TIDMGCM

RNS Number : 4081W

GCM Resources PLC

22 December 2021

2 2 Dec ember 20 2 1

GCM Resources plc

("GCM" or the "Company")

(AIM:GCM)

Final Results for the year ended 30 June 20 2 1

Notice of Annual General Meeting

GCM Resources plc announces the publication of its final audited

results for the year ended 30 June 20 2 1 (the "Annual Report and

Accounts") and that the Company's 20 21 Annual General Meeting will

be held at 10.00 a.m. on

Thurs day 20 January 20 22 , at QEII Centre, Broad Sanctuary, Westminster, London, SW1P 3EE .

The Annual Report and Accounts and the Notice of Annual General

Meeting will be posted to shareholders today. Copies are available

on request from the Company and will be available on the Company's

website ( www.gcmplc.com ). The Annual Report & Financial

Statements are also available on the 'Financial Reports' page of

the Company's website.

For further information:

GCM Resources plc WH Ireland Ltd

Keith Fulton James Joyce

Finance Director Andrew De Andrade

+44 (0) 20 7290 1630 +44 (0) 20 7220 1666

GCM Resources plc

Tel: +44 (0) 20 7290 1630

info@gcmplc.com; www.gcmplc.com

Executive Chairman's Statement

The Board presents the Company's Annual Report and Accounts for

the year ended 30 June 2021, in a year where progress has not met

our expectations, primarily due to the effects of the Coronavirus

Pandemic. Consider that towards the end of 2020, it appeared the

world was emerging from the pandemic, with countries slowly opening

up their borders and re-emerging from national lockdowns. However,

this momentum was arrested by the rapid emergence of the "Delta

Variant", which completely stifled business activity for the

majority of 2021. For instance, in Bangladesh rolling lockdowns

from March to August 2021 severely restricted movement and kept

government and private business offices mostly closed. It has been

an extremely frustrating period for GCM and on behalf of the Board,

I once more extend our appreciation for the continued support of

our shareholders.

We have remained focussed on delivering returns on shareholder

investment through packaging the Project in its best possible form

with the key step still being approval from the Bangladesh

Government. It is worth reflecting, however, on what actually

constitutes the Project. Firstly, and most importantly, the

Project's core asset is the proposed Phulbari open-pit coal mine

development, which would deliver over 15 Mtpa high quality thermal

coal for at least 30 years. Based on the latest, highly

energy-efficient Ultra-Supercritical power plant technology, the

Phulbari coal mine's full production would support 6,600MW.

Secondly, to ensure the mine's economic sustainability, we have put

in place arrangements with development partner Power Construction

Corporation of China, Ltd. ("PowerChina") to establish a minimum

power plant output totalling 4,000MW. This would ensure a reliable

market for the bulk of the Phulbari coal and provide time to

determine the best market for the remaining production.

During this last Financial Year, we secured a strategic coal

mine development partner with the signing of a Framework Agreement

on 12 October 2020 with China Nonferrous Metal Industry's Foreign

Engineering and Construction Co., Ltd. ("NFC"). On 6 December 2020,

PowerChina agreed to an extension of the original memorandum of

understanding ("MoU") established with NFC and PowerChina relating

to coal mine development, to allow formal continuing discussions in

regards to PowerChina taking a higher level of participation in the

Project. This MoU was extended for six months on 6 June 2021 and

again extended on 22 November 2021 to run through to 6 December

2022. Also, on 19 January 2021 the Joint Venture Agreements with

PowerChina for the initial 4,000MW (two 2,000MW Stages) were

extended to 15 March 2022.

Other steps taken in Financial Year 2021 include:

-- On 8 January 2021, we undertook a Board reorganisation with

the aim of increasing the level of Non-Executive Director

participation. This saw myself (Mohd. Najib Bin Abdul Aziz) being

appointed Non-Executive Chairman and expansion of the Board to now

include two Non-Executive Directors. Datuk Michael Tang PJN

continues as Executive Director and Chief Executive Officer. Also,

to enhance the Board's working knowledge of the Project and

Bangladesh, on 22 January 2021 Gary Lye was appointed Executive

Director while continuing in roles as GCM's Chief Operating Officer

and Chief Executive Officer of our subsidiary, Asia Energy

Corporation (Bangladesh) Pty Ltd.

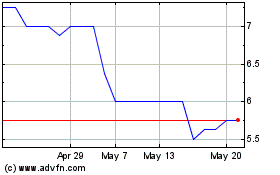

-- On 26 March 2021, the Company successfully placed 13,446,661

new ordinary shares of 1 pence each with institutional and

professional investors at a price of 7.5 pence per share (the

"Issue Price") via an accelerated bookbuild (the "Placing"). The

Placing raised gross proceeds of GBP1.01 million and the Issue

Price was a discount of approximately 19 per cent to the mid-market

closing price on 25 March 2021.

Outside the Reporting Period there were a number of other

developments:

-- On 31 August 2021, an MoU was signed with Sion Corporation of

Japan ("SION"), Versatech Energy Innovation Limited and AC Biode

Co. Ltd for providing a suitable and effective environmental

solution for the management of the fly-ash waste product that will

be produced by the Project. This will include investigations into

the production of SION's composite material CircuLite from fly-ash

and the application of CircuLite to various environmental and

agricultural improvements within Bangladesh.

-- On 22 September 2021, the Chinese President Xi Jinping

delivered a pre-recorded address to the United Nations General

Assembly where he stated as the world emerged from this pandemic,

efforts to revitalise economies would also include the pursuit of

"greener", more balanced development and a need for inclusive

growth. In this regard he stated China would step up efforts to

assist Developing Countries access "green" and "low carbon" energy,

and that China would not build new coal-fired power projects

abroad.

It is noted that no further details were provided, there has

been no immediate change in China's policy and the impact on

China's future financing of coal-fired power projects would not

really be understood until a policy is framed and it is seen how

that policy is implemented.

It is also noted that since that UN Meeting the world entered a

deepening energy crisis, reminiscent of the 1970's energy shortage.

Although there's been some drop from "sky-high" fuel prices,

supply/demand issues are expected to keep prices high. Lessons from

this are clear: the Renewable Energy Pathway is not

straightforward, even in Developed Countries; Renewable Energy

systems at this juncture are not reliable for Base Load Power;

Countries having their own energy resources are scrambling to lift

production of existing fossil fuel operations and

are looking to develop greenfield opportunities; and a Strategic

Mix of "own fuels" and "imported fuels" provides the best energy

security as countries move towards integrating Renewable Energy

systems.

-- The COP 26 UN Climate Change Conference took place from 31

October to 12 November 2021. Although the Conference announced a

Global Coal to Clean Power Transition initative whereby countries

were invited to make their commitments on how to phase out

coal-based energy in the form of political non-binding statements,

the response varied, with key countries such as China, Australia,

India, Japan and the USA not signing up. It was reported Bangladesh

also did not participate in this initiative.

Being the Chair of the Climate Vulnerable Forum (CVF) that represents the interests of the 48 climate-vulnerable Least Developed and Developing Countries, Bangladesh's major statements at the COP 26 were directed at how these countries would deal with loss and damage caused by the effects of climate change. A principal focus was to obtain commitment from the Developed Countries to fulfil their commitments of providing US$100 billion annually to be directed at adaptation and mitigation measures.

