TIDMNANO

RNS Number : 8577O

Nanoco Group PLC

03 February 2023

FOR IMMEDIATE RELEASE 3 February 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS THE

SAME HAS BEEN RETAINED IN UK LAW AS AMED BY THE MARKET ABUSE

(AMMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR").

Nanoco Group PLC

( " Nanoco", the " Group", or the " Company")

Definitive Agreements Signed with Samsung for $150m Litigation

Settlement

A transformative outcome for Nanoco

Nanoco Group plc (LSE: NANO), a world leader in the development

and manufacture of cadmium-free quantum dots and other specific

nanomaterials emanating from its technology platform, announces the

final agreements (collectively, the "Settlement") have been signed

to settle the litigation with Samsung on a no fault basis for the

alleged infringement of the Group's IP.

The Group has separately published a trading update this morning

for its half year ended 31 January 2023.

Litigation settlement overview

-- Litigation concluded with $150m cash settlement to be paid in

two equal tranches (by 5 March 2023 and by 3 February 2024)

-- Nanoco retain over $90m net proceeds after litigation costs

-- Settlement structured as a sale of non-core patents and a

global, perpetual, fully paid up licence agreement

-- Settlement ends all global litigation with Samsung; Nanoco's

IP fully validated by the legal process

-- Nanoco retains full freedom to operate in all markets,

territories, products and material types

Chris Richards, Chairman of Nanoco Group plc, said:

"This has been a long and hard battle for Nanoco. The outcome is

remarkable, given the relative scale of Nanoco and Samsung. The

settlement value is almost three times our own low case damages

model; settling now avoids the risks associated with further

litigation and the adverse impact from the time value of money in

an appeals process that would have extended for years. Even more

importantly, it validates Nanoco's core IP, which we will continue

to defend vigorously.

"In deciding the allocation of the net proceeds, the Board will

balance any investment needs of Nanoco's growing organic business

with a firm intention to deliver a material return of capital to

shareholders."

Brian Tenner, Chief Executive Officer of Nanoco Group plc,

said:

"Today marks the start of a new chapter for Nanoco. We have

successfully validated our core IP against one of the world's

biggest electronics companies, who were advised by one of the most

expensive law firms in the world. Others operating in our space

should take note.

"We therefore remain vigilant to other potential infringement

activity, as well as opportunities to pro-actively deliver new

licence agreements. The confirmation of the validity of our IP is

already encouraging more commercial interest in Nanoco as a

supplier of leading edge nano-materials.

"We have also generated a transformational amount of value for

our stakeholders, whilst providing the funding for investment in

the business. We have done this while transforming Nanoco and

positioning ourselves for significant organic growth in the near

term. Most importantly, we have a foundation on which to focus on

the organic business as we continue to build on the significant

positive momentum achieved in the last few years."

Settlement agreements

The Settlement is structured as two agreements:

-- IP Licence agreement: This global, perpetual, fully paid up

licence agreement encapsulates any past or future royalties that

would have been paid / come due to be paid.

-- IP Sale agreement: This encapsulates the divestment of a

number of non-core patents from Nanoco to Samsung, with Nanoco

receiving a fully paid up, perpetual and global licence on the

divested patents. Neither of the two patents due to be presented at

trial were included in the sale.

For clarity, Nanoco retains complete freedom to operate in all

of its markets, territories, products and material types.

Nanoco will receive gross proceeds of $150 million (GBP125

million [1] ), $65m for the IP Licence agreement and $85m for the

IP Sale agreement, payable in two equal tranches by 5 March 2023

and by 3 February 2024. Nanoco expect to retain over 60% (over

$90m) of this sum, after deducting legal and litigation funding

costs. Legal and litigation funding costs have first claim on the

proceeds. There will be a tax liability but this is anticipated to

be modest.

The Settlement ends all global litigation between the Parties

(including Germany and China) , and Samsung will receive a fully

paid up, perpetual, global licence that runs until the expiration

of Nanoco's current individual patents.

Expected accounting impact of the settlement

The notes below set out a summary of the expected accounting

treatment of the two agreements in the Group's Financial

Statements, subject to confirmation during the statutory audit of

the Group's FY23 Annual Report and Accounts.

The sale of IP will be accounted for as a profit on disposal of

intangible assets in accordance with the requirements of IAS 38

Intangible Assets. This is expected to generate a net profit on

disposal of approximately GBP70.0m based on the proceeds noted

above less the current net book value of the patents at the point

of sale. This profit on disposal will be recognised in the FY23

Financial Statements.

The income from the IP Licence agreement will be accounted for

in accordance with the requirements of IFRS15 Revenue from

Contracts with Customers. It is expected that the revenue from the

IP contract will be recognised over the average estimated remaining

life of the existing entire IP portfolio after the sale of IP noted

above, even though the cash will be received in the two tranches

noted earlier (a revenue recognition period of approximately nine

years). The patents that would have been presented if the trial had

gone ahead had remaining lives of two and a half years and five

years respectively.

