TIDMDXSP

DXS INTERNATIONAL PLC

(AQSE: DXSP)

ANNUAL RESULTS

for the year ended 30 April 2023

The Board of DXS International plc ("the Company"), the AQSE

Growth Market quoted healthcare information and digital clinical

decision support systems provider, is pleased to announce its

audited Final Results for the year ended 30 April 2023.

Financial highlights:

-- Revenue increased by 3% to GBP3,391,219 (2022: GBP3,285,050).

-- Core recurring revenue model continues to be resilient.

-- Profit after tax of GBP225,191 compared to GBP222,250 in 2022, an

increase of 1%.

-- Cash at bank at the period end was GBP371,978 (2022: GBP452,379).

Operational highlights:

-- Successful trial of SMART Referral solution with a hospital fertility

clinic reducing referral rejections from 36% to 0% saving clinician

wasted time and reducing waiting list.

-- Hypertension medicines optimisation solution completed the NHS IM1

integration and compliance processes and has entered the formal

evaluation which is anticipated to complete in October 2023.

-- We have designed and implemented a free trial sales initiative for our

two key solutions.

-- SMART Referral solution which has been shown to reduce referral

rejections from 36% to 0% and cut waiting times by more than 50%.

-- Our hypertension medicines optimisation solution designed by UK

GPs to optimise the treatment of long-term conditions in

accordance with best evidence guidelines.

Both these solutions align with NHS aims and objectives.

Post-Period

Raised GBP500,000 in May from existing and new investors and

GBP130,000 from management and consultants (by way of salary and

fee conversion) to boost our sales and marketing efforts.

Management share options expired and will be replaced with a

suitable replacement scheme in due course.

Outlook

The pace of accessing the NHS market remains challenging,

primarily due to the inaccessibility of pressured NHS staff

struggling to deal with treatment backlogs, strikes, staff

shortages, restructuring and budget constraints. This adds elements

of uncertainty to the rate of our growth plans and while we believe

our sales and revenue targets to be highly achievable in the medium

term, the envisioned timeframe remains uncertain.

In light of this, the market expectation of GBP4.7m annual

revenue in the current financial year may no longer be achievable,

but the Company remains confident that it will be achieved in the

calendar year 2024.

David Immelman, Chief Executive of DXS, commented:

"Sales progress is proving to be frustratingly slow, however

there is no doubt that we have 'first of type' solutions that can

deliver significant results for healthcare providers and their

patients. We are continuing with our development of cutting edge

healthcare solutions focused on delivering improved health outcomes

more cost effectively in the UK and internationally. Accessing

healthcare markets present many hurdles, however equally as we

overcome each of these, we are acutely aware that our competition

faces similar challenges.

Our strategy is to remain super focused underpinned by the

conviction of ultimately delivering results to our stakeholders and

our shareholders."

The Directors of DXS International plc accept responsibility for

this announcement. This announcement contains information which,

prior to its disclosure, was inside information as stipulated under

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 (as amended).

Contacts :

David Immelman 01252 719800

DXS International plc

www.dxs-systems.com

AQSE Corporate Broker

Hybridan LLP 020 3764 2341

Claire Louise Noyce

Corporate Advisor

City & Merchant 020 7101 7676

David Papworth

Notes to Editors

About DXS:

DXS International presents up to date treatment guidelines and

recommendations, from Clinical Commissioning Groups and other

trusted NHS sources, to doctors, nurses and pharmacists in their

workflow and during the patient consultation. This effective

clinical decision support ultimately translates to improved

healthcare outcomes delivered more cost effectively and which

should significantly contribute towards the NHS achieving its

projected efficiency savings.

The following information is extracted from the DXS

International plc audited accounts for the year ended 30 April

2023.

CHAIRMAN'S REPORT

The Board announce its results for the year ending 30(th) April

2023.

