Ferrar (Chief Financial

Officer) will take place at 09:30 (BST) today. The conference call

can be accessed by dialling +44 (0)330 336 9601 and quoting the

confirmation code '1668061', and the webcast can be accessed using

the link:

https://webcasting.brrmedia.co.uk/broadcast/6214e5f7599ba174a3a33776

The presentation will be available on the Company's website and

there will be a replay of the call available following the

presentation at https://www.centralasiametals.com .

Presentation via Investor Meet Company

The Company will also hold a live presentation relating to the

2021 Full Year Results via the Investor Meet Company platform today

at 15:00 (BST). The presentation is open to all existing and

potential shareholders. Questions can be submitted at any time

during the live presentation. Investors can sign up to Investor

Meet Company for free and add to meet Central Asia Metals Plc

via:

https://www.investormeetcompany.com/central-asia-metals-plc/register-investor

For further information contact:

Central Asia Metals Tel: +44 (0) 20 7898 9001

Nigel Robinson, CEO

Gavin Ferrar, CFO

Louise Wrathall, Director of Corporate louise.wrathall@centralasiametals.com

Relations

Peel Hunt (Nominated Advisor and Tel: +44 (0) 20 7418 8900

Joint Broker)

Ross Allister

David McKeown

BMO Capital Markets (Joint Broker) Tel: +44 (0) 20 7236 1010

Thomas Rider

Pascal Lussier Duquette

BlytheRay (PR Advisors) Tel: +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

Rachael Brooks

Note to editors:

Central Asia Metals, an AIM-listed UK company based in London,

owns 100% of the Kounrad SX-EW copper project in central Kazakhstan

and 100% of the Sasa zinc-lead mine in North Macedonia.

For further information, please visit www.centralasiametals.com

and follow CAML on Twitter at @CamlMetals and on LinkedIn at

Central Asia Metals Plc

Chairman's statement

2021 brought a very different metal price environment to the

previous year and I am delighted that we have reported for the year

record revenue, profits, free cash flow and of course returns to

our shareholders. We have also advanced many other aspects of our

business which are equally as important to our other stakeholders,

and I am pleased that our team has wholeheartedly embraced the

sustainability aspects on which we place such importance.

OUR PURPOSE

Our purpose is to produce base metals, which are essential for

modern living, profitably in a safe and sustainable environment for

all our stakeholders and we have fulfilled this purpose during

2021.

Coupled with strong commodity prices, our Kounrad and Sasa base

metal production generated EBITDA of $141.5 million and free cash

flow of $103.8 million. This has enabled us to continue

deleveraging, and we ended the year in our first period-end net

cash position since we acquired Sasa in 2017. The remainder of our

corporate debt facility will be repaid in 2022.

SUSTAINABILITY

We have continued to devote much of our time and energy to

advancing our sustainability efforts during 2021. In Q2 2021 we

published our second standalone Sustainability Report. This was the

Company's first report drafted in accordance with the Global

Reporting Initiative ('GRI') Standards 'Core option'. Forming the

foundation for the 2020 Sustainability Report, CAML engaged

external consultants, ERM, to conduct an independent stakeholder

engagement exercise to verify and assess the relative importance of

material sustainability topics for the Company and its

stakeholders. The report also identified four of the UN Sustainable

Development Goals ('SDGs') to which the Company has the capacity to

best contribute. CAML's third Sustainability Report will be

published shortly and will detail our activities during 2021

corporately and at the Kounrad and Sasa operations.

While we have advanced many areas of sustainability during 2021,

we have in particular focused on climate change and have developed

a Climate Change Strategy which sees us commit to a 50% reduction

in our greenhouse gas ('GHG') emissions versus 2020 by 2030. We

were pleased to have secured effectively 100% renewable power for

our Sasa operation in July 2021, which will result in a reduction

in our Group emissions on an annualised basis by approximately 35%.

Our 2021 annual report contains our first commentary towards the

Taskforce for Climate-Related Financial Disclosures ('TCFD')

reporting and demonstrates our efforts in this regard to date and

our plans going forward.

During H1 2021, we completed the River Remediation Project,

which was undertaken as a result of the September 2020 tailings

storage facility 4 ('TSF4') incident. We have removed as much as

possible of the tailings from the riverbed, and have planted trees,

shrubs and grasses along the banks of the river. While monitoring

of water quality and biodiversity will of course be ongoing, I am

pleased that we have now drawn a line under the incident to the

satisfaction of our stakeholders.

GOVERNANCE

On 31 July 2021, Nigel Hurst-Brown retired from the CAML Board.

Nigel was our first Chairman, guiding CAML through its listing on

the AIM Market of the London Stock Exchange in 2010, until my

transition to Chairman in 2016. He was a diligent member of the

Board for 15 years and I thank him for his commitment to our

business and his wise counsel during his tenure with us.

On 31 March 2021, Mike Prentis joined the CAML Board, as well as

the Audit, Sustainability, Remuneration and Nomination Committees.

His input has already been invaluable as he brings important

capital markets experience and investor insights, as well as a

rigorous approach to his non-executive role.

Robert Cathery has informed me of his plans to retire from the

CAML Board at the conclusion of our 2022 Annual General Meeting

('AGM'). Our Nomination Committee has been busy appraising

candidates for roles that will help to ensure the company continues

to embrace its forward-looking aspirations in line with our stated

purpose, as well as ensuring the highest standards of corporate and

business governance.

To that end, in January 2022, CAML announced the appointment of

Dr Mike Armitage to the Board as an Independent Non-Executive

Director. Mike brings a wealth of international technical

experience and will support management and be invaluable to the

Board, both in terms of our current operations and with our

business development activities. Mike's long career with SRK in

particular has seen him review, assist with due diligence, and help

to develop numerous mineral properties globally, therefore he has

the technical calibre that the CAML Nomination Committee believes

is crucial in overseeing a successful mining business for the long

term.

I am pleased to advise that Louise Wrathall, our Director of

Corporate Relations, has agreed to join the Board as an additional

Executive Director, responsible for corporate development, at the

conclusion of the forthcoming AGM on 26 May 2022. Louise has been a

key member of the senior management team since she joined CAML in

2015 and further enhances the skills of the Board, emphasising the

importance we place on investor relations, business development and

environmental, social and governance ('ESG').

Our Sustainability Committee has put much focus on advancing our

sustainability and climate change strategies this year and I am

grateful to Dr Gillian Davidson, who chairs that committee,

advising the senior management team ahead of presenting these

crucial aspects to the wider Board.

During the year, we hired a dedicated Group Internal Controls

and Risk Manager, who has brought a logical, practical and rigorous

approach to risk. Without effective risk management, we would be

unable to meet our strategic objectives and create value for our

stakeholders, and I am grateful to the Audit Committee for taking

overall responsibility for this crucial aspect of our business,

which affects each and every one of us on a daily basis.

ACKNOWLEDGEMENTS

I would like to thank the Board of Directors, our senior

management team and all of our employees for their dedication to

our business during 2021. Your efforts do not go unnoticed and we

very much appreciate your hard work. I would like to extend my

thanks to our stakeholders for their support as well.

CEO's statement

2021 FINANCIAL OVERVIEW

Sasa produced 22,167 tonnes of zinc in concentrate and 27,202

tonnes of lead in concentrate at a C1 zinc equivalent cash cost of

production of $0.63 per pound.

