Helium Ventures Plc £250,000 Fundraise and Update on Acquisition

21 September 2023 - 4:00PM

UK Regulatory

TIDMHEV

Helium Ventures plc

("Helium Ventures" or the "Company")

£250,000 Fundraise

Update on Acquisition

Director Dealings & Related Party Transaction

Helium Ventures plc (AQSE:HEV) announces an issue of equity to raise £250,000

(the "Placing") and an update on the proposed acquisition of Vestigo

Technologies Ltd ("Trackimo").

Fundraise

The Company has raised net proceeds of £250,000 through the issue of 6,250,000

new ordinary shares of 1 pence each at price of 4 pence per share ("Placing

Shares") and has issued an additional 812,500 new ordinary shares of 1 pence

each at price of 4 pence per share ("Fee Shares") in relation to the Placing and

broking fee retainer. The funds will be utilised for ongoing working capital

associated with the proposed Trackimo transaction.

Director Participation in the Placing

Charlie Wood and Neil Ritson, both directors of the Company, have subscribed

for, in aggregate, 1,750,000 new ordinary shares in the Placing. The beneficial

holdings of the Directors before and after the fundraise are set out below:

+--------+------------+---------+------------+---------------+

|Director|Current |Placing |Resultant |Resultant % |

| |shareholding|Shares |shareholding|shareholding on|

| | | | |Admission |

+--------+------------+---------+------------+---------------+

|Neil |1,050,000 |500,000 |1,550,000 |6.5% |

|Ritson | | | | |

+--------+------------+---------+------------+---------------+

|Charlie |1,600,000 |1,250,000|2,850,000 |11.9% |

|Wood* | | | | |

+--------+------------+---------+------------+---------------+

*1,250,000 of Mr Wood's Placing Shares are subscribed via Orana Corporate LLP of

which he is a Partner and 33.3% shareholder

Related Party Transaction

The participation of Neil Ritson and Charlie Wood, through Orana Corporate LLP

(a company of which Mr Wood is a Partner and 33.3% shareholder), in the Placing

as Directors of the Company constitute related party transactions pursuant to

Rule 4.6 of the AQSE Growth Market Access Rulebook (the "Transactions"). Fungai

Ndoro, being the director of the Company independent of the Transactions,

confirms that, having exercised reasonable care, skill and diligence, the

related party transactions are fair and reasonable insofar as the shareholders

of Helium Ventures are concerned.

Acquisition Update

Following engagement with corporate advisers, the decision has been reached to

pursue an admission to trading on AIM of the London Stock Exchange Group plc

("LSE") instead of the Standard Segment of the LSE as previously announced by

the Company. The main rationale is to enable the combined group to obtain

EIS/VCT relief under the HMRC Knowledge Intensive Pathway prior to admission.

The Company expects to announce the appointment of a Nomad/Broker to manage the

AIM admission in due course.

If the Company is successful in seeking an admission to AIM, the Company will

maintain its dual listing on the AQSE Growth Market. As announced on 7 October

2022, the Company's ordinary shares remain suspended from trading on the AQSE

Growth Market pending the acquisition of Trackimo.

The outlook and timing for the proposed acquisition is subject to the completion

of the remaining due diligence, shareholder approval, and successful admission

of the Company's ordinary shares to trading on AIM and the Company is working

diligently to ensure a timely and successful outcome prior to the end of 2023.

Helium Ventures plc looks forward to providing further updates to its

shareholders as the acquisition progresses.

Trackimo Update

Trackimo has generated $US12.3m in revenue, EBITDA of £682k in the 6-month

period to 30 June 2023 and is cashflow positive for the period.

- New CEO Mark Notton was appointed on 1 September 2023.

· With more than 20 years of experience, his experience of developing and

commercialising technological innovation will be vital for expanding the

business over the coming years. Across his career, Mark has led development and

commercialisation of innovation in global titans all around the world -

including Google, Motorola and Samsung where he was responsible for delivering

the commercial strategy for a business unit running into multi billions of

pounds.

· As CEO of Trackimo, Mark will lead the opening and expansion of the UK

office, as well as target a tripling of global revenues in the next three years.

- Trackimo business cashflow positive and trading in line with budget.

- Tracki device updates:

· Tracki tracker

· Number one best-selling tracking device on USA Amazon - circa 18k units

per month, with continual month-on-month growth in Q3.

· TrackiPet

· US launch on Amazon in July 2023, with average sales above 100 units per

month.

· Europe launch at PATS trade show on 1 October 2023 - new team established

to drive distribution agreements.

· US distribution expected to begin in Q4 2023 - new team established to

drive distribution agreements.

· NickWatch

· Israel & UK launch initial launch with key retailers including Argos.

· Nickwatch now launched on UK Amazon.

· Roll out in Germany and Spain scheduled for Q4 2024.

· Trackimo GPS Tracking device - listed on Amazon.