At April 2023, the turnover increased by 3% to GBP3,391,219

(2022: GBP3,285,050). Despite increased expenditure in research and

development, the Company produced a profit after tax of GBP225,191

compared to GBP222,250 in 2022, an increase of 1%. Cash at bank at

the period end was GBP371,978 (2022: GBP452,379).

The year continued to present significant challenges accessing

our target market. NHS staff are currently focused on dealing with

backlogs and the NHS restructuring which is ongoing. However, again

our recurring revenue model proved to be resilient enabling a

modest revenue increase of 3%.

The UK currently remains our sole source of revenue being split

between the NHS and the pharmaceutical industry. Despite these

disruptions, we have been able to begin engaging with prospective

customers regarding new sales opportunities, particularly for our

new SMART Referral and Hypertension solutions.

Our successful Fertility Clinic Referral Study continues

delivering significant results with referral rejection rates now

down from 36% to 0% and waiting times down by 55%. These positive

outcomes have initiated a collaboration with an Academic Health

Science Network to formally evaluate the outcomes of our SMART

referrals in Cancer and ENT settings. The NHS is now demanding

evidence before investing. Another key revenue opportunity is

delivering metadata with each referral form which can be imported

into hospital systems improving workflow and operational

efficiencies.

Our hypertension medicines optimisation solution has now entered

an important National Institute of Health Research (NIHR) funded

evaluation phase after completing the NHS IM1 integration and

compliance certification processes. The evaluation is formally

being evaluated by the Eastern Academic Health Science Networks CVD

and Evaluation Team. This report is expected to be completed by

October 2023 and will provide formal evidence of how the ExpertCare

hypertension solution will improve hypertension treatment in

accordance with NICE guidelines as well as shift workloads from GPs

to more junior Pharmacists and Nurses as well as cutting reviewing

times.

To fund our sales and marketing efforts for SMART Referrals,

SMART Pathways and the ExpertCare hypertension solutions, we have

recently raised GBP500,000 from existing and new investors.

Development of our new cloud version of our DXS Point of Care

solution continues and we hope to release the first version by

November 2023.

While accessing healthcare markets remains a painfully slow

process, we are more resolute than ever that our decision to invest

in SMART intelligent digital solutions is correct. Ongoing

statements by politicians, patient bodies, clinician groups,

academic institutions and the media continually reinforce the

current state of healthcare delivery in the UK. Prime Minister

Rishi Sunak said: "Cutting waiting lists is one of my top five

priorities".

Recent government announcements have emphasised the importance

of controlling blood pressure. High blood pressure (hypertension)

places a considerable burden on the NHS, where it is responsible

for 12% of all visits to GPs with an estimated annual cost to the

NHS of over GBP2 billion. The 2023/24 NHS Priorities and

Operational Planning Guidance reconfirmed the ongoing need to

improve productivity, make progress in delivering the key NHS Long

Term Plan ambitions and continue to transform the NHS for the

future. This included increasing the percentage of patients with

hypertension treated to NICE guidance to 77% by March 2024. The

ExpertCare hypertension solution is the ideal product to support

this drive in a timely, cost-effective manner.

The enthusiastic reception that our new products are receiving

from clinicians confirms that our strategy for managing referrals

and hypertension with our SMART digital solutions are aligned with

the NHS' stated objectives and underpinned by a competent,

enthusiastic, and committed team. This commitment was demonstrated

by key management's commitment to taking reduced drawings as well

as converting unpaid remuneration of GBP130,628 to equity.

REPORT OF THE DIRECTORS

The directors present their annual report and the audited

financial statements for the year ended 30 April 2023. The

Chairman's statement which is included in this report includes a

review of the achievements of the Company, the trading performance,

financial position, and trading prospects.

DIRECTORS

The directors for the year were:

-- Bob Sutcliffe -- Chairman

-- David Immelman -- CEO

-- Steven Bauer -- COO

PRINCIPAL ACTIVITIES

The group's principal activities during the period were the

development and distribution of clinical decision support to

General Practitioners, Nurses, and Retail Pharmacies in the United

Kingdom. The commercial side included the licensing of DXS to

various Clinical Commissioning Groups (CCGs) and the sale of

e-detailing opportunities to the Pharmaceutical Industry.