Our Kounrad operations continued to perform well, delivering

copper cathode output above production guidance at 14,041 tonnes.

Kounrad's 2021 C1 copper cash cost of production remained low by

global standards at $0.57 per pound.

Despite the persistent global challenges of COVID-19, commodity

prices performed well during 2021 and demand for copper, zinc and

lead improved materially versus 2020. This, combined with CAML's

base metal production, has led to us reporting record gross revenue

of $235.2 million and record EBITDA of $141.5 million at an EBITDA

margin of 60% for 2021.

We have continued to deleverage during 2021, with a $10 million

early debt repayment in addition to our regular monthly payments.

CAML ended 2021 in a net cash position of $22.7 million with cash

in the bank of $59.2 million (including restricted cash).

The Group generated 2021 free cash flow of $103.8 million,

enabling us to recommend a 12 pence per share final dividend. This

equates to a full-year dividend of 20 pence per share, which

represents 45% of 2021 free cash flow.

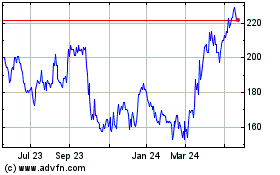

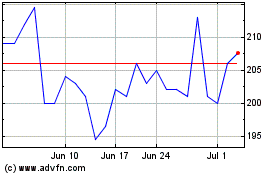

MARKET PERFORMANCE

During 2021, the CAML share price traded within a range of

GBP2.19 to GBP2.93, ending the year at GBP2.59, which represents an

8% increase on the 31 December 2020 price of GBP2.40. CAML

outperformed the FTSE AIM All Share/ Basic Resources Index, which

lost approximately 17% during 2021. Since the Company's IPO in

September 2010, CAML's share price has significantly outperformed

the FTSE AIM All Share/ Basic Resources Index, primarily due to

CAML's strong operational performance, low production costs and

attractive high dividend yield.

SUSTAINABILITY

We remain focused on safety and were therefore disappointed to

report four LTIs at Sasa during the year. We recorded zero LTIs at

Kounrad though, and therefore our 2021 total as a Group was four,

with a LTIFR of 1.69, a worsening of our performance since 2020 and

one which is reflected in Executive Director and senior management

compensation. Lessons have been learnt from the Sasa incidents and,

as ever, effective safety training and supervision for our

employees is a priority and is crucial to achieving an improving

safety record.

The strong financial performance we have reported underpins our

business and we place significant emphasis on ensuring that we are

sustainable for all stakeholders. To demonstrate our efforts and

achievements in this area, we will soon be publishing our third

Sustainability Report, our second to GRI standards ('core

option').

During 2021, we have developed a CAML Climate Change Strategy,

which focuses on five key objectives:

- Produce the metals which contribute positively to the energy transition

- Work towards decarbonisation

- Ensure we are operationally resilient

- Focus on our strategic and business resilience

- Deliver clear and transparent climate-related disclosures

Also during the year, we undertook risk analysis work focusing

on our physical risks at both of our operations, as well as any

likely transition risks which could affect our business, and we

have adjusted our internal financial modelling so that we can now

apply a shadow carbon price. We were pleased to be able to report

at the time of our interim results in September 2021 our agreement

with EVN to purchase solely renewable power for our Sasa

operations, thereby enabling us to commit to a Group GHG emission

reduction from this activity alone of approximately 35%. In

December 2021, our Board agreed to the construction of a solar

power plant at Kounrad. These two key developments, in combination

with some additional smaller initiatives, have led us to commit to

a Group Scope 1 and Scope 2 GHG emission reduction target of 50%

versus 2020 by 2030. We will also aim to be net-zero by 2050.

Having also firmed up our governance of climate change, we are

pleased to be able to begin reporting towards TCFD within our 2021

Annual Report and Sustainability Report.

In terms of our longstanding focus on the communities around our

operations, we have completed during H1 2021 to the satisfaction of

our local and national stakeholders the River Remediation Project

and we were delighted to be able to develop for the local community

the Youth Park along the banks of the affected river in our local

town, Makedonska Kamenica.

This outdoor area comprises trails and walkways along the river

with trees, flower beds and a gazebo, as well as children's play

areas, and we have been pleased to see this area being enjoyed by

so many in the community close to Sasa. During 2021, we spent a

total of $0.5 million at Sasa and Kounrad, supporting the local

communities and our host countries nationally as we played our part

in helping to mitigate the negative health impacts of the COVID-19

pandemic as well as other sustainable development projects that

have been identified.

Supporting our local communities in general is a vital aspect of

what we do in the areas close to the operations and, as a result,

we enjoy good relations with our neighbours and we believe we have

brought some real, positive change. We established the Kounrad

Foundation for charitable donations in 2018 and, in 2021, we

established a similar foundation for Sasa.

SASA

We encountered some difficult ground conditions at Sasa during

2021 and this, coupled with our enhanced approach to underground

safety risks, resulted in our zinc and lead production being

marginally below production guidance for 2021. However, we are

confident that our transition to the cut and fill mining method is

the optimal choice that will largely alleviate these issues for the

long term. We have made solid progress in this regard during 2021

as we began to construct the new Central Decline and have developed

over 500 metres from both surface and underground during the year.

We have also procured various key pieces of equipment for the paste

backfill plant and we have advanced our design work for the dry

stack tailings plant and landform.

KOUNRAD

During the year at Kounrad, leaching operations performed well,

as did the SX-EW processing facilities which achieved availability

of over 99%. We continued to develop more of the Western Dumps for

future leaching operations, while focusing on maximising copper

extraction in the Eastern Dumps. While capital expenditure remained

low at $2.8 million, it was $1.0 million higher than that spent in

2020 because the team invested in the intermediate leach solution

('ILS') infrastructure that should ensure maximum copper recoveries

for the medium term.

OUTLOOK

The CAML Board and management team are closely monitoring the

political situation in Kazakhstan, following the unrest in January

2022, as well as the situation in Ukraine. Our operations have

remained unaffected and, most importantly, our employees are safe

and well.

Notwithstanding this uncertainty, the outlook for 2022 is

positive, with a strong base metal price environment, improving

zinc treatment charges and solid demand for the metals we

produce.

Our production guidance for Sasa is 790,000 to 810,000 tonnes of

ore, which should lead to between 20,000 and 22,000 tonnes of zinc

in concentrate and between 27,000 and 29,000 tonnes of lead in

concentrate. At Kounrad, we expect to produce between 12,500 and

13,500 tonnes of copper.

Our focus at Sasa during 2022 will be progressing the Cut and

Fill Project, which will see us extract the maximum resources in a

safer, more sustainable and efficient manner. The project comprises

the development of the new Central Decline, as well as construction

of a paste backfill plant and associated reticulation pipework, and

a dry stack tailings plant and associated landform. From a

permitting perspective, the paste backfill and dry stack tailings

aspects of the Cut and Fill Project are effectively viewed in North

Macedonia as an overarching yet much improved tailings storage

solution for the long term.

While the overall approach is welcome in-country, CAML is the

first company in North Macedonia to propose the use of paste

backfill and dry stack tailings technology. Consequently, there is

no precedent in the country regarding best practice, which has

resulted in the Ministry of the Environment and Physical Planning

('MoEPP') requesting additional information to support our future

tailings disposal plans. This has led to a short-term delay in the

permitting process and we now expect the paste backfill plant to be

constructed and commissioned during H1 2023, and the dry stack

tailings component to be completed during H2 2023. CAML expects

that this timing adjustment will have minimal impact on 2023

production levels.

