Gulf Keystone Petroleum Ltd (GKP) Operational & Corporate

Update 30-Jan-2023 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement, transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

30 January 2023

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational & Corporate Update

Gulf Keystone, a leading independent operator and producer in

the Kurdistan Region of Iraq ("KRI" or "Kurdistan"), today provides

an operational and corporate update. The information contained in

this announcement has not been audited and may be subject to

further review.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"2022 was a strong year for GKP, in which we made progress on

multiple fronts that will position the company to maximise

long-term value from the Shaikan Field. We laid the initial

groundwork for a material increase in production levels in 2023 and

2024, while progressing towards key project sanction milestones of

the Shaikan Field Development Plan. In addition, we paid record

dividends to our shareholders of USD215 million, bringing total

shareholder distributions to USD415 million since 2019, while at

the same time strengthening our balance sheet through repayment of

our USD100 million bond.

Looking ahead, we are positive about the outlook for oil prices,

although we remain vigilant about the challenges facing the global

economy and the recent delays to KRG payments. Consequently, as we

move towards FDP approval and transition to increased investment in

profitable production growth from the Jurassic reservoir to drive

cash generation, we have put in place a flexible capital programme

for 2023 that is responsive to the external environment. This will

enable the Board to prudently manage the balance between our

liquidity levels, growth investment and distributions to maximise

total risk adjusted returns for shareholders. To underline the

Board's continued commitment to reviewing the return of excess cash

to shareholders as we progress, we are pleased to announce the

declaration of an interim dividend of USD25 million."

Operational

-- 2022 was a Lost Time Incident ("LTI") free year with only one

minor recordable incident. Following over440 days without an LTI,

an incident occurred during drilling operations in January 2023.

The safety of ourworkforce is our priority and we are currently

carrying out an investigation

-- Gross average production in 2023 year to date of c.47,800

bopd(1), with the recent increase driven by thegradual ramp up of

SH-16, which was brought online in December 2022

-- Ongoing drilling programme expected to drive production

growth:? SH-17 drilled and completed in early 2023, under budget

and ahead of schedule; currently being hookedup to commence

production in Q1 2023, in line with guidance ? SH-18 (formerly

SH-P) recently spudded, with first production expected in Q2 2023,

as previouslyannounced

-- Gross average production for 2022 of 44,202 bopd in line with

guidance, up from 43,440 bopd in 2021: ? Incremental production

driven by:? The benefit of SH-13 and SH-14 production, brought

on-stream in December 2021 ? Start-up of SH-15 in April 2022 and

SH-16 in December 2022 ? Mostly offset by:? Prudent management of

well production rates to avoid trace amounts of water production

ahead ofinstallation of water handling capacity, including the

shut-in of SH-12 for most of H1 2022 ? The temporary shut-in of one

well during Q4 2022 due to an isolated ESP electrical failure ? In

line with expectations and our development plan, continued base

natural decline currentlyestimated at 6-10% per annum across the

Shaikan Field, which remains low relative to the industry

evenfollowing production of around 115 million barrels to date

Financial

-- 2022 net capex of c.USD115 million comprised of:? Drilling

costs of c.USD65 million, including the SH-15 and SH-16 wells that

were drilled and broughtonline during the year, and SH-17 which was

completed in early 2023 ? Facilities and future well pad

preparation costs of c.USD35 million, including early work related

tothe expansion of PF-1 and PF-2 with water handling capacity and

installation of flowlines connecting the newwell pads to the

production facilities ? Well work over and intervention costs of

c.USD15 million

-- 2022 gross Opex per barrel of c.USD3.2/bbl, in line with 2022

guidance of USD2.9-USD3.3/bbl, despite increasedactivity and

industry cost inflation

-- During 2022, GKP received USD450 million from the Kurdistan

Regional Government ("KRG") for crude oil salesand repayment of

historic revenue arrears

-- GKP recently received net USD39 million from the KRG for

August 2022 crude oil sales. Discussions areongoing with the KRG

regarding payments for September to November 2022 crude oil sales,

which are overdue

-- Continuing engagement with the Ministry of Natural Resources

("MNR") regarding proposed amendments to theShaikan Lifting

Agreement, including a change in reference price for Shaikan crude

oil sales from Dated Brent tothe local Kurdistan Blend benchmark

("KBT"), effective 1 September 2022

-- Record dividends paid in 2022 of USD215 million, representing

a sector-leading dividend yield of 41%(2)