With 11,775MW coal-fired power plants commissioned or in the

pipeline, the Bangladesh Government demonstrates coal-fired power

will remain significant in its own strategic energy mix for several

decades as it moves to integrate Renewable Energy. Whilst the

option remains to install power plants at the Phulbari coal mine

site, there is also the potential to supply coal to the country's

already commissioned and under construction coal-fired plants. We

have amended our Proposal to Government accordingly and in this

scenario, Greenhouse Gas emissions (CO (2) ) from large-scale

shipping of that quantity of coal to Bangladesh would be eliminated

(replaced by rail / barging over far less distance). This, coupled

with Phulbari coal's higher energy enabling "more power for less

coal", will directly reduce Bangladesh's Greenhouse Gas Emissions

(CO (2) ) by over 30% compared to imported coal.

It is recognised that social and economic development is also

necessary for the Least Developed and Developing Countries to be

better prepared and more capable to combat the effects of Climate

Change. An important component is access to expansive low-cost

energy and power. In addition to the aforementioned Greenhouse Gas

Emissions (CO (2) ) reduction, utilising Phulbari's coal will not

only potentially save the Bangladesh Government many Billions of

Dollars on its fuel and power generation costs but also would

enable power to be delivered at a lower tariff, thus helping to

drive economic development.

On 19 October 2021, the Company announced it was pursuing

extension of the Framework Agreement with NFC for mine development

(which expired on 12 October 2021) and we remain confident of

agreeing such an extension, however, noting there are additional

procedures required to complete the extension as a result of recent

and as yet unclarified guidance from the Chinese Government in

regards to such agreements.

Our team in Bangladesh has been pursuing how the Phulbari coal

mine could become a "Net Zero Carbon" or "Green Mine" operation

through:

-- Utilising electrically powered mining equipment;

-- Developing a large-scale Solar Power Park (Carbon-Offsetting)

within the Project area which would supply to the grid and also

power the Phulbari mining operation; and

-- Additional Carbon Offsetting through progressive development

of an extensive forest plantation as part of the land

rehabilitation plant.

This is an exciting development both for GCM and the Project as

the Carbon Offsetting amounts to almost five times the calculated

mine Greenhouse Gas Emission (CO (2) ) and clearly establishes the

Phulbari coal mine can be a Net Zero Carbon "Green Mine" operation.

This opens up new opportunities and we have begun discussions with

our NFC and PowerChina development partners.

Unfortunately, Financial Year 2021, like 2020 will also be

remembered for the Coronavirus Pandemic and its negative effect on

business. GCM has maintained its business, ensured the safety of

its staff (all of our Bangladesh staff eligible for vaccinations

were vaccinated in March this year) and also managed to position

the Project for presentation to the Bangladesh Government in a form

that is well suited to the times. We believe the Project is

potentially Bangladesh's "Energy Security Pathway for its Renewable

Energy Transition".

Finally, I would like to once again thank the shareholders and

all our stakeholders, for your continued commitment and support for

GCM and its prospects. I also extend my appreciation to the Board

and staff for their hard work, and I extend mine and the Board's

thanks to James Hobson whom was a valuable addition to the Board

during 2021, but unfortunately on 30 November 2021 resigned from

the Board to concentrate on his new personal venture.

Mohd. Najib Abdul Aziz

Non-Executive Chairman

21 December 2021

Group Strategic Report

Strategy and business model

GCM Resources plc ("GCM") remains committed to a strategy of

developing the Phulbari coal deposit as a captive, large-scale,

open pit mining operation supporting over 6,000MW of highly

energy-efficient Ultra-Supercritical power generation (the

"Project"). In fact, based on a power plant feasibility study

undertaken in conjunction with our development partner, PowerChina,

the Phulbari coal mine annual production would support some

6,600MW.

GCM's strategy and business model is based on forming

partnerships with various internationally renowned companies,

specifically Chinese State-owned enterprises, to assist with

obtaining the necessary government approvals, the requisite

financing and developing the coal mine and power plants. The

business model incorporates consultants to provide crucial guidance

and lobbying support both in Bangladesh and Internationally.

A fundamental pillar of our business model has always been the

establishment of a reliable domestic market for the Phulbari coal

mine's full production, i.e., to ensure it is economically

sustainable and be able to secure project finance. The market

solution we have been promoting with our development partner has

been to set up new power plants (in stages) matching the mine's

ramp-up to 15Mtpa nameplate production. This resulted in Joint

Venture Agreements covering 4,000MW, leaving flexibility in

marketing the remaining coal mine production.

While this business model essentially remains valid, it has been

modified, taking into account an element of uncertainty regarding

financing of new coal-fired power projects. This uncertainty became

evident from the Chinese President's recent address to the United

Nations General Assembly which cast doubt over China financing new

coal-fired power projects abroad. Although there has been no

further clarification or policy statement, the business model has

been expanded to include a large part or all of the Phulbari coal

production being marketed to the Bangladesh Government coal-fired

power plants. This market is growing and, according to recent

reports, will reach in excess of 10,000MW power generating

capacity, i.e., some 40% more than the Phulbari's production can

support. It also is a 'Win - Win" as the Project would have a

secure market and the Bangladesh Government would secure a high

quality coal supply with reduced supply and cost risks, save

billions of dollars on excessive coal tonnage imports and power

generating costs and at the same time be able to supply power at

lower tariffs.

GCM believes its strategy and business model will deliver the

project approval. The Project in turn will deliver the Bangladesh

Government the lowest coal-based energy price and cheapest

electricity which will underpin expansion and competitiveness of

its industries, produce new higher paying jobs and grow its

economy. This will greatly support the Government in realising its

Vision 2041 being to:

-- End absolute poverty and to be graduated into higher middle-income status by 2031; and

-- Eradicate poverty on way to becoming a developed nation by 2041

Progress in-line with the strategy

The Company delivered a "Feasibility Study and Scheme of

Development" for the coal mine component of the Project in October

2005. This mine development proposal remains robust, having been

fully evaluated through the Definitive Feasibility Study ("DFS").

The DFS combines over two hundred individual studies by a team of

international and national experts, with a view to delivering a

world-class mining project plan, based on proven international best

mining practices.

With the assistance of Hong Kong based Dyani Corporation Limited

("Dyani"), the Company developed close working relationships with

the Chinese state-owned-enterprises China Gezhouba Group

International Engineering Co Limited ("CGGC"), Power Construction

Corporation of China Ltd ("PowerChina") and China Nonferrous Metal

Industry's Foreign Engineering and Construction Co., Ltd. ("NFC").

Currently the following agreements are in place to support GCM's

strategy for delivering the Project:

-- Joint Venture Agreements with PowerChina for 4,000MW of mine-mouth power plants.

-- Framework Agreement with NFC for developing the open pit coal

mining operation based on the Phulbari coal basin's world class 572

million tonnes (JORC 2004 compliant) high quality thermal and

semi-soft coking coal resource. Noting that this Agreement expired

in October 2021 and discussions are actively underway to extend the

arrangement.