We expect 2022 capital expenditure of between $28 million and

$30 million, of which between $11 million and $13 million is

expected to be committed to sustaining capex. CAML expects

additional Cut and Fill Project capital expenditure in the order of

$10 million in 2023. This will be largely related to construction

of the dry stack tailings landform as well as capitalised decline

development, plus costs associated with increasing the processing

plant throughput capacity to 900,000 tonnes per year.

By September 2022, we expect to have repaid our corporate debt

facility, and therefore all of the debt associated with our $402.5

million Sasa acquisition in late 2017. Sasa has already generated

EBITDA of $245.1 million under our ownership and we look forward to

a long mine life continuing to generate significant value from this

asset until at least 2037. We are in a strong position from which

to grow again through acquisition and our business development

activities continue in this regard.

While COVID-19 continues to be a feature of our lives, we have

gained confidence over the last two years in the measures we have

put in place to try to manage, as best we can, infection rates on

our sites and we continue to hope for an improving global situation

as vaccination rates continue to grow. CAML has not accessed any

financial support throughout the pandemic from any government and

has not furloughed any employees.

Sustainability review

OVERVIEW

At CAML, sustainability means protecting the longevity of our

operations and working towards an enduring net positive outcome

after the end of life of our assets by upholding strong ethical

practices throughout the Company and our supply chain, prioritising

the safety, health and development of our people, conducting

business in an environmentally responsible manner and positively

contributing to our communities and countries of operation.

To achieve this, a focus on safety and sustainability is one of

our three strategic pillars, incorporated into our day-to-day

operations, led from the top by CAML's Board and a priority in

everything that we do. We have specific, robust and effective risk

management systems, with sustainability related risks and

opportunities fully integrated, to enable the Company to meet its

strategic objectives.

In our second year of reporting in line with GRI, we have worked

to improve disclosure and provide a comprehensive overview of our

sustainability approach in our Sustainability Report. By aligning

our business activities to the Sustainable Development Goals

('SDGs'), we aim to make a meaningful contribution to global

challenges. We have included SDG 7 and 13 in our target goals in

2021, as a result of our new Climate Change Strategy.

DELIVERING VALUE THROUGH STEWARDSHIP

CAML has a strong framework to promote ethical behaviour and

good corporate governance within our business and supply chain and

sets high standards that are crucial for the effective running and

sustainability of our operations.

We believe that a robust approach to human rights is vital to

fulfilling our corporate responsibilities, not only in respect of

our employees but for the workers along our supply chains and

within our communities. This is underpinned by our formal Human

Rights Policy, which covers internationally recognised rights.

Our procurement strategies at both sites aim to provide a level

playing field for suppliers, insisting on good governance,

compliance with local laws, respect for human rights, safety and

due care for the environment. We aim to work closely with our

suppliers to ensure we are part of a responsible value chain and

developed a social assessment process in 2021.

MAINTAINING HEALTH AND SAFETY

Safety is our most material issue and is at the heart of

everything we do. Our goal of achieving zero harm in the workplace

is laid out in the Company's Sustainability Policy and we have a

clear safety improvement target of achieving a 15% decrease in the

LTIFR over a five-year period. We recently hired a Group Health and

Safety Manager to further develop and implement a fully integrated

sustainable safety culture and train our local health and safety

teams to the highest standards.

Wherever possible, we look to eliminate occupational health

risks brought about by our operations. The challenges encountered

as a result of COVID-19 have served to highlight the importance of

maintaining a robust strategy to protect the health and contribute

towards the wellbeing of all our employees. We acted quickly at the

start of the pandemic to implement health protection measures and

48% of our workforce at Sasa and 99% at Kounrad have received one

or more COVID-19 vaccinations. Whilst vaccine hesitancy is an issue

in North Macedonia, we have initiatives aimed at addressing

this.

FOCUSING ON OUR PEOPLE

A motivated, dedicated and skilled workforce, underpinned by our

strong workplace culture and values, is a key enabler of our

success, and we are committed to attracting and retaining the best

people. We aim to ensure we have the succession plans and training

programmes in place to develop our leaders of tomorrow. In 2021,

our 1,052 employees received an average 36 hours of training.

CAML recognises the importance of diversity, specifically when

considering the breadth of thought, approach and opinion fostered

by a diverse group. We also have several initiatives to ensure that

CAML's workplaces are attractive and suitable for all.

We prioritise local hiring as one of the primary ways of

contributing to the economic security of our communities and want

to ensure that our workers are well remunerated. All Kounrad

employees are covered by a collective bargaining agreement.

Negotiations regarding a three-year agreement at Sasa commenced in

Q4 2021, with the intention to implement during 2022. 100% of our

Kounrad employees are Kazakh, and only 1% of our employees at Sasa

are expatriates.

CARING FOR THE ENVIRONMENT

We take our environmental responsibilities seriously and ensure

that we comply with the laws and regulations of the countries of

operation. We recognise the growing importance of understanding the

impact of climate change on the environment in which we operate and

its potential impact on the business. In 2021, we developed a

Climate Change Strategy, with a goal of achieving a 50% reduction

in Group GHG emissions by 2030 and net zero by 2050 and we are

beginning to report towards TCFD, with information detailed in the

2021 Sustainability Report. We have implemented or are planning

several decarbonisation initiatives, which include a renewable

power purchase agreement at Sasa and the construction of a solar

power plant at Kounrad.

We are mindful of our duty to ensure responsible waste

management and minimisation. We believe that our activities in

Kazakhstan have generally had a positive impact on the environment

by eliminating historical pollution from copper-rich solutions

leaching prior to the Company's ownership of Kounrad. We are firmly

committed to the environmental and socially responsible disposal of

tailings at Sasa. Our Cut and Fill Project that is currently in the

implementation phase will involve the more environmentally friendly

management of our tailings, incorporating storage as paste in our

underground voids as well as dry stack tailings. The water we are

able to remove from the dry stack tailings process should ensure a

75% reduction in Sasa's surface water abstraction from 2026

onwards.

UNLOCKING VALUE FOR OUR COMMUNITIES

We aim to provide real benefits to our local communities and

host countries by delivering philanthropic support, fostering

sustainable development, facilitating socio-economic progress and

helping the youth and most vulnerable members of the community in

line with our human rights commitments.

Both operations have community development programmes in place,

with foundation charities used as vehicles for targeted social

donations. At least 0.25% of the respective site's revenue is

committed for social development projects. Given the specialised

nature of our work, we are focused on providing the next generation

of experts in our local communities with the required skills, aided

by our Sasa training centre in North Macedonia.

Operations review

Sasa

SASA PRODUCTION AND SALES

In 2021, Sasa mined 818,609 tonnes of ore and processed 830,709

tonnes of ore. The average head grades for the year were 3.14% zinc

and 3.52% lead and the average 2021 metallurgical recoveries were

84.9% for zinc and 93.1% for lead.

Sasa produces a zinc concentrate and a separate lead

concentrate. Total production for 2021 was 44,383 tonnes of zinc

concentrate at an average grade of 49.9% and 37,893 tonnes of lead

concentrate at an average grade of 71.8%.