The group continues to invest in research and development both

locally and internationally and during this financial year has

invested GBP1,380,617 into R&D for the introduction,

continuation, and completion of a number of new DXS solutions.

These are targeted at providing clinicians and with solutions to

improve referring and the therapeutic management of long-term

conditions. These products are aligned with the NHS strategy of

Digital First and Empowering the Wider Workforce.

During the period we have borrowed GBP750,000 and repaid

GBP268,792 on bank and third-party loans.

FINANCIAL INSTRUMENTS

The Directors believe that there is no material risk arising in

respect of interest rates on loans, credit, and liquidity.

DIVID

The Directors do not recommend a dividend.

DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the financial

statements for each financial year. The directors have elected to

prepare the financial statements in accordance with United Kingdom

Generally Accepted Accounting Practice (United Kingdom Accounting

Standards and applicable law). Under company law the directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Group for that period. In

preparing these financial statements, the directors are required

to:

-- Select suitable accounting policies and apply them consistently.

-- Make judgments and accounting estimates that are reasonable and prudent.

-- State whether UK accounting principles have been followed subject to any

material departures disclosed and explained in the financial statements

and,

-- Prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Group and Company will continue in the

business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

DIRECTORS' RESPONSIBILITIES TO AUDITORS

The directors have taken all the necessary steps that they ought

to have taken as directors in order to make themselves aware of all

relevant audit information and to establish that the Company's

auditors are aware of that information.

As far as the directors are aware, there is no relevant audit

information of which the Company's auditor is unaware.

Approved by the board and signed on its behalf by:

D A Immelman

Director

21(st) July 2023

STRATEGIC REPORT

SECTION 172 REPORT

Section 172 of the Companies Act requires that a director of the

Company is managing in the best interests of all stakeholders --

Customers, Employees and Shareholders.

In the spirit of above, the Directors of DXS International plc,

strive to maintain a reputation for high but fair standards in the

best interest of its stakeholders.

Our primary focus is on our customers and here we regard our

relationships and channels of communications of paramount

importance. We operate in a sensitive environment, healthcare, and

as such ensure that we meet all the standards required by our

customers, such as Information Governance and Clinical Safety. In

addition, we comply with ISO standards which assures an overarching

good governance approach to all operations.

The Board is focused on delivering value for Shareholders

underpinned by motivated Employees delivering above average

delivery of solutions and service to Customers. In achieving the

foregoing, the Company focuses on continued innovation via a policy

of research and development funded through organic investment plus

capital raises, as agreed at shareholder meetings, noting it has

not as a Company raised any external equity financing in the year

to April 2023, and supported by clearly communicated vision and

direction.

In our communication to Shareholders the Board is clear in terms

of its short, medium, and long-term strategy and maintains an

open-door approach to Shareholders seeking additional clarity on

any issue. The Board releases notices on a regular basis informing

Shareholders of developments in areas of business progress,

non-confidential strategic decisions, and any change to company

policy. Risks and opportunities are set out in this strategic

review.

The Group is small and while clear management structures are in

place all employees, if required, have direct access to the

Executive Directors on a daily basis and, if necessary, to the

Chairman. The group retains HR services to ensure the fair and

equitable treatment of employees. The Company promotes a policy of

promoting from within supported by training and mentorship. We

encourage diverse thinking and recognise strengths and contribution

to the business.

REVIEW OF THE GROUPS BUSINESS

The Group Profit after Tax is GBP225,191 (2022 - GBP222,250).

The Operating (Loss) amounts to (GBP42,653) (2022 (GBP57,776)).

There was an increase in amortisation of GBP91,098 to GBP660,645.