Power Proposal documents required by the Government for approval

of the initial 4,000MW power plants have been prepared and the

overall Project Proposal has been expanded to include:

-- Significant benefits of supplying coal directly to the Government's own power plants;

-- Large-scale Solar Power Park (up to 2,330MW) on the Project

area within the first couple of years;

-- "Green Mine" with Carbon Offsetting (including forest)

resulting in Net Carbon Zero mining operation; and

-- Very significant reduction in Green House Gas Emissions (CO

(2) ) of over 30% using Phulbari coal vs. Imported Coal

As GCM does not yet generate any revenue, the Board expects that

the Group's operations will continue to be funded by a combination

of equity and debt financing.

Continuing for the foreseeable future, the Company's cash

expenditure is not expected to increase and, as far as possible,

obligations to key stakeholders will be primarily satisfied by the

issue of new ordinary shares in the capital of the Company

("Ordinary Shares"), to both incentivise those stakeholders and

preserve cash.

Year in review

GCM began the reporting year in lock-downs with international

borders largely closed due to the Coronavirus pandemic (exacerbated

by the virulent "Delta Variant"). Government offices were closed

with face-to-face meetings not possible. To put it in perspective,

in Bangladesh movement of people and opening of government and

private business offices did not happen until mid-August 2021

(outside the reporting period) and a "business as usual" situation

is still evolving.

Despite the pandemic, GCM managed to remain in close contact

with its development partners. On 12 October 2020, arrangements

with mine development partner NFC progressed to signing a Framework

Agreement. It was agreed to jointly develop the Project's proposed

coal mine and that a Joint Venture would be established with NFC

acquiring a 5% interest from GCM, based on a valuation. NFC agreed

to arrange financing and in return would be appointed EPC

contractor for mine development. Discussions are currently underway

with NFC and other Chinese Government officials to extend this

Agreement.

On 6 December 2020, PowerChina agreed to an extension of the

original memorandum of understanding ("MoU") established with NFC

and PowerChina relating to coal mine development, to allow

continuing discussions aimed at PowerChina taking a higher level of

participation in the Project. This MoU was further extended on 6

June 2021, and 23 November 2021 and now runs through to 6 December

2022. Also, on 19 January 2021 the Joint Venture Agreements with

PowerChina for the initial 4,000MW (two Stages) power plants were

extended to 15 March 2022.

Outside the reporting period, on 31 August 2021, GCM signed an

MoU with a consortium of Sion Corporation of Japan ("SION"),

Versatech Energy Innovation Limited and AC Biode Co. Ltd for

providing management of the Project's power plant fly-ash waste

product. SION has developed a multifunctional material, CircuLite,

which can be manufactured from fly-ash and would have wide

application in Bangladesh for environmental pollution control and

in agricultural for soil conditioning.

GCM's team in Bangladesh has strengthened the Project Proposal

by bolstering the case for Phulbari coal being supplied to the

Government's own coal-fired power plants (expected to exceed

10,000MW). There is a compelling case with huge monetary savings

for the Government in terms of coal purchases and power generation.

The Proposal also now includes a large Solar Power Park within the

Project area, which could be operational within the first two years

of Project approval and would supply power to the mine as well as

the National Grid. The Project's Agricultural Improvement and Land

Rehabilitation Plans also create significant additional Carbon

Offsetting. The net result is the Project could have a Carbon Zero

"Green Mine" and the Government could reduce its Greenhouse Gas

Emissions (CO (2) ) by over 30% by using Phulbari's coal instead of

Imported.

The Company remains committed to ensuring the local community

and local authorities remain fully informed on the Project. Our

social licence ultimately is built upon a successful relationship

with the local community. Our field teams continued to work with

the local community, maintaining social distancing, wearing masks

and complying with other necessary health safety guidelines to

exchange information regarding the Project. We are pleased to

report the positive trend in the level of local community support

continues. The Project's Resettlement Action Plan remains valid

with our field teams having completed an update of village

populations and households in the Project area throughout 2019 and

recently completed a land price study.

The Board is pleased to have delivered against its strategy of

forming development partnerships covering coal mine and power

plants and to have now expanded the Project Proposal to showcase

coal being supplied to the Government's own coal-fired power plants

and to include the huge reduction in Greenhouse Gas Emissions (CO

(2) ) and exciting prospect of a large-scale Solar Power Park.

These features have been discussed with Government officials in

preparation for presenting the Proposal for the Bangladesh

Government's approval.

The Company appointed WH Ireland Limited as it Nominated Advisor

and Broker on 11 January 2021.

Finance review

The Group recorded a loss of GBP1,874,000 during the year ended

30 June 2021 compared to a loss of GBP1,515,000 during the previous

year. The loss increased from the comparative year principally due

to an increase in non-cash, share-based payments accrued in

accordance with the Group's agreements with Dyani in relation to

pre-development expenditure. The increase was from GBP420,000 in

2020 to GBP809,000 this year, as a result of a milestone payment to

the consultant being reached in 2021, but their continuing

partnership allows the Group to continue its progress in-line with

GCM's strategy of developing power generation as a new business

stream, with no slow-down in pursuing continuing project

progress.

The Group recorded a net increase in cash at the end of the year

to GBP717,000 (2020: GBP69,000). Net cash used in operations for

the year was GBP326,000 (2020: GBP572,000), cash used in investing

activities was GBP557,000 (2020: GBP366,000), and cash inflow from

financing was GBP1,531,000 (2020: GBP622,000).

The Group has continued its aim to maintain tight control of

expenditure incurred during the year: Administrative expenses were

down by 21.7% to GBP717,000 for the year ended 30 June 2021 (2020:

GBP916,000) as a result of a one-off consulting expense in the

prior year, however, finance costs increased by 201.6% to

GBP383,000 (2020: GBP127,000). Capitalised expenditure in relation

to the mine proposal was GBP552,000 for the year ended 30 June 2021

compared to GBP377,000 in the previous year. Overall costs

excluding pre-development expenditure decreased by 29.5% to

GBP682,000 from GBP968,000 in the prior year, as noted above.

To finance its operations during the year, GCM drew down

GBP600,000 from the short-term loan facility with Polo Resources

Limited ("Polo") (the "Polo Loan Facility"). The Polo Loan has not

been increased during the year and remains at a facility of

GBP3,500,000. The terms of the loan facility were amended in March

2021, with two of the salient amendments being an increase in the

interest rate to 15%, but also Polo has agreed that it will not

serve a repayment request on the company for 5 years from the date

of the agreement, replacing the previous provision that it was

payable on demand with 90 days' notice. (See Note 12 for detailed

terms). In addition to the funding from Polo, GCM also completed a

successful Placing in conjunction with WH Ireland Ltd, raising

Gross proceeds of GBP1,009,000 in April 2021.

As at the date of this report, the Company had drawn down

GBP3,200,000 of the Polo Loan Facility and the Company currently

has approximately GBP167,000 in available cash resources, which

along with the remaining GBP300,000 of the Loan Facility the

Director's believe will only be sufficient to fund the Company's

cash requirements for the next four months, assuming the Company's

currently forecast cash costs. The Company is exploring other

financing options, and is confident of securing additional funding

by the end of January 2022 (the "Additional Funding").