Units 2021 2020 2019

Ore mined t 818,609 826,421 817,714

--------- -------- -------- --------

Plant feed t 830,709 820,215 820,491

--------- -------- -------- --------

Zinc grade % 3.14 3.37 3.29

--------- -------- -------- --------

Zinc recovery % 84.9 86.1 86.5

--------- -------- -------- --------

Lead grade % 3.52 3.85 3.77

--------- -------- -------- --------

Lead recovery % 93.1 94.3 94.5

--------- -------- -------- --------

Zinc concentrate t (dry) 44,383 47,583 47,104

--------- -------- -------- --------

Grade % 49.9 50.0 49.6

--------- -------- -------- --------

Contained

zinc t 22,167 23,815 23,369

--------- -------- -------- --------

Lead concentrate t (dry) 37,893 41,289 40,366

--------- -------- -------- --------

Grade % 71.8 72.0 72.3

--------- -------- -------- --------

Contained

lead t 27,202 29,742 29,201

--------- -------- -------- --------

Sasa typically receives from smelters approximately 84% of the

value of its zinc in concentrate and approximately 95% of the value

of its lead in concentrate. Accordingly, total 2021 payable

production was 18,616 tonnes of zinc and 25,842 tonnes of lead.

Payable base metal in concentrate sales from Sasa in 2021 were

18,586 tonnes of zinc and 25,245 tonnes of lead. CAML's 2021

Operations Update, released on 11 January 2022, stated 2021 lead

sales of 25,877 tonnes. The restated figure reflects the final lead

concentrate shipment of the year that was delayed until January

2022, and therefore revenue from those metal sales will instead be

reflected in the 2022 financial year. During 2021, Sasa sold

323,849 ounces of payable silver to Osisko Gold Royalties, in

accordance with its streaming agreement.

HEALTH AND SAFETY

During 2021, there were four LTIs at Sasa and no MTIs, therefore

a total of four TRIs for the operation. COVID-19 remains a risk to

the welfare of CAML employees and contractors and there have been

cases of the virus at Sasa during the year. Despite this, and

despite a relatively low vaccination take-up rate, the Company is

confident that its COVID-19 procedures at both operations will be

sufficient to protect the welfare of its employees, meet respective

government guidance and maintain production going forwards.

MINING

A total of 818,609 tonnes of ore were mined using the sublevel

caving method during the year from the 990m and 910m working areas.

This was 1% lower than 2020 predominantly due to 385 metres of

unplanned rehabilitation works and localised poor ground

conditions. The ore from the underground operations is hoisted via

the Golema Reka shaft to surface (c.70%) and the remainder is

trucked to surface via the existing XIVb decline using a fleet of

20 tonne Epiroc trucks.

The average combined grade of the ore mined was 6.66% zinc and

lead, approximately 5% below the planned grade due to challenging

ground conditions coupled with an enhanced approach to underground

safety risk. This resulted in short term reductions in flexibility

of working areas and increased dilution, which led to reduced zinc

and lead head grades versus expected metal content.

Total ore development in the two working areas totalled 2,683

metres, which was 8% above budget and involved accessing additional

sub levels below the 910m level during Q4 2021. Waste development

for the year totalled 2,165 metres for approximately 74,000 tonnes

of waste, generated from internal ramp access and crosscuts to the

ore body, raise development and the development of the Central

Decline. During the year five new Epiroc units were purchased (one

twin boom jumbo drilling machine for the Central Decline

development, one 20 tonne truck, two seven tonne loaders and a new

Daimec diamond drilling machine) reducing the average age of the

Epiroc underground fleet of equipment from seven years to just over

five years. In addition to the Epiroc equipment, a Putzmiester

shotcrete unit and mixer were purchased to enable fully mechanised

placement of shotcrete, replacing the handheld units previously

used underground.

Preparation underground for the transition to cut and fill

mining began during the year with the relocation of existing

services in the existing XIVb decline (c.1.2 kilometres) to

accommodate the new paste fill services.

PROCESSING

Sasa processed 830,709 tonnes of ore during the year, an

increase of 1.2% versus 2020, and the plant had an overall

availability of 93%. Major maintenance works were completed during

the year, including replacement and rebuilding of the primary

crusher and improvements made to both ball and rod mills as well as

the SMD zinc regrind mill. Works were also undertaken on one of the

spiral classifiers and the filter presses. In addition, the Sasa

analytical laboratory was totally refurbished during the year, both

externally and internally.

TSF4 ran smoothly during the year, and the team was reinforced

with an additional two engineers and a dedicated TSF Manager. 24

hour per day surveillance of the facility was maintained throughout

the year and an independent audit of the facilities was completed

by Knight Piesold. An additional one kilometre tailings pulp line

from TSF3.1 to TSF4 was installed during the year.

DRILLING

A total of 4,818 metres of exploitation drilling was completed

during the year on the two working levels 910m and 990m to provide

additional information on the grade/thickness of the three

orebodies on the sub levels.

A total of 4,883 metres of exploration drilling was completed

below the 830m level to improve the confidence levels of the

mineralisation at depth with the objective of converting inferred

mineral resources to indicated resources. There was no exploration

drilling completed at Kozja Reka or Golema Reka during the

year.

The exploration programme during the year was adversely affected

by COVID-19 due to restrictions on external contractors on site.

The drill rig was instead used to provide data for hydrogeological

studies that were completed by consultants, SRK Consulting (UK)

Ltd, as part of Sasa's Environmental and Social Impact Assessment

('ESIA') work that was undertaken during 2021.

A comprehensive dewatering programme was also completed during

the year with over 500 metres of drainage holes drilled.

2022 PRODUCTION GUIDANCE

Prior to the transition to cut and fill mining at Sasa, which

will create a safer and sustainable underground mining operation

for the long term, CAML cautiously allows for continued ground

support challenges in its 2022 guidance and will maintain its

enhanced approach to underground safety risks. The Company

therefore targets ore mined of between 790,000 and 810,000

tonnes.

This should result in zinc in concentrate production of between

20,000 and 22,000 tonnes and lead in concentrate production of

between 27,000 and 29,000 tonnes. The Sasa team is also working on

the development of an increased number of sub-levels to enhance

flexibility. This will enable a greater number of potential working

faces in the event of further support being required in some

areas.

CUT AND FILL PROJECT

In 2020, the Board agreed to transition the Svinja Reka

operations at Sasa from the current sub-level caving mining method

to cut and fill stoping. The cut and fill mining method involves

filling mined voids with a backfill paste material containing

tailings to provide support, rather than allowing the roof to cave

as is the case with the current sub-level caving method. To achieve

this, a backfill plant will be constructed, along with associated

reticulation pipework to transport this material underground.

Given that a major component of the backfill material will be

tailings generated from the Sasa processing plant, it is estimated

that approximately 70% of Sasa's life of mine tailings will be

stored either underground in the form of paste, or in a dry stack

tailings facility that will be developed as part of the

project.

The Cut and Fill Project also includes development of a new

decline to facilitate swifter access to the orebody. In 2021, a

dedicated capital projects team was formed consisting of four

engineers and two administrative employees who are led by CAML's

Group Metallurgist. The team is further supported by Sasa's civil

engineering, permitting and administrative teams together with

external local and international designers and consultants.