The Group has a credit of GBP322,897 for UK Corporation Tax (2022

credit- GBP320,985) for the year.

The profit after tax for the year increased by GBP2,941 after a

significant investment into R&D of GBP1,380,617. Revenue

remained robust with an increase of GBP106,169 in revenue. As an

accredited NHS solutions provider, DXS has well-established

business continuity and disaster recovery protocols in place.

We have continued the development of our new Aios cloud-based

system. In addition, we completed our IM1 integration for EMIS

which has now been NHS accredited and a NIHR funded trial for our

ExpertCare hypertension solution is underway.

Although the NHS remains notoriously slow in adopting new

technology, our sustained efforts are seeing gained awareness of

our new SMART referral and Hypertension solution which we believe

will begin generating revenue in the new financial year.

Our strategy remains aligned with both the new NHS Long Term

Plan and opportunities abroad.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risk to the Company in the UK is that the NHS

dramatically changes its plans or cuts its budgets. This seems

unlikely, particularly with the current the NHS' stated objective

for clinicians to operate using digital technologies with which our

new Aios and ExpertCare solutions are aligned.

Failure to achieve predicted quantities of DXS contracts, and

slower development of additional revenue streams may result in

revenues growing more slowly than anticipated. These may be

mitigated due to the launch of market ready new products as the

current situation normalises.

Our plans for expansion outside of the UK mitigate this risk.

Here we continue with our research and development plans to take

our new Expert Hypertension solution into international markets

where improved management of Hypertension and other long-term

conditions are a top priority.

ANALYSIS OF BUSINESS DURING YEARING APRIL 2023

Revenue was marginally in line with market expectations,

increasing by GBP106,169 while Profit after tax increased by

GBP2,941.

FINANCIAL METRICS

-- Group Revenue of GBP3,391,219 has increased by 3%. Definition: Total

Group sales including distribution of clinical decision support to

General Practitioners and the licensing of DXS to CCGs and healthcare

publishers. Group Revenue includes the sale of medicine education slots

to the pharmaceutical industry.

-- Underlying Group Profit after Tax was GBP225,191, a 1% increase. This was

mainly due to increased investment of development. Definition: Underlying

profit provides information on the underlying performance of the

business.

-- Depreciation and amortisation of deferred Research and Development

expenditure and Goodwill in 2023 was GBP704,091 and in 2022 was

GBP659,247.

-- Earnings Per Share 2023 0.5p, 2022 0.5p. Definition: Earnings per share

is the underlying profit divided by the weighted average number of

ordinary shares in issue.

-- ROE 2023 5%, 2022 5%. Definition: Return on Equity (ROE) is the ratio of

net profit of a company to its shareholders funds. It measures the

profitability of a company by expressing its net profit as a percentage

of its shareholders funds which include share capital, share premium,

provision for costs of share option awards and retained earnings.

CORPORATE GOVERNANCE

We are committed to establish, maintain, and continually improve

an Integrated Management System (IMS) that conforms to relevant ISO

requirements.

To achieve this objective, we commit to:

-- continual improvement in our performance and services to our

stakeholders.

-- Identify, assess, reduce, and eliminate hazards and risks pertaining to

our business.

-- Set risk-based objectives and targets to meet applicable statutory,

business, information security and service level obligations.

-- Comply with mutually agreed quality and service level requirements of our

customers.

-- Develop our people and provide sufficient resources to meet our

objectives and targets.

We communicate the IMS Policy to all personnel working for or on

behalf of DXS to ensure that they are made aware of their

individual IMS obligations.