The cash and receivable due for the IP licence will give rise to

a significant deferred income balance of approximately GBP54.0m in

the Group's Financial Statements that will be recognised as revenue

in line with the nine year period noted above. Revenue from the IP

licence in H2 of FY23 is expected to be approximately GBP3.0m and

then GBP6.0m each year thereafter until the deferred income has

been recognised in full.

The costs of the litigation (approximately GBP47.0m) will be

expensed in full in FY23 as a standalone cost reflecting the fact

that the litigation itself has now ceased. There will also be a one

off interest charge of approximately GBP4.7m linked to the Group's

loan notes that were executed in July 2021, based on a successful

conclusion to the Samsung litigation.

The Group's accumulated tax losses will be available to offset

any tax impacts from the above subject to final tax computations,

normal UK rules restricting the utilisation of losses in any one

year, and any overseas withholding tax. Depending on forecasts of

the possible utilisation of tax losses in future financial years, a

deferred tax asset may be recognised in the Group's Financial

Statements. It is expected that net cash tax payable in respect of

FY23 will be modest. The final tax position will also depend on any

losses in the organic business in the year (excluding the Samsung

agreements) as well as any beneficial impact of both the UK's

R&D tax credit and Patent Box regimes.

The Group expects to have net negative distributable reserves in

a number of subsidiary companies and in the parent company itself

after the impact of the transactions noted above. The Group will

therefore review options for its future capital structure prior to

the receipt of the second tranche of proceeds around February 2024

in order to facilitate a possible return of funds to

shareholders.

For further information, please contact:

Nanoco Group PLC :

Brian Tenner, CEO +44 (0)1928 761 404

Liam Gray, CFO & Company Secretary

Peel Hunt (Joint Corporate Broker):

Paul Gillam +44 (0) 20 7418 8900

James Smith

Turner Pope Investments (Joint Corporate Broker):

Andrew Thacker +44 (0) 20 3657 0050

James Pope

MHP : +44 (0) 203 128 8570

Reg Hoare

Pete Lambie

nanoco@mhpgroup.com

- Ends -

The person responsible for arranging for the release of this

announcement on behalf of Nanoco is Liam Gray, Chief Financial

Officer.

MAR

The information contained within this announcement is considered

by the Company to contain inside information for the purposes of UK

MAR. Upon the publication of this announcement via a Regulatory

Information Service, this inside information will be considered to

be in the public domain.

FORWARD LOOKING STATEMENTS

This announcement (including information incorporated by

reference in this announcement) and other information published by

Nanoco may contain statements about Nanoco that are or may be

deemed to be forward looking statements. Such statements are

prospective in nature. All statements other than historical

statements of facts may be forward looking statements. Without

limitation, statements containing the words "targets", "plans",

"believes", "expects", "aims", "intends", "will", "may",

"anticipates", "estimates", "projects" or "considers" or other

similar words may be forward looking statements.

Forward looking statements inherently contain risks and

uncertainties as they relate to events or circumstances in the

future. Important factors such as business or economic cycles, the

terms and conditions of Nanoco's financing arrangements, tax rates,

or increased competition may cause Nanoco's actual financial

results, performance or achievements to differ materially from any

forward looking statements. Due to such uncertainties and risks,

readers are cautioned not to place undue reliance on such forward

looking statements, which speak only as of the date hereof. Nanoco

disclaims any obligation to update any forward looking or other

statements contained herein, except as required by applicable

law.

Notes for editors:

About Nanoco Group plc

Nanoco (LSE: NANO) harnesses the power of nano-materials.

Nano-materials are materials with dimensions typically in the range

1 - 100 nm. Nano-materials have a range of useful properties,

including optical and electronic. Quantum dots are a subclass of

nano-material that have size-dependent optical and electronic

properties. The Group produces quantum dots and other

nano-materials. Within the sphere of quantum dots, the Group

exploits different characteristics of the quantum dots to target

different performance criteria that are attractive to specific

markets or end-user applications such as the Display, Sensor and

Electronics markets. An interesting property of quantum dots is

their absorption spectrum. Nanoco's HEATWAVE(TM) quantum dots can

be tuned to absorb light at different wavelengths across the

near-infrared spectrum, rendering them useful for applications

including image sensors. Another interesting property of quantum

dots is photoluminescence: the emission of longer wavelength light

upon excitation by light of a shorter wavelength. The colour of

light emitted depends on the particle size. Nanoco's CFQD(R)

quantum dots are free of cadmium and other toxic heavy metals, and

can be tuned to emit light at different wavelengths across the

visible and infrared spectrum, rendering them useful for a wide

range of applications including displays, lighting and biological

imaging.

Nanoco was founded in 2001 and is headquartered in Runcorn, UK,

with a US subsidiary, Nanoco Inc., in Concord, MA. Nanoco continues

to build out a world-class, patent-protected IP portfolio generated

both by its own innovation engine, as well as through

acquisition.