Corporate Social Responsibility

GCM's vision, goal and planned actions are in line with the

basic values of integrity and fairness for all stakeholders. GCM's

social licence to operate requires an on-going acceptance of the

Project with its proposed mining operation and the Company (and

subsidiary Asia Energy) by community stakeholders and the general

public. For any large mining project to be successful it is crucial

to develop and maintain a partnership with all concerned

stakeholders, particularly at the local level.

Physical activity in the Project area during 2020-21 was

restricted due to the Coronavirus pandemic and the Bangladesh

Government's Coronavirus management plans which resulted in

lockdowns with restricted movement. However, GCM's field teams

still managed to work with the local community, maintaining social

distancing, wearing masks and complying with other necessary health

safety guidelines to exchange information regarding the Project.

The network of over 60 local grass-roots community liaison

assistants, selected from across the Project area, were invaluable

in maintaining two-way communication with the local community. The

trend in local community support continues to rise.

Field teams have also completed an update of the Resettlement

Action Plan's population database and number of potentially

'project affected people' and also completed a land price

survey.

The Project will improve the economic and social well-being of

people in the Project area. Community feedback delivers consistent

messages that the majority want development of their area (rated as

one of the poorest in Bangladesh) and stress the importance of job

opportunities and other benefits. Some 17,000 jobs are expected to

be directly and indirectly created as a consequence of developing

the mine and associated infrastructure. However, many thousands of

additional jobs would be created by having an expansive reliable

power supply enabling new industrial development. One such

industrial opportunity would come through industrial mineral

co-products that can be extracted from the mine overburden material

removed to access the coal. These co-products (in very large

quantities) include clay for bricks and pottery, China Clay for

ceramics, silica sand for glass manufacturing and a range of sand,

gravels and rock aggregates for the construction industry.

Conservative estimates of the value of these co-products amounts to

some US$17 Billion over the life of the Project.

GCM is conscious of the fact that the Project would be developed

within an area that is over 80% open farm land. The Project's

Agricultural Improvement Plan aims to off-set the impact of mining

on agriculture by providing year-round irrigation water to the

adjacent farms and providing farmers with improved inputs, training

and marketing assistance all aimed at increasing agricultural

output in the region.

The Project will require resettlement of approximately 40,000

people, with 12,000 people moving to a new town extension and the

remainder moving to new village sites or electing to use the

opportunity to move to other areas in Bangladesh. This resettlement

is to occur in six phases over a period of approximately 10-12

years from commencement of development and is intended to be

carried out under international scrutiny.

The Resettlement Action Plan details the compensation packages

which include range of measures such as long-term livelihood

restoration support, replacement homes, retraining, employment and

various financial assistance allowances. Apart from new housing

there will be religious centres, schools, health centres,

electricity, reticulated water supply and improved sanitation. The

Company also intends to provide skills training and offer

preferential employment opportunities to the Project affected

people and will establish community reference groups so the local

community can have input to planning and implementation.

GCM further reiterates its commitment to developing the Project

in accordance with the highest international and national

environmental and social standards. The Company remains to be a

signatory of the UN Global Compact, the world's largest voluntary

corporate responsibility initiative, and is committed to complying

with the social and environmental policies and standards of the

International Finance Corporation (World Bank), the Equator

Principles, the Asian Development Bank's (ADB) Safeguard Policies

as well as the current policies and laws of Bangladesh.

Risks and uncertainties

The predominant risks and uncertainties faced by the Company are

set out below:

Political and economic - risk that the Company's new approach,

being to establish the Phulbari open pit coal mine as being captive

to and packaged to supply either: (a) up to 6,000 MW of

state-of-the-art highly energy efficient Ultra-Supercritical power

plants, or (b) to supply all or in part of the Phulbari captive

open pit coal mine production to the Government's own power plants

(the "Project"), is not approved by the Government of Bangladesh.

However, the Project has also been expanded and enhanced with the

addition of a large-scale Solar Power Park (supplying the mine and

National Grid) and a range of Carbon Offsetting measures that would

enable the coal mine to be Carbon Net Zero (a "Green Mine"). The

use of Phulbari coal instead of imported coal would also reduce

Bangladesh's Greenhouse Gas Emissions (CO (2) ) by over 30%, save

the Government Billions of Dollars in energy and power generation

cost and allow a reduced power tariff supplying cheaper power

allowing industries to both expand and become more competitive. The

Board has also embarked on a strategy which involves bringing in

strategic development partners as it believes this will be an

attractive proposition for the Government and does provide the best

opportunity for realising the huge benefits the Project is capable

of delivering. The Company's Bangladesh team is also in contact

with Government officials to prepare for delivery of the expanded

Proposal. The Company has also endeavoured to reduce this risk by

employing the services of credible consultants / lobbyists,

however, it recognises that the timing of approval remains in the

hands of the Government. The Company retains its right to seek

legal redress in accordance with the terms of the Contract with the

Government in the event approval is not ultimately forthcoming.

Refer to Note 1 of the consolidated financial statements for

further information.

Strategic - risk that the strategic partnership with the Chinese

state-owned-enterprises PowerChina and NFC do not proceed and thus

undermining the Company's strategy of presenting the Project as a

captive coal mine with 6,000MW power generation that would take

sufficient thermal coal production to ensure the mine's economic

sustainability. As explained in the "Political and economic risk"

section, the Company has already expanded the Proposal to promote

all or part of the Phulbari captive open pit coal mine production

being sold to the Government's own power plants, thus reducing or

eliminating the dependency on having mine-mouth power plants as the

sole market for the Phulbari coal. The current and prolonged world

energy crisis with escalated coal and LNG prices also makes the

proposition of the Government using Phulbari coal for its power

plants much more attractive. The Company has also taken steps to

further reduce this risk through recent signed agreements and is

continuing dialogue with the development partners aimed at further

strengthening these strategic partnerships; and has in place

incentive-based schemes with Dyani to enhance the relationships

with the Chinese government organisations and with the Bangladeshi

controlled entity, DGI, to assist with taking the Project through

the government approval process to implementation. The Company's

Bangladesh team is also in contact with Government officials to

prepare for delivery of the expanded Proposal.

Financing - risk that the Company will not be able to raise

necessary funds as and when required to take the Project through

the government approval process to implementation stage. The

Directors are confident that the necessary funds will be obtained

as and when required. For further details refer to the Directors'

Report.

Commercial - risk that the Project's economic viability is

undermined by sustained adverse movement of coal price and key cost

elements. The current and prolonged world energy crisis with

escalated coal and LNG prices makes the proposition of the

Government using Phulbari coal for its power plants much more

attractive. Analysts predict the supply/demand forces will support

continuing high coal prices in the medium term, thus using Phulbari

coal will give the Government some protection against supply and

cost escalation risk, making the Project more attractive. To

further reduce economic viability risk there will be a rise and

cost provision for the coal mine with the coal supply agreements

for the power plants. Bangladesh has several new power projects

under construction and others in the pipeline with the full

capacity set out in a recent Government report to be in excess of

10,000MW, i.e., some 40% more than can be supported by the Phulbari

coal mine's full production.