Approved by the board and signed on its behalf by:

D Immelman

Director

21(st) July 2023

FINANCIAL STATEMENTS

INCOME STATEMENT

Year ended 30 April 2023

2023 2022

Continuing Operations Continuing Operations

GBP GBP

Turnover 3,391,219 3,285,050

Cost of Sales (466,722) (412,904)

_________ _________

Gross Profit 2,924,497 2,872,146

Administration Costs (2,261,897) (2,269,633)

Depreciation and Amortisation (705,253) (660,289)

_________ _________

Operating profit (42,653) (57,776)

Sundry income 5 2,153

_________ _________

(42,648) (55,623)

Interest payable and similar

expenses (55,058) (43,022)

_________ _________

Loss on ordinary activities

before taxation (97,706) (98,645)

Tax on ordinary activities 322,897 320,895

_________ _________

Profit for the year 225,191 222,250

========= =========

Profit per share

0.5p 0.5p

-- basic

0.5p 0.5p

-- fully diluted

========= =========

Statement of Other Comprehensive Income

Year ended 30 April 2023

2023 2022

GBP GBP

Profit for the year 225,191 222,250

Other comprehensive income - -

Tax on components of other comprehensive

income - -

_________ _________

Total comprehensive income for

the year 225,191 222,250

========= =========

Statement of Financial Position

Year ended 30 April 2023

Company Company

Group 2023 Group 2022 2023 2022

GBP GBP GBP

Fixed Assets

Intangible Assets 5,860,209 5,183,683 - -

Tangible Assets 1,222 2,645 - -

Investments - 3,486,478 2,815,831

_________ _________ _________ _________

5,861,331 5,186,328 3,486,478 2,815,831

_________ _________ _________ _________

Current assets

Debtors: amounts falling due

within one year 791,321 693,702 18,393 32,762

Cash at bank and in hand 371,978 452,379 200,929 195,800

_________ _________ _________ _________

1,163,299 1,146,081 219,322 228,562

Creditors: amounts falling due

within one year (865,475) (889,761) (239,518) (50,478)

_________ _________ _________ _________

Net current assets 297,824 256,320 (20,196) 178,084

_________ _________ _________ _________

Total assets less current

liabilities 6,159,155 5,442,648 3,466,282 2,993,915

Creditors:

Amounts falling due after more

than one year (720,446) (331,330) (470,042)- -

Deferred income (848,876) (746,676) - -

_________ _________ _________ _________

4,589,833 4,364,642 2,996,240 2,993,915

========= ========= ========= =========

Capital and reserves

Called up share capital 159,246 159,246 159,246 159,246

Share Premium 2,671,321 2,671,321 2,671,321 2,671,321

Share option reserve 21,382 173,808 21,382 173,808

Retained earnings 1,737,884 1,360,267 1,737,884 (10,460)

_________ _________ _________ _________

Shareholders' funds 4,589,833 4,364,642 2,996,240 2,993,915

========= ========= ========= =========

As permitted by Section 408 of the Companies Act 2006, the

Income Statement of the parent company is not presented as part of

these financial statements. The Company made a profit of GBP2,325

(2022 - GBP2,395) for the year.

The financial statements were approved and authorized for issue

by the Board on 21(st) July 2023.

Signed on behalf of the Board of directors

D Immelman R Sutciffe

Director Director

Company Registration number : 06311313

STATEMENT OF CASH FLOWS

Year ended 30 April 2023

Group Group

2023 2022

GBP GBP

Cash flow from operating activities 549,8083 907,862

Interest paid (55,058) (43,022)

Sundry Income 5 2,153

R&D tax credit received 323,897 249,895

_________ _________

Net cash flow from operating activities 818,647 1,116,888

_________ _________

Cash flow from investing activities - -

Payments to acquire intangible fixed

assets (1,380,617) (1,284,961)

Payments to acquire tangible fixed

assets 361 (2,354)

_________ _________

(1,380,256) (1,287,315)

_________ _________

Financing Activities -

Expense in respect of share issue

in February 2020 - (5,000)

Repayment of long term loans (268,792) (164,512)

Advance of long term loans 750,000 -

_________ _________

481,208 (169,512)

_________ _________

Net (decrease) in cash and cash

equivalents (80,401) (339,939)