Admission

Application has been made for the 7,062,500 new ordinary shares to be admitted

to trading on the Aquis Stock Exchange Growth Market on or around 26 September

2023 ("Admission") and will rank pari passu with the ordinary shares of the

Company in issue. The Company's ordinary shares remain suspended from trading.

Total voting rights

Following Admission, the Company's issued share capital will comprise 23,902,500

ordinary shares of 1p each, with each share carrying the right to one vote,

therefore the total number of voting rights in the Company will be 23,902,500.

This figure may be used by shareholders as the denominator for calculations by

which they will determine if they are required to notify their interest in the

Company, or a change to their interest in the Company, under theFinancial

Conduct Authority'sDisclosure Guidance and Transparency Rules.

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company accept responsibility for the

contents of this announcement.S

Enquiries:

Helium Ventures plc +44 (0) 20 3475 6834

Neil Ritson

Cairn Financial Advisers LLP (AQSE Corporate Adviser) +44 (0) 20 72130 880

Liam Murray / Ludovico Lazzaretti

For more information please visit: www.heliumvs.com

Note:

Certain statements made in this announcement are forward-looking statements.

These forward-looking statements are not historical facts but rather are based

on the Company's current expectations, estimates, and projections about its

industry; its beliefs; and assumptions. Words such as 'anticipates,' 'expects,'

'intends,' 'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These statements are not a

guarantee of future performance and are subject to known and unknown risks,

uncertainties, and other factors, some of which are beyond the Company's

control, are difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security holders not to

place undue reliance on these forward-looking statements, which reflect the view

of the Company only as of the date of this announcement. The forward-looking

statements made in this announcement relate only to events as of the date on

which the statements are made. The Company will not undertake any obligation to

release publicly any revisions or updates to these forward-looking statements to

reflect events, circumstances, or unanticipated events occurring after the date

of this announcement except as required by law or by any appropriate regulatory

authority.

+--+----------------------------++------------+++----+

|Notification |

|of a |

|Transaction |

|pursuant to |

|Article |

|19(1) of |

|Regulation |

|(EU) No. |

|596/2014 |

+--+----------------------------++------------+++----+

|1 |Details of the person |

| |discharging managerial |

| |responsibilities/person |

| |closely associated |

+--+----------------------------++------------+++----+

|a.|Name |A) Neil Ritson |

| | | |

| | |B) Charlie |

| | |Wood |

+--+----------------------------++------------+++----+

|2 |Reason for notification | |

+--+----------------------------++------------+++----+

|a.|Position/Status |A) Non |

| | |-executive Chairman |

| | |of the Company |

| | | |

| | |B) Director of|

| | |the Company |

+--+----------------------------++------------+++----+

|b.|Initial notification/ |Initial notification|

| | | |

| |Amendment | |

+--+----------------------------++------------+++----+

|3 |Details of the issuer, |

| |emission allowance market |

| |participant, auction |

| |platform, auctioneer or |

| |auction monitor |

+--+----------------------------++------------+++----+

|a.|Name |Helium Ventures plc |

+--+----------------------------++------------+++----+

|b.|LEI |213800FTI7HOEKR9DX55|

+--+----------------------------++------------+++----+

|4 |Details of the |

| |transaction(s): section to be |

| |repeated for (i) each type of |

| |instrument; (ii) each type of |

| |transaction; (iii) each date; |

| |and (iv) each place where |

| |transactions have been |

| |conducted |

+--+----------------------------++------------+++----+

|a.|Description of the financial|Ordinary shares of 1|

| |instrument, type of |pence each |

| |instrument | |

| |Identification Code |ISIN: GB00BLR8T846 |

+--+----------------------------++------------+++----+

|b.|Nature of the transaction |Participation in the|

| | |Placing |

+--+----------------------------++------------+++----+

|c.|Price(s) and volume(s) || ||| |

| | || Price(s)||| |

| | ||Volume(s) ||| |

| | ||A) 4p ||| |

| | ||500,000 ||| |

| | ||B) 4p ||| |

| | ||1,250,000 ||| |

+--+----------------------------++------------+++----+

| |

+--+----------------------------++------------+++----+

|d.|Aggregated information |N/A |

| | | |

| |- Aggregated Volume | |

| | | |

| |- Price | |

+--+----------------------------++------------+++----+

|e.|Date of the transaction |20 September 2023 |

+--+----------------------------++------------+++----+

|f.|Place of the transaction |AQSE |

+--+----------------------------++------------+++----+

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

Helium Ventures (AQSE:HEV)

Historical Stock Chart

From Apr 2024 to May 2024

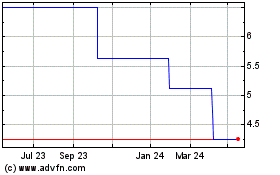

Helium Ventures (AQSE:HEV)

Historical Stock Chart

From May 2023 to May 2024