In H1 2022, Sasa plans to recruit an additional four engineers

to join the capital projects team, which will include a

construction and health and safety manager representing the

construction management contractor. Progress has been made in all

aspects of the Cut and Fill Project with $8.3 million expenditure

incurred on the project during 2021. Of this amount $5.9 million

has been capitalised and $2.4 million recognised in non-current

receivables (note 23). Permitting processes for the various work

streams are also underway.

Central Decline

Construction of the Central Decline is underway. This decline

will be larger than the existing decline access to the mine and

will provide increased ventilation, easier access for reticulation

infrastructure and the potential to increase ore mined in the

medium term. The profile of the decline has been increased to

facilitate the potential future use of the slightly larger

underground electric vehicles, and an analysis of diesel versus

electric vehicles is currently underway.

Development of the portal on surface began in August 2021 and,

by the end of the year, 71 metres had been developed from surface

and a total of 432 metres were developed from underground on the

910m level. The total length of this decline will be approximately

four kilometres and construction will be undertaken in three stages

during the next four years.

Paste Backfill Plant

The site location for the paste backfill plant has been

confirmed, the equipment lay down area established, and the new

site offices have arrived at Sasa. Process engineering design has

been completed and all major components for the plant have been

ordered, including the civils and structural steels, thickener and

flocculant plant, the continuous mixer, various pumps including the

paste pump and in excess of eight kilometres of pipes for the

underground reticulation. In Q4 2021, the Metso-Outotec flocculent

and thickener plant was delivered to site.

A further milestone was the completion of the civil and

structural design of the paste backfill plant building with a local

company being awarded the construction contract. Detailed design of

the electrical and process control systems (supported by Paterson

and Cooke and Rockwell Automation) is ongoing and associated orders

are scheduled to begin in Q1 2022.

Construction and commissioning of the paste backfill plant is

expected to be undertaken during H1 2023.

Dry Stack Tailings

The dry stack tailings project comprises two separate aspects -

design and construction of the landform on which to stack the dry

tailings, and design and construction of the dry stack tailings

filter plant.

The design of the dry stack tailings filter plant is scheduled

to be completed in Q1 2022. The key component of the plant is the

press filter, and this has been procured from Metso-Outotec

alongside peripheral items such as pumps and holding tanks.

Construction of the filter plant will start immediately following

completion of the paste backfill plant and will take approximately

four months to complete. The design of the dry stack storage

landform by consultants, Knight Piésold, is on target to be

completed in Q1 2022. Ground works will then be undertaken in

preparation of receiving dry, filtered tailings in H2 2023.

Kounrad

2021 CATHODE PRODUCTION

During the year, the SX-EW plant produced 14,041 tonnes of

copper cathode, a slight increase from the previous year of 13,855

tonnes. Total Kounrad copper production since operations commenced

in April 2012 is now 124,141 tonnes, averaging over 1,070 tonnes

per month since start-up.

During 2021, copper was leached from the Eastern and Western

Dumps, with both areas performing well. Winter leaching of the

Eastern Dumps was suspended in early December 2020 and was

restarted in April 2021 and, over the winter period, copper

production was generated solely from the Western Dumps. This trial

resulted in an increase in solution viscosity, which had a negative

impact on organic reagent consumption. Additional tracking measures

have since been implemented whilst operating two leaching blocks on

the Eastern Dumps during the winter period of 2021/2022, and all

operational parameters are being closely monitored.

HEALTH AND SAFETY

There were no LTIs, or MTIs at Kounrad during 2021, meaning that

there were no TRIs. There have now been 1,324 days since the last

LTI at Kounrad. COVID-19 remains a risk to the welfare of CAML

employees and contractors and there have been cases of the virus at

Kounrad during 2021, despite a 99% vaccination rate. That said, the

Company is confident that its COVID-19 procedures at both

operations will be sufficient to protect the welfare of its

employees, meet respective government guidance and maintain

production.

LEACHING OPERATIONS

Both the Eastern and Western Dumps were simultaneously leached

during 2021, with the production split being 15% and 85%

respectively.

In the Eastern Dumps, the team focused on irrigating previously

leached blocks in order to maximise the recovery of copper. This

technique was implemented on various blocks that had been allowed

to rest for periods of, in some cases, almost two years. During

this rest period, bacterial and chemical activity continued to

solubilise copper mineralisation. In addition, with the purchase of

a new bulldozer, the summer period was spent pushing and levelling

side walls along Dump 7. This new area of exposed material will be

leached during 2022. Adopting these approaches resulted in the

typical pregnant leach solution ('PLS') grade pick-up averaging

about 0.7 grammes per litre ('gpl'). This was better than

anticipated and resulted in extracted copper of 2,116 tonnes from

this area during eight months of leaching. This takes the total

quantity of copper recovered from this resource area, since

operations commenced, to 79,847 tonnes or c.99.8% of that initially

forecast at the time of the CAML Initial Public Offering ('IPO') in

2010. The daily average area under irrigation at the Eastern Dumps

during the year was 27.7 hectares.

This approach of leaching and rotating around all the old,

rested blocks will be undertaken during 2022 for the full year,

with anticipated pick-up grades being in the region of

0.6-0.7gpl.

At the end of December 2021, an earth moving contract was

awarded to relocate approximately 180,000 cubic metres of material,

containing approximately 2,000 tonnes of copper, which was

effectively sterilised as it was located too close to the Kazakhmys

railway line. A cut-back leaving a 30 metre distance to the railway

line from the dump toe will be developed, through which a lined

trench extension of 950 metres will be installed. The excavated

material, which is currently unleached, will be placed on top of

Block 2 of Dump 9-10 and this work will allow access to previously

unreachable materials in Block 12 of Dump 5 and also Dump 3. All

relocation and installation works should be completed before the

end of 2022, at a total cost of around $0.5 million, and leaching

of this material is scheduled for 2023.

At the Western Dumps, the focus of irrigation remained on parts

of Dumps 16, 22 and 1A, with two cells accessed at Dump 21 from

June. During 2021, 11,924 tonnes of copper were recovered from

these areas, contributing approximately 85% of the total Kounrad

copper production. This Western Dump tonnage was the highest

achieved since leaching commenced in 2017 and was positively

impacted by higher than forecast PLS grades returning from the area

of Dump 21. The average daily area under irrigation on the Western

Dumps increased to 37.5 hectares (33 hectares in 2020) of both new

and previously leached material. The volume of raffinate pumped

around the site averaged 1,211 cubic metres per hour ('m(3) /hr').

This was lower than the 1,338 m(3) /hr pumped in 2020 due to the

Eastern Dumps not being leached in winter. During the summer

period, a proportion of the off-flow solutions from the Eastern

Dumps were recycled across to the Western Dumps with the aim of

maintaining broadly stable PLS grades to the solvent extraction

('SX') plant. This technique operated successfully and will be

continued in 2022, as and when appropriate.

Given the planned switch to almost all leaching from the Western

Dumps by 2024-2025, engineering studies have been finalised to

implement a split irrigation and solution collection system to

allow the operation of an Intermediate Leach System ('ILS'), which

should result in an increase in the copper grade of the PLS

generated at the Western Dumps. During 2021 as part of Phase 1 of

the project, a 14 kilometre water delivery pipeline was fully

installed, together with the east to west transfer pumps and,

during late Autumn, was wet commissioned to confirm the design

flow-rate of 180-200 cubic metres per hour ('m(3) /hr'). During

2022, the second phase will be completed in readiness for

operations from Spring 2023 onwards, as and when required. This

involves the construction of various collection ponds and the

installation of the top of dump distribution and irrigation

system.