Cash and Cash equivalents at 1 May

2021 452,379 792,318

_________ _________

Cash and Cash equivalents at 30

April 2022 371,978 452,379

========= =========

Cash and Cash equivalents consists

of:

Cash at bank and in hand 371,978 452,379

========= =========

Current Non Current

Net Debt Reconciliation Debt Debt Cash Total

GBP GBP GBP GBP

At 30 April 2021 (207,139) (449,125) 792,318 136,054

Cash Flow (85,993) 117,795 (339,939) (308,137)

_________ _________ ________ _________

At 30 April 2022 (293,132) (331,330) 452,379 (172,083)

Non -- cash flow - (389,116) - (389,116)

Cash Flow (20,354) - (80,401) (100,755)

_________ _________ ________ _________

At 30 April 2023 (313,486) (720,446) 371,978 (661,954)

========= ========= ========= =========

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

Year ended 30 April 2023

1 Summary of significant accounting policies

(a) General information and basis of preparation.

DXS International PLC is a public company limited by shares

incorporated in England and Wales. The address of the registered

office is given in the company information on Page 1 of these

financial statements.

The group's principal activities during the year were the

development and distribution of clinical decision support to

General Practitioners, Nurses and Retail Pharmacies in the United

Kingdom and South Africa. The commercial side includes the

licensing of DXS products to various CCG's (Central Commissioning

Groups), the sale of e- detailing opportunities to the

pharmaceutical industry, the UK Primary Care sector and the

licencing of DXS technology to healthcare publishers.

The financial statements have been prepared in accordance with

applicable accounting standards including Financial Reporting

Standard 102 Applicable in the UK and Republic of Ireland (FRS 102)

and the Companies Act 2006. The financial statements have been

prepared on a going concern basis under the historical cost

convention. The financial statements are prepared in sterling which

is the functional currency of the company.

In the opinion of the Directors the group has sufficient funding

to continue as a going concern for at least twelve months from the

date of approval of the financial statements.

Should the group be unable to continue trading, adjustments

would have to be made to reduce the value of assets to their

recoverable amounts and to provide for any further liabilities that

might arise. The financial statements do not reflect any such

adjustments.

The significant accounting policies applied in the preparation

of these financial statements are set out below. These policies

have been consistently applied to all years presented unless

otherwise stated.

(b) Intangible assets

Intangible assets acquired separately from a business are

capitalised at cost.

Research and development expenditure, other than specific

identifiable development expenditure, is written off against

profits in the year in which it is incurred.

Identifiable development expenditure is capitalised to the

extent that the technical, commercial and financial feasibility can

be demonstrated. Developed products are for use within the NHS and

other medical institutions within both the UK and internationally.

The Group is already a supplier of services to the NHS.

Goodwill arising on business combinations is capitalised,

classed as an asset on the balance sheet and amortised over its

useful life. The period originally chosen for writing off the

current goodwill was 20 years because the directors believed that

this was the period of time for the benefit to be received. The

Directors reviewed the anticipated future life of the goodwill

during 2020. It was considered that the anticipated future life of

the goodwill would not exceed 3 years from 1 May 2020. Accordingly

the Net Book Value of the goodwill at 30 April 2020 was amortised

over 3 years.

Intangible assets are amortised over a straight line basis over

their useful lives. The useful lives of intangible assets are as

follows:

Intangible type Useful life Reasons

--------------------- --------------------------- --------------------------

Development 5 years from the date Period of time for benefit

expenditure that the specific product to be received.

is completed and available

for distribution.

--------------------- --------------------------- --------------------------

Provision is made for any impairment.

(c) Tangible fixed assets

The company capitalises items purchased as Tangible Fixed Assets

which have a cost in excess of GBP550.

Tangible fixed assets are stated at cost less accumulated

depreciation.