Legal - risk that the mining lease and exploration licences are

revoked. The Group continues to comply with all terms of the

Contract with the Government for "Exploration and Mining of Coal in

Northern Bangladesh" and is careful to ensure that all ongoing

conditions of the Contract and the associated mining lease and

exploration licences are met. GCM has received legal opinion that

the Contract is enforceable under Bangladesh and International

law.

Health and safety, social and environmental risks - The Group

remains committed to developing the Project and meeting the highest

international social and environmental standards as detailed in the

Corporate Social Responsibility section within this Strategic

Report.

Climate Change risk - Increased awareness and action against

climate change will put pressure on governments and financing

organisations to reduce exposure to fossil fuel related power

generation. This could affect future Bangladeshi Government policy

towards coal fired generation and limit funding appetite for the

Project. Bangladesh is scheduled to officially become a developing

country in 2026 as the UN committee recommended that the country

should get five years, instead of three, to prepare for the

transition due to the impact of Covid-19 on its economy. Until

2026, the country will continue to enjoy the trade benefits as an

LDC. The Bangladesh Government has also recently adopted its Vision

2041 which aims to end absolute poverty and to be graduated into

higher middle-income status by 2031 and eradicate poverty on way to

becoming a developed nation by 2041.

Bangladesh has minimal emissions and is far behind the developed

countries in terms of GDP and power generation per capita.

Considering the year 2019 (immediately prior to the COVID pandemic

and the worldwide economic slowdown) published figures indicate its

contribution to the world's CO (2) production was some 0.25

percent, i.e. Bangladesh is not a significant emitter.

Vision 2041 identifies two fundamental energy and power sector

pillars necessary to support the Vision: (i) Adopting a least-cost

power generation expansion path; and (ii) Promoting supply of

low-cost primary energy. To achieve this, it needs to steadily grow

its power generation capacity (efficient low cost power) to drive

industrial development and create sustainable new well-paying jobs.

To this end, even if the Phulbari full coal production was consumed

in over 6,000MW of power being generated in the year 2019,

Bangladesh's contribution to the world's CO (2) production would

still have been minimal at less than 0.35%.

The Bangladesh Government recognises the importance of

commercial fuel diversity for its power generation, however, at

present it is heavily reliant on imported fuels, which exposes the

country to inherent world-market risks in terms of maintaining

supply and controlling cost.

The Phulbari Project remains focused entirely on serving

Bangladesh's domestic requirements, adhering to its policies and

laws and supporting its development goals. The Project will assist

Bangladesh achieve its NDC targets as it balances issues to achieve

its Development goals. By using Phulbari's high quality coal high

energy efficient low emission Ultra-Supercritical power plants the

country will not only eliminate greenhouse emissions associated

with coal shipping and handling, but importantly it will realise a

large amount of clean coal technology produced power at tariffs

that will make its industries more competitive. This will help

drive Bangladesh economic development and ability to deal with the

effects of climate change.

Board engagement with stakeholders

This section serves as our section 172 statement and should be

read in conjunction with the rest of the Strategic Report and the

Company's Corporate Governance Statement.

Section 172 of the Companies Act 2006 requires a Director of a

company to act in the way he or she considers, in good faith, and

would be most likely to promote the success of the company for the

benefit of its members as a whole. In doing this, section 172

requires a Director to have regard, among other matters, to: the

likely consequences of any decision in the long term; the interests

of the company's employees; the need to foster the company's

business relationships with suppliers, governments, local

communities, and others; the impact of the company's operations on

the community and the environment; the desirability of the company

maintaining a reputation for high standards of business conduct;

and the need to act fairly with members of the company.

The Directors uses its Board meetings as a mechanism for giving

careful consideration to the factors set out above in discharging

their duties under section 172.

Stakeholder engagement

Key stakeholder groups we engage with are listed below, together

with an explanation of why we focus on them and how we engage

them.

Employees

The success of the Group is dependent upon the hard work and

dedication of all our employees. The Board ensures a continuing

investment in existing employees who are supported through

professional, technical and on-the-job training relevant to their

functional areas, as well as other relevant role-specific training.

The Board directs executives and senior managers to keep staff

informed of the progress and development of the Company on a

regular basis through formal and informal meetings and regular

communications. In addition, the Board ensures funds are provided

for regular events to encourage employee participation in local

community initiatives.

Government Agencies & Local Communities

The Group operates in the regulated mining sector in Bangladesh.

The Board ensures the Company adopts a positive focus on

maintaining productive relations with local communities and all

levels of government. As a result, the Chief Executive Officer and

Chief Operating Officer regularly conduct consultations with

multi-levels of government agencies to ensure that all regulatory

approvals and permits remain in good order. Development of local

community improvement programmes are undertaken with consultation

of local government and community representatives in order to

maintain positive and productive relationships necessary to advance

the Phulbari project.

As a mining exploration Group, the Board takes seriously its

ethical responsibilities to the communities and environment in

which it works. Wherever possible, local communities are engaged in

the geological operations & support functions required for

field operations. The regions in which the Group operates have

native title laws. The Company is respectful of native title rights

and engages proactively with local communities. In addition, we are

careful to manage the environmental obligations of our work, and in

particular undertake site rehabilitation programmes, and prepare

mine management plans, in accordance with local laws and

regulations. Our goal is to meet or exceed standards, in order to

ensure we maintain our social licence to operate from the

communities with which we interact.

Contractors & Suppliers

Our proposed Joint Venture associates, consultants and suppliers

are key business partners, and the quality of goods and services we

receive are essential to supporting operations and to enhance the

project process with our goal to successfully submit our project

proposal to the Bangladesh Government for approval.

During the year, the Board committed significant resources into

fostering improved relationships with our key partners. As directed

by the Board, management collaborates and continually works with

our partners and the full supply chain, sharing best practice and

seeking out synergies to improve .

Lender

For the entire reporting period the Chairman, CEO and FD, on

behalf of the Board have been in regular contact with its lender.

An extension to the loan agreement was agreed during the year,

which enabled the Group to continue on a stable financial

platform.

Investors

Investors are considered key stakeholders, and consequently

investor relations are a focus area for Directors. Where possible

the Board engages investors on Group performance following project

updates and results announcements with face to face meetings or

scheduled calls. Over the past year however these consultations

have been severely impacted by the legal & country specific

restrictions placed upon Directors given the world economic climate

under the Covid-19 pandemic.

