TIDMOMI

RNS Number : 8949M

Orosur Mining Inc

17 January 2023

Orosur Mining Inc - Colombia update

-- Negotiations to complete the Mining Company Constituent

Documents with Minera Monte Aguila are progressing.

-- US$2 million Phase 2 Payment to be paid soon.

-- Process of forming new JV company underway.

-- Once formed, the JV company will be owned 49% by Orosur and 51% by Minera Monte Aguila.

London, Tuesday 17(th) January, 2023 . Orosur Mining Inc.

("Orosur" or the "Company") (TSXV/AIM:OMI) , is pleased to provide

an update to progress at the Company's flagship Anzá Project

("Project") in Colombia.

The Project is subject to an Exploration Agreement with Venture

Option ("Exploration Agreement") with Colombian company Minera

Monte Águila ("MMA"). MMA is itself a joint venture between Newmont

Corporation ("Newmont") and Agnico Eagle Mines Limited ("Agnico"),

and is the Colombian entity by which these two companies jointly

exercise their rights and obligations with respect to the

Exploration Agreement over the Project.

Orosur is pleased to announce that the Company and MMA are

advancing negotiations of a joint venture agreement (the "Mining

Company Constituent Documents") that would govern the development

and operations of the Project. The joint venture will operate under

a new Colombia legal entity (the "Mining Company") that would hold

the Project mining concessions and applications, with MMA as

manager. The process to create the Mining Company has now commenced

and is expected to take several months to complete. During this

process, MMA will be able to continue exploration at the Project,

and any expenditures incurred by MMA during this interim period

will form part of the Phase 2 qualifying expenditures.

In the meantime, MMA has agreed to pay the US$2 million Phase 2

Payment contemplated by the Exploration Agreement to Orosur, in

advance of finalising the Mining Company Constituent Documents.

Funds are expected to be received from MMA soon.

After the formation of the Mining Company and entering into the

Mining Company Constituent Documents , as per the Phase 2 earn-in

provisions, MMA may earn an additional 14% ownership in the Mining

Company if it has spent US$20 million in qualifying exploration

expenditures on the Project on or prior to the fourth anniversary

of the parties entering into the Mining Company Constituent

Documents . If the Phase 2 earn-in is completed, MMA would own 65%

of the Mining Company and the Company would own the remaining

35%.

Orosur Executive Chairman Louis Castro commented:

"We are pleased that MMA will be advancing to Phase 2 of the

Project and that the US$2 million will be paid soon. Both actions

support the Company's continued belief in the strength and

potential of the Project".

F or further information, visit www.orosur.ca , follow on

twitter @orosurm or contact :

Orosur Mining Inc.

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Kasia Brzozowska

Tel: +44 (0) 20 3 470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Communications and Investor Communications

Tim Thompson

Mark Edwards

Fergus Mellon

orosur@flagstaffcomms.com

Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

About Orosur Mining Inc.

Orosur Mining Inc. (TSXV / AIM: OMI) is a minerals explorer and

developer focused on identifying and advancing projects in South

America. The Company operates in Colombia, Argentina and Brazil and

has discontinued operations in Uruguay.

About the Anzá Project

Anzá is a gold exploration project, comprising three exploration

licences, four exploration licence applications, and several small

exploitation permits, totalling 207.5km2 in the prolific Mid-Cauca

belt of Colombia.

The Anzá Project is currently wholly owned by Orosur via its

subsidiary, Minera Anzá S.A.

The project is located 50km west of Medellin and is easily

accessible by all-weather roads and boasts excellent infrastructure

including water, power, communications and large exploration camp.

.

Forward Looking Statements

All statements, other than statements of historical fact,

contained in this news release constitute "forward looking

statements" within the meaning of applicable securities laws,

including but not limited to the "safe harbour" provisions of the

United States Private Securities Litigation Reform Act of 1995 and

are based on expectations estimates and projections as of the date

of this news release.

Forward-looking statements include, without limitation; the

exploration plans in Colombia and the funding from Minera Monte

Águila of those plans; Minera Monte Águila's continued involvement

in the Anza Project ; the timing for the formation of a new mining

company or mining venture to hold the project; the entering into of

the JVA between the Company and MMA; the possibility of further

expenditures by MMA during the interim period; the ability for

Loryser to implement the Creditor's Agreement successfully in

Uruguay and other events or conditions that may occur in the

future. The Company's continuance as a going concern is dependent

upon its ability to obtain adequate financing, to reach profitable

levels of operations and to reach a satisfactory implementation of

the Creditor's Agreement in Uruguay. These material uncertainties

may cast significant doubt upon the Company's ability to realize

its assets and discharge its liabilities in the normal course of

business and accordingly the appropriateness of the use of

accounting principles applicable to a going concern. There can be

no assurance that such statements will prove to be accurate. Actual

results and future events could differ materially from those

anticipated in such forward-looking statements. Such statements are

subject to significant risks and uncertainties including, but not

limited, those as described in Section "Risks Factors" of the MDA

and the Annual Information Form. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events

and such forward-looking statements, except to the extent required

by applicable law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFUFWMEDSELF

(END) Dow Jones Newswires

January 17, 2023 02:00 ET (07:00 GMT)

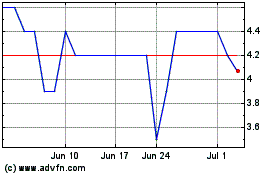

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

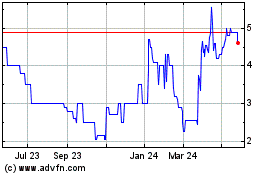

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024