Evrima Plc CEO Direct Financing

01 December 2022 - 3:19AM

UK Regulatory

TIDMEVA

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY EVRIMA PLC TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMENDED ("MAR"). ON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

30 November 2022

Evrima plc

("Evrima" or the "Company")

CEO, Burns Singh T Bhohi commits £250,000 in Working Capital via Secured

Convertible Loan Notes

Evrima plc, the investment issuer focused on structuring investment

transactions in the mining and junior exploration and development industries

are pleased to provide an update with respect a direct financing arrangement

entered into between the Company and the Company's Chief Executive Officer

("CEO"), Burns Singh Tennent-Bhohi.

Burns Singh Tennent-Bhohi, Chief Executive Officer commented,

"Global policy shifts in Central Banking monetary policy have seen tightening

measures that have aggressively reduced liquidity in global financial markets,

increased capital outflows and importantly also signalled an increased cost of

risk in money markets. These shifts coupled with geo-political uncertainties

have created challenges for capital markets and of net-positive significance to

Evrima, asset allocation.

The Company does maintain liquid assets that if sold today would offer capital

reallocation opportunities and more than sufficient sustaining capital to cover

planned corporate activity for the foreseeable future without the need for

external equity financing.

Whilst I entirely appreciate that the aforementioned is in contrast to the

announcement today, I believe that our equity interests in Premium Nickel

Resources Corporation and Eastport Ventures Inc. should be maintained until the

Board have visibility of a number of key corporate items that we believe

accelerate the valuation of these interests held by the company. These items

have a 12-18-month horizon and whilst we will remain vigilant of opportunities

to capitalise profits without hesitation at all times, we want to specifically

ensure that the Company's decisions to dispose are to generate capital gains

for capital reallocation and/or distribution purposes rather than our

motivation to dispose being predicated by funding operational costs associated

with the business.

To this end, it was important that in the Board taking this view which

ultimately carries its own level of risk to our shareholders, that I ensure

that the Company is well capitalised to support this strategy and even more so

given the challenges in capital markets at present.

It continues to be a very busy period at the company, and the Company will be

providing further updates with respect to the Company's next evolution which

the Board has been diligently working on."

£250,000 Secured Convertible Loan Note ("SCLN") Facility

* Chief Executive Officer, Burns Singh Tennent-Bhohi has made available the

SCLN of which £100,000 will be drawn down immediately

* SCLN shall have a maturity of 12 months from the date of the agreement

entered between both parties, with the Maturity date being 29.11.2023

* The SCLN shall carry a coupon of 10% and will be rolled-up on draw of funds

to the borrower and payable upon maturity

* The SCLN will maintain a floating charge over the assets of the Company

* Upon redemption and at the election of the lender, the lender shall have

the right to redeem the monies owing through cash redemption, conditional

settlement by way of an issue of equity or settlement by way of a

distribution of assets that reflect the monetary sum lent and outstanding,

including all and any accrued interest payable to the lender

* Burns Singh Tennent-Bhohi has the right to serve the Directors notice and

intention to convert any monies outstanding at the lower of the mid-price

of Evrima as at the date of this agreement being, four pence per share (£

0.04) or the 15-day volume weighted average price (VWAP) preceding the

lenders intention to serve notice to convert.

Chief Executive Officer, Burns Singh Tennent-Bhohi has proposed that the terms

of conversion and the right to convert any debt outstanding be subject to and

conditional on shareholder approval (resolution to be included at the upcoming

Annual General Meeting) to ensure shareholders have the right to vote on what

is a substantive issue of equity to one party.

The Company expects to post its notice to convene its AGM in the coming days, a

copy of which will be available at the Company's website.

Burns Singh Tennent-Bhohi will abstain from voting on the proposed resolution

put to shareholders.

Conditional on Shareholder Approval:

The SCLN constitutes a related party transaction under Rule 4.6 of the AQSE

Growth Market Access Rulebook. The Directors of Evrima, save for Burns Singh

Tennent-Bhohi, consider that having exercised reasonable care, skill and

diligence, the related party transaction is fair and reasonable as far as the

shareholders of Evrima are concerned.

The Directors of Evrima accept responsibility for this announcement.

This announcement contains information which, prior to its disclosure, was

inside information as stipulated under Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310 (as amended).

Ends -

Enquiries :

Company:

Burns Singh Tennent-Bhohi (CEO & Director): burns@evrimaplc.com

Simon Grant-Rennick (Executive Chairman): simon@evrimaplc.com

Novum Securities Limited (AQSE Corporate Adviser):

David Coffman / George Duxberry: + 44 (0) 20 7399 9400

END

(END) Dow Jones Newswires

November 30, 2022 11:19 ET (16:19 GMT)

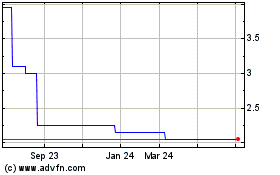

Evrima (AQSE:EVA)

Historical Stock Chart

From Dec 2024 to Jan 2025

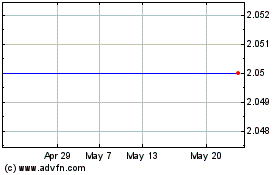

Evrima (AQSE:EVA)

Historical Stock Chart

From Jan 2024 to Jan 2025