Application rates of solution to the dumps were maintained at a

slightly reduced level of 2.12 litres per square metre per hour

('l/m(2) /hr') throughout the year. Direct field experience has

confirmed that materials in Dump 1A require a lower application

rate of approximately 1.5l/m(2) /hr to achieve optimum solution

penetration.

Utilising a second dedicated bulldozer for the Western Dumps,

significant levelling and shaping earthworks were undertaken during

2021 preparing future blocks for irrigation. Additionally, certain

changes were made to the irrigation systems used on winter blocks

in order to better maintain operational availability. These include

the replacement of all line control valves in October 2021,

solution temperature monitoring probes and also the installation of

duplicate, unconnected, dripper lines beneath the HDPE covers which

can be quickly connected to the header pipes in the event of

unexpected freezing.

SX-EW PLANT

The SX-EW plant continued to operate efficiently during 2021 and

the overall operational availability throughout the year was 99.4%.

This was 0.1% below that of 2020, due to a number of storm events

negatively affecting the regional incoming power supplies.

With the average Western Dumps copper grade of around 0.1%, the

average PLS grade for the year was 2.36gpl, somewhat higher than

2020 and mainly due to the positive returns from Dump 21. Solution

flow rates averaged 988m(3) /hr, with summer rates increasing to

1,200m(3) /hr. During the year each of the four Extract settler

units was taken off-line to facilitate inspection and any necessary

repairs and, after 10 years of operations, their condition was

found to be excellent.

While the increased levels of iron in the Western Dumps

generally has a positive impact on leaching, this also typically

results in a reduction in the current efficiency of the plating

process. The average for 2022 was 11gpl of iron, compared to under

9gpl in 2020, resulting in power consumed per tonne of copper

plated increasing by 3% to 4,183 kWh per tonne.

At the start of Q2 2021, 616 anodes were renewed in the EW1

building, with a further 400 pieces being renewed in Q3 2021. The

installation of these new anodes assisted in minimising the

increase in unit plated power consumption. An extra 960 anodes were

ordered in Q4 2021 for arrival and installation in EW2 in mid-2022.

Following receipt and installation of these anodes, no further

anode replacement programmes are expected until 2024.

The focus for the operations team has been on continued safe,

efficient plant operations and the tight control of all operating

costs. During Q3 2021, certain plant management / supervisory and

shift operating regimes were modified to enhance overall control

and productivity, which have all been implemented very

successfully.

COPPER SALES

Throughout the year, the quality of CAML's copper cathode

product has once again been maintained at high levels both

chemically and visually and there have been no negative quality

claims. Regular in-house and independent metallurgical analyses

have consistently reported 2021 copper purity of around 99.998%.

The Company continues to sell the majority of copper production

through its off-take arrangements with Traxys, the terms of which

are fixed until December 2022.

2022 PRODUCTION GUIDANCE

The 2022 guidance for Kounrad's copper cathode production

remains between 12,500 and 13,500 tonnes.

Financial review

SUMMARY

2021 was a record year for the Group, with EBITDA of $141.5

million which reflects strong prices of our metals amid

accelerating demand and a shortfall in supply. This result was

achieved despite global inflationary pressures resulting in some

cost increases. CAML is now in a net cash position for the first

reporting period since the acquisition of Sasa, and the Group

continues to reward shareholders with strong dividends as well as

looking after its other stakeholders.

2021 MARKET OVERVIEW

Kazakhstan

According to the National Bank of Kazakhstan, where CAML

produces its copper, Kazakhstan's 2021 GDP expanded by 4%, and

official inflation was 8.4%.

Copper

2021 was a strong year for copper, despite ongoing concerns

about COVID-19, rising inflation, logistic issues and troubles in

the Chinese property market. During 2021, refined copper was

strongly supported by demand from end-users and restocking has been

particularly strong as a result of vaccination rollouts, pent-up

consumer demand, fiscal stimulus packages and a general low

interest rate environment. During the year the increase in supply

of refined copper production of 3.2% has lagged demand increase of

4.4%.

The International Copper Study Group ('ICSG') indicated a 2021

global refined copper deficit of 340,000 tonnes.

North Macedonia

According to the National Bank of North Macedonia, North

Macedonia's 2021 GDP is expected to have expanded by 4.0%, with

inflation of 3.2%.

Zinc

The zinc market rebounded well in 2021, due to a 0.6% increase

in global growth in supply and a 5.8% increase in demand for zinc

metal. These figures reflect the global recovery from 2020 which

was severely affected by the initial spread of the COVID-19

pandemic.

Mine production recovered sharply by 4.5% after significant

interruptions during the previous year and, while zinc concentrate

production also increased, freight delays and strong smelter demand

resulted in falling treatment charges from $300/dmt to $160/dmt

year on year. Demand was also much improved, as evidenced by a rise

in the LME metal price from c.$2,700 to c.$3,500 per tonne during

the year and a decrease in LME metal stocks.

According to the International Lead and Zinc Study Group

('ILZSG'), there was an overall 2021 deficit of 192,000 tonnes. Two

European smelters (Porto Vesme Italy and Auby in Belgium) announced

closures towards the end of 2021 which will tighten the metal

market in 2022. The market in this current year could also be

affected by the significant delays experienced in seaborne

deliveries, which represent approximately 50% of all zinc

concentrate movements.

Lead

The lead market remains healthy with a modest 2021 surplus of

46,000 tonnes expected by the ILZSG. Demand continues to grow

despite the push to reduce dependence on lead-acid batteries. It is

deemed unlikely that lead demand will see any dramatic falls in the

coming years as EV's will continue to be a strong source of

demand.

Consumption of lead metal in 2021 rebounded by 4.3% from 2020

and, as a consequence, the market for lead concentrates remained

tight during 2021. Stocks of both lead metal and lead concentrates

were relatively low throughout the year despite mine production

increasing by 3.8%. Like zinc, supply of seaborne lead concentrates

was also affected by the tightness in the freight market. The lead

metal prices moved up from c.$2,000 to c.$2,300 per tonne during

the year and concentrate treatment charges fell year-on-year.

PERFORMANCE OVERVIEW

CAML's 2021 gross revenue was the highest recorded to date, up

significantly by 38% to $235.2 million (2020: $170.3 million).

Uncertainty caused by the COVID-19 pandemic was alleviated and

market conditions moved favourably during the year and the prices

of copper, zinc and lead reflected the increasing global demand for

these metals.

The Group also generated record 2021 EBITDA of $141.5 million

(2020: $95.7 million), and its EBITDA margin also improved

significantly to 60% (2020: 56%) which, despite the global

inflationary pressures, reflects the Group's ability to maintain

low costs across the operations.

Earnings per share ('EPS') from continuing operations was 47.69

cents (2020: 24.78 cents), 92% higher than the previous year.

Against such a backdrop, CAML generated strong free cash flow of

$103.8 million (2020: $58.9 million), allowing the Board to propose

a record dividend within policy. The Group has accelerated its

deleveraging, having repaid corporate debt of $48.4 million during

the year (2020: $38.4 million) which included an additional $10

million early repayment. As at 31 December 2021, drawn overdraft

facilities totalled $9.6 million (2020: $9.7 million) resulting in

net cash of $22.7 million (2020: net debt of $36.2 million).