On behalf of the Board,

Datuk Michael Tang PJN

Chief Executive Officer

21 December 2021

Consolidated Financial Statements

Consolidated Statement of Comprehensive Income

For year ended 30 June

Notes 2021 2020

GBP000 GBP000

Operating expenses

Pre-development expenditure 16 (809) (420)

Exploration and evaluation costs 35 (52)

Administrative expenses (717) (916)

Operating loss 3 (1,491) (1,388)

Finance costs (383) (127)

Loss before tax (1,874) (1,515)

Taxation 6 - -

Loss for the year (1,874) (1,515)

Other comprehensive income - -

Total comprehensive expense for

the year (1,874) (1,515)

------- --------

Loss per share

Basic (pence per share) 7 (1.5p) (1.45p)

Diluted (pence per share) 7 (1.5p) (1.45p)

Consolidated Statement of Changes in Equity

For year ended 30 June

Share Share premium Share based Accumulated Total

capital account payments losses

not settled

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 July

2019 9,864 50,497 5,835 (27,564) 38,632

Total comprehensive

loss - - - (1,515) (1,515)

Share issuances

(net of costs)

(1) 1,392 3,037 (4,348) - 81

Shares to be issued - - 420 - 420

Share based payments - - (201) - (201)

Balance at 30

June 2020 11,256 53,534 1,706 (29,079) 37,417

Total comprehensive

loss - - - (1,874) (1,874)

Share issuances 792 2,155 (1,938) - 1,009

Share issuance

costs - (78) - - (78)

Shares to be issued - - 809 - 809

Share based payments - - 6 - 6

Balance at 30

June 2021 12,048 55,611 583 (30,953) 37,289

-------- ------------- ------------ ----------- -------

Consolidated Balance Sheet Company number 04913119

As at 30 June

Notes 2021 2020

GBP000 GBP000

Current assets

Cash and cash equivalents 717 69

Other receivables 8 13 16

Total current assets 730 85

Non-current assets

Property, plant and equipment 8 13

Right of use assets 13 59 33

Intangible assets 9 42,179 41,627

Total non-current assets 42,246 41,673

Total assets 42,976 41,758

-------- ---------

Current liabilities

Payables 11 (1,422) (1,073)

Lease liabilities 13 (40) (27)

Borrowings 12 - (3,220)

Total current liabilities (1,462) (4,320)

Non-current liabilities

Lease liabilities 13 (22) (21)

Borrowings 12 (4,203) -

-------- ---------

Total non-current liabilities (4,225) (21)

Total liabilities (5,687) (4,341)

-------- ---------

Net assets 37,289 37,417

-------- ---------

Equity

Share capital 14 12,048 11,256

Share premium account 14 55,611 53,534

Other reserves 14 583 1,706

Accumulated losses (30,953) (29,079)

Total equity 37,289 37,417

-------- ---------

These financial statements were approved by the Board of

Directors and were signed on their behalf by:

Keith Fulton

Executive Director

21 December 2021

Consolidated Cash Flow Statement

For year ended 30 June

2021 2020

GBP000 GBP000

Cash flows from/(used in) operating

activities

(Loss) before tax (1,874) (1,515)

Adjusted for:

Pre-development expenditure 16 809 420

Finance costs 383 127

Other non-cash expenses - 18

(682) (950)

Movements in working capital:

Decrease in operating receivables 2 13

Increase in operating payables 354 219

Cash used in operations (326) (572)

Net cash used in operating activities (326) (572)

Cash flows used in investing

activities

Payments for property, plant - -

and equipment

Payments for intangible assets (557) (366)

Net cash used in investing activities (557) (366)

Cash flows from financing activities

Issue of ordinary share capital 1,009 22

Share issue costs (78) -

Proceeds from borrowing 600 600

Net cash from financing activities 1,531 622

Total increase/(decrease) in

cash and cash equivalents 648 (316)

Cash and cash equivalents at

the start of the year 69 385

Cash and cash equivalents at

the end of the year 717 69

------- --------

Notes to the Consolidated Financial Statements

1. Accounting policies

GCM Resources plc is domiciled in England and Wales, was

incorporated in England and Wales as a Public Limited Company on 26

September 2003 and admitted to the London Stock Exchange

Alternative Investment Market ("AIM") on 19 April 2004.

The financial report was authorised for issue by the Directors

on 21 December 2021, and the Consolidated Balance Sheet was signed

on the Board's behalf by Keith Fulton.

Basis of preparation

The consolidated financial statements have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and applied in

accordance with the Companies Act 2006. The accounting policies

which follow set out those policies which apply in preparing the

financial statements for the year ended 30 June 2021.

The functional and presentational currency of each of the

entities in the Group is pounds sterling, and all values are

rounded to the nearest thousand pounds (GBP000) except where

otherwise indicated.

Political and economic risks - carrying value of intangible

asset

The principal asset is in Bangladesh and accordingly subject to

the political, judicial, fiscal, social and economic risks

associated with operating in that country.

The Group's principal project relates to thermal coal and

semi-soft coking coal, the markets for which are subject to

international and regional supply and demand factors, and

consequently future performance will be subject to variations in

the prices for these products.

GCM, through its subsidiaries, is party to a Contract with the

Government of Bangladesh which gives it the right to explore,

develop and mine in respect of the licence areas. The Group holds a

mining lease and exploration licences in the Phulbari area covering

the prospective mine site. The mining lease has a 30-year term from

2004 and may be renewed for further periods of 10 years each, at

GCM's option.

In accordance with the terms of the Contract, GCM submitted a

combined Feasibility Study and Scheme of Development report on 2

October 2005 to the Government of Bangladesh. Approval of the

Scheme of Development from the Government of Bangladesh is

necessary to proceed with development of the mine. GCM continues to

await approval.

The Group has received no notification from the Government of

Bangladesh (the "Government") of any changes to the terms of the

Contract. GCM has received legal opinion that the Contract is

enforceable under Bangladesh and International law, and will

consequently continue to endeavour to receive approval for

development.

Accordingly, the Directors believe that the Phulbari Coal and

Power Project (the "Project") will ultimately receive approval,

although the timing of approval remains in the hands of the

Government. To enhance the prospects of the Project, GCM has

engaged in a strategy to align the Project with the needs and

objectives of the Government. This includes the option to supply

coal to both the Government's commissioned and in the pipeline

power plants, which total 11,755MW. The Government is seeking to

grow its economy and deliver electricity at prices that will ensure

competitiveness of its industries. Utilising Phulbari's coal will

enable cheaper electricity than imported coal options. The Group's

strategy is to combine the planned coal mine with 6,000MW power

plants in conjunction with large Chinese State-owned engineering

enterprises. The last twelve months progress which has been made in

pursuit of this strategy is highlighted with the Group Strategic

Report.

Until approval of the Scheme of Development from the Government

of Bangladesh is received there is continued uncertainty over the

recoverability of the intangible mining assets. The Directors

consider that it is appropriate to continue to record the

intangible mining assets at cost, however if for whatever reason

the Scheme of Development is not ultimately approved the Group

would impair all of its intangible mining assets, totalling

GBP42,179,000 as at 30 June 2021.

Going concern

As at 30 June 2021, the Group had GBP717,000 in cash and

GBP732,000 in net current liabilities. The directors and management

have prepared a cash flow forecast to December 2022, which shows

that the Group will require further funds to cover operating costs

to advance the Phulbari Coal and Power Project and meet its

liabilities as and when they fall due. Based on current forecasts,

additional funding will need to be either raised from third parties

or drawn down under the short-term loan facility with Polo

Resources Limited ("Polo Loan Facility") by the end of January

2022, in order to meet current operating cost projections. The

Directors also note that, under the amended terms of the existing

Polo Loan Facility, the lender agreed not to serve a repayment

request in cash for 5 years from the date of amended terms, 26

March 2021, or alternatively convert to shares at 7.5 pence per

share at the lender's option. The Company does not currently have

secured funding arrangements in place to cover this loan or further

potential expenditure which may be needed to advance the Project

and, accordingly, should Polo request repayment of the Polo Loan

Facility, GCM will need to raise funds in a short amount of time,

which may not be available on terms acceptable to the Board or on a

workable timeframe.

The Company currently has GBP300,000 available for drawdown

under the Polo Loan Facility at the date of this report, and based

on projected future cash expenditure, the remaining amount

available for drawdown under the Polo Loan Facility at the date of

this report is not expected to be sufficient to support the

Company's operations for the twelve months from the date of this

report. At the current run rates, along with the Company's existing

cash resources, this is only expected to provide sufficient capital

for the next four months. The Company intends to explore

alternative funding options over the next two months, with the aim

to complete and secure the necessary third-party funding by the end

of January 2022.

In forming the conclusion that it is appropriate to prepare the

financial statements on a going concern basis the Directors have

made the following assumptions that are relevant to the next twelve

months:

- Sufficient additional funding can be obtained for working capital purposes; and

- In the event that operating expenditure increases

significantly as a result of successful progress with regards to

the Phulbari Coal and Power Project, sufficient funding can be

obtained.

While the Directors remain confident that necessary funds will

be available as and when required, as at the date of this report

these funding arrangements are not secured, the above conditions

and events represent material uncertainties that may cast

significant doubt over the Group's ability to continue as a going

concern. The financial statements have been prepared on a going

concern basis. The financial statements do not include the

adjustments that would result if the Group was unable to continue

as a going concern.

Upon achieving approval of the Phulbari Coal and Power Project,

significant additional financial resources will be required to

proceed to development.

Use of judgements, estimates and assumptions

The preparation of the consolidated financial statements

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses.

The estimates and underlying assumptions are reviewed on an

on-going basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period or in the period of revision and future periods if

the revision affects both current and future periods.

Intangibles

In assessing the recoverability of intangible assets, if an

impairment trigger under IFRS 6 is identified then intangibles are

tested for impairment. Management has identified impairment

triggers to be the market capitalisation of the Company compared to

the recognised amount on the balances sheet and the delay in

obtaining approval of the Scheme of Development. To assess for

recoverability estimates are used to determine the expected net

return on investment. The estimated return on investment takes into

account estimated recoverable reserves, coal prices, development

and production costs, capital investment requirements, discount

rates and environmental and social costs among other things.

Management has considered the estimated return on investment to be

significantly higher than the current carrying value and therefore

no impairment has been accounted for. The headroom in the value in

use calculation compared to the carrying value is not sensitive to

probable changes in the key underlying assumptions. Refer to

"Political and economic risks - carrying value of intangible asset"

section within Note 1 for further details in respect of the

recoverability of intangible mining assets and the boards judgement

regarding the ultimate approval of the project being secured.

Power plant development costs

Power project expenditure is expensed as pre-development

expenditure until it is probable that future economic benefits

associated with the Project will flow to the Group and the costs

can be measured reliably. To assess whether it is probable that

future economic benefits will arise from the power plant

development costs, management judgement was required and

considered: objective evidence that the power plant is technically

and economically feasible, and objective evidence that the

appropriate authorities of the Government of Bangladesh have, or

are likely to approve power plant development. All power project

expenditure were accordingly expensed in the year.

Amendments to the short-term loan

Judgement was required in determining the accounting for the

Group's short-term loan which was restructured during the year. The

restructure was considered to represent a significant modification

with the loan restructured to allow the lender the continuing right

to convert the outstanding loan balance and accrued interest to new

ordinary shares, but to defer the repayment period. Previous

judgement was required in assessing whether the restructured

facility represented a compound financial instrument in accordance

with IAS32 Financial Instruments: Presentation or a prima facie on

demand loan facility. Management concluded that as the loan has no

maturity date and must be repaid within 14 days of receiving a

request, it is in effect a rolling 14-day short term loan, however

as a further amendment has been claused as such the lender would

not serve a repayment request on the Borrower for 5 years from

March 2021, the loan is now in the current year being classed as a

non-current liability. Accordingly, the loan continues to be

categorised as an on demand loan facility with no value attributed

to the conversion feature and the loan carried forward at its face

value.

Basis of consolidation

Where the Company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

Company and its subsidiaries (the "Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full. The consolidated

financial statements incorporate the results of business

combinations using the acquisition method. In the statement of

financial position, the acquiree's identifiable assets, liabilities

and contingent liabilities are initially recognised at their fair

values at the acquisition date. The results of acquired operations

are included in the consolidated statement of comprehensive income

from the date on which control is obtained. They are deconsolidated

from the date on which control ceases.

Property, plant and equipment

Items of property, plant and equipment are stated at cost less

accumulated depreciation and impairment losses. Such cost includes

costs directly attributable to making the asset capable of

operating as intended.

Depreciation is charged to the income statement on a

straight-line basis over the estimated useful lives of each part of

an item of property, plant and equipment. The estimated useful

lives in the current and comparative periods are as follows:

-- buildings 7 - 40 years

-- plant and equipment 3 - 15 years

-- vehicles 5 - 7 years

The residual value, the useful life and the depreciation method

applied to an asset are reassessed at least annually.

Power project development costs

Power project expenditure is expensed as pre-development

expenditure until it is probable that future economic benefits

associated with the project will flow to the Group and the costs

can be measured reliably. When it is probable that future economic

benefits will flow to the Group, all costs associated with

developing a power plant project are capitalised as power project

expenditure within property, plant and equipment category of

tangible non-current assets. The capitalised expenditure will

include appropriate technical and administrative expenses but not

general overheads. Power project assets are not depreciated until

the asset is ready and available for use.

Intangible assets

Acquired intangible assets, are measured initially at cost and

are amortised on a straight-line basis over their estimated useful

lives.

Exploration and evaluation costs are capitalised as exploration

and evaluation assets on an area of interest basis in accordance

with IFRS 6. Costs such as geological and geophysical surveys,

drilling and commercial appraisal costs, and other directly

attributable costs of exploration and appraisal including technical

and administrative costs, are capitalised as intangible exploration

and evaluation assets.

Exploration and evaluation assets are only recognised if the

rights of the area of interest are current and either:

(i) the expenditures are expected to be recouped through

successful development and mining of the area of interest, or by

its sale; or

(ii) activities in the area of interest have not reached a stage

which permits a reasonable assessment of the existence or otherwise

of economically recoverable reserves and active and significant

operations in, or in relation to, the area of interest are

continuing or planned for the future.

Exploration and evaluation assets are assessed for impairment if

sufficient data exists to determine technical feasibility and

commercial viability, and facts and circumstances suggest that the

Group should test for impairment. In the event that there is an

indicator of impairment, the Group performs an impairment test in

accordance with its policy on impairment as stated below. For the

purposes of impairment testing, exploration and evaluation assets

are allocated to cash-generating units to which the exploration

activity relates.

Once the technical feasibility and commercial viability of the

extraction of mineral resources in an area of interest are

demonstrable, exploration and evaluation assets attributable to

that area of interest are first tested for impairment and then

reclassified from intangible assets to mining property and

development assets within property, plant and equipment.