-- Cash balance of USD151 million(3) with no outstanding

debt

Outlook

-- As we move towards approval of the Field Development Plan

("FDP"), we are focused on driving profitableproduction growth by

expanding the production facilities and continuing our drilling

campaign in the Jurassicreservoir, capitalising on the attractive

returns resulting from the quick payback of investment under the

PSC(4)following the recent recovery of the majority of our historic

costs, while continuing to return excess cash toshareholders,

underlined by our declaration of a USD25 million interim dividend,

payable on 3 March 2023

-- In line with our rigorous focus on capital discipline and

maintaining a robust balance sheet, we havebuilt flexibility into

our work programme, predicating investment levels on the timeliness

of KRG payments and oilprices:? Improvements in KRG payment timing

and a continuation of the robust oil price environment wouldenable

us to continue drilling beyond SH-18 and update our guidance ? A

deterioration in market conditions, including continued delays to

KRG payments, would lead us toreview potential reductions in our

work programme and guidance

-- In 2023, we will bring SH-17 and SH-18 online to target

double digit percentage production growth, whilelaying the

foundation for an inflection in annual average production growth in

2024 by preparing well pads andflowlines to enable continuous

drilling and advancing the expansion of our production facilities,

including theinstallation of water handling capacity

-- We remain confident in the Shaikan Field's significant

production growth potential. We are preparing aCompetent Person's

Report ("CPR") as at 31 December 2022, which will provide an

updated independent third-partyevaluation of Shaikan's reserves and

resources. We expect to announce the results of the CPR in Q1

2023

2023 guidance

-- Gross average production in 2023 is expected to be 46,000 to

52,000 bopd, representing an 11% increasefrom 2022 at the

mid-point:? Reflects anticipated contributions from SH-17 and

SH-18, the benefits of well workovers, continuedprudent management

of well production rates to avoid trace amounts of water

production, and natural fielddeclines ? If we continue to drill

beyond SH-18, we would expect to review production guidance

-- 2023 net capital expenditure guidance of USD160-USD175

million:? USD30-USD35 million: Completion of SH-17, drilling of

SH-18 and well workover programme to optimiseproduction ?

USD45-USD50 million: Long lead items and preparing well pads to

enable continuous drilling beyond SH-18 ? USD85-USD90 million:

Continued expansion of production facilities, targeting by H2 2024

an increase intotal field capacity from c.60,000 bopd currently to

85,000 bopd and installation of water handling capacity,potentially

enabling the increase in production rates from constrained wells ?

We continue to manage pressures in a supply constrained market

-- 2023 gross Opex guidance of USD3.0-USD3.4/bbl, underpinned by

the Company's continued focus on strict costcontrol

-- Monitoring discussions between the Federal Iraqi Government

and the KRG on the management of oil and gasassets in Kurdistan

following the Iraqi Federal Supreme Court ruling in February 2022.

GKP operations currentlyremain unaffected

Shaikan Field Development Plan

-- The FDP is expected to enhance the sustainability and

longevity of the company's capacity for shareholderdistributions,

while generating material economic value for Kurdistan and

significantly reducing flaring throughthe Gas Management Plan, a

requirement of the PSC

-- Capitalising on the Shaikan Field's significant growth

potential and current estimated 2P reserves toproduction ratio of

c.29 years, the FDP is expected to increase Jurassic gross

production plateau up to 85,000 bopdand test the Triassic

reservoir, targeting initial pilot production of up to 10,000

bopd

-- As we move towards FDP approval, we have agreed with the MNR

to proceed with execution of the Jurassicreservoir expansion to

increase profitable production and cash flow generation, with

investment levels predicatedon timely payments from the KRG and a

robust oil price environment

(MORE TO FOLLOW) Dow Jones Newswires

January 30, 2023 02:00 ET (07:00 GMT)

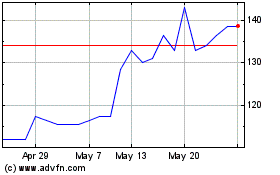

Gulf Keystone Petroleum (AQSE:GKP.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gulf Keystone Petroleum (AQSE:GKP.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025