Sasa's 2021 EBITDA was $57.5 million (2020: $42.3 million), with

a margin of 56% (2020: 51%). Whilst sales volumes for both zinc and

lead were lower during 2021 due to reduced head grades, zinc and

lead prices increased significantly during the year and treatment

charges reduced from April 2021 onwards. Sasa's EBITDA also

reflects an unfavourable movement in the North Macedonian Denar

exchange rate to the US Dollar of 4%, as well as higher energy

prices and salaries. Kounrad's 2021 EBITDA was $106.0 million

(2020: $65.5 million), with a margin of 80% (2020: 75%). The EBITDA

increased year on year due to the improved average copper price

received coupled with consistent copper sales.

Kounrad's EBITDA reflects an increase in costs due to higher

usage of reagents, as well as rising electricity prices and

salaries.

INCOME STATEMENT

Group profit before tax from continuing operations increased by

83% to $109.3 million (2020: $59.8 million). This was primarily as

a result of the aforementioned reasons, with higher revenue due to

significantly improved commodity prices. There were also reduced

finance costs of $3.9 million (2020: $6.7 million) due to the

significant reduction of debt during the year and the reduced LIBOR

rates. The 2021 economic recovery has resulted in global inflation

that has adversely affected several key costs such as energy and

reagents, as well as salaries, which have increased our Group cost

base.

Revenue

CAML generated 2021 gross revenue of $235.2 million (2020:

$170.3 million), which is reported after deduction of treatment

charges, but before deductions of offtake buyer's fees and silver

purchases for the silver stream. Net revenue after these deductions

was $223.4 million (2020: $160.1 million).

Sasa

Overall, Sasa generated 2021 gross revenue of $103.1 million

(2020: $82.7 million). A total of 18,586 tonnes (2020: 19,930

tonnes) of payable zinc in concentrate and 25,245 tonnes (2020:

28,218 tonnes) of payable lead in concentrate were sold during

2021. The payable lead in concentrate sales is lower than that

disclosed in the CAML 2021 Operations update as the final lead

concentrate shipment of the year was delayed until January 2022

and, under the Free on Board ('FOB') terms, this revenue will be

recognised in the 2022 financial year.

The challenging ground conditions at Sasa coupled with an

enhanced approach to underground safety risks resulted in short

term reductions in flexibility of working areas at the mine,

leading to a reduction in ore mined year on year and increased

dilution which led to reduced zinc and lead head grades. Lower

production led to a reduction in payable concentrate sold at Sasa.

The zinc price achieved was 35% higher than that achieved in 2020

and the lead price achieved was 23% higher than that achieved in

2020.

Treatment charges were lower during the year at $18.8 million

(2020: $22.2 million) as a result of improved negotiated terms from

April 2021 onwards for both zinc and lead and reduced volumes of

deliveries. Treatment charges are expected to further reduce from

April 2022 onwards as more favourable terms have recently been

agreed. During 2021, the offtake buyer's fee for Sasa was $1.2

million (2020: $0.9 million).

Zinc and lead concentrate sales agreements have been extended

with Traxys through to 31 March 2023 for 100% of Sasa production to

align this with the tenor of the smelter contracts. Three new

smelters were identified in 2021 to further diversify CAML's

customer base and 3,309 dry tonnes of payable lead and zinc in

concentrate were sold to them during 2021. Group selling and

distribution costs decreased to $2.1 million (2020: $2.6 million)

as the prior period included international shipping costs to

Asia.

Sasa has an existing silver streaming agreement with Osisko Gold

Royalties whereby Sasa receives approximately $6 per ounce for its

silver production for the life of the mine.

Kounrad

A total of 13,983 tonnes (2020: 13,763 tonnes) of copper cathode

from Kounrad were sold as part of the Company's offtake arrangement

with Traxys which has been extended through to end of December

2022. The commitment is for a minimum of 95% of Kounrad's annual

production. A further 68 tonnes (2020: 97 tonnes) were sold

locally, a reduction from the prior year due to weaker local demand

as a result of COVID-19. Total Kounrad copper sales were 14,051

tonnes (2020: 13,860 tonnes).

Gross revenue increased due to the higher average copper price

received, which was $9,384 per tonne in 2021 (2020: $6,267 per

tonne), while sales volumes remained consistent. This generated

gross revenue for Kounrad of $132.0 million (2020: $87.7 million).

During 2021, the offtaker's fee for Kounrad was $2.6 million (2020:

$2.5 million).

2021 hedging

Given the increased capital expenditure to deliver the Sasa Cut

and Fill Project, the Group entered into commodity price hedge

contracts for a portion of its 2021 metal production. These

arrangements ensured that CAML retained its exposure to strong

copper, zinc and lead prices, while protecting a meaningful

proportion of revenues during the higher capex period and

continuing to rapidly deleverage. A Zero Cost Collar contract for

30% of copper production, which included a put option of $6,900 per

tonne and a call option of $8,380 per tonne, was put in place for

Kounrad. Also, two swap contracts were put in place for 30% of

Sasa's payable zinc production to be sold at $2,804 per tonne and

30% of its payable lead production to be sold at $2,022 per tonne.

As a result of these financial instruments, the Company recognised

$6.7 million (2020: nil) of realised losses during the year. These

financial instruments have expired at the end of the year and so

their year-end fair value was calculated as zero. The Group has not

put in place any further hedge contracts for 2022.

Cost of sales

Group cost of sales for the year was $80.5 million (2020: $72.0

million) and this includes depreciation and amortisation charges of

$28.9 million (2020: $28.6 million). The year on year increase of

12% includes greater Group royalty costs of $2.6 million linked to

the higher realised prices for all commodities. Global

macro-economic conditions led to an increase in key production cost

components such as reagents, electricity and salaries. The Company

continues to focus on factors such as disciplined capital

investments, working capital initiatives and other control

measures.

Sasa

Sasa's cost of sales for the period was 9% higher than the

previous corresponding period at $55.4 million (2020: $51.0

million) as Sasa faced certain global inflationary pressures.

However, 27% of this total cost increase ($1.2 million) was

currency related as the North Macedonian Denar, which is pegged to

the Euro, strengthened to an average of 52.06 against the US Dollar

versus a 2020 average of 54.02. Production costs increased due to

higher energy costs of $0.7 million as the electricity prices

increased by 63% from $6.4/kWh to $10.4/kWh. Other material cost

increases included $0.6 million rise in salaries, $0.4 million for

maintenance of equipment and $0.3 million higher costs of reagents,

explosives and other consumables.

2021 depreciation increased by $0.4 million versus 2020 due

primarily to the inclusion of TSF4 depreciation within these

calculations for a full period, which commenced in May 2020.

2021 royalties were $0.4 million higher than those of 2020

(2020: $2.4 million). This tax is calculated at the rate of 2%

(2020: 2%) on the value of metal recovered during the period and

the significant increase in metal prices was only moderately offset

by lower production.

Kounrad

Kounrad's 2021 cost of sales was $25.1 million (2020: $21.0

million) and 54% of this accretion was due to higher mineral

extraction tax ('MET') paid. MET is a royalty charged by the

Kazakhstan authorities at the rate of 5.7% (2020: 5.7%) on the

value of metal recovered during the year. MET for the year was $7.3

million (2020: $5.1 million) and an increase resulted from the

higher average copper price relating to similar sales volumes

versus the previous year.