Nanoco is listed on the Main Market of the London Stock Exchange

and trades under the ticker symbol NANO. For further information

please visit: www.nanocotechnologies.com.

visit: www.nanocotechnologies.com .

Litigation Funder - GLS Capital LLC

The litigation against Samsung was funded by GLS Capital LLC of

Chicago and the GLS team was led Adam Gill.

GLS Capital is a commercial litigation finance firm with more

than $500 million under management. Founded by litigation finance

industry veterans, GLS focuses on investments in complex commercial

litigation and arbitration, patent infringement litigation, and

life sciences litigation. GLS prides itself on decision-making

speed and the pace of its investment process. Armed with a broad

investment mandate and fully discretionary capital, all investment

decisions are made internally by the GLS investment committee,

which provides certainty and transparency for counterparties

throughout the investment lifecycle. More information about GLS

Capital can be found at www.glscap.com .

Strategic Adviser

Epicentre Law, PC

Ron Epstein has been an adviser to Nanoco on strategic IP issues

for a number of years. He supported Nanoco throughout the

litigation against Samsung as the Strategic Adviser to the Board

and as a member of the Litigation Sub-Committee.

With more than 30 years of experience in developing, optimizing,

and transacting Intellectual Property (IP) asset portfolios, Ron is

recognized as a global leader in helping patent owners maximize the

value of their IP. As a market-maker, Ron has been instrumental in

defining the category of patent brokers in the emerging patent

marketplace, delivering over $1 billion of value from the sale or

licensing of patents in over 150 transactions. As a thought leader,

Ron has contributed to the public discourse, consulted with

companies and law firms on complex IP transactions, and has helped

to develop many who are now leaders in their own right in the IP

monetization industry. More information about Epicentre Law can be

found at http://www.epicenterip.com/.

Litigation Advisers

Caldwell Cassady Curry - Trial Counsel ('CCC')

The trial team at CCC was led by Bradley Caldwell, a trial

lawyer who focuses on patent infringement and complex commercial

litigation.

Caldwell Cassady & Curry is a U.S.-based law firm

specializing in high-stakes patent infringement lawsuits and

complex business disputes. Caldwell Cassady & Curry's track

record includes cases involving a diverse array of leading

technologies. The firm has won billions of dollars in verdicts and

settlements against some of the largest companies in the world.

More information about CCC can be found at

https://caldwellcc.com/.

Mintz, Levin, Cohn, Ferris, Glovsky, and Popeo ("Mintz") - Lead

Legal Advisers

Michael Newman at Mintz led the litigation team in prosecuting

the US suit as well as co-ordinating actions in overseas

jurisdictions. Mr Newman was also personally instrumental in all

five of Nanoco's patents and all 47 claims being validated by the

Patent Trial and Appeal Board.

Mintz Levin has a proven track-record of successfully

representing patent owners of all sizes and across all industries

in disputes before the Patent Trial and Appeal Board, the

International Trade Commission, and the federal district courts.

Mintz also advises clients on a wide range of other strategic

patent matters, including licensing, portfolio management and

valuation, and patent prosecution. More information about Mintz can

be found at https://www.mintz.com/.

Ward, Smith & Hill PLLC - Local Counsel

Our local counsel team in Texas was led by Johnny Ward.

Ward, Smith & Hill is a trial law firm with a long history

of representing clients throughout the Lone Star State. Our office

in Longview supports the firm's emphasis on cases tried in every

division of the U.S. District Court for the Eastern District of

Texas and in state courts throughout the East Texas region. Ward,

Smith & Hill is well-known among law firms throughout the U.S.

based on our work together in high-stakes trials involving

intellectual property claims, oil and gas disputes, business

litigation matters, breach of contract, and serious personal

injuries. Our attorneys have tried more than 350 cases with

impressive results. Our team is made up of seasoned, ethical

attorneys who provide clients with proven courtroom track records,

including AV-rated lawyers, two former federal judges, and two

attorneys Certified by the Texas Board of Legal Specialization.

More information about Ward, Smith & Hill can be found at

https://wsfirm.com/.

MHP - Litigation and Financial PR advisers

Reg Hoare

Pete Lambie

Christian Harte

[1] Using FX rate of $1.20 / GBP1.00 throughout this document,

the estimated average FX rate during H1 FY23 - actual rates in

financial statements will vary depending on which financial

statement any figures appear in and movements in FX rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFIDFRIVIIV

(END) Dow Jones Newswires

February 03, 2023 02:15 ET (07:15 GMT)

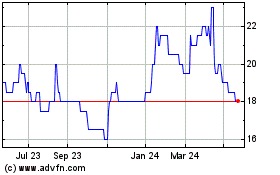

Nanoco (AQSE:NANO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

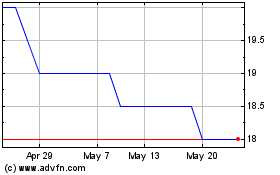

Nanoco (AQSE:NANO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024