Impairment

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. If any such indication

exists, or when annual impairment testing for an asset is required,

the Group makes an estimate of the asset's recoverable amount. An

asset's recoverable amount is the higher of an asset's or

cash-generating unit's fair value less costs to sell and its value

in use and is determined for an individual asset, unless the asset

does not generate cash inflows that are largely independent of

those from other assets or groups of assets. Where the carrying

amount of an asset exceeds its recoverable amount, the asset is

considered impaired and is written down to its recoverable amount.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset. Impairment losses of

continuing operations are recognised in the income statement in

those expense categories consistent with the function of the

impaired asset.

An assessment is made at each reporting date as to whether there

is any indication that previously recognised impairment losses may

no longer exist or may have decreased. If such indication exists,

the recoverable amount is estimated. A previously recognised

impairment loss is reversed only if there has been a change in the

estimates used to determine the asset's recoverable amount since

the last impairment loss was recognised. If that is the case the

carrying amount of the asset is increased to its recoverable

amount. That increased amount cannot exceed the carrying amount

that would have been determined, net of depreciation, had no

impairment loss been recognised for the asset in prior years. Such

reversal is recognised in profit or loss. After such a reversal the

depreciation charge is adjusted in future periods to allocate the

asset's revised carrying amount, less any residual value, on a

systematic basis over its remaining useful life.

Financial Instruments

Financial instruments are recognised when the Group becomes a

party to the contractual provisions of the instrument and are

subsequently measured at amortised cost.

Classification and measurement of financial assets

The initial classification of a financial asset depends upon the

Group's business model for managing its financial assets and the

contractual terms of the cash flows. The Group's financial assets

are measured at amortised costs and are held within a business

model whose objective is to hold assets to collect contractual cash

flows and its contractual terms give rise on specified dates to

cash flows that represent solely payments of principal and

interest.

The Group's cash and cash equivalents and other receivables are

measured at amortised cost. Other receivables are initially

measured at fair value. The Group holds other receivables with the

objective to collect the contractual cash flows and therefore

measures them subsequently at amortised cost.

Cash and cash equivalents

Cash includes cash on hand and demand deposits with any bank or

other financial institution. Cash equivalents are short-term,

highly liquid investments that are readily convertible to known

amounts of cash which are subject to an insignificant risk of

changes in value.

Impairment of financial assets

The Group recognises loss allowances for expected credit losses

("ECL's") on its financial assets measured at amortised cost. Due

to the nature of its financial assets, the Group measures loss

allowances at an amount equal to the lifetime ECLs. Lifetime ECLs

are the anticipated ECLs that result from all possible default

events over the expected life of a financial asset. ECLs are a

probability-weighted estimate of credit losses.

Classification and measurement of financial liabilities

A financial liability is initially classified as measured at

amortised cost or FVTPL. A financial liability is classified as

measured at FVTPL if it is held-for-trading, a derivative or

designated as FVTPL on initial recognition.

The Group's accounts payable, accrued liabilities and short-term

debt are measured at amortised cost.

Accounts payable and accrued liabilities are initially measured

at fair value and subsequently measured at amortised cost. Accounts

payable and accrued liabilities are presented as current

liabilities unless payment is not due within 12 months after the

reporting period.

Short-term debt is initially measured at fair value, net of

transaction costs incurred. Subsequently they are measured at

amortised cost using the effective interest rate method. Short-term

debt is classified as current when payment is due within 12 months

after the reporting period.

The Group has no financial liabilities measured at FVTPL.

Where there is a modification to a financial liability, the

financial original liability is de-recognised and a new financial

liability is recognised at fair value in accordance with the

Group's policy.

Other loans and borrowings

All loans and borrowings which are financial instruments are

initially recognised at the present value of cash payable to the

lender (including interest). After initial recognition they are

measured at amortised cost using the effective interest rate

method. The effective interest rate amortisation is included in

finance costs in the income statement.

Cash and cash equivalents

Cash and short-term deposits in the balance sheet comprise cash

at banks and in hand.

Income tax

Income tax on the profit or loss for the year comprises current

and deferred tax. Income tax is recognised in the income statement

except to the extent that it relates to items recognised outside

profit and loss, in which case it is recognised in other

comprehensive income or directly in equity as appropriate.

Current tax is the expected tax payable on the taxable income

for the year, using tax rates enacted or substantially enacted at

the balance sheet date, and any adjustment to tax payable in

respect of previous years.

Deferred income tax is recognised on all temporary differences

arising between the tax bases of assets and liabilities and their

carrying amounts in the financial statements, with the following

exceptions:

-- where the temporary difference arises from the initial

recognition of goodwill or of an asset or liability in a

transaction that is not a business combination that at the time of

the transaction affects neither accounting nor taxable profit or

loss;

-- in respect of taxable temporary differences associated with

investments in subsidiaries, associates and joint ventures, where

the timing of the reversal of the temporary differences can be

controlled and it is probable that the temporary differences will

not reverse in the foreseeable future; and

-- deferred income tax assets are recognised only to the extent

that it is probable that taxable profit will be available against

which the deductible temporary differences, carried forward tax

credits or tax losses can be utilised.

Deferred income tax assets and liabilities are measured on an

undiscounted basis at the tax rates that are expected to apply when

the related asset is realised or liability is settled, based on tax

rates and laws enacted or substantively enacted at the balance

sheet date.

Foreign currency transactions

Transactions in currencies other than pounds sterling are

recorded at the foreign exchange rate ruling at the date of the

transaction. Monetary assets and liabilities denominated in foreign

currencies at the balance sheet date are translated at the foreign

exchange rate ruling at that date. Foreign exchange differences

arising on translation are recognised in the income statement.

Non-monetary assets and liabilities that are measured in terms of

historical cost in a foreign currency are translated using the

exchange rate at the date of the transaction.

Share based payments

The cost of equity-settled transactions is measured by reference

to the fair value at the date at which they are granted and is

recognised as an expense over the vesting period, which ends on the

date on which the recipients become fully entitled to the award.

Fair value is determined using an appropriate pricing model. In

valuing equity-settled transactions, no account is taken of any

vesting conditions, other than conditions linked to the price of

the shares of the Company (market conditions) or to conditions not

related to performance or service (non-vesting conditions).

Where equity settled share based payments are made to

non-employees the cost of equity-settled transactions is measured

by reference to fair value of the goods or services received and

measured at the date the entity obtains the goods or the

counterparty renders the service.

Where the fair value of the goods or services received cannot be

estimated reliably, the entity measures the goods or services

received, and the corresponding increase in equity, indirectly, by

reference to the fair value of the equity instruments granted,

measured at the date the entity obtains the goods or the

counterparty renders service.

At each balance sheet date before vesting, the cumulative

expense is calculated, representing the extent to which the vesting

period has expired and management's best estimate of the

achievement or otherwise of non-market conditions, number of equity

instruments that will ultimately vest or in the case of an

instrument subject to a market condition or non-vesting condition,

be treated as vesting as described above. This includes any award

where non-vesting conditions within the control of the Group or the

employee are not met. W here the equity-settled share based payment

is directly attributable to exploration and evaluation activities,

the movement in cumulative expense since the previous balance sheet