There was also a 2021 increase in certain reagent costs of $0.9

million to $2.3 million (2020: $1.4 million). This was due to a

metallurgical adjustment arising from solely leaching the Western

Dumps during the winter period.

2021 Kounrad power costs were $0.5 million higher than 2020, due

to a 15% increase in local electricity prices from $0.039/kWh to

$0.045/kWh.

During the year, the Kazakhstan Tenge moved favourably for CAML,

depreciating against the US Dollar. The average exchange rate for

the year was 426 KZT/USD (2020: 413 KZT/ USD), with the Kazakhstan

Tenge being worth on average 3% less in US Dollar terms in 2021

compared to 2020. The depreciation and amortisation charges during

the year remain consistent at $3.9 million (2020: $3.9

million).

In line with the industry standard, CAML calculates C1 cash cost

by including all direct costs of production at Kounrad and Sasa

(reagents, power, production labour and materials, as well as

realisation charges such as freight and treatment charges) in

addition to local administrative expenses. Royalties, depreciation

and amortisation charges are excluded from C1 cash cost.

Sasa

Sasa's C1 zinc equivalent cash cost of production for 2021 was

$0.63 per pound (2020: $0.50 per pound). Although there were cost

increases, the reduced treatment charges countered the impact of

these so the $0.13 per pound increase in the C1 calculation was due

to the decreased production volumes of zinc ($0.03 per pound) and a

higher proportion of pro-rata zinc costing resulting from the zinc

equivalent calculation due to the increase in zinc revenue versus

lead in 2021 ($0.10 per pound). The on-site costs were $44.1 per

tonne (2020: $39.2 per tonne) and reflected global cost

increases.

Kounrad

Kounrad's 2021 C1 cash cost of copper production was $0.57 per

pound (2020: $0.51 per pound) and this remains amongst the lowest

in the copper industry. The increase in C1 cash cost versus 2020 is

due to higher on-site costs ($0.07 per pound) offset by higher

production volumes ($0.01 per pound) and a weaker Kazakhstan Tenge.

Approximately 70% of the C1 cash cost base in Kazakhstan is

denominated in Tenge. The average C1 cash cost since production

commenced in 2012 is $0.55 per pound.

Group

CAML reports its Group C1 cash cost on a copper equivalent basis

incorporating the production costs at Sasa. The Group's 2021 C1

copper equivalent cash cost was $1.32 per pound (2020: $1.15 per

pound). This number is calculated based on Sasa's 2021 zinc and

lead payable production, which equated to 11,959 copper equivalent

tonnes (2020: 15,227 copper equivalent tonnes) which has decreased

due to the significantly increased copper price relative to the

zinc and lead price and is added to Kounrad's 2021 copper

production of 14,041 tonnes (2020: 13,855 tonnes).

The Group C1 cash cost on a copper equivalent basis has

increased largely as a result of lower copper equivalent production

units mainly due to lower lead and zinc prices relative to copper

and partly due to higher costs at both Sasa and Kounrad.

CAML's fully inclusive copper equivalent cost of production has

primarily been adversely affected by a reduction in copper

equivalent tonnes due to the relative price performance of all

three base metals, as well as an increase in royalty costs.

Administrative expenses

During the year, administrative expenses increased to $22.1

million (2020: $19.0 million), largely due to an increased noncash

share-based payment charge of $2.4 million (2020: $0.9 million)

resulting from the vesting of three years' worth of share options

granted to employees. The comparative year shows only one year's

worth of vesting share options as the policy long-term incentive

plan was recently adjusted. In addition, in the comparative period

there were no additional divided share awards made given that the

Company did not declare a final 2019 dividend.

There was also an increase in employee related costs due to pay

rises, additional insurance premiums, and more business travel

following the easing of lockdown restrictions in prior year.

Finance costs

The Group reduced its finance costs in 2021 to $3.9 million

(2020: $6.7 million) principally driven by a lower debt balance

from further scheduled debt repayments of $38.4 million throughout

the year and an additional $10 million early repayment of the

corporate debt facility. The interest rates incurred also reflected

a lower LIBOR rate.

Taxation

2021 Group corporate income tax increased significantly to $25.1

million (2020: $16.0 million) as a result of higher profits at

Kounrad of $102.6 million (2020: $61.7 million) taxed at a

corporate income tax rate of 20% and at Sasa of $32.3 million

(2020: $16.3 million) at a corporate income tax rate of 10%. The

Group's underlying effective tax rate was $23.0% (2020: 26.8%)

which reflects the increased profits at both operations.

Discontinued operations

The Group continues to report the results of the Copper Bay

entities within Discontinued Operations. These assets were fully

written off in prior years.

BALANCE SHEET

Cut and Fill Project

The Group continues to invest significantly at Sasa with the

implementation of the Cut and Fill Project, comprising the

construction of a Paste Backfill Plant and associated underground

reticulation infrastructure, a Dry Stack Tailings Plant and

associated landform and the development of the new Central

Decline.

Capital expenditure on Cut and Fill Project totalled $8.3

million of which $5.9 million has been capitalised. This includes

$3.3 million on the Paste Backfill Plant including costs of $0.6

million for thickener tank, $0.3 million for displacement pumps and

construction and design. There was a further $0.9 million spent on

underground reticulation. There was also $1.4 million spent on the

Dry Stack Tailings filtration plant including $0.7 million on the

larox filter.

Central Decline costs include $1.2 million of capitalised

development and $2.4 million on new equipment including new

underground fleet.

The Group intends to spend $17-$19 million on its Cut and Fill

Project in 2022.

Sustaining Capital expenditure

The Group sustaining capital expenditure capitalised was $8.8

million (2020: $8.5 million), comprising $2.7 million (2020: $1.3

million) costs at Kounrad and $6.1 million (2020: $7.2 million) at

Sasa.

Kounrad sustaining expenditure included $1.2 million on solution

pipes, lining and dripper pipes and expenditure of $0.7 million on

new anodes and a new bulldozer of $0.2 million.

Sasa sustaining capital expenditure includes capitalised mine

development of $2.7 million, $0.5 million on underground fleet,

$0.3 million on a new drill rig and $0.2 million on TSF 4 pulp line

costs.

Working Capital

As at 31 December 2021, current trade and other receivables were

$6.2 million (31 December 2020: $8.9 million), which includes trade

receivables from the offtake sales of $1.2 million (31 December

2020: $1.9 million) and $2.5 million in relation to prepayments and

accrued income (31 December 2020: $2.6 million). The corporate tax

recoverable balance at Sasa has decreased by $1.2 million due to

increase in zinc and lead prices reducing the previously

accumulated recoverable balance.

Non-current trade and other receivables were $7.3 million (31

December 2020: $3.8 million), which has increased due to

prepayments made on property, plant and equipment as part of the

Sasa Cut and Fill Project as well as prepayments at Kounrad. As at

31 December 2021, a total of $3.3 million (31 December 2020: $3.3

million) of VAT receivable was still owed to the Group by the

Kazakhstan authorities. Recovery is still expected through the

local sales of cathode to offset these recoverable amounts.

As at 31 December 2021, current trade and other payables were

$16.1 million (31 December 2020: $12.9 million).