Depreciation is provided on all tangible fixed assets at rates

calculated to write off the cost , less estimated residual value,

of each asset on a systematic basis over its expected useful life

as follows:

Plant and equipment 3-4 years straight line

(d) Debtors and creditors receivable/ payable within one year

Debtors and creditors with no stated interest rate and

receivable or payable within one year are recorded at transaction

price. Any losses arising from impairment are recognised in the

profit and loss account in other administration expenses.

(e) Loans and borrowings

Loans and borrowings are initially recognised at the transaction

price including transaction costs. Subsequently they are measured

at amortised cost using an effective interest rate method. If an

arrangement constitutes a finance transaction it is measured at

present value.

(f) Grants

Government Grants, including non - monetary grants, shall not be

recognised until there is reasonable assurance that :

(a) the entity will comply with the conditions attached to them;

and

(b) the grants will be received.

An entity shall recognise grants either based on the performance

model or the accrual model. This policy choice shall be applied on

a class-by-class basis.

(g) Tax

Current tax represents the amount of tax payable or receivable

in respect of the taxable profit for the current or past reporting

periods. It is measured at the amount expected to be paid or

recovered using the tax rates and laws that have been enacted or

substantively enacted by the reporting date.

(h) Turnover and other income

Turnover is measured at the fair value of the consideration

received or receivable net of VAT and trade discounts. The policy

adopted for the recognition of turnover is as follows:

Sale of services and products

Turnover is from the sale of products and services to the

pharmaceutical industry and the UK Primary Care sector and is

recognised over the term of service contract and is apportioned on

a time basis representing the delivery of the service.

(i) Foreign currency

Foreign currency transactions are initially recognised by

applying to the foreign currency amount the exchange rate between

the functional currency and the foreign currency at the date of the

transaction.

Monetary assets and liabilities denominated in a foreign

currency at the balance sheet date are translated using the closing

rate.

Foreign exchange gains or losses are recognised in the Income

Statement.

(j) Employee benefits

When employees have rendered service to the company, short term

employee benefits to which the employees are entitled are

recognised at the undiscounted amount expected to be paid in

exchange for that service.

The company operates a defined contribution plan for the benefit

of its employees. Contributions are expensed as they become

payable.

(k) Leases

Rentals payable under operating leases are charged to the income

statement on a straight line basis over the period of the

lease.

(l) Share option policy

The company recognised as an expense, the fair value of share

options granted over their vesting period. The fair value is

calculated by applying an option pricing model.

(m) Key judgements and Key accounting estimates

The Key judgements or Key Accounting estimates with a material

effect on the carrying value of assets and liabilities are set out

below -.

In regards to the going concern of the company, the directors

have considered cash flow forecasts for the period to April 2025

which include estimates to be earned from the new Aios and

Expertcare A1 solutions which are expected to be revenue generating

from late 2023. Also included are increased costs which, if

forecasted sales are slower than anticipated, can be reduced

accordingly. In addition the company has issued shares to the value

of GBP500,000, before expenses, since the year end.

Given the additional funds received and the market potential for

the new products, supported by trial results, the directors

consider it appropriate to adopt the going concern basis of

accounting and are satisfied that there is no material

uncertainty.

The Research and Development tax credit received from HMRC is

not a Government grant but a recognition of the costs incurred in

respect of the company's research and development and is received

through an adjustment to the taxable income of the company.

The Group has used a level of judgement around key assumptions

on the technical feasibility of products under development, the

consideration of the estimated useful lives of these products and a

degree of estimate in respect of the capitalised attributable cost

including the estimated amount of time charged by employees.

(n) Reduced disclosure

DXS International PLC meets the definition of a qualifying

entity under FRS 102 paragraph 1.12(b) and has therefore taken

advantage of the disclosure exemption in relation to the parent

cash flow statement.

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

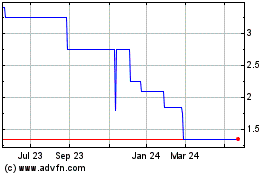

DXS (AQSE:DXSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

DXS (AQSE:DXSP)

Historical Stock Chart

From Nov 2023 to